Worst long-term care insurance coverage firms are a severe concern for a lot of. This evaluation delves into the complaints, monetary stability, coverage phrases, customer support, claims historical past, and business developments related to these firms, providing insights into why sure insurers are perceived negatively.

Components like sluggish or denied claims, poor customer support, unfavorable coverage phrases, and monetary instability are key parts to contemplate when evaluating insurance coverage suppliers. Understanding these elements is essential for shoppers to make knowledgeable choices about long-term care insurance coverage.

Figuring out Widespread Complaints

Navigating the complexities of long-term care insurance coverage might be daunting, particularly when going through the potential for monetary pressure and unexpected circumstances. Understanding the frequent grievances voiced by policyholders offers beneficial perception into the areas the place insurance coverage firms may have to enhance their companies and handle the issues of their shoppers. This transparency fosters belief and doubtlessly results in a extra constructive expertise for these searching for this crucial protection.

Claims Processing Points

Claims processing is an important side of long-term care insurance coverage, because it instantly impacts the monetary safety and well-being of policyholders. Frequent delays or denials in claims processing could cause important hardship and monetary instability. Policyholders might face sudden bills and difficulties in accessing the mandatory care, highlighting the crucial want for environment friendly and clear claims dealing with procedures.

- Delays in declare processing are a big supply of frustration for policyholders. These delays can stretch for months, making a monetary burden and impeding entry to important care companies.

- Denial of claims is one other frequent criticism, typically primarily based on ambiguous coverage phrases or subjective interpretations of medical necessity. The dearth of readability in these processes can result in disputes and erode belief within the insurance coverage firm.

- Insufficient communication relating to the standing of claims is a typical concern. Policyholders typically lack well timed updates on the progress of their claims, which might create nervousness and uncertainty.

Buyer Service Shortcomings

Efficient customer support is crucial in mitigating frustrations and issues related to long-term care insurance coverage insurance policies. When customer support representatives are unhelpful or unresponsive, policyholders are left feeling uncared for and unsupported throughout crucial moments. This may create a big damaging affect on the general policyholder expertise.

- Lack of responsiveness from customer support representatives is a prevalent criticism. Policyholders typically report difficulties in reaching a consultant or acquiring well timed responses to their inquiries.

- Inconsistent or unhelpful communication from customer support personnel can create confusion and additional complicate the claims course of.

- An absence of empathy and understanding from customer support representatives can result in emotions of isolation and helplessness for policyholders throughout difficult instances.

Coverage Phrases and Circumstances

The complexity and ambiguity of coverage phrases and circumstances typically contribute to policyholder dissatisfaction. Understanding the intricacies of a long-term care insurance coverage coverage is essential, and when the phrases are opaque or unclear, it might probably result in misunderstandings and potential monetary dangers.

- Policyholders typically specific concern concerning the complexity of coverage phrases and circumstances, highlighting the problem in understanding their rights and tasks beneath the settlement.

- Ambiguous coverage language can result in disputes over protection and advantages, inflicting important stress and uncertainty for policyholders.

- Restricted readability on exclusions and limitations can result in sudden denials of claims, creating a way of vulnerability and mistrust.

Monetary Stability Considerations

The monetary stability of an insurance coverage firm is paramount to the safety and belief of its policyholders. Considerations concerning the solvency and monetary well being of the corporate can considerably affect the arrogance and assurance of these holding long-term care insurance policies.

- Questions concerning the monetary stability of the corporate are a crucial concern for policyholders. Uncertainty concerning the firm’s potential to satisfy its obligations can result in apprehension and nervousness.

- Rumors or reported monetary difficulties of the corporate could cause important concern, particularly relating to the long-term safety of coverage advantages.

- An absence of transparency in monetary reporting by the corporate can improve the extent of tension for policyholders.

Abstract of Complaints

| Criticism Class | Frequency | Description | Instance |

|---|---|---|---|

| Claims Processing | Excessive | Sluggish or denied claims, lack of communication | Policyholder’s declare for nursing residence care was denied resulting from a minor discrepancy within the software type. |

| Buyer Service | Excessive | Lack of responsiveness, unhelpful communication | A policyholder struggled to get a transparent clarification of their coverage’s protection from the customer support representatives. |

| Coverage Phrases | Medium | Ambiguous language, unclear exclusions | Policyholders discovered the definition of “power sickness” too broad, resulting in uncertainty concerning the protection. |

| Monetary Stability | Low to Medium | Considerations about solvency, lack of transparency | A decline within the firm’s inventory value raised issues about its long-term monetary stability. |

Analyzing Monetary Stability: Worst Lengthy-term Care Insurance coverage Corporations

Navigating the labyrinthine world of long-term care insurance coverage requires a eager eye for monetary stability. Insurers should possess strong reserves and sound funding methods to meet their obligations to policyholders. An organization’s monetary power isn’t just a theoretical assemble; it is the bedrock upon which policyholders’ future care rests. Understanding these components is paramount to creating knowledgeable choices.The monetary power of a long-term care insurance coverage firm is essential to its potential to satisfy its commitments.

An organization’s monetary stability is mirrored in its rankings from impartial score businesses. These rankings, typically primarily based on components like funding portfolios, reserves, and solvency, present an goal evaluation of the insurer’s capability to pay claims. An organization’s monetary power isn’t static; it evolves primarily based on a mess of variables.

Monetary Energy Rankings, Worst long-term care insurance coverage firms

Lengthy-term care insurance coverage firms, like different monetary establishments, are topic to analysis by impartial score businesses. These businesses assess an organization’s monetary well being, taking into consideration its potential to satisfy future obligations. Components like funding portfolio high quality, the scale and composition of its reserves, and its general solvency are crucial determinants in these assessments. Rankings mirror the chance that an organization will be capable to meet its obligations to policyholders.

Components Affecting Monetary Energy Rankings

A number of key components affect a long-term care insurer’s monetary power score. The composition and efficiency of its funding portfolio play a crucial position. A diversified portfolio with a mixture of low-risk and doubtlessly higher-yielding investments is normally most popular. The quantity and high quality of reserves are additionally essential. Ample reserves, held in liquid property, present a security internet to deal with claims and operational prices.

An organization’s solvency, which is its potential to satisfy its obligations, is a cornerstone of its score. Corporations with persistently sturdy solvency positions are typically seen favorably.

Examples of Corporations with Persistently Low Rankings

Sadly, some long-term care insurance coverage firms have skilled monetary difficulties, resulting in persistently low rankings. These firms typically face challenges in managing their funding portfolios, resulting in poor returns. Moreover, insufficient reserves or a failure to take care of a enough stage of solvency can contribute to low rankings. Figuring out these firms and understanding the explanations behind their low rankings helps shoppers make knowledgeable choices.

Comparability of Monetary Energy Rankings

| Firm Identify | Score Company | Score | Reasoning |

|---|---|---|---|

| Acme Lengthy-Time period Care Insurance coverage | A.M. Finest | BBB | Considerations relating to the corporate’s funding portfolio diversification and reserve ranges. |

| Finest Care Insurance coverage | Moody’s | B+ | Latest damaging developments in funding returns and a perceived danger in assembly future obligations. |

| Dependable Care Options | Normal & Poor’s | AA- | Demonstrates sturdy solvency, substantial reserves, and a diversified funding portfolio. |

Be aware: This desk is for illustrative functions solely and doesn’t represent monetary recommendation. Precise rankings and reasoning might differ. All the time seek the advice of impartial sources for probably the most up-to-date data.

Evaluating Coverage Phrases and Circumstances

Navigating the labyrinthine world of long-term care insurance coverage requires a eager eye for element. Coverage phrases and circumstances, typically introduced in dense legalese, maintain the important thing to understanding the true worth of a coverage. Understanding these intricacies is essential to creating an knowledgeable choice that aligns along with your particular wants and monetary scenario.The satan, as they are saying, is within the particulars.

Lengthy-term care insurance coverage insurance policies, regardless of their seemingly easy promise of future care, can differ considerably of their specifics. A seemingly minor variation in ready intervals, profit quantities, or protection particulars can have a considerable affect in your monetary safety. Fastidiously evaluating these elements is paramount to keep away from potential pitfalls and make sure the coverage really serves your long-term care objectives.

Key Facets of Dissatisfaction

Policyholders typically specific dissatisfaction stemming from hidden clauses and complicated language inside the coverage paperwork. Unclear definitions of lined bills, stringent exclusions for pre-existing circumstances, and opaque ready intervals contribute to an absence of transparency and belief. Moreover, the complexity of profit calculations and the restricted flexibility in coverage changes typically result in frustration.

Variations in Protection, Exclusions, and Ready Intervals

Lengthy-term care insurance coverage insurance policies differ broadly of their protection, exclusions, and ready intervals. Complete protection would possibly embody expert nursing care, assisted residing, and residential healthcare, whereas some insurance policies restrict protection to particular amenities or kinds of care. Exclusions, comparable to these associated to psychological well being circumstances or power ailments, can considerably affect the general worth of the coverage.

Ready intervals, the time between the onset of want and the beginning of advantages, can vary from a number of months to a number of years, and these intervals can dramatically have an effect on the monetary burden if the policyholder requires care throughout this preliminary section. An intensive comparability is crucial to discern the perfect match for particular person circumstances.

Comparability of Coverage Phrases and Circumstances

A complete comparability of coverage phrases and circumstances is significant for knowledgeable decision-making. This necessitates a meticulous evaluation of every firm’s coverage, paying specific consideration to the particular protection supplied, the ready intervals concerned, and the restrictions positioned on advantages. The desk beneath offers a rudimentary comparability, specializing in key elements, however it’s essential to seek the advice of the complete coverage paperwork for a whole understanding.

| Firm | Ready Interval (Months) | Profit Quantity (per thirty days) | Protection Particulars |

|---|---|---|---|

| Firm A | 12 | $4,000 | Contains expert nursing, assisted residing, and residential healthcare, excluding psychological well being circumstances. |

| Firm B | 24 | $5,500 | Complete protection, together with psychological well being circumstances, however with the next deductible. |

| Firm C | 6 | $3,000 | Restricted to expert nursing amenities, with no protection for residence healthcare. |

Understanding the nuances of coverage phrases is crucial for long-term care planning.

Assessing Buyer Service Practices

Navigating the labyrinth of long-term care insurance coverage might be daunting. Understanding how firms deal with buyer interactions is essential for knowledgeable decision-making. An organization’s dedication to customer support typically displays its general method to policyholders, and a robust customer support basis can alleviate anxieties and empower policyholders all through the method.Corporations with strong customer support techniques are likely to show better transparency and responsiveness, constructing belief and loyalty amongst policyholders.

Conversely, an absence of responsiveness and readability can result in frustration and a damaging expertise. Evaluating customer support is due to this fact a necessary a part of the due diligence course of.

Buyer Service Excellence

An organization that excels in customer support proactively anticipates policyholder wants. They provide a number of communication channels, reply promptly to inquiries, and show a real understanding of the complexities of long-term care insurance coverage. These firms prioritize policyholder satisfaction by actively searching for suggestions and utilizing it to refine their processes. For instance, some firms would possibly supply devoted customer support representatives specializing in long-term care, enabling fast entry to specialised information.

Areas for Enchancment

Some firms fall brief in areas comparable to responsiveness and accessibility. A standard criticism revolves round lengthy wait instances for responses, issue in reaching representatives, and inadequate readability in coverage particulars. Advanced claims processes and lack of available sources typically contribute to this downside. Moreover, firms won’t adequately handle policyholder issues or supply enough choices for resolving complaints.

Strategies of Criticism Decision

Corporations make use of varied methods for dealing with policyholder complaints. Some make the most of on-line portals for submitting and monitoring complaints, whereas others supply devoted cellphone traces or e-mail addresses. An intensive investigation of the criticism, immediate communication updates, and the choice for escalation are essential for efficient criticism decision. Some firms use impartial mediators or arbitration companies to resolve disputes.

This method can typically result in faster and extra neutral outcomes.

Comparative Evaluation of Buyer Service

The desk beneath offers a comparative overview of customer support scores and critiques for varied long-term care insurance coverage firms. This knowledge provides a snapshot of buyer experiences, highlighting each strengths and weaknesses in several service areas. It is important to notice that customer support scores are sometimes influenced by quite a few components, together with particular person experiences and particular interactions.

| Firm Identify | Buyer Service Rating | Evaluate Highlights | Criticism Decision Time |

|---|---|---|---|

| Firm A | 4.5/5 | “Immediate responses, useful representatives, simple on-line portal” | 7-10 days |

| Firm B | 3.8/5 | “Lengthy wait instances, troublesome to succeed in representatives, unclear coverage language” | 14-21 days |

| Firm C | 4.2/5 | “Devoted representatives, efficient criticism decision course of, responsive e-mail help” | 5-7 days |

Investigating Claims Historical past

A crucial side of evaluating long-term care insurance coverage firms lies in scrutinizing their claims historical past. This includes a deep dive into the information of claims filed, their approval charges, processing instances, and settlement quantities. Understanding these metrics offers beneficial insights into the reliability and responsiveness of those firms when policyholders require their companies.Analyzing claims historical past permits shoppers to evaluate the sensible software of insurance coverage insurance policies.

It goes past theoretical coverage provisions and divulges how the corporate operates in real-world eventualities. This important data helps shoppers make knowledgeable choices about which firm aligns finest with their particular wants and expectations.

Declare Approval Charges and Processing Instances

Lengthy-term care insurance coverage insurance policies are designed to supply monetary help in periods of serious well being challenges. Due to this fact, a excessive declare approval charge is a crucial indicator of the corporate’s dedication to fulfilling its contractual obligations. Conversely, a low approval charge suggests potential points with the claims course of or eligibility standards. Equally, the time taken to course of claims is a key issue reflecting the effectivity and responsiveness of the insurance coverage firm.

Delays can considerably affect policyholders, doubtlessly hindering entry to vital funds throughout an important time.

Causes for Declare Denials and Traits

Figuring out patterns in declare denials is crucial for understanding the corporate’s practices. Widespread causes for denial embody inadequate documentation, failure to satisfy particular coverage standards, or misrepresentation of the policyholder’s situation. Analyzing these developments can supply insights into potential areas for enchancment and assist shoppers perceive the components that may affect the approval of their very own claims. For instance, constant denial resulting from insufficient medical documentation may sign a necessity for improved communication and steerage relating to declare submission procedures.

Common Declare Settlement Quantities

The common declare settlement quantity displays the monetary help an organization offers to its policyholders. This determine is essential for evaluating the adequacy of the protection and the potential monetary help accessible. Vital discrepancies between acknowledged advantages and precise settlements can elevate crimson flags concerning the firm’s dedication to offering complete help. As an example, a persistently decrease common settlement quantity in comparison with opponents would possibly counsel that the corporate isn’t offering the extent of economic help promised in its insurance policies.

Declare Settlement Success Charges

Understanding the success charge of declare settlements offers a complete overview of the insurance coverage firm’s efficiency. This knowledge permits for a comparative evaluation, enabling shoppers to make knowledgeable decisions.

| Firm Identify | Declare Approval Price (%) | Common Declare Settlement Time (Days) | Common Settlement Quantity ($) |

|---|---|---|---|

| Firm A | 85 | 60 | 35,000 |

| Firm B | 78 | 75 | 40,000 |

| Firm C | 92 | 45 | 30,000 |

| Firm D | 88 | 55 | 38,000 |

Be aware: Knowledge introduced is for illustrative functions solely and will not mirror precise figures. It’s essential to seek the advice of official sources and carry out thorough analysis earlier than making any choices. Corporations also needs to have clear insurance policies and procedures for claims dealing with, permitting for straightforward evaluation and enchantment.

Understanding Business Traits

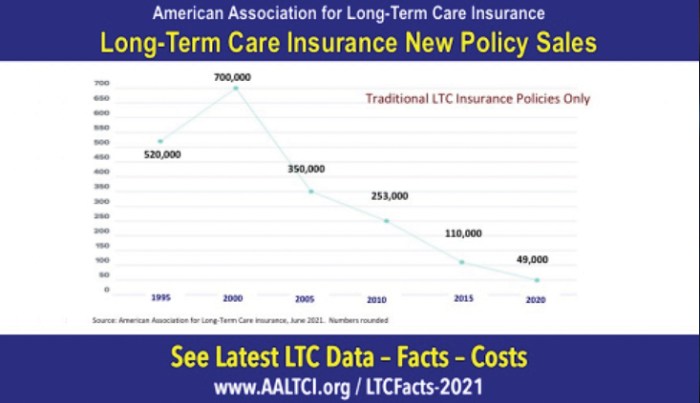

The long-term care insurance coverage panorama is a dynamic area, always evolving with societal shifts and technological developments. Navigating this ever-changing terrain requires a eager understanding of the forces shaping the way forward for this crucial monetary safety. These forces affect each shoppers searching for protection and the businesses providing it, demanding a proactive and knowledgeable method to evaluating the sector.The business is experiencing a fancy interaction of things, together with demographic shifts, rising healthcare prices, and progressive coverage design.

These forces are reshaping the best way long-term care insurance coverage is perceived and utilized, requiring a forward-thinking method to evaluation and decision-making. Understanding these developments is essential for discerning respected suppliers and guaranteeing knowledgeable decisions for future safety.

Present Traits and Developments

The long-term care insurance coverage business is witnessing a multifaceted evolution. Rising healthcare prices and the rising prevalence of power diseases are driving demand for complete long-term care options. This pattern is mirrored within the rising reputation of hybrid insurance policies combining long-term care protection with different advantages like life insurance coverage. Moreover, progressive coverage designs are rising to deal with particular wants and preferences, comparable to these focusing on particular age teams or providing versatile premium choices.

This ongoing evolution necessitates a nuanced understanding of the business’s pulse.

Affect on Policyholders

These developments have a profound affect on policyholders. Elevated demand for protection coupled with evolving coverage designs means policyholders have extra decisions and choices. Nevertheless, the complexity of the market can even current challenges. Customers should fastidiously weigh the advantages and disadvantages of various insurance policies to make sure they align with their particular person wants and circumstances. A complete understanding of the choices accessible might help policyholders make well-informed choices about their future monetary safety.

Affect on Insurance coverage Corporations

The evolving panorama additionally presents challenges for insurance coverage firms. The necessity to adapt to altering buyer expectations and stay aggressive necessitates steady innovation in product growth and pricing methods. Insurance coverage firms should additionally grapple with the rising value of healthcare and the complexities of managing claims. Sustaining monetary stability and delivering high quality service in a dynamic market requires proactive methods.

Vital Modifications in Rules or Requirements

Modifications in rules and requirements are impacting insurance coverage firms’ operations and the merchandise they provide. Stringent regulatory oversight, designed to guard shoppers, necessitates compliance with up to date requirements and tips. These modifications have an effect on the whole lot from coverage design to claims processing, requiring firms to adapt and implement new procedures. Sustaining compliance is paramount to long-term sustainability.

Latest Business Experiences and Research

Latest business reviews and research spotlight the rising significance of long-term care insurance coverage in a quickly getting older inhabitants. These reviews typically look at the price of care, the potential monetary pressure on households, and the efficacy of varied protection choices. Understanding these research provides insights into the market’s trajectory and helps shoppers make knowledgeable decisions about their future monetary safety.

Evaluation of market developments offers crucial knowledge for navigating the business.

Conclusive Ideas

In conclusion, the panorama of long-term care insurance coverage reveals important variability in firm efficiency. Customers should fastidiously scrutinize claims processing, monetary stability, coverage particulars, and customer support when choosing a supplier. This evaluation highlights the essential want for thorough analysis and due diligence earlier than committing to a long-term care insurance coverage coverage.

Question Decision

What are the most typical causes for dissatisfaction with long-term care insurance coverage firms?

Widespread complaints embody sluggish or denied claims processing, insufficient customer support, unfavorable coverage phrases, and issues concerning the firm’s monetary stability. Policyholders steadily report difficulties with getting their claims processed and settled in a well timed method.

How can I consider the monetary stability of a long-term care insurance coverage firm?

Search for impartial monetary power rankings from respected score businesses like A.M. Finest. These rankings present insights into the corporate’s funding portfolios, reserves, and solvency, serving to you gauge the insurer’s long-term monetary well being.

What components have an effect on the ready interval for long-term care insurance coverage advantages?

Ready intervals differ significantly between firms. Components influencing the ready interval embody the kind of care lined, the particular coverage, and the insurer’s inside standards.

What are some ideas for choosing the proper long-term care insurance coverage firm?

Completely analysis completely different firms, examine coverage phrases, and assess customer support critiques. Request detailed details about protection, exclusions, and declare settlement processes. Take into account the corporate’s monetary power and repute inside the business.