Unum long run care insurance coverage – Unum long-term care insurance coverage – a vital consideration for future well-being. Navigating the complexities of long-term care will be daunting, however understanding the choices obtainable can ease the burden. This complete information dives deep into Unum’s choices, evaluating them with opponents and exploring essential concerns for coverage choice.

Unraveling the intricacies of long-term care insurance coverage can really feel overwhelming. Nevertheless, armed with the suitable data, you can also make knowledgeable choices that safeguard your future and peace of thoughts. This information will break down the specifics of Unum’s plans, providing clear comparisons and beneficial insights that can assist you navigate the method.

Introduction to Lengthy-Time period Care Insurance coverage

Lengthy-term care insurance coverage is a crucial instrument for securing monetary help throughout prolonged intervals of incapacity. It offers a security internet, defending people from the substantial monetary burdens related to long-term care wants, equivalent to nursing residence stays or in-home help. Understanding the several types of insurance policies and their protection is essential for making knowledgeable choices.This doc Artikels the elemental features of long-term care insurance coverage, protecting coverage sorts, advantages, and essential comparability elements.

A complete understanding of those components empowers people to navigate the complexities of long-term care planning successfully.

Understanding Lengthy-Time period Care Insurance coverage Insurance policies

Lengthy-term care insurance coverage insurance policies are designed to pay for the prices of care which may be required over an prolonged interval as a result of an sickness or damage that limits each day actions. The insurance policies cowl bills for numerous forms of care, equivalent to nursing properties, assisted residing services, or in-home care companies.

Forms of Lengthy-Time period Care Insurance coverage Insurance policies

Completely different coverage sorts cater to various wants and budgets. A wide range of choices exist, providing various ranges of protection and premiums. The most typical sorts embody:

- Particular person Insurance policies: These insurance policies are tailor-made to the particular wants of a person, providing flexibility in protection and premiums. They permit for personalization of advantages and protection quantities, typically offering a higher diploma of management over the plan.

- Group Insurance policies: Supplied by means of employers or different organizations, these insurance policies present protection to a bunch of people. They typically have standardized advantages and premiums, making them a extra accessible possibility for these with employer-sponsored packages.

- Hybrid Insurance policies: Combining components of each particular person and group insurance policies, hybrid plans supply a stability of customization and accessibility. They’ll present higher flexibility in protection whereas sustaining a sure stage of affordability.

Advantages and Protection Choices in Lengthy-Time period Care Insurance coverage

Lengthy-term care insurance coverage insurance policies sometimes cowl a variety of companies, serving to to alleviate monetary burdens throughout extended intervals of want. Frequent advantages embody:

- Nursing Residence Care: Offers monetary help for the price of nursing residence stays, together with room and board, medical care, and different related bills. This protection typically varies by the extent of care wanted, from fundamental assisted residing to expert nursing.

- Residence Healthcare: Covers bills associated to in-home care companies, equivalent to private care, treatment reminders, and different help wanted to keep up independence throughout the residence atmosphere.

- Grownup Day Care: Covers bills for grownup day care companies, which supply supervised actions and help for people needing help through the day.

Evaluating Coverage Sorts

A complete understanding of the varied coverage sorts is important to deciding on essentially the most appropriate plan. The next desk Artikels key traits of various coverage sorts.

| Coverage Kind | Advantages | Premiums | Exclusions |

|---|---|---|---|

| Particular person Coverage | Excessive stage of customization; tailor-made to particular wants | Premiums can range tremendously relying on age, well being, and desired protection | Pre-existing situations, sure forms of care, or particular geographic places could also be excluded. |

| Group Coverage | Commonplace advantages and premiums, probably extra inexpensive | Usually based mostly on employer contribution and worker participation | Restricted customization choices; might not cowl all potential wants |

| Hybrid Coverage | Mixture of customization and affordability | Premiums are normally someplace between particular person and group insurance policies | Protection choices is perhaps restricted compared to a person coverage |

Unum Lengthy-Time period Care Insurance coverage Specifics

Unum’s long-term care insurance coverage supply quite a lot of choices for people in search of safety in opposition to the monetary burdens of long-term care wants. Understanding the particular options, plan choices, prices, and comparisons with opponents is essential for making an knowledgeable resolution. These plans are designed to assist guarantee monetary safety throughout a probably difficult time.Unum’s plans are rigorously structured to offer protection for numerous eventualities, from aiding with each day actions to extra intensive care.

The plans’ strengths and weaknesses are offered to facilitate a complete understanding of the merchandise. An in depth desk Artikels the completely different plan choices, their corresponding protection quantities, and related premiums.

Particular Options of Unum’s Plans

Unum’s long-term care insurance coverage merchandise present a variety of advantages and options. These options are tailor-made to fulfill particular person wants, together with protection for expert nursing services, assisted residing services, and residential healthcare companies. Insurance policies sometimes supply choices for inflation safety, permitting protection to maintain tempo with rising healthcare prices.

Plan Choices Supplied by Unum

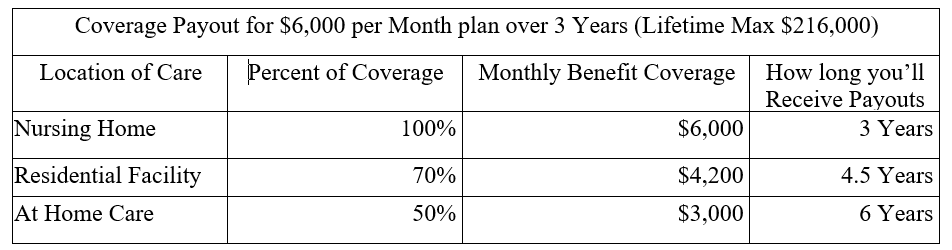

Unum affords a number of long-term care insurance coverage plan choices. Every plan is designed to deal with particular wants and monetary conditions. Plan choices cater to various ranges of protection and premium quantities.

Typical Prices and Premiums

The prices and premiums related to Unum’s plans range relying on elements like the chosen protection quantity, the insured’s age and well being, and the chosen profit interval. Premiums are sometimes calculated based mostly on actuarial information and threat evaluation. For instance, a youthful, more healthy particular person would probably pay decrease premiums than an older particular person with pre-existing situations.

Comparability with Rivals

Unum’s long-term care insurance coverage are in contrast with these of different main suppliers out there. Components like protection quantities, profit intervals, and premium buildings are thought of. This comparability helps shoppers perceive the worth proposition of Unum’s choices relative to opponents. Variations in administrative charges and claims processing procedures are additionally key components within the comparability.

Strengths and Weaknesses of Unum’s Plans

Unum’s long-term care insurance coverage have strengths and weaknesses. Strengths typically embody complete protection choices, aggressive premiums, and a popularity for dependable service. Weaknesses would possibly embody restricted availability of sure plan choices or various buyer satisfaction scores. These elements must be thought of alongside particular person wants.

Unum’s Plan Choices, Protection, and Premiums

| Plan Identify | Each day Profit Quantity | Most Profit Interval (months) | Annual Premium (instance) |

|---|---|---|---|

| Unum Safe Care Plan | $200 | 36 | $1,500 |

| Unum Premier Care Plan | $300 | 60 | $2,200 |

| Unum Elite Care Plan | $400 | 84 | $3,000 |

Notice: Premiums are estimated and should range based mostly on particular person elements. This desk offers a normal illustration.

Advantages and Protection Evaluation

Marga ni Unum Lengthy-Time period Care Insurance coverage, ipataridaon ma narima ni sipak na manfaat na sipar roha na. Marpansingon do inangka ni manfaat na, jala patut do diparrohahon angka naeng mambahen keputusan na patut.

Coated Forms of Care

Unum Lengthy-Time period Care Insurance coverage mambahen protection di angka jenis perawatan na berbeda, laho mangurupi angka pemegang polis di situasi na susah. Jenis perawatan na dibahen protection i termasuk expert nursing care, assisted residing, dan residence well being care. Expert nursing care iparsatongon do angka pelayanan perawatan medis na rumit, na laho mangurupi angka pasien na butuh pengawasan na ketat.

Assisted residing, ipataridaon do lingkungan na nyaman jala mendukung, na mangurupi pemegang polis na membutuhkan bantuan di angka kegiatan sehari-hari. Residence well being care iparsatongon do pelayanan kesehatan di rumah, na mangurupi pemegang polis na naeng dirawat di rumah. Protection ni berbeda-beda targantung di angka perjanjian na dibahen.

Protection Quantities

Jumlah protection na dibahen Unum Lengthy-Time period Care Insurance coverage dapat berubah-ubah, tergantung di jumlah premi na dibayar, usia, dan jenis perawatan na dipilih. Untuk memastikan angka protection na tepat, penting do menghubungi agen Unum untuk informasi lebih lanjut.

Coverage Exclusions and Limitations

Adong do angka pengecualian dan batasan na patut diparrohahon. Angka pengecualian i termasuk perawatan na disebabkan oleh kecelakaan, penyakit psychological, atau perawatan na di luar cakupan polis. Penting do membaca dengan teliti angka syarat dan ketentuan na tertera di polis, agar dapat memahami dengan jelas angka batasan dan pengecualian na berlaku.

Examples of Conditions The place Protection Would Be Helpful

Unum Lengthy-Time period Care Insurance coverage dapat bermanfaat di berbagai situasi, contohnya ketika pemegang polis membutuhkan perawatan jangka panjang karena sakit kronis, stroke, atau cedera serius. Protection ni dapat membantu memenuhi kebutuhan perawatan medis, biaya hidup, dan angka pengeluaran lainnya, na dapat mengurangi beban keuangan di keluarga. Contoh lain, ketika seseorang na butuh bantuan di angka kegiatan sehari-hari, protection ni dapat membantu membayar biaya assisted residing atau residence well being care.

Adjusting Protection Quantities

Jumlah protection na dapat disesuaikan, tergantung di kebutuhan na diperlukan. Pemilik polis dapat memilih angka protection na berbeda-beda, laho menyesuaikan dengan kondisi keuangan mereka. Jumlah protection ni dapat diubah, namun ada syarat dan ketentuan na berlaku. Penting do menghubungi agen Unum untuk mendiskusikan angka perubahan protection ni.

Abstract Desk, Unum long run care insurance coverage

| Jenis Perawatan | Jumlah Protection (Contoh) |

|---|---|

| Expert Nursing Care | Rp 10.000.000 per bulan |

| Assisted Dwelling | Rp 5.000.000 per bulan |

| Residence Well being Care | Rp 3.000.000 per bulan |

Catatan: Jumlah protection na tertera hanyalah contoh dan dapat berubah-ubah tergantung pada polis dan perjanjian na dibuat.

Coverage Concerns and Comparisons

Marhite marhite, within the realm of long-term care insurance coverage, diligent consideration is essential. Understanding the nuances of assorted insurance policies, particularly Unum’s choices, is essential for making knowledgeable choices. Choosing the proper protection requires cautious analysis of particular person wants and monetary conditions.Evaluating long-term care insurance coverage insurance policies is a multifaceted course of. Components equivalent to protection quantities, premiums, and exclusions should be scrutinized.

Comparisons with different insurers are important to know the aggressive panorama and the worth proposition of Unum’s insurance policies. Moreover, the power to tailor a coverage to particular circumstances is paramount, as are riders and add-ons for enhanced protection. A deep dive into the motivations behind buying long-term care insurance coverage reveals frequent elements, equivalent to anticipating potential future wants and guaranteeing monetary safety throughout a difficult time.

Components to Think about When Evaluating Insurance policies

Evaluating long-term care insurance coverage insurance policies necessitates a complete strategy. Consideration of protection quantities, premium prices, and coverage exclusions are elementary. Components just like the insured’s age, well being standing, and life-style are important for assessing potential dangers and tailoring protection accordingly. The length of protection and the forms of care coated are essential components to contemplate. Lastly, the monetary implications of various coverage choices, together with premium funds and potential payouts, should be totally analyzed.

Evaluating Unum’s Insurance policies with Different Insurers

Evaluating Unum’s long-term care insurance coverage insurance policies with these of different main insurers is significant. This comparability necessitates an in depth evaluation of assorted features, together with premiums, protection quantities, and coverage exclusions. Such a comparability offers a complete understanding of the aggressive panorama and helps potential policyholders make knowledgeable choices. Unum’s choices should be evaluated alongside these of opponents to evaluate worth and match for particular person wants.

Tailoring a Coverage to Particular Circumstances

Tailoring a long-term care insurance coverage coverage to particular person wants is paramount. Components just like the insured’s age, well being, and life-style affect the sort and quantity of protection required. Adjusting protection based mostly on these elements ensures the coverage successfully addresses particular person wants. This contains concerns of the extent of care wanted, the anticipated length of care, and the monetary implications.

Significance of Coverage Riders and Add-ons

Coverage riders and add-ons are important elements of long-term care insurance coverage. They supply alternatives to customise protection to fulfill particular wants. For instance, a rider for inflation safety safeguards in opposition to rising healthcare prices. Different add-ons might tackle particular care wants, equivalent to specialised nursing care or residence healthcare. These riders and add-ons improve the coverage’s flexibility and guarantee it successfully addresses potential future wants.

Frequent Causes for Selecting Lengthy-Time period Care Insurance coverage

People select long-term care insurance coverage for a large number of causes. A main motivator is the will to keep up monetary safety throughout a interval of potential dependency and excessive healthcare prices. The safety from escalating healthcare bills is a big issue. Moreover, guaranteeing high quality care and sustaining dignity are additionally essential concerns. The anticipation of future wants and a need for peace of thoughts are sometimes cited as key motivations.

Comparative Evaluation of Coverage Choices

| Characteristic | Unum Coverage A | Unum Coverage B | Main Insurer X | Main Insurer Y |

|---|---|---|---|---|

| Premium (Annual) | $2,500 | $3,000 | $2,800 | $2,750 |

| Protection Quantity (Each day) | $200 | $300 | $250 | $350 |

| Coverage Exclusions | Pre-existing situations (excluding sure exceptions) | Pre-existing situations (excluding sure exceptions) | Sure continual situations, residence modifications | Care in a nursing facility, residence modifications |

Notice

* This desk offers a simplified comparability. Particular coverage particulars and exclusions might range. Seek the advice of with a monetary advisor for customized steerage.

Understanding the Advantages of Lengthy-Time period Care Insurance coverage

Marga ni, naeng, dipaima marhite-hite paruhuman ni angka ulaon ni ngolu on. Aek ni ngolu on martimbang, jala sai naeng mambahen parsalisian tu bangku. Ulaon ni ngolu on, ulaon na mandorang, jala adong ma hasusaan na boi mambahen sitaonon na legan. Marhite-hite paruhuman ni ulaon ni ngolu on, naeng ma taulas taringot tu pertahanan ni ngolu on, jala songon dia pelean ni pertahanan ni ngolu on.Di bagasan angka na masa di ngolu on, adong ma angka hasusaan na martimbang na boi mambahen sitaonon tu bangku.

Hasusaan on boi mambahen angka parsalisian di ngolu on. Pardos ni angka parsalisian on, sai naeng ma taulas jala dipaima taringot tu pertahanan ni ngolu on, jala songon dia pelean ni pertahanan ni ngolu on. Paruhuman ni pertahanan ni ngolu on, naeng ma tajadi parsalisian na rumit.

Lengthy-Time period Monetary Implications of Needing Lengthy-Time period Care

Hasonangan ni angka ulaon ni ngolu on, naeng ma martimbang jala naeng ma mambahen parsalisian. Adong ma angka parsalisian na legan di ngolu on, jala naeng ma adong angka pertahanan di ngolu on. Hasusaan ni ngolu on, naeng ma taruhum jala tarpatuduhon. Angka parsalisian di ngolu on, naeng ma taruhum jala tarpatuduhon. Paruhuman ni parsalisian on, naeng ma tarpatuduhon.Piga-piga halak boi mardongan hasusaan na rumit, naeng ma taruhum.

Di naeng ma tarpatuduhon parsalisian on, naeng ma martimbang. Adong ma angka parsalisian na rumit na boi mambahen angka parsalisian di ngolu on.

How Lengthy-Time period Care Insurance coverage Protects In opposition to Monetary Pressure

Ulaon ni ngolu on, sai naeng ma mambahen parsalisian. Marhite-hite pertahanan ni ngolu on, naeng ma mambahen parsalisian na rumit. Pertahanan ni ngolu on, naeng ma martimbang jala naeng ma mambahen angka parsalisian. Pertahanan ni ngolu on, naeng ma mambahen pertahanan.Pertahanan ni ngolu on, naeng ma taruhum jala naeng ma tarpatuduhon. Pertahanan ni ngolu on, naeng ma mambahen parsalisian na rumit.

Pertahanan ni ngolu on, naeng ma mambahen parsalisian. Pertahanan ni ngolu on, naeng ma mambahen parsalisian na rumit.

Actual-World Examples of How Lengthy-Time period Care Insurance coverage Can Assist Households

Paruhuman ni angka ulaon ni ngolu on, naeng ma tarpatuduhon. Angka contoh ni, naeng ma martimbang. Angka contoh ni, naeng ma tarpatuduhon. Angka contoh ni, naeng ma mambahen parsalisian.Angka contoh ni, naeng ma mambahen parsalisian na rumit. Angka contoh ni, naeng ma mambahen parsalisian.

Angka contoh ni, naeng ma taruhum. Angka contoh ni, naeng ma tarpatuduhon. Angka contoh ni, naeng ma mambahen parsalisian.

Potential Financial savings from Avoiding Out-of-Pocket Bills

Sai naeng ma angka pertahanan ni ngolu on martimbang. Marhite-hite pertahanan ni ngolu on, naeng ma taruhum jala tarpatuduhon. Angka pertahanan ni ngolu on, naeng ma mambahen parsalisian. Marhite-hite pertahanan ni ngolu on, naeng ma taruhum jala tarpatuduhon.

Paruhuman ni ngolu on, naeng ma taruhum jala naeng ma tarpatuduhon. Marhite-hite paruhuman ni ngolu on, naeng ma tarpatuduhon angka parsalisian.

Potential Monetary Burden of Lengthy-Time period Care With out Insurance coverage

Naeng ma tarpatuduhon angka parsalisian di ngolu on. Di naeng ma taruhum jala tarpatuduhon. Angka pertahanan ni ngolu on, naeng ma tarpatuduhon. Angka parsalisian di ngolu on, naeng ma tarpatuduhon.

- Biaya perawatan jangka panjang dapat mencapai jutaan rupiah per tahun, tergantung pada tingkat perawatan yang dibutuhkan.

- Biaya ini dapat mencakup biaya perawatan medis, perawatan di rumah, dan fasilitas perawatan lansia.

- Biaya ini dapat menguras tabungan dan aset finansial, menyebabkan kesulitan finansial bagi keluarga.

Coverage Choice and Buying Course of

Marhitek marhitek, memilih asuransi perawatan jangka panjang (long-term care) memang proses yang penting. Membutuhkan pertimbangan matang dan wawasan yang luas. Proses ini bukan hanya tentang memilih produk, tapi juga memahami kebutuhan finansial jangka panjang Anda.

Steps in Buying a Lengthy-Time period Care Insurance coverage Coverage

Understanding the steps concerned in buying a long-term care insurance coverage coverage is essential for making an knowledgeable resolution. It is like navigating a winding highway, every step a essential milestone.

- Evaluation of Wants: This preliminary step includes a complete analysis of your present and anticipated future healthcare wants. Think about your age, well being standing, potential for future sicknesses, and monetary assets. This cautious analysis ensures you choose a coverage that adequately addresses your long-term care necessities. Components such because the estimated length of care, and anticipated prices are additionally essential concerns.

- Analysis and Comparability of Insurance policies: Thorough analysis is significant. Examine completely different insurance policies supplied by numerous insurance coverage suppliers, noting protection particulars, premiums, and exclusions. Study the advantages and limitations of every coverage to make sure it aligns together with your particular wants. This cautious scrutiny ensures you do not overlook any necessary particulars.

- Session with a Monetary Advisor: Searching for steerage from a monetary advisor specializing in insurance coverage is very advisable. They’ll present skilled recommendation tailor-made to your particular person circumstances. A monetary advisor may also help navigate the complexities of long-term care insurance coverage, guaranteeing the most effective match in your scenario.

- Coverage Choice: Primarily based in your wants and the advisor’s suggestions, choose a coverage that gives sufficient protection and suits your price range. The coverage ought to clearly Artikel the advantages, limitations, and related prices.

- Software and Approval: Full the appliance course of totally, offering all essential info. The insurance coverage supplier will then assessment your software and decide in case your coverage request is permitted. This important step includes verifying your info and evaluating your eligibility for protection.

- Coverage Evaluate and Cost: Totally assessment the coverage paperwork, guaranteeing readability on protection particulars and monetary obligations. Pay the premiums based on the coverage phrases. Make sure the cost construction aligns together with your monetary capability. This assessment course of prevents any potential misunderstandings or points later.

Significance of Consulting with a Monetary Advisor

A monetary advisor performs a significant position in navigating the complexities of long-term care insurance coverage. Their experience helps you make knowledgeable choices, guaranteeing the very best final result in your monetary future. They may also help you examine insurance policies and choose essentially the most acceptable one in your wants.

- Experience in Insurance coverage: A monetary advisor specializing in insurance coverage possesses in-depth data of assorted insurance coverage merchandise, together with long-term care insurance coverage. Their experience ensures that you just obtain customized steerage, tailor-made to your particular wants and circumstances.

- Goal Evaluation of Wants: Monetary advisors can objectively assess your monetary scenario and healthcare wants. This goal evaluation helps you make knowledgeable choices, avoiding potential pitfalls.

- Understanding Your Monetary State of affairs: A monetary advisor may also help you perceive how long-term care insurance coverage suits inside your general monetary plan. This holistic understanding ensures you are making choices that align together with your long-term monetary targets.

- Coverage Comparability and Choice: Advisors can examine numerous long-term care insurance coverage insurance policies, contemplating elements like protection quantities, premiums, and exclusions. This comparability ensures you choose essentially the most appropriate coverage in your wants.

Examples of Monetary Advisors Specializing in Insurance coverage

Numerous forms of monetary advisors specialise in insurance coverage, every with particular areas of experience. Figuring out the suitable advisor is important for tailor-made steerage.

- Insurance coverage Brokers: These advisors symbolize a number of insurance coverage firms, permitting for complete comparisons of assorted insurance policies. They enable you to navigate the complexities of the insurance coverage market, guaranteeing you choose the most effective coverage in your scenario.

- Licensed Monetary Planners (CFPs): These professionals typically have in depth data of monetary planning, together with insurance coverage methods. They’ll incorporate long-term care insurance coverage into your general monetary plan.

- Chartered Life Underwriters (CLUs): These advisors specialise in life insurance coverage and associated monetary merchandise. They’ll supply steerage on numerous insurance coverage merchandise, together with long-term care insurance coverage.

Frequent Inquiries to Ask an Insurance coverage Supplier

Asking the suitable questions is essential for acquiring correct details about long-term care insurance coverage insurance policies. Clear communication is essential.

- Protection Particulars: Inquire in regards to the particular forms of care coated, together with expert nursing care, assisted residing, and residential healthcare. Clearly understanding the scope of protection is significant.

- Coverage Exclusions: Determine any potential exclusions or limitations within the coverage. This proactive strategy prevents any surprises in a while.

- Premium Construction: Perceive the premium cost schedule and its influence in your price range. Understanding the premium construction helps you handle your funds successfully.

- Coverage Administration: Inquire in regards to the declare course of, the coverage administration, and the procedures for making claims. Having a transparent understanding of the declare course of is necessary.

Evaluating Insurance policies Primarily based on Particular person Wants

Evaluating insurance policies based mostly on particular person wants includes a meticulous course of. Think about your private scenario to make sure you make the most effective resolution.

- Protection Quantity: Think about the quantity of protection wanted based mostly in your anticipated healthcare bills. This consideration ensures that the coverage adequately addresses your long-term care wants.

- Premium Price: Assess the premium value and its influence in your price range. This step ensures that the premium value aligns together with your monetary capability.

- Coverage Limitations: Consider the coverage’s limitations and exclusions. This analysis helps you perceive the particular limitations of the coverage.

Step-by-Step Information to Selecting the Proper Coverage

This step-by-step information offers a framework for selecting the best long-term care insurance coverage coverage.[Visual representation (flowchart)

cannot be created here]

Claims Course of and Reimbursement

Marhitei Unum long-term care insurance coverage, prosesi declare and reimbursement, penting dipelajari untuk memastikan pemahaman lengkap tentang hak dan tanggung jawab. Proses ini menentukan bagaimana klaim diproses dan bagaimana pembayaran dilakukan. Pemahaman yang jelas akan membantu dalam menghadapi situasi yang mungkin muncul.

Unum Lengthy-Time period Care Insurance coverage Claims Course of Overview

Unum long-term care insurance coverage declare proses biasanya dimulai dengan pengajuan permohonan tertulis yang lengkap. Dokumen-dokumen yang dibutuhkan akan bervariasi, tergantung pada jenis klaim dan kondisi yang dialami. Hal ini penting untuk menghindari penundaan atau penolakan klaim.

Situations Requiring Declare Submitting

Berikut beberapa contoh skenario di mana klaim mungkin diajukan:

- Pasien membutuhkan perawatan di fasilitas perawatan jangka panjang karena stroke.

- Pasien membutuhkan bantuan dalam aktivitas sehari-hari seperti makan, mandi, dan berpakaian.

- Pasien mengalami cedera yang memerlukan perawatan intensif di rumah sakit.

- Pasien membutuhkan bantuan dalam kegiatan mobilitas.

Typical Declare Processing Timeframe

Waktu pemrosesan klaim untuk Unum long-term care insurance coverage dapat bervariasi, tetapi umumnya membutuhkan beberapa minggu. Waktu yang dibutuhkan bergantung pada kompleksitas kasus, kelengkapan dokumen, dan kesiapan pihak-pihak terkait. Penting untuk memahami bahwa proses ini mungkin memerlukan waktu, dan penting untuk berkomunikasi secara efektif dengan perusahaan asuransi.

Reimbursement Course of and Related Prices

Proses pengembalian dana umumnya mengikuti prosedur yang telah ditetapkan oleh Unum. Biaya administrasi dan biaya lain yang terkait dengan proses tersebut, jika ada, akan dijelaskan dalam polis asuransi. Untuk menghindari kebingungan, sebaiknya Anda berkonsultasi dengan perwakilan Unum untuk mendapatkan informasi lebih lanjut.

Desk of Claims Course of Phases

Berikut tabel yang menjelaskan tahapan-tahapan dalam proses klaim:

| Tahap | Deskripsi |

|---|---|

| Pengajuan Klaim | Pengumpulan dokumen-dokumen yang diperlukan dan pengirimannya ke Unum. |

| Evaluasi Klaim | Tim Unum akan mengevaluasi kelengkapan dan keabsahan dokumen. |

| Pemeriksaan Medis (Jika dibutuhkan) | Jika diperlukan, Unum mungkin meminta pemeriksaan medis tambahan untuk memastikan validitas klaim. |

| Keputusan Klaim | Unum akan memberikan keputusan terkait klaim (disetujui atau ditolak). |

| Pembayaran | Jika klaim disetujui, Unum akan melakukan pembayaran sesuai dengan ketentuan polis. |

Lengthy-Time period Care Insurance coverage Traits and Future Outlook

Di masa kini, industri asuransi perawatan jangka panjang mengalami perubahan yang dinamis. Faktor-faktor seperti demografi, kemajuan teknologi, dan pergeseran preferensi pelanggan turut membentuk lanskap industri ini. Pemahaman akan tren saat ini dan proyeksi masa depan sangat penting untuk para pemangku kepentingan, termasuk nasabah dan penyedia asuransi.

Present Traits within the Lengthy-Time period Care Insurance coverage Business

Tren-tren terkini di industri asuransi perawatan jangka panjang menunjukkan peningkatan kesadaran akan pentingnya perencanaan perawatan jangka panjang. Semakin banyak orang yang menyadari kebutuhan untuk melindungi diri mereka dan keluarga dari biaya perawatan jangka panjang yang tinggi. Permintaan untuk polis asuransi perawatan jangka panjang yang lebih fleksibel dan terjangkau juga meningkat, seiring dengan kebutuhan individu untuk menyesuaikan dengan gaya hidup dan kondisi keuangan mereka.

Penyedia asuransi terus berinovasi dengan menawarkan produk-produk yang lebih terintegrasi dengan layanan kesehatan dan pilihan perawatan yang beragam.

Potential Future Developments and Modifications

Perkembangan masa depan dalam industri asuransi perawatan jangka panjang diprediksi akan didorong oleh peningkatan kebutuhan perawatan jangka panjang seiring dengan bertambahnya populasi lansia. Inovasi teknologi, seperti penggunaan kecerdasan buatan (AI) dan perangkat telemedis, diantisipasi dapat meningkatkan efisiensi dan aksesibilitas layanan perawatan jangka panjang. Pilihan perawatan yang lebih private dan terintegrasi, seperti layanan perawatan di rumah, akan menjadi semakin penting.

Pilihan pembayaran yang lebih beragam dan fleksibel, seperti pembayaran berbasis nilai, juga diantisipasi akan muncul di masa depan.

Technological Developments and Their Influence

Kemajuan teknologi akan sangat berpengaruh pada industri asuransi perawatan jangka panjang. Penggunaan perangkat telemedis dan kecerdasan buatan dapat meningkatkan efisiensi layanan perawatan dan menurunkan biaya perawatan. Sistem manajemen perawatan yang terintegrasi dapat memantau kondisi pasien secara real-time dan memberikan intervensi yang tepat waktu. Hal ini dapat mengurangi beban pada sistem perawatan kesehatan dan meningkatkan kualitas hidup pasien.

Influence of Ageing Populations

Pertumbuhan populasi lansia secara signifikan akan meningkatkan kebutuhan akan asuransi perawatan jangka panjang. Angka harapan hidup yang meningkat dan perubahan pola hidup akan berpengaruh terhadap kebutuhan perawatan jangka panjang. Peningkatan jumlah individu yang membutuhkan perawatan jangka panjang akan menciptakan tantangan dan peluang bagi industri asuransi perawatan jangka panjang.

Predicted Lengthy-Time period Care Insurance coverage Prices

Berikut adalah perkiraan biaya asuransi perawatan jangka panjang di masa depan, dengan mempertimbangkan beberapa skenario:

| Skenario | Perkiraan Biaya (Tahun 2030) | Perkiraan Biaya (Tahun 2040) |

|---|---|---|

| Skenario Standar | Rp 100 juta – Rp 200 juta | Rp 200 juta – Rp 400 juta |

| Skenario Tinggi | Rp 200 juta – Rp 300 juta | Rp 400 juta – Rp 600 juta |

Catatan: Biaya di atas merupakan perkiraan dan dapat bervariasi tergantung pada berbagai faktor, termasuk kesehatan individu, jenis perawatan yang dibutuhkan, dan lokasi geografis.

End result Abstract

In conclusion, Unum long-term care insurance coverage offers a beneficial security internet for future wants. By understanding the completely different plan choices, prices, and advantages, you can also make knowledgeable choices to guard your monetary well-being and the well-being of your family members. This information acts as a place to begin for additional analysis and consultations with monetary advisors. Keep in mind, your alternative ought to align together with your particular person circumstances and long-term targets.

Query & Reply Hub: Unum Lengthy Time period Care Insurance coverage

What are the standard prices related to Unum’s long-term care insurance coverage?

Premiums range considerably relying on the chosen plan, age, well being standing, and protection quantities. A complete quote comparability is important to know the monetary implications of various choices.

What are the several types of care coated by Unum?

Unum sometimes covers expert nursing, assisted residing, and residential well being care. Particular protection particulars must be reviewed throughout the coverage paperwork.

How can I examine Unum’s plans with different insurers?

Complete comparability tables, available on-line, may also help assess premium prices, protection quantities, and coverage exclusions. Seek the advice of with a monetary advisor for customized steerage.

What are the steps concerned in buying a Unum long-term care insurance coverage coverage?

Usually, you will want to finish an software, present medical info, and pay the preliminary premium. Consulting a monetary advisor is very advisable.