Unleash the ability of the letter of cancellation of automotive insurance coverage! Think about this: you have determined to ditch that month-to-month insurance coverage cost, possibly for a snazzier, extra reasonably priced experience or just since you’ve outgrown the necessity. This complete information will stroll you thru the method, from the preliminary inkling to the ultimate, satisfying affirmation. Get able to navigate the sometimes-tricky world of insurance coverage cancellations, and reclaim your monetary freedom!

This doc meticulously particulars your complete cancellation course of, from understanding the nuances of the letter itself to the often-overlooked authorized concerns. We’ll cowl the important parts of a cancellation letter, the timelines concerned, the monetary implications, and even the nuances of various insurance coverage suppliers. We’ll even throw in some humorous anecdotes alongside the way in which!

Understanding the Letter of Cancellation

A letter of cancellation for automotive insurance coverage is a proper notification to the insurance coverage firm that you just intend to finish your coverage. It is a essential doc that Artikels the termination of your protection and ensures a easy transition. This doc particulars the method and important parts of such a letter.A letter of cancellation formally signifies the policyholder’s resolution to finish their automotive insurance coverage settlement with the insurer.

This motion is often initiated when a policyholder now not requires the insurance coverage protection, needs to modify to a different insurer, or has skilled a major change of their circumstances. This doc particulars the aim, key components, and causes behind this motion.

Objective and Operate of a Cancellation Letter

A letter of cancellation serves as a legally binding settlement to terminate the automotive insurance coverage coverage. It formally informs the insurance coverage firm of the policyholder’s intent to discontinue the protection and Artikels the efficient date of cancellation. This ensures a transparent file of the termination and facilitates the return of any relevant premiums.

Key Parts of a Cancellation Letter

A well-structured cancellation letter sometimes consists of the next components:

- Coverage particulars: The letter ought to clearly state the coverage quantity, the insured’s title, the car particulars (yr, make, mannequin, VIN), and the efficient coverage begin and finish dates.

- Cancellation date: The letter should specify the exact date on which the policyholder needs the cancellation to take impact. This can be a vital component to keep away from any confusion or overlapping protection.

- Cause for cancellation: Whereas not all the time necessary, offering a quick and concise clarification for the cancellation might be useful for each the policyholder and the insurer.

- Contact data: The letter ought to embody the policyholder’s contact data (tackle, telephone quantity, e-mail) for the insurance coverage firm to simply attain out for additional inquiries or clarifications.

- Signature and date: The letter needs to be signed by the policyholder, and the date of signing needs to be clearly indicated to confirm the authenticity and timing of the cancellation request.

Causes for Cancelling Automotive Insurance coverage

Policyholders might cancel their automotive insurance coverage for numerous causes, together with:

- Shifting to a location with completely different insurance coverage necessities.

- Promoting the insured car.

- Switching to a different insurer providing higher charges or protection.

- Not needing the protection because of a change in circumstances (e.g., ceasing to function a car).

- Dissatisfaction with the present insurance coverage coverage’s phrases and circumstances.

Technique of Sending a Cancellation Letter

The method of sending a cancellation letter to the insurance coverage firm often includes:

- Writing a proper letter outlining the coverage particulars, cancellation date, and purpose for cancellation.

- Sending the letter through licensed mail, registered mail, or e-mail, whichever methodology is most well-liked and specified by the insurance coverage firm.

- Conserving a duplicate of the letter for private information.

- Following up with the insurance coverage firm to make sure the cancellation request has been acquired and processed accurately.

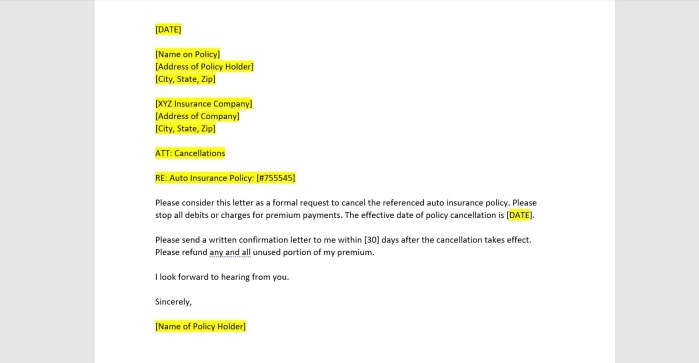

Cancellation Letter Template

| Part | Content material |

|---|---|

| Coverage Particulars | Coverage Quantity: [Policy Number] Insured Identify: [Insured Name] Automobile Particulars: [Year, Make, Model, VIN] Coverage Begin Date: [Start Date] Coverage Finish Date: [End Date] |

| Cancellation Date | Efficient Date of Cancellation: [Date] |

| Cause for Cancellation | [Brief explanation, e.g., Selling the vehicle, Moving to a new location, etc.] |

| Contact Data | [Insured Name] [Address] [Phone Number] [Email Address] |

| Signature and Date | ____________________________ [Signature] [Date] |

Authorized Necessities and Issues

Cancelling automotive insurance coverage includes particular authorized obligations and tasks. Understanding these obligations ensures a easy and compliant cancellation course of, stopping potential authorized points. Failure to stick to those necessities can result in penalties and problems.Following the insurer’s cancellation procedures is essential. Insurers usually have particular timelines and documentation necessities. Adhering to those tips safeguards your rights and avoids delays or disputes.

Policyholder Obligations

Policyholders are chargeable for notifying their insurer of their intent to cancel. This notification sometimes requires a proper letter of cancellation. This letter ought to clearly state the policyholder’s intention and the efficient date of cancellation. Moreover, the policyholder should make sure the cancellation is communicated in writing.

Significance of Following Cancellation Procedures

Adherence to the insurer’s cancellation procedures is significant. Deviation from these procedures might result in a refusal of the cancellation request, doubtlessly delaying or stopping the termination of the coverage. This might lead to persevering with to be answerable for funds. An absence of formal notification may additionally create points if claims are filed through the cancellation interval.

Penalties of Non-Compliance

Failing to comply with the insurer’s cancellation procedures may end up in the coverage remaining energetic. This implies the policyholder might proceed to be chargeable for premium funds and is probably not launched from protection. Moreover, failure to supply required paperwork might impede the cancellation course of. In some circumstances, non-compliance might lead to authorized motion from the insurer.

Required Paperwork

To make sure a easy cancellation course of, policyholders ought to collect related paperwork. These paperwork sometimes embody the coverage particulars, proof of cost for the present coverage interval, and every other documentation requested by the insurer. A duplicate of the cancellation letter itself can also be important for record-keeping.

- Coverage paperwork (together with the coverage quantity and efficient dates)

- Proof of cost (receipts or financial institution statements)

- Any requested supporting paperwork (e.g., proof of tackle change)

Potential Authorized Points

Potential authorized points through the cancellation course of might come up if there is a dispute in regards to the coverage’s protection or the validity of the cancellation. For instance, misunderstandings in regards to the cancellation interval or required paperwork can result in disagreements. Moreover, if a declare is made through the cancellation interval, the insurer might not settle for accountability, resulting in authorized challenges.

Comparability of Cancellation Procedures

Various kinds of automotive insurance coverage insurance policies might have various cancellation procedures. Some insurance policies might permit for cancellation with shorter discover durations, whereas others might have extra advanced necessities. The cancellation procedures might differ relying on the insurer and coverage sort. Complete insurance policies, for example, might need extra stringent necessities in comparison with primary legal responsibility insurance policies.

Timeline and Procedures: Letter Of Cancellation Of Automotive Insurance coverage

Letting go of your automotive insurance coverage can really feel a bit like parting methods with an outdated pal. Understanding the steps concerned and the anticipated timeframe makes the method smoother and fewer aggravating. This part particulars the method, from initiating the cancellation to receiving affirmation.The method of canceling automotive insurance coverage is simple. A transparent understanding of the steps concerned helps policyholders navigate the method effectively.

This consists of understanding the standard timeframe, accessible strategies for submitting requests, and the affirmation course of.

Initiating the Cancellation

To begin the cancellation course of, it’s essential to inform your insurance coverage firm of your intent. This sometimes includes submitting a written request. This may be carried out by means of numerous strategies, together with mail, e-mail, or by means of a web based portal, if accessible. A transparent and concise letter outlining your intention to cancel is crucial. Coverage particulars, together with your coverage quantity and the efficient cancellation date, needs to be included for readability and effectivity.

Processing the Request

As soon as the insurance coverage firm receives your cancellation request, they evaluate it to make sure all needed data is offered and to provoke the cancellation course of. This sometimes takes between one and 7 enterprise days. Throughout this time, the corporate verifies your request, processes the paperwork, and calculates any excellent prices. They may additionally want supporting paperwork if there are any uncommon circumstances.

Affirmation of Cancellation

After processing, the insurance coverage firm sends a affirmation letter. This affirmation letter particulars the cancellation date, excellent prices (if any), and every other pertinent data. This letter serves as proof that your cancellation request has been acquired and processed.

Strategies of Submission

You may submit your cancellation request through mail, e-mail, or on-line portals, if provided by the insurer. Mail is a standard methodology, however it might take longer for processing. E-mail permits for faster communication, whereas on-line portals supply essentially the most streamlined method, usually with automated responses. Select the strategy that fits your wants and preferences.

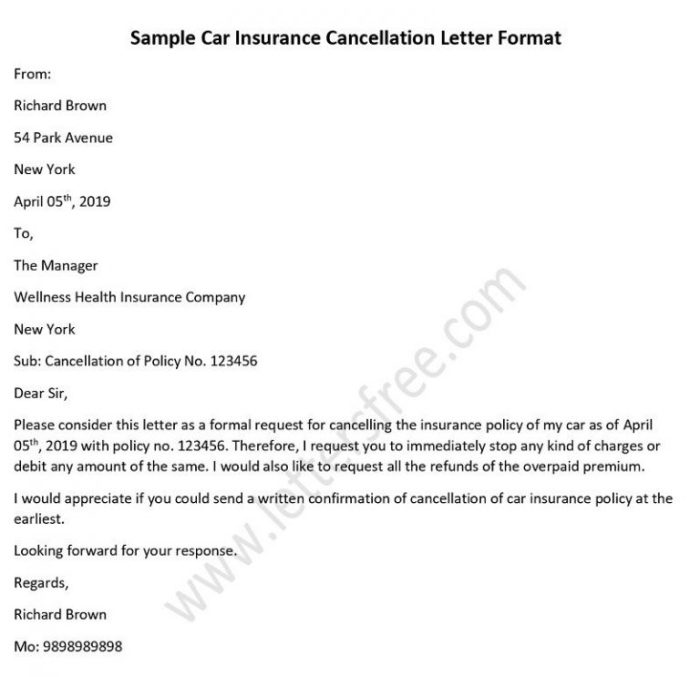

Examples of Affirmation Letters, Letter of cancellation of automotive insurance coverage

Affirmation letters sometimes embody the coverage quantity, cancellation date, any excellent funds, and a abstract of the cancellation particulars. They verify the insurer’s acceptance of the cancellation request. An instance of a affirmation letter would possibly learn: “Expensive [Policyholder Name], This letter confirms the cancellation of your automotive insurance coverage coverage, [Policy Number], efficient [Cancellation Date]. A ultimate cost of [Amount] is due by [Date].

We respect your enterprise.”

Timeline Desk

| Stage | Description | Estimated Time | Required Paperwork |

|---|---|---|---|

| Initiation | Policyholder notifies insurer of cancellation intent. | Fast | Coverage particulars |

| Processing | Insurer opinions request and processes cancellation. | 1-7 enterprise days | Supporting paperwork (if relevant) |

| Affirmation | Insurer sends affirmation of cancellation. | 1-3 enterprise days | N/A |

Monetary Implications

Cancelling your automotive insurance coverage can have monetary implications, starting from potential charges to refunds. Understanding these facets is essential for a easy transition. Figuring out the monetary phrases and circumstances concerned ensures a clear and knowledgeable resolution.The monetary implications of cancelling your automotive insurance coverage coverage lengthen past merely paying the cancellation charge. It is important to grasp the method for receiving any pay as you go premiums or unused protection, and the way this cancellation would possibly have an effect on any current claims or future insurance coverage insurance policies.

Cancellation Charges

Cancellation charges range considerably primarily based on the insurance coverage supplier and the coverage phrases. Some suppliers might cost a charge for cancelling early, whereas others won’t. These charges are sometimes primarily based on the remaining coverage time period. It is essential to evaluate the particular phrases and circumstances Artikeld in your insurance coverage coverage. As an example, a coverage cancelled throughout the first 30 days would possibly incur a major cancellation charge.

Refund of Premiums

The refund course of for unused premiums is dictated by the insurance coverage supplier’s insurance policies. Insurance policies usually have particular timelines for refund requests and processes, and these are sometimes acknowledged within the coverage paperwork. Refunds could also be partially or totally depending on the coverage cancellation date, and the protection interval. A coverage cancelled after the protection interval has commenced will possible lead to a smaller refund.

Claims Affect

Cancelling your automotive insurance coverage coverage would possibly affect any current or future claims. If a declare is filed earlier than the cancellation date, the insurance coverage supplier will possible honor the declare underneath the phrases of the coverage. Nevertheless, a cancellation would possibly result in the denial of any claims made after the cancellation date, until there are distinctive circumstances. The specifics are specified by your coverage doc.

Take into account any excellent claims or protection earlier than making a cancellation resolution.

Affect on Future Insurance policies

Your cancellation of the present coverage would possibly affect your eligibility and premium charges for future insurance coverage insurance policies. Insurance coverage corporations might assess your cancellation historical past when evaluating future purposes. The affect of this cancellation on future insurance policies can vary from a slight premium enhance to an entire denial of protection. Insurance coverage corporations typically take into account the cancellation historical past when figuring out your future premium charges.

Examples of Cancellation Charges and Refund Eventualities

A coverage cancelled throughout the first month might incur a $50 cancellation charge. A coverage cancelled after six months of the 12-month coverage interval might lead to a partial refund of the unused premium.

Abstract of Monetary Implications

| Merchandise | Description |

|---|---|

| Cancellation Charges | Potential charges for early cancellation, usually depending on the remaining coverage time period. |

| Refund of Premiums | Refund course of primarily based on the coverage’s phrases, doubtlessly partial or full, relying on the cancellation date and protection interval. |

| Claims Affect | Present claims filed earlier than cancellation will possible be honored, however claims after cancellation is perhaps denied, until exceptions apply. |

Insurance coverage Supplier Specifics

Navigating the cancellation course of can differ considerably between insurance coverage suppliers. Understanding these variations ensures a easy and environment friendly termination of your coverage. Every firm has its personal algorithm, deadlines, and necessities, so cautious consideration to element is vital.Insurance coverage corporations usually tailor their cancellation insurance policies to mirror their particular enterprise fashions and customer support approaches. This could result in distinct procedures for cancelling protection, impacting the timeline and potential monetary implications for policyholders.

Variations in Cancellation Insurance policies

Totally different insurance coverage suppliers have various cancellation insurance policies. Some corporations would possibly supply extra flexibility in cancellation phrases, whereas others might have stricter tips. Elements such because the size of the coverage, the kind of protection, and the explanation for cancellation can all affect the specifics of the cancellation process.

Cancellation Procedures Comparability

Insurance coverage corporations use various procedures for cancellation requests. Some would possibly require written notification through mail, whereas others might favor on-line portals or telephone calls. The timeframe for processing cancellation requests additionally varies.

Particular Necessities for Cancellation

Every insurance coverage supplier has particular conditions for cancelling automotive insurance coverage. These necessities might embody offering a proper discover of cancellation, assembly particular deadlines, and adhering to any pre-cancellation necessities. As an example, some insurers require proof of different protection earlier than the cancellation might be finalized.

Distinctive Phrases and Situations

Sure insurance coverage suppliers have distinctive phrases and circumstances concerning cancellation. These would possibly embody penalties for early cancellation, particular clauses for sure forms of insurance policies, or exceptions for specific circumstances. One instance could possibly be a requirement for offering an in depth purpose for cancellation in sure circumstances.

Contact Channels for Cancellation Inquiries

Contacting the suitable channels is crucial for initiating a cancellation. Totally different insurance coverage corporations present numerous avenues for contacting their customer support groups. These might embody telephone numbers, on-line portals, or e-mail addresses. Direct communication channels streamline the method.

Complete Information to Cancellation Insurance policies

For a radical overview, it’s extremely really helpful to seek the advice of the particular cancellation insurance policies of every insurance coverage supplier. These insurance policies sometimes Artikel the required steps, timelines, and circumstances for cancellation. Reviewing these insurance policies straight from the supplier’s web site is essentially the most correct methodology. These paperwork usually include essential particulars concerning cancellation charges, deadlines, and the method itself.

Seek the advice of the official web sites of various suppliers to entry these paperwork. For instance, State Farm’s web site might have a particular part devoted to cancellation insurance policies. Likewise, Allstate and Geico’s web sites might supply related assets.

Closing Wrap-Up

So, you are able to bid farewell to your automotive insurance coverage? This information has armed you with the information to navigate the cancellation course of with confidence. Bear in mind, thorough preparation and adherence to the insurance coverage firm’s particular procedures are key. Free your self from pointless insurance coverage burdens, and embrace the liberty that comes with a canceled coverage. Now go forth and reclaim your hard-earned money!

FAQ Abstract

What if I cancel my insurance coverage after which get into an accident?

Cancelling your insurance coverage would not magically erase your tasks. You will want to grasp your state’s necessities concerning uninsured/underinsured motorist protection, and it’s best to definitely keep away from driving with out insurance coverage. Contact your insurance coverage supplier to see if there are any particular concerns associated to claims.

How lengthy does it take to obtain the cancellation affirmation?

Processing instances range, however typically, you possibly can anticipate a affirmation inside 1-7 enterprise days, relying on the insurance coverage supplier and the specifics of your request. Take into account that weekends and holidays usually are not sometimes counted.

Can I cancel my insurance coverage mid-policy time period?

Sure, most insurance policies permit for mid-term cancellation. Nevertheless, you might incur cancellation charges. Assessment your coverage particulars rigorously and make contact with your insurer for particular particulars.

What if I want to alter the cancellation date in my letter?

It is best to contact your insurance coverage supplier on to request a change to the cancellation date. Keep away from merely altering the letter your self, as this might result in problems.