Safeco auto insurance coverage rental automotive protection: Navigating the complexities of defending your rental automobile is simpler than you assume. This complete information explores the intricacies of Safeco’s rental automotive insurance coverage, outlining commonplace protection, choices, and potential limitations. We’ll additionally dive into protection limits, deductibles, and learn how to file claims in varied situations, empowering you to make knowledgeable selections about your rental safety.

Understanding the particular phrases and situations, together with coverage language and potential exclusions, is vital to maximizing your protection. We’ll present a transparent comparability of Safeco’s protection in opposition to rivals, empowering you to decide on probably the most appropriate plan. This information additionally covers including rental automotive protection to your present coverage, and optimizing prices. In the end, we wish you to confidently lease understanding your priceless funding is protected.

Understanding Rental Automobile Protection

Safeco’s rental automotive protection is designed to guard you in case of an accident or injury to a rental automobile. This protection extends past your private automobile insurance coverage, offering a security internet whenever you’re driving a borrowed automotive. Understanding the specifics of this protection is essential for avoiding monetary burdens throughout a rental automotive incident.Safeco’s rental automotive protection presents a complete security internet, offering safety in opposition to varied dangers related to rental automotive utilization.

This contains complete safety in opposition to accidents, damages, and different surprising occasions which may happen whereas utilizing a rental automobile.

Customary Protection Offered by Safeco

Safeco’s commonplace rental automotive protection usually contains legal responsibility safety, just like the protection of your private auto coverage. This implies Safeco can pay for damages you trigger to a different get together’s automobile or accidents you inflict on them, as much as coverage limits. Nonetheless, it could not cowl damages to the rental automobile itself. This safety is essential for stopping you from being held personally accountable for vital monetary losses.

Rental Automobile Protection Choices

Safeco presents varied protection choices to satisfy totally different wants. A full protection possibility typically extends to the automobile itself, masking damages no matter who’s at fault. This complete protection offers safety in opposition to a wider vary of potential incidents. A fundamental possibility may solely cowl damages brought on by you, whereas a full protection coverage may present broader safety.

The selection of protection is dependent upon your particular person wants and danger tolerance.

Examples of Protection Activation

Rental automotive protection will be activated in quite a few conditions. As an example, in case you’re concerned in a collision whereas driving a rental automotive, and the opposite get together is at fault, your Safeco protection will possible kick in. Equally, if the rental automotive suffers injury because of vandalism or theft, Safeco’s protection could present compensation. The protection can even typically activate in conditions involving weather-related injury, resembling a flood or a storm.

Comparability with Different Main Insurance coverage Suppliers

Safeco’s rental automotive protection usually compares favorably to different main suppliers. Nonetheless, the particular phrases and situations differ between suppliers. Some suppliers could supply decrease deductibles, whereas others may present further advantages like roadside help. For instance, one supplier may cowl injury because of pre-existing situations, whereas Safeco may exclude such cases. Comparability procuring and cautious assessment of coverage particulars are essential to make sure one of the best protection on your wants.

Potential Limitations and Exclusions

It is important to grasp the constraints and exclusions of Safeco’s rental automotive protection. For instance, injury brought on by pre-existing situations on the rental automotive may not be coated. Equally, sure forms of injury, like these brought on by intentional acts, may be excluded. Rigorously reviewing the coverage doc will reveal these specifics. The exclusions needs to be thought-about when making your alternative.

Protection Comparability Desk

| Insurance coverage Supplier | Protection Sort | Deductible | Limitations |

|---|---|---|---|

| Safeco | Full Protection | $500 | Harm brought on by pre-existing situations, injury because of intentional acts. |

| XYZ Insurance coverage | Full Protection | $1000 | Excludes injury from put on and tear, injury because of negligence by the renter. |

| ABC Insurance coverage | Legal responsibility Solely | $250 | Doesn’t cowl injury to the rental automobile, solely legal responsibility to others. |

Protection Limits and Deductibles

Safeco’s rental automotive insurance coverage protection protects you if in case you have an accident whereas driving a rental automobile. Understanding the bounds and deductibles of this protection is essential to managing potential prices and making certain you are adequately protected. This part particulars the everyday protection limits, out there deductibles, and the way they have an effect on your declare course of.Rental automotive protection, like different insurance coverage insurance policies, operates with outlined limits and deductibles.

These elements considerably affect the monetary implications of a declare. Selecting an acceptable deductible can steadiness the price of premiums in opposition to potential out-of-pocket bills within the occasion of an accident.

Protection Limits

Safeco’s rental automotive insurance coverage usually offers protection for damages as much as a particular restrict. This restrict is the utmost quantity Safeco can pay for repairs or substitute of the rental automobile in case of an accident. The precise restrict could differ relying on the rental settlement and Safeco’s coverage. Policyholders ought to at all times seek the advice of their particular coverage paperwork for exact particulars on protection limits.

Deductible Choices

Safeco often presents varied deductible choices for rental automotive protection. A deductible is the quantity you are liable for paying out-of-pocket earlier than Safeco steps in to cowl the remaining prices. Decrease deductibles typically end in increased month-to-month premiums, whereas increased deductibles cut back premiums however improve your monetary duty in case of an accident.

Impression of Deductible Quantity on Claims

The deductible quantity immediately impacts the price of a declare. The next deductible means a smaller premium however a bigger out-of-pocket expense if a declare arises. Conversely, a decrease deductible results in the next premium however much less monetary burden in case of an accident. For instance, a $500 deductible means you pay $500 upfront, and Safeco covers the remaining quantity as much as the coverage restrict.

A $1000 deductible would imply you pay $1000, and Safeco covers the rest.

Declare Submitting Course of

Submitting a declare for a rental automotive accident usually entails reporting the incident to Safeco and offering supporting documentation, resembling a police report, rental settlement, and restore estimates. Safeco will assess the declare and decide the quantity of protection supplied primarily based on the coverage’s phrases.

Significance of Understanding Protection Limits and Deductibles

Understanding protection limits and deductibles permits you to make knowledgeable selections about your rental automotive insurance coverage. A radical understanding helps in budgeting for potential bills and selecting one of the best protection choices on your wants and monetary state of affairs. The desk beneath offers a comparative overview of various deductible choices and their related prices.

Deductible Quantities and Prices

| Deductible Quantity | Month-to-month Premium Enhance | Declare Processing Time |

|---|---|---|

| $500 | $10 | 7 enterprise days |

| $1000 | $5 | 5 enterprise days |

Protection in Completely different Eventualities

Safeco’s rental automotive protection offers a security internet when surprising occasions happen whereas driving a rental automobile. Understanding how this protection applies in varied conditions, from minor fender benders to main accidents, is essential for accountable renters. This part particulars Safeco’s rental automotive protection utility in numerous circumstances, outlining protection limitations and vital issues.This part delves into how Safeco’s rental automotive protection safeguards policyholders in a wide selection of conditions, starting from minor collisions to extra extreme accidents.

It explains the protection’s utility in several situations, together with injury brought on by third events, and highlights cases the place protection could not apply.

Minor Accident Protection

Safeco’s rental automotive protection typically extends to minor accidents, however the specifics rely upon coverage particulars. Policyholders ought to at all times verify their particular coverage doc for exact protection limits. Protection for minor accidents usually entails injury repairs throughout the coverage’s acknowledged limits. This contains deductibles, which can differ relying on the coverage.

Third-Celebration Harm Protection

Safeco rental automotive protection ceaselessly covers injury to the rental automotive brought on by a 3rd get together. This safety is usually out there if the policyholder is deemed not at fault within the incident. The protection usually applies to the damages ensuing from the third get together’s actions, topic to coverage limits and deductibles. Examples embody incidents like collisions brought on by one other driver’s negligence or injury from one other automobile.

Conditions The place Protection Could Not Apply

Safeco’s rental automotive protection could not apply in sure circumstances. This contains conditions the place the injury is because of pre-existing situations on the automobile or misuse by the renter. Moreover, if the renter is discovered at fault for the incident, protection could also be restricted or unavailable, relying on the particular coverage phrases. Different exclusions could contain injury from pure disasters or intentional acts.

Situation-Primarily based Information to Protection Software

| Situation | Protection Software |

|---|---|

| Minor accident with minimal injury (e.g., a scratch) | Protection possible applies, relying on the coverage’s deductible and limits. |

| Accident with substantial injury to the rental automotive brought on by one other driver | Protection possible applies if the policyholder will not be at fault. |

| Harm to the rental automotive because of a pre-existing situation | Protection is unlikely to use. |

| Harm brought on by the renter’s reckless driving | Protection is prone to be restricted or unavailable. |

Claiming Protection in Case of a Main Accident

The method for claiming protection in a significant accident entails a number of steps. First, the policyholder should contact their Safeco consultant or the designated claims division. They should report the incident and supply crucial particulars, together with the accident location, date, time, and concerned events. Gathering supporting documentation, resembling police experiences and restore estimates, can be essential for a easy declare processing.

Following the declare course of Artikeld by Safeco is important for a well timed and environment friendly decision.

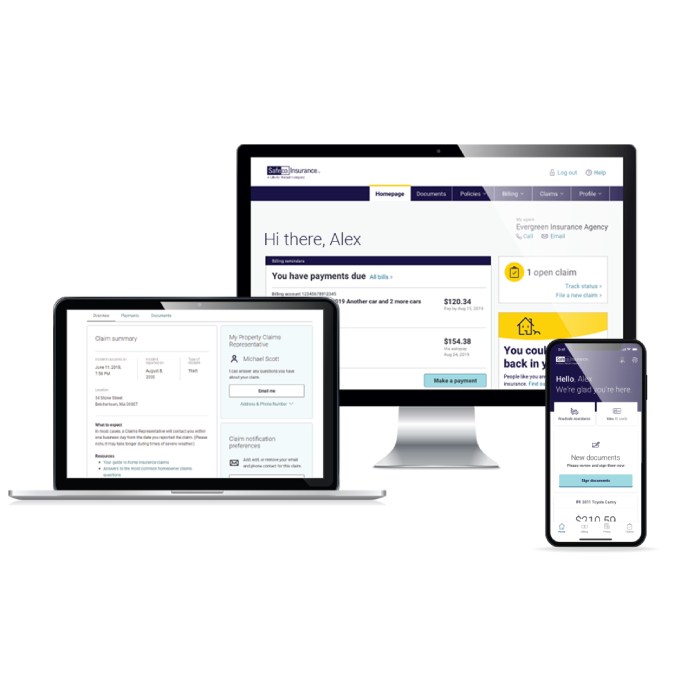

Including Rental Automobile Protection

Including rental automotive protection to your Safeco auto insurance coverage coverage offers essential safety when you might want to lease a automobile. This protection extends your present coverage’s safety past your personal automotive, providing monetary safety in varied circumstances. Understanding the method and elements concerned in including this protection is important for making knowledgeable selections.Including rental automotive protection is an easy course of.

It is usually dealt with via your present insurance coverage agent or on-line portal. Elements influencing the price of this protection differ, typically relying on the particular phrases of your coverage and the rental automobile’s traits.

Strategy of Including Rental Automobile Protection

Including rental automotive protection typically entails submitting a request to your insurance coverage supplier. This may be performed on-line, by cellphone, or via your devoted insurance coverage agent. The particular steps and required data could differ barely relying in your coverage sort and your insurance coverage supplier’s procedures. Overview your coverage paperwork or contact your agent for probably the most present and correct directions.

Elements Influencing the Price of Rental Automobile Protection

A number of elements affect the value of including rental automotive protection to your present Safeco coverage. These elements embody:

- Protection Limits: Larger protection limits often result in increased premiums. The quantity of protection you choose immediately impacts the associated fee.

- Deductible Quantity: The next deductible typically means a decrease premium. This can be a sum you pay out-of-pocket earlier than the insurance coverage firm begins to pay.

- Coverage Sort: The particular sort of Safeco auto insurance coverage coverage you maintain, resembling liability-only or complete protection, can have an effect on the price of including rental automotive protection. Extra complete insurance policies typically embody or supply extra beneficiant rental automotive protection.

- Rental Car Sort: The kind of rental automobile you ceaselessly use (e.g., a luxurious automotive or a compact automotive) may affect the premium. This is because of elements just like the estimated price of restore and substitute for varied forms of autos.

- Rental Interval: The size of the rental interval can have an effect on the premium quantity. An extended rental interval often means the next premium.

Paperwork Required for Including Rental Automobile Protection

The paperwork required so as to add rental automotive protection may differ relying in your insurer’s procedures. Usually, the method entails offering the next data:

- Coverage particulars: Your Safeco coverage quantity and some other related coverage data.

- Rental automobile particulars: Details about the kind of rental automobile you will be driving (e.g., make, mannequin, yr).

- Rental interval: Begin and finish dates of the rental interval.

- Contact data: Your private contact data and any further data the insurer requires.

Advantages of Buying Rental Automobile Protection

Buying rental automotive protection offers substantial advantages. This protection typically helps defend you financially in conditions the place your personal automobile is unavailable or broken.

- Monetary Safety: Within the occasion of an accident or injury to a rental automotive, the protection will help reimburse the prices of repairs, substitute, and even rental charges.

- Peace of Thoughts: Figuring out you will have rental automotive protection can get rid of the concern and stress related to surprising automobile points.

- Authorized Safety: In some circumstances, rental automotive protection could also be required by the rental firm or essential to keep away from authorized repercussions.

Calculating the Price of Including Protection

Calculating the price of including rental automotive protection to an present Safeco coverage requires understanding the various factors talked about earlier. This price is commonly decided primarily based on the particular phrases of your coverage and the options of the protection you choose. An in depth quote out of your insurer is often probably the most correct strategy to decide the particular price on your circumstances.

Understanding Coverage Language: Safeco Auto Insurance coverage Rental Automobile Protection

Navigating the high quality print of your Safeco auto insurance coverage rental automotive protection is essential for understanding your rights and obligations. This part delves into the important thing phrases, phrases, and the significance of cautious assessment to make sure a easy expertise if you might want to use the protection.Understanding the coverage language prevents potential surprises and ensures that you’re totally conscious of your obligations and the protection limits.

This contains understanding the particular situations underneath which the protection applies, and learn how to deal with any claims successfully.

Key Phrases and Definitions

A transparent understanding of the phrases and phrases utilized in your rental automotive protection coverage is important. Familiarize your self with the particular language of your coverage. This can assist you perceive the extent of your protection and the situations underneath which it applies. The next phrases are ceaselessly used:

- Deductible: The quantity you pay out-of-pocket earlier than your insurance coverage protection kicks in. This quantity varies relying in your coverage. For instance, a coverage may need a $500 deductible for collision injury, which means you pay the primary $500 of restore prices your self.

- Collision Protection: Insurance coverage that covers injury to your automobile if it is concerned in a collision, no matter who’s at fault. This usually contains injury from hitting one other automotive, a stationary object, or an animal.

- Complete Protection: This protection protects in opposition to injury to your automobile brought on by occasions apart from a collision. Examples embody vandalism, hearth, hail, or theft.

- Rental Reimbursement: The portion of your coverage that covers rental automotive bills in case your automobile is broken or rendered unusable because of a coated occasion. This typically has its personal limitations and necessities.

- Exclusions: Particular conditions or circumstances during which the rental automotive protection won’t apply. These are sometimes detailed within the coverage’s high quality print.

- Coverage Limits: The utmost quantity your insurance coverage firm can pay for a declare. That is essential for understanding how a lot protection you will have and whether or not you want further safety.

Significance of Reviewing the Superb Print, Safeco auto insurance coverage rental automotive protection

Rigorously reviewing the high quality print is paramount for correct interpretation. The coverage’s particular phrases and situations govern the scope of your rental automotive protection. Coverage wording can differ from one insurer to a different, and the particular clauses in your Safeco coverage will decide the extent of your safety. Ignoring the high quality print might result in misunderstandings and doubtlessly have an effect on your capacity to file a declare or obtain compensation.

All the time consult with the official coverage doc to grasp any potential limitations or restrictions.

Dealing with Unclear Coverage Factors

If any part of your coverage is unclear, take the next steps:

- Contact Safeco immediately. Their customer support representatives can present clarification on ambiguous factors in your coverage.

- Overview the coverage’s glossary of phrases. Many insurance policies embody a glossary to elucidate particular phrases in plain language.

- Search skilled recommendation. In case you’re nonetheless not sure, consulting with an insurance coverage skilled will help you interpret the coverage and determine potential gaps in protection.

Disputing a Declare Primarily based on Coverage Language

In case you consider a declare has been dealt with incorrectly because of misinterpretation of the coverage language, observe these steps:

- Doc the whole lot. Collect all related coverage paperwork, correspondence, and proof associated to the declare.

- Contact Safeco’s customer support division. Clarify your considerations and request a assessment of the declare primarily based in your coverage.

- Escalate the dispute if crucial. If the preliminary decision is not passable, you may have to escalate the matter to the next degree inside Safeco.

- Think about in search of authorized counsel. In case you’re unable to resolve the problem via Safeco’s inside channels, a authorized skilled can advise in your rights and choices.

Suggestions and Methods

Maximizing your rental automotive protection entails a strategic strategy. Understanding your wants, evaluating choices, and proactively managing potential points are essential for minimizing prices and maximizing safety. This part offers sensible recommendation to navigate the complexities of rental automotive insurance coverage.Rental automotive protection is a multifaceted choice, and the best strategy hinges on cautious planning and understanding of the elements at play.

By using these methods, you’ll be able to make sure you’re well-prepared for any eventuality whereas minimizing monetary burdens.

Choosing the Proper Rental Automobile Protection

Rental automotive insurance coverage choices differ considerably, and choosing the proper one requires cautious consideration. Elements just like the size of your rental, the kind of automobile, and your present insurance coverage coverage all play a task. Consider your private circumstances to find out probably the most applicable protection degree. Rental corporations typically supply a spread of choices, from fundamental legal responsibility to complete safety.

Evaluate the associated fee and scope of protection to find out one of the best match.

Optimizing the Price of Rental Automobile Protection

Rental automotive insurance coverage will be expensive, however optimizing the value is achievable. Verify for reductions provided by your auto insurance coverage supplier. Many corporations accomplice with rental businesses to offer bundled reductions, which can lead to appreciable financial savings. Overview your present insurance coverage coverage for potential inclusions of rental automotive protection. Think about the opportunity of self-insurance in circumstances the place the danger is low and the associated fee is substantial.

Avoiding Rental Automobile Insurance coverage Claims

Minimizing the probability of a declare is paramount for cost-effectiveness. Rigorously assessment the rental settlement and observe any particular phrases associated to insurance coverage. Be conscious of your environment and drive cautiously to keep away from accidents. Keep the automobile in good situation throughout your rental interval. Thorough documentation of the automobile’s situation upon pickup and return is essential.

By proactively stopping incidents, you’ll be able to considerably cut back the prospect of needing to file a declare.

Understanding Your Rights When Submitting a Declare

Understanding your rights as a policyholder is essential through the declare course of. If an accident happens, promptly report it to the rental firm and native authorities. Collect all related documentation, together with the police report, rental settlement, and any witness statements. Keep clear and concise communication with the insurance coverage firm. Be ready to offer all crucial data to expedite the declare course of.

Within the occasion of disputes, seek the advice of with a authorized skilled to grasp your choices.

Coping with a Rental Automobile Insurance coverage Firm

When coping with the insurance coverage firm, keep knowledgeable and arranged strategy. Doc all communication, together with correspondence and cellphone conversations. Be clear and concise in your statements and responses. Don’t hesitate to hunt recommendation from an insurance coverage skilled or authorized consultant if wanted. By adopting a structured and proactive strategy, you’ll be able to navigate the declare course of successfully and effectively.

Epilogue

In conclusion, Safeco auto insurance coverage rental automotive protection presents a spread of choices to go well with varied wants. Understanding the totally different protection sorts, limits, and deductibles is important. By rigorously contemplating the nuances of your coverage, and consulting this complete information, you will be well-equipped to make your best option on your rental wants. Bear in mind, proactive data is your finest protection in the case of defending your rental automotive.

Important FAQs

What are the everyday protection limits for rental automotive insurance coverage supplied by Safeco?

Safeco’s rental automotive protection limits differ relying on the particular coverage. Discuss with your coverage paperwork for precise particulars, or contact Safeco immediately for clarification.

How does Safeco’s rental automotive protection deal with injury to the rental automotive brought on by a 3rd get together?

Safeco’s protection usually handles injury brought on by third events. Overview your particular coverage for particulars on the extent of this protection and the claims course of.

What are the steps for including rental automotive protection to an present Safeco coverage?

Contact Safeco on to inquire about including rental automotive protection. They will information you thru the method, together with crucial paperwork and related prices.

What are the important thing phrases in Safeco’s rental automotive protection insurance policies?

Key phrases, like deductible, collision protection, and complete protection, are outlined inside your coverage paperwork. Seek the advice of the coverage itself or contact Safeco for clarification on these phrases.