Automotive insurance coverage in port st lucie fl – Automotive insurance coverage in Port St. Lucie, FL: Navigating the native market can really feel overwhelming, nevertheless it does not need to be. This information breaks down every little thing you have to learn about discovering one of the best coverage to your wants. We’ll cowl coverage sorts, pricing components, and even easy methods to file a declare.

Understanding the native market is essential. Port St. Lucie, FL has a selected mixture of demographics and driving habits that impression insurance coverage charges. We’ll discover these nuances and spotlight one of the best suppliers within the space, serving to you evaluate insurance policies and discover probably the most reasonably priced choices whereas guaranteeing satisfactory protection.

Introduction to Automotive Insurance coverage in Port St. Lucie, FL

The automobile insurance coverage market in Port St. Lucie, Florida, like many different areas, is a fancy panorama formed by varied components. Understanding these components is essential for acquiring appropriate protection and managing monetary dangers related to proudly owning a automobile. This overview offers a glimpse into the out there insurance policies, widespread price influences, and important protection choices.The insurance coverage panorama in Port St.

Lucie, very similar to the encompassing areas, is pushed by a mixture of state rules, native financial situations, and the particular traits of the neighborhood. These traits, mixed with the necessity for dependable safety, decide the kind and value of insurance coverage out there.

Frequent Varieties of Automotive Insurance coverage Insurance policies

Varied sorts of automobile insurance coverage insurance policies cater to completely different wants and danger tolerances. These insurance policies usually embrace legal responsibility, collision, and complete protection. Legal responsibility insurance coverage protects policyholders from monetary duty within the occasion of an accident the place they’re at fault. Collision insurance coverage covers damages to the insured automobile ensuing from an accident, no matter who’s at fault.

Complete insurance coverage covers damages to the insured automobile from occasions aside from collisions, similar to vandalism, theft, or weather-related harm.

Elements Influencing Automotive Insurance coverage Charges in Port St. Lucie

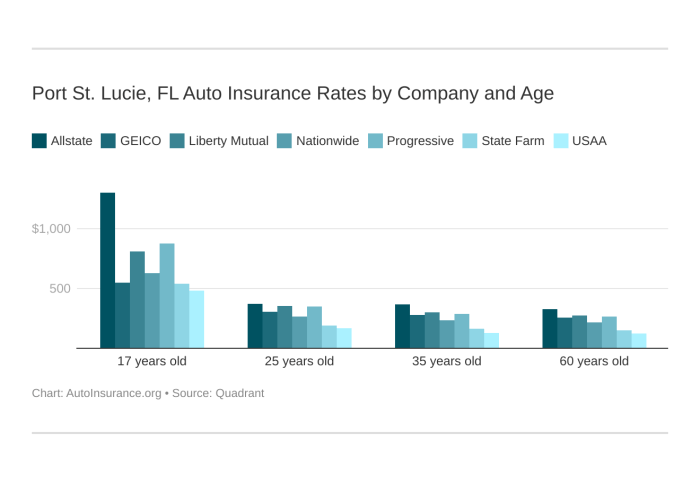

A number of components affect automobile insurance coverage charges in Port St. Lucie, FL. Demographics, similar to age and driving historical past, considerably impression premiums. Greater danger drivers, usually youthful people, are likely to face larger charges resulting from a perceived higher chance of accidents. The native driving atmosphere and accident statistics additionally play a task.

Areas with larger accident charges usually see corresponding will increase in insurance coverage premiums.

Typical Insurance coverage Protection Choices

The usual insurance coverage protection choices out there in Port St. Lucie, FL, embrace legal responsibility, collision, and complete protection. Legal responsibility protection protects policyholders from monetary duty within the occasion of an accident the place they’re at fault. Collision protection covers damages to the insured automobile from accidents, no matter who’s at fault. Complete protection protects the automobile from non-collision occasions, similar to vandalism, theft, or pure disasters.

Minimal Insurance coverage Necessities in Port St. Lucie, FL

The next desk Artikels the everyday minimal insurance coverage necessities in Port St. Lucie, FL. These necessities are essential for authorized compliance and will range relying on the particular coverage and the insurance coverage supplier.

| Protection Sort | Description | Minimal Requirement |

|---|---|---|

| Legal responsibility Bodily Damage | Covers accidents to others in an accident the place the insured is at fault. | $10,000 per particular person, $20,000 per accident |

| Legal responsibility Property Harm | Covers harm to the property of others in an accident the place the insured is at fault. | $10,000 per accident |

| Uninsured/Underinsured Motorist | Protects the insured and their automobile if concerned in an accident with an at-fault driver missing satisfactory insurance coverage. | Required most often |

Evaluating Insurance coverage Suppliers in Port St. Lucie, FL

Navigating the varied panorama of automobile insurance coverage suppliers in Port St. Lucie, FL, can really feel overwhelming. Understanding the pricing methods, standard selections, buyer suggestions, and repair experiences is essential for making an knowledgeable choice. This evaluation goals to supply a complete overview of those key components, enabling residents to pick out probably the most appropriate protection.

Pricing Methods of Insurance coverage Suppliers

Varied components affect the pricing methods employed by insurance coverage suppliers in Port St. Lucie. Premiums are sometimes decided by components similar to the motive force’s age, driving report, automobile sort, and placement. Insurance coverage corporations usually use subtle actuarial fashions to evaluate danger and alter premiums accordingly. For instance, a driver with a historical past of accidents or site visitors violations may expertise larger premiums in comparison with a secure driver with a clear report.

Standard Insurance coverage Corporations in Port St. Lucie, FL

A number of insurance coverage corporations are prevalent in Port St. Lucie. These corporations continuously provide aggressive charges and in depth protection choices to cater to the varied wants of residents. Native corporations, together with nationwide giants, compete for market share, usually using completely different methods to draw clients. A number of the outstanding corporations usually acknowledged for his or her presence and visibility within the space embrace State Farm, Geico, Progressive, and Allstate.

Buyer Opinions and Scores

Buyer evaluations and rankings present invaluable insights into the experiences of Port St. Lucie residents with varied insurance coverage suppliers. On-line platforms and unbiased assessment websites provide aggregated suggestions, enabling potential clients to achieve a broader perspective on the companies supplied by completely different corporations. For instance, State Farm may obtain excessive marks for its responsive customer support, whereas Progressive is likely to be lauded for its user-friendly on-line platform.

Buyer Service Experiences

Customer support experiences play a big function in shaping perceptions of insurance coverage suppliers. The effectivity, helpfulness, and responsiveness of customer support representatives can affect buyer satisfaction. Completely different suppliers might make the most of various channels for buyer help, similar to telephone, electronic mail, and on-line portals. Optimistic experiences contribute to model loyalty and favorable suggestions.

Comparability of Main Insurance coverage Corporations

This desk Artikels the options and advantages of three outstanding insurance coverage corporations working in Port St. Lucie, FL. The data introduced right here offers a preliminary comparability and shouldn’t be thought of a complete analysis.

| Insurance coverage Firm | Options | Advantages |

|---|---|---|

| State Farm | Wide selection of protection choices, robust native presence, in depth community of brokers, wonderful customer support popularity. | Aggressive charges, personalised service, claims dealing with effectivity, and sturdy help system. |

| Geico | Easy on-line platform, easy insurance policies, reasonably priced premiums, reductions for varied standards. | Handy digital expertise, doubtlessly decrease prices, ease of coverage administration, and number of reductions. |

| Progressive | Superior expertise integration, progressive instruments for coverage administration, a number of reductions, responsive customer support choices. | Digital accessibility, streamlined processes, aggressive charges, and potential for varied reductions. |

Elements Affecting Automotive Insurance coverage Premiums

Within the vibrant Port St. Lucie neighborhood, securing the best automobile insurance coverage is essential for peace of thoughts. Understanding the components that affect premiums permits residents to make knowledgeable choices and doubtlessly scale back their prices. This information empowers drivers to navigate the complexities of the insurance coverage panorama and discover probably the most appropriate protection for his or her wants.

Driving Data and Insurance coverage Premiums, Automotive insurance coverage in port st lucie fl

Driving information are a big determinant in Port St. Lucie, FL, automobile insurance coverage premiums. A clear driving report, free from accidents and site visitors violations, usually interprets to decrease premiums. Conversely, a historical past of accidents or shifting violations, similar to dashing tickets or reckless driving, usually results in larger premiums. Insurance coverage corporations assess the chance related to every driver primarily based on their previous driving habits.

This danger evaluation helps them decide the chance of future claims, which straight impacts the premium. The severity and frequency of previous incidents play an important function in calculating the premium.

Car Sort and Mannequin Impression on Insurance coverage Prices

The sort and mannequin of a automobile considerably affect insurance coverage premiums in Port St. Lucie. Luxurious automobiles and sports activities vehicles usually have larger premiums resulting from their perceived larger danger of harm or theft in comparison with commonplace fashions. Moreover, automobiles with superior security options or distinctive design components can have an effect on insurance coverage prices. The worth of the automobile additionally influences the price of insurance coverage, as higher-value automobiles usually incur larger premiums to compensate for the higher monetary danger to the insurance coverage firm.

Location-Based mostly Variations in Insurance coverage Charges

Insurance coverage charges in Port St. Lucie, FL, can range relying on the particular location. Areas with larger crime charges or larger incidences of accidents might have correspondingly larger insurance coverage premiums. This displays the insurance coverage firm’s evaluation of the relative danger of claims in particular areas throughout the metropolis. Proximity to high-traffic areas, accident-prone intersections, or areas with a historical past of auto thefts can even affect charges.

Age and Gender’s Affect on Premiums

Age and gender are components that affect automobile insurance coverage premiums. Youthful drivers, usually perceived as larger danger resulting from inexperience, usually face larger premiums in comparison with older, extra skilled drivers. Equally, in some areas, insurance coverage corporations might contemplate gender as an element of their danger evaluation. This isn’t all the time the case, and insurance policies might differ from firm to firm.

Elements like driving expertise and habits can nonetheless considerably impression premiums, no matter age or gender.

Correlation Between Driving Historical past and Insurance coverage Premiums

| Driving Report | Premium Impression |

|---|---|

| No accidents or violations | Decrease premiums |

| Minor accident (fender bender) | Barely larger premiums |

| A number of accidents | Considerably larger premiums |

| Critical accident | Very excessive premiums |

| Visitors violations (dashing, reckless driving) | Greater premiums |

| DUI/DWI | Extraordinarily excessive premiums, usually with limitations or exclusions |

Claims Course of and Assets

Navigating the claims course of generally is a essential facet of securing compensation within the occasion of an accident. Understanding the steps concerned and the assets out there can considerably streamline the method, guaranteeing a smoother expertise for all events concerned. This part particulars the everyday procedures and timelines related to submitting a automobile insurance coverage declare in Port St. Lucie, FL.The method for submitting a automobile insurance coverage declare in Port St.

Lucie, FL, is designed to be honest and environment friendly, with established procedures to deal with varied sorts of claims. This part offers a complete overview of the declare course of, together with the steps concerned, timelines, and out there assets.

Declare Submitting Course of Overview

Submitting a automobile insurance coverage declare includes a sequence of steps designed to make sure a immediate and correct decision. A transparent understanding of those steps is important for a clean and environment friendly declare course of.

| Step | Process |

|---|---|

| 1. Report the Accident | Instantly report the accident to the police and your insurance coverage firm. Collect data such because the names and speak to particulars of all events concerned, witness statements, and an outline of the harm to automobiles. This preliminary report is essential for the next declare course of. |

| 2. Collect Documentation | Compile all related documentation, together with the police report, medical information (if relevant), restore estimates, and another supporting proof. Thorough documentation strengthens the declare and aids within the evaluation course of. |

| 3. Contact Your Insurance coverage Firm | Contact your insurance coverage firm to provoke the declare course of. Present the mandatory data and documentation gathered within the earlier steps. Adhering to the corporate’s particular declare procedures is crucial for a clean course of. |

| 4. Present Proof of Loss | Submit proof of the damages, similar to images, movies, or restore estimates, to the insurance coverage firm. This documentation is important to help your declare and exhibit the extent of the loss. |

| 5. Consider and Assess the Declare | The insurance coverage firm will consider the declare, together with the validity and extent of the damages. This analysis course of might contain inspections, value determinations, and investigations to find out the legitimacy and protection. |

| 6. Negotiate and Settle | As soon as the declare is evaluated, the insurance coverage firm will negotiate a settlement quantity. If the settlement quantity is suitable, the declare could be resolved. If not, a dispute decision course of could be initiated. |

Varieties of Automotive Insurance coverage Claims

Varied sorts of claims could be filed below automobile insurance coverage insurance policies in Port St. Lucie, FL. Understanding the completely different classes is important to make sure acceptable dealing with of every case. These embrace:

- Property Harm Claims:

- Bodily Damage Claims:

- Uninsured/Underinsured Motorist Claims:

These claims tackle harm to your automobile ensuing from an accident or different coated occasion. The method includes documentation of the harm and acquiring restore estimates. Examples embrace collisions, hail harm, or vandalism.

These claims contain compensation for accidents sustained in an accident. Documentation is essential, encompassing medical payments, misplaced wages, and ache and struggling. Examples embrace accidents sustained by drivers, passengers, or pedestrians concerned within the accident.

If an accident includes a driver with out insurance coverage or with inadequate protection, your coverage’s uninsured/underinsured motorist protection will help compensate for damages. Documentation of the accident and the at-fault driver’s lack of insurance coverage is important.

Timeframes for Claims Processing

The timeframe for claims processing in Port St. Lucie, FL, varies relying on the complexity of the declare. Elements such because the extent of the harm, the provision of documentation, and the necessity for additional investigation can affect the processing time. Usually, easy claims with available documentation are processed inside just a few weeks, whereas extra advanced claims might take a number of months.

Examples embrace circumstances requiring unbiased value determinations or in depth medical evaluations.

Dispute Decision Mechanisms

If a disagreement arises concerning a declare, varied dispute decision mechanisms can be found. These mechanisms intention to resolve disputes amicably and effectively, together with negotiation, mediation, or in excessive circumstances, arbitration. Understanding these avenues can forestall disputes from escalating.

Reductions and Saving Suggestions

Securing favorable automobile insurance coverage charges in Port St. Lucie, FL, hinges on savvy methods and proactive measures. Understanding out there reductions and implementing prudent monetary habits can considerably scale back premiums, permitting for higher monetary flexibility. Diligence in sustaining a pristine driving report and embracing secure driving practices are pivotal in reaching these financial savings.

Varieties of Reductions

Varied reductions are sometimes supplied by insurance coverage suppliers in Port St. Lucie. These might embrace reductions for secure driving, bundling insurance policies, and for particular automobile options. Reductions for good scholar drivers, anti-theft units, and accident-free driving information are additionally prevalent. These incentives incentivize accountable driving habits and reward those that exhibit a dedication to security.

Lowering Premiums

Lowering automobile insurance coverage premiums requires a multifaceted method. Drivers can leverage reductions, keep a clear driving report, and discover bundling choices to attain important financial savings. A complete understanding of those methods is essential to securing decrease premiums.

Particular Examples of Financial savings

A driver with a clear driving report and a latest, licensed anti-theft system put in of their automobile might qualify for a considerable low cost. This interprets to a notable discount of their month-to-month insurance coverage premiums. Bundling owners or renters insurance coverage with auto insurance coverage can additional scale back the general value. For instance, a driver who bundles their auto, house, and life insurance coverage insurance policies may see a ten% to twenty% discount of their general premiums.

Significance of Sustaining a Good Driving Report

Sustaining a pristine driving report is paramount in securing favorable automobile insurance coverage charges. A clear driving historical past signifies accountable driving habits, decreasing the chance profile for insurance coverage corporations. Consequently, drivers with a clear report are sometimes rewarded with decrease premiums.

Protected Driving Practices

Protected driving practices are essential in securing reductions and sustaining a superb driving report. Adhering to hurry limits, avoiding distracted driving, and working towards defensive driving methods contribute to a safer driving report. This, in flip, can result in decrease insurance coverage premiums.

Bundling Insurance coverage Insurance policies

Bundling insurance coverage insurance policies, similar to auto, house, and life insurance coverage, can usually result in important financial savings. This method consolidates protection below one supplier, doubtlessly yielding substantial reductions in premiums. Insurance coverage suppliers usually provide reductions for patrons who bundle their insurance policies.

Suggestions for Saving Cash on Automotive Insurance coverage

- Keep a clear driving report. Keep away from site visitors violations and accidents to take care of a low danger profile.

- Evaluation and evaluate charges from completely different insurance coverage suppliers commonly. This proactive method can unearth higher offers.

- Set up and keep anti-theft units in your automobile. This demonstrates a dedication to safety and may usually yield reductions.

- Bundle your insurance coverage insurance policies (auto, house, life) to doubtlessly safe important reductions.

- Make the most of reductions for secure drivers, good college students, or different related classes.

- Request quotes from a number of insurance coverage suppliers, taking into consideration their popularity, service choices, and particular coverage particulars.

- Contemplate including non-obligatory extras, similar to complete protection, if needed, to make sure satisfactory safety.

Suggestions for Selecting the Proper Coverage

Navigating the world of automobile insurance coverage in Port St. Lucie, FL, can really feel like navigating a maze. Understanding the intricacies of various insurance policies and suppliers is essential to securing one of the best safety to your automobile and monetary well-being. Selecting the best automobile insurance coverage coverage is not only about discovering the bottom worth; it is about aligning protection along with your particular wants and monetary state of affairs.Selecting the best automobile insurance coverage coverage includes a cautious consideration of your particular person circumstances and desires.

The coverage you choose ought to provide satisfactory safety with out pointless prices. This requires a eager eye for element and an understanding of the assorted components at play.

Understanding Coverage Phrases and Circumstances

Comprehending the phrases and situations of a automobile insurance coverage coverage is paramount. These particulars Artikel the specifics of protection, exclusions, and limitations. Failing to understand these points can result in unexpected points when making a declare. Thorough assessment of the high quality print is essential to keep away from any surprises down the highway. Understanding the coverage’s limitations, similar to geographical restrictions or exclusions for particular sorts of accidents, is important.

Evaluating Insurance policies Based mostly on Particular Wants

Evaluating completely different insurance coverage insurance policies requires a structured method. Establish your distinctive wants, similar to the worth of your automobile, your driving historical past, and your required protection limits. Consider the advantages and downsides of every coverage to pick out the one which most accurately fits your state of affairs. A comparative evaluation primarily based on these standards will result in a extra knowledgeable choice.

Elements to Contemplate When Choosing a Coverage

A number of essential components affect the choice of an appropriate automobile insurance coverage coverage. These embrace protection limits, deductibles, and coverage add-ons. Understanding these components permits for a tailor-made coverage that aligns along with your monetary capability and danger tolerance. Protection limits outline the utmost quantity the insurance coverage firm pays for damages or accidents. Deductibles characterize the quantity you will need to pay out-of-pocket earlier than the insurance coverage firm steps in.

Studying the Superb Print

Fastidiously scrutinizing the high quality print is important. Hidden clauses, exclusions, and limitations is likely to be ignored, doubtlessly resulting in a scarcity of protection in surprising circumstances. This follow ensures that the coverage precisely displays your wants and expectations. Studying the high quality print permits for an entire understanding of the coverage’s limitations and ensures you are not caught off guard.

Comparability Desk of Protection Choices

| Protection | Description | Price (Estimated, Port St. Lucie, FL) |

|---|---|---|

| Legal responsibility Protection | Covers damages to others in case of an accident you trigger. | $50-$200/12 months |

| Collision Protection | Covers harm to your automobile no matter who’s at fault. | $75-$250/12 months |

| Complete Protection | Covers harm to your automobile from occasions aside from collisions (e.g., vandalism, hearth, theft). | $50-$150/12 months |

| Uninsured/Underinsured Motorist Protection | Protects you in case you’re concerned in an accident with an uninsured or underinsured driver. | $50-$100/12 months |

| Private Damage Safety (PIP) | Covers medical bills and misplaced wages for you and your passengers. | $25-$75/12 months |

“Understanding your particular wants and evaluating insurance policies primarily based on these wants are key steps in choosing the proper automobile insurance coverage coverage.”

Final Conclusion

In conclusion, securing the best automobile insurance coverage in Port St. Lucie, FL includes understanding native components, evaluating suppliers, and selecting a coverage that matches your wants. By contemplating the insights offered on this information, you will be well-equipped to make an knowledgeable choice. Keep in mind to assessment your coverage commonly to make sure continued safety and alter your protection as wanted.

Solutions to Frequent Questions: Automotive Insurance coverage In Port St Lucie Fl

What are the everyday minimal insurance coverage necessities in Port St. Lucie, FL?

Minimal necessities range by state however often embrace legal responsibility protection. Verify along with your native Division of Motor Automobiles (DMV) for probably the most up-to-date particulars. It is all the time greatest to get greater than the minimal, particularly for complete protection.

How do I file a declare for automobile harm?

The method often includes reporting the accident to the police, documenting the harm, and contacting your insurance coverage firm. Maintain detailed information and comply with the particular directions offered by your insurer.

What reductions can be found for automobile insurance coverage in Port St. Lucie, FL?

Many reductions can be found, similar to multi-policy reductions, secure driving incentives, and reductions for sure automobile sorts or options. Ask your insurer in regards to the choices out there to you.