Pilot automobile insurance coverage necessities by state current an enchanting panorama of rules, various considerably throughout the nation. Navigating these variations is essential for pilots and companies alike. This information delves into the intricacies of pilot automobile insurance coverage, highlighting the distinctive traits that set it other than commonplace auto insurance coverage, and detailing the state-specific necessities that affect coverage phrases and premiums.

Understanding these nuances ensures accountable operations and protects your funding in pilot autos.

The various necessities, from minimal legal responsibility protection to particular bodily harm stipulations, fluctuate based mostly on components just like the automobile sort, the pilot’s expertise, and the geographic location of operations. This complete overview empowers you to make knowledgeable selections about your pilot automobile insurance coverage wants, guaranteeing compliance and peace of thoughts.

Introduction to Pilot Automobile Insurance coverage: Pilot Automobile Insurance coverage Necessities By State

Pilot automobile insurance coverage is a specialised sort of protection designed for autos used within the transportation of products or individuals, usually in a brief or non-routine capability. It differs considerably from commonplace auto insurance coverage, because it addresses the distinctive dangers and duties related to these particular makes use of. Understanding these variations is essential for guaranteeing enough safety for the automobile and its operator.Pilot vehicles, usually used for transporting high-value cargo or for uncommon circumstances, require a selected degree of safety as a result of elevated legal responsibility.

Normal auto insurance coverage insurance policies could not adequately cowl the potential dangers related to such operations. This specialization is critical to guard in opposition to the potential monetary repercussions from accidents or damages.

Distinctive Traits of Pilot Automobile Insurance coverage

Pilot automobile insurance coverage insurance policies are tailor-made to cowl the precise wants of autos employed in non permanent or non-standard transportation roles. This specialised protection usually gives broader safety than commonplace auto insurance coverage. The precise traits usually embody enhanced legal responsibility protection and prolonged protection durations. A complete pilot automobile coverage sometimes addresses distinctive operational wants, equivalent to longer distances, a number of drivers, or higher-risk cargo.

Causes for Particular Protection Necessities

Pilot vehicles usually function underneath circumstances that enhance the danger of accidents or damages. This consists of transporting precious cargo, working in difficult or distant areas, or needing protection for a number of drivers. Normal auto insurance coverage insurance policies could not adequately handle these heightened dangers, making specialised pilot automobile insurance coverage important.

Varieties of Pilot Automobile Insurance coverage

Several types of pilot automobile insurance coverage cater to varied wants. Insurance policies would possibly deal with legal responsibility protection, complete protection, or each. There may additionally be variations in protection durations, particular automobile sorts, and even geographic limitations. Every sort of pilot automobile insurance coverage goals to handle the actual necessities of its meant use case.

Comparability of Pilot Automobile and Normal Automobile Insurance coverage

| Function | Pilot Automobile Insurance coverage | Normal Automobile Insurance coverage |

|---|---|---|

| Protection | Sometimes broader protection, together with greater legal responsibility limits and potential for added add-ons equivalent to cargo safety. | Focuses on commonplace driver legal responsibility, property harm, and private damage safety. |

| Premiums | Typically greater as a result of elevated threat profile related to pilot automobile utilization. | Premiums fluctuate based mostly on components like driver historical past, automobile sort, and site. |

| Exclusions | Might have particular exclusions for pre-existing harm or misuse not associated to the pilot automobile’s meant perform. | Normal exclusions apply for particular circumstances equivalent to intentional harm or reckless driving. |

State-Particular Necessities

Pilot automobile insurance coverage necessities fluctuate considerably from state to state, reflecting the varied wants and situations inside every jurisdiction. These variations stem from differing ranges of threat evaluation, regulatory frameworks, and financial components. Understanding these nuances is essential for guaranteeing compliance and avoiding potential authorized points.State rules for pilot automobile insurance coverage usually take into account components equivalent to the kind of operation, the pilot’s expertise, and the potential for accidents.

Rural areas, with probably much less stringent visitors rules and better distances between populated areas, could have completely different insurance coverage requirements in comparison with densely populated city areas, which regularly have greater visitors densities and stricter security measures.

Components Driving Variations in Necessities

A number of components contribute to the disparity in pilot automobile insurance coverage rules throughout states. These components embody the frequency and severity of accidents particularly areas, the prevailing visitors legal guidelines, and the density of air visitors management. Moreover, differing insurance coverage market forces and state-specific regulatory our bodies additionally play a job in shaping the necessities.

Comparability of Insurance coverage Necessities by Area

Insurance coverage necessities for pilot vehicles in city areas sometimes demand greater protection ranges in comparison with rural areas. That is as a result of elevated threat of accidents and potential for better legal responsibility in areas with excessive visitors densities. City areas usually have extra advanced and densely packed roadways, requiring pilots to train better warning and navigate intricate visitors patterns.

Rural areas, whereas probably posing completely different challenges like lengthy distances and fewer frequent supervision, could have fewer incidents and thus require completely different ranges of insurance coverage.

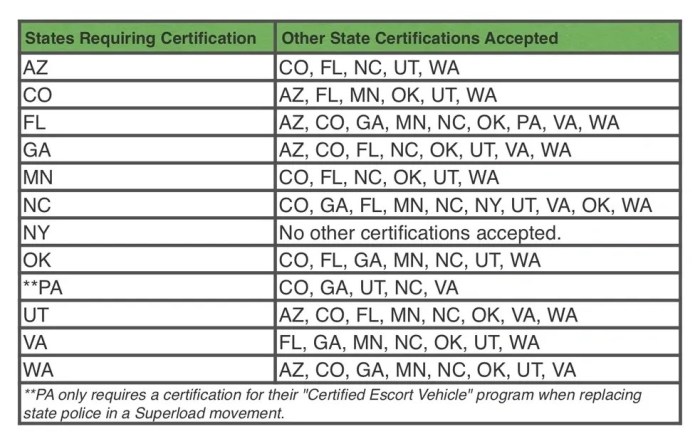

Key Insurance coverage Necessities in Particular States

The desk beneath gives a common overview of the minimal insurance coverage necessities for pilot vehicles in particular states. Observe that these are simplified examples and should not embody all potential stipulations. It’s essential to seek the advice of with state-specific insurance coverage suppliers or regulatory our bodies for exact and up-to-date info.

| State | Minimal Legal responsibility Protection | Bodily Harm Protection | Different Necessities |

|---|---|---|---|

| California | $15,000 per particular person/$30,000 per accident (Bodily Harm) / $5,000 (Property Harm) | $50,000 | Pilot certification and expertise necessities |

| New York | $25,000 per particular person/$50,000 per accident (Bodily Harm) / $10,000 (Property Harm) | $25,000 | Pilot coaching information, licensing, and compliance with FAA rules |

| Texas | $30,000 per particular person/$60,000 per accident (Bodily Harm) / $25,000 (Property Harm) | $25,000 | Background checks, flight security coaching, and insurance coverage renewal necessities |

Protection Elements

Pilot automobile insurance coverage insurance policies, like some other insurance coverage, have particular parts designed to guard the insured occasion. Understanding these parts is essential for making knowledgeable selections in regards to the protection wanted to your pilot automobile. The insurance policies are structured to handle potential dangers related to using a pilot automobile, together with legal responsibility for accidents, harm to the automobile, and different unexpected circumstances.

Important Elements of Pilot Automobile Insurance coverage Insurance policies

Pilot automobile insurance coverage insurance policies sometimes embody a number of key parts, every serving a definite goal in mitigating dangers. These parts are designed to supply complete safety, masking varied facets of pilot automobile operations.

Legal responsibility Protection

Legal responsibility protection is a elementary facet of pilot automobile insurance coverage. It protects the policyholder from monetary duty in case of accidents or incidents involving a pilot automobile the place the policyholder is at fault. This protection sometimes pays for damages or accidents to others attributable to the pilot automobile’s actions. For instance, if a pilot automobile is concerned in an accident leading to accidents to a pedestrian, legal responsibility protection would assist compensate the pedestrian for his or her medical bills and different losses.

Collision Protection

Collision protection comes into play when a pilot automobile is concerned in an accident the place the trigger is exterior to the pilot automobile. This protection pays for the damages to the pilot automobile, no matter who’s at fault. For example, if a pilot automobile collides with one other automobile, collision protection would cowl the repairs or substitute of the pilot automobile.

That is necessary because it protects the policyholder from the monetary burden of repairing or changing their very own automobile.

Complete Protection

Complete protection gives broader safety past collisions. It covers damages to the pilot automobile attributable to occasions apart from collisions, equivalent to theft, vandalism, fireplace, hail, or pure disasters. For instance, if a pilot automobile is stolen or broken by a storm, complete protection would assist cowl the prices related to the harm.

Deductibles and Coverage Limits

Deductibles and coverage limits are necessary facets of pilot automobile insurance coverage. A deductible is the quantity the policyholder should pay out-of-pocket earlier than the insurance coverage firm begins paying for damages. Coverage limits characterize the utmost quantity the insurance coverage firm pays for a coated declare. These limits assist outline the monetary duty the policyholder and the insurance coverage firm share.

For instance, a deductible of $500 means the policyholder pays the primary $500 of any declare earlier than the insurance coverage firm steps in.

Exclusions and Limitations

Pilot automobile insurance coverage insurance policies sometimes embody exclusions or limitations to outline the scope of protection. These exclusions assist delineate the conditions not coated underneath the coverage. Understanding these exclusions is crucial to keep away from surprises or misunderstandings in case of a declare. For instance, some insurance policies could exclude protection for damages attributable to intentional acts or reckless driving.

A cautious evaluate of the coverage wording is necessary to know the precise conditions which might be coated.

Protection Varieties Desk

| Protection Sort | Clarification | Instance |

|---|---|---|

| Legal responsibility | Protects the policyholder from monetary duty in case of accidents or incidents involving a pilot automobile the place the policyholder is at fault. | Pays for damages or accidents to others attributable to the pilot automobile’s actions. |

| Collision | Covers damages to the pilot automobile in accidents, no matter who’s at fault. | Covers repairs or substitute if the pilot automobile collides with one other automobile. |

| Complete | Covers damages to the pilot automobile attributable to occasions apart from collisions, equivalent to theft, vandalism, fireplace, hail, or pure disasters. | Covers prices related to harm to the pilot automobile on account of a storm or theft. |

Coverage Variations and Concerns

Pilot automobile insurance coverage insurance policies, like different insurance coverage sorts, exhibit variations based mostly on a number of components. Understanding these variations is essential for choosing a coverage that adequately covers the distinctive wants of a pilot’s operation. These variations come up from the varied nature of pilot operations, plane sorts, and pilot expertise.

Coverage Variations by Pilot Automobile Sort, Pilot automobile insurance coverage necessities by state

Pilot automobile insurance coverage insurance policies usually fluctuate based mostly on the kind of plane. A coverage for a small, single-engine plane can have completely different protection wants and prices in comparison with a big, multi-engine business plane. This distinction in protection and price displays the various dangers related to every sort of plane.

Small Plane (e.g., single-engine Cessna): Insurance policies for small plane often have decrease premiums in comparison with bigger plane as a result of diminished threat of great harm or loss. Protection for these plane sometimes focuses on legal responsibility, collision, and complete harm, in addition to potential medical bills for passengers and others concerned in accidents.

Massive Plane (e.g., multi-engine jets): Insurance policies for bigger plane, notably these used for business operations, entail greater premiums reflecting the elevated threat of accidents and potential liabilities. These insurance policies often embody extra intensive protection, equivalent to broader legal responsibility safety for passenger accidents, greater limits for property harm, and probably protection for hull harm or substitute.

Components Influencing Pilot Automobile Insurance coverage Prices

A number of components considerably influence the price of pilot automobile insurance coverage. These components are important to contemplate when evaluating and choosing a coverage.

- Plane Sort: The dimensions, complexity, and age of the plane instantly affect the danger evaluation and subsequent premium calculation. Extra advanced or bigger plane sometimes have greater premiums.

- Pilot Expertise: A pilot’s flight hours, coaching, and accident historical past instantly have an effect on the insurance coverage firm’s threat evaluation. Pilots with intensive expertise and a clear document usually qualify for decrease premiums.

- Pilot’s Driving Document (together with air document): Much like automobile insurance coverage, a pilot’s accident historical past, violations, and claims instantly influence the price of insurance coverage. A clear document signifies decrease threat, resulting in decrease premiums.

- Location of Operations: The geographical space the place the pilot operates the plane impacts insurance coverage premiums. Some areas are thought-about higher-risk zones on account of climate situations, terrain, or different components.

- Fleet Dimension: The variety of plane within the pilot’s fleet influences the overall threat publicity for the insurance coverage firm. Bigger fleets usually imply greater premiums.

- Operation Sort: Whether or not the plane is used for private use, business operations, or different actions impacts the extent of threat and, consequently, the premium.

- Protection Limits: Larger protection limits for legal responsibility, medical bills, and property harm enhance the premium.

- Deductibles: Decrease deductibles translate to greater premiums, whereas greater deductibles end in decrease premiums.

Illustrative Examples of Coverage Variations

Think about a pilot flying a single-engine Cessna for private use versus a business pilot working a big multi-engine jet. The Cessna pilot’s coverage will doubtless deal with legal responsibility, collision, and complete protection with decrease premiums in comparison with the business pilot’s coverage, which might embody intensive legal responsibility protection for passenger accidents, probably together with hull harm, and better protection limits. The business pilot’s coverage would additionally doubtless have premiums considerably greater as a result of bigger plane sort and business operations.

The pilot’s expertise and accident historical past would additional refine these premium variations.

Discovering and Buying Pilot Automobile Insurance coverage

Securing pilot automobile insurance coverage is an important step in guaranteeing the security and monetary safety of your operation. This course of entails cautious consideration of varied components and diligent analysis to search out essentially the most appropriate protection at a good worth. Understanding the steps concerned can result in a smoother and extra knowledgeable decision-making course of.Discovering the suitable pilot automobile insurance coverage supplier and evaluating insurance policies successfully are important for acquiring optimum protection.

By understanding the method and procedures, you can also make an knowledgeable resolution that aligns together with your wants and funds.

Finding Pilot Automobile Insurance coverage Suppliers

Quite a few insurance coverage suppliers specialise in pilot automobile protection. Researching and contacting these suppliers is step one. On-line serps and business directories are precious assets for finding potential suppliers. Pilot automobile insurance coverage is commonly supplied by firms with experience in aviation insurance coverage, or these specializing basically legal responsibility protection.

Evaluating Pilot Automobile Insurance coverage Quotes

Acquiring a number of quotes is essential for securing the very best pilot automobile insurance coverage protection. The quotes mirror varied components, together with the kind of plane, pilot expertise, flight routes, and potential liabilities.

- Gathering Data: Compile particulars about your plane, flight operation specs, and pilot {qualifications}. This info is important for correct and related quotes.

- Requesting Quotes: Contact a number of insurance coverage suppliers, outlining the precise wants of your pilot automobile operation. Present full particulars for correct evaluation.

- Evaluating Quotes: Fastidiously evaluate every quote, evaluating premiums, protection limits, and exclusions. Analyze the completely different coverage choices and situations supplied by every supplier.

- Evaluating Protection: Scrutinize the protection parts and exclusions inside every coverage. Understanding the coverage particulars is important for making an knowledgeable resolution.

Acquiring Pilot Automobile Insurance coverage Protection

After evaluating quotes, the subsequent step entails formally making use of for the pilot automobile insurance coverage coverage. The method varies by supplier, however usually consists of finishing an software, offering supporting paperwork, and arranging cost.

- Finishing the Utility: Fastidiously full the applying type, offering correct and complete details about your pilot automobile operation.

- Offering Supporting Paperwork: Put together crucial paperwork equivalent to plane registration, pilot licenses, and flight operation particulars. This ensures the supplier can precisely assess the dangers concerned.

- Arranging Fee: Overview the cost phrases and make the mandatory preparations to finalize the acquisition of the pilot automobile insurance coverage coverage.

Steps to Evaluating Quotes Successfully

A structured method to evaluating quotes can save effort and time.

- Determine Wants: Clearly outline the precise protection required to your pilot automobile operation. Decide the mandatory limits for legal responsibility and potential damages.

- Collect Data: Compile all crucial info relating to your plane, pilot expertise, flight routes, and potential liabilities. This detailed info is essential for the insurance coverage supplier to evaluate the dangers.

- Request Quotes: Contact a number of insurers, offering the collected info precisely and totally. Guarantee all pertinent particulars are conveyed.

- Analyze Quotes: Evaluate premiums, protection limits, and coverage exclusions. Concentrate on particular facets like deductibles, endorsements, and the kinds of protection included.

- Search Clarification: If any facet of a quote is unclear, do not hesitate to contact the insurance coverage supplier for clarification. Thorough understanding is essential.

Understanding the coverage phrases, situations, and exclusions earlier than buying is paramount. A complete understanding of the coverage’s positive print prevents unexpected points or misunderstandings sooner or later.

Ending Remarks

In conclusion, securing the suitable pilot automobile insurance coverage is paramount for each operational effectivity and authorized compliance. The journey via state-specific necessities, protection parts, and coverage variations gives an in depth understanding of the complexities concerned. By understanding the components influencing prices and the significance of diligent analysis, pilots and companies can confidently navigate the panorama of pilot automobile insurance coverage, securing complete safety for his or her autos and operations.

This information acts as your compass, serving to you discover the suitable insurance coverage resolution to match your particular wants and guarantee your fleet stays well-protected.

Fast FAQs

What kinds of protection are sometimes included in a pilot automobile insurance coverage coverage?

Most pilot automobile insurance coverage insurance policies embody legal responsibility protection to guard in opposition to claims arising from accidents, collision protection to handle harm ensuing from collisions, and complete protection for damages from different occasions like theft or vandalism. Particular protection particulars and exclusions fluctuate by insurer and state.

How does the pilot’s expertise have an effect on the insurance coverage premiums?

A pilot’s expertise and driving document usually affect premiums. A pilot with a clear document and intensive expertise could qualify for decrease premiums, whereas these with a historical past of accidents or violations could face greater charges.

What are some widespread components driving the variations in pilot automobile insurance coverage necessities throughout states?

Variations in state rules, together with minimal legal responsibility necessities, bodily harm protection stipulations, and extra mandated provisions, contribute to the variations in pilot automobile insurance coverage necessities. City versus rural areas, for instance, could have completely different accident statistics, influencing the protection wanted.

How do I evaluate quotes from completely different insurance coverage suppliers for pilot automobile insurance coverage?

Evaluating quotes entails gathering info on the automobile’s specs, the pilot’s expertise and document, and the specified protection ranges. Use on-line comparability instruments, contact a number of insurers instantly, and punctiliously evaluate coverage paperwork to establish one of the best match.