Ought to I purchase hole insurance coverage on a used automotive? This significant query arises for a lot of potential used automotive patrons. Understanding the nuances of ordinary used automotive insurance coverage, the potential dangers related to proudly owning a used car, and the worth proposition of hole insurance coverage is vital to creating an knowledgeable choice. This information supplies a complete overview, exploring numerous elements that can assist you decide if hole insurance coverage is true to your state of affairs.

Normal used automotive insurance coverage usually covers injury and theft, however typically has limitations. Hole insurance coverage steps in to bridge the monetary hole between the automotive’s worth and what you owe on the mortgage. By assessing the dangers, the worth of hole insurance coverage, and the influencing elements, you can also make a well-reasoned choice.

Understanding Used Automotive Insurance coverage Fundamentals

Used automotive insurance coverage, like another type of auto insurance coverage, protects you financially if one thing goes improper. It is a essential part of accountable automotive possession, safeguarding your funding and your private legal responsibility. Understanding the usual protection, exclusions, and declare processes is important for making knowledgeable choices.

Normal Used Automotive Insurance coverage Protection

Normal used automotive insurance coverage insurance policies usually cowl damages to your car attributable to accidents or different occasions, corresponding to theft, vandalism, or weather-related injury. The particular protection supplied is dependent upon the coverage and the chosen add-ons. It is vital to completely evaluation the coverage particulars to know the scope of your safety.

Exclusions and Limitations

Insurance coverage insurance policies typically have exclusions and limitations. These are particular circumstances or conditions that the coverage doesn’t cowl. Frequent exclusions may embrace pre-existing injury, put on and tear, injury from regular use, or injury prompted deliberately by the policyholder. Understanding these exclusions helps keep away from disappointment when making a declare.

Function of Deductibles in Claims

Deductibles play a major function in used automotive insurance coverage claims. A deductible is a predetermined sum of money that the policyholder should pay out-of-pocket earlier than the insurance coverage firm steps in to cowl the remaining prices. This quantity varies primarily based on the coverage and the chosen protection stage. The next deductible usually leads to decrease premiums. For instance, a $500 deductible means the policyholder pays the primary $500 of any restore or substitute value, and the insurance coverage firm pays the remainder.

Comparability of Protection Sorts

| Protection Sort | Description | Instance |

|---|---|---|

| Legal responsibility | Covers damages you trigger to different individuals’s property or accidents to different individuals. It doesn’t cowl your individual car’s injury. | For those who crash into one other automotive, legal responsibility insurance coverage would cowl the damages to the opposite automotive and any accidents to the opposite driver. |

| Complete | Covers damages to your car attributable to occasions not involving collisions, corresponding to vandalism, hearth, hail, theft, or climate occasions. | In case your automotive is stolen or broken by a storm, complete insurance coverage would cowl the damages. |

| Collision | Covers damages to your car in a collision, no matter who’s at fault. | In case you are concerned in a automotive accident, collision insurance coverage would cowl the damages to your car, even when you weren’t at fault. |

Understanding the nuances of every protection sort is crucial to choosing the proper coverage to your wants. Completely different circumstances necessitate completely different protection ranges.

Evaluating the Dangers of Proudly owning a Used Automotive

Shopping for a used automotive could be a good monetary transfer, nevertheless it’s important to know the potential dangers. These dangers aren’t simply in regards to the car’s situation; additionally they contain the monetary repercussions of surprising occasions. Figuring out these dangers empowers you to make knowledgeable choices about insurance coverage, upkeep, and total possession.

Components Growing the Danger of Harm or Theft

Used vehicles, in contrast to new ones, typically have a historical past of use. This historical past can considerably affect the chance of injury or theft. Components corresponding to earlier accidents, poor upkeep, and even the automotive’s mannequin and 12 months can have an effect on its vulnerability. As an example, older fashions is likely to be extra prone to mechanical failures resulting in accidents.

- Prior Accidents: A automotive with a historical past of accidents, even minor ones, may have hidden structural injury. This injury won’t be obvious throughout a visible inspection, however it might probably result in expensive repairs or perhaps a full loss if not addressed.

- Excessive-Theft Areas: Vehicles parked in areas with a excessive incidence of automotive theft are naturally at a better threat. Understanding the native crime statistics will help assess the potential menace.

- Poor Upkeep Historical past: A automotive that hasn’t been correctly maintained over time may be extra vulnerable to mechanical failures, resulting in accidents or costly repairs. Neglecting routine upkeep can result in a breakdown, which may end up in injury to the car and even to different autos in a collision.

- Lack of Correct Documentation: Incomplete or lacking information in regards to the automotive’s historical past can obscure essential info, like earlier injury or repairs. This lack of transparency provides to the uncertainty surrounding the automotive’s situation.

Potential Monetary Influence of Main Accidents or Theft

The monetary implications of a significant accident or theft may be substantial. The worth of the used automotive will probably lower, and the price of repairs or substitute elements may be vital. That is notably true for older autos with restricted resale worth.

- Decreased Resale Worth: A automotive concerned in an accident or theft will inevitably depreciate in worth. Restore prices can considerably impression the automotive’s value, particularly if the injury is in depth.

- Restore Prices: Repairing vital injury may be fairly costly. Components for older fashions is likely to be laborious to seek out or unusually expensive. Estimating these prices is essential earlier than committing to a purchase order.

- Complete Loss: In extreme accidents, a automotive could also be deemed a complete loss, which means its restore value exceeds its present market worth. This implies the proprietor loses the complete funding.

Comparability of Accident and Harm Probability, Ought to i purchase hole insurance coverage on a used automotive

Used vehicles have a better probability of accidents and injury in comparison with new vehicles, that are usually in higher situation and have fewer miles on the odometer. Nonetheless, this chance relies upon considerably on the particular automotive’s historical past.

- Greater Mileage: Used vehicles usually have extra miles than new vehicles. Elevated mileage correlates with a better threat of wear and tear and tear, resulting in extra potential points.

- Earlier Accidents: A used automotive’s historical past of accidents considerably impacts its threat profile. A automotive with a documented accident historical past has a better likelihood of needing expensive repairs or replacements.

Potential for Mechanical Points and Repairs

Used vehicles are extra prone to mechanical points than new ones. The longer a automotive has been in use, the extra probably it’s to expertise issues requiring repairs. This will dramatically have an effect on the car’s worth and the proprietor’s funds.

- Elevated Upkeep Wants: Used vehicles typically require extra frequent upkeep in comparison with new ones. Ignoring upkeep can result in vital issues, additional lowering the automotive’s worth and growing restore prices.

- Anticipated Repairs: A radical inspection by a mechanic will help determine potential mechanical issues. Understanding these potential points is crucial for planning and budgeting.

Frequent Used Automotive Damages and Restore Prices

Predicting the exact value of repairs is troublesome. Nonetheless, a basic overview of widespread damages and their potential impression may be useful.

| Harm Sort | Potential Restore Prices |

|---|---|

| Minor fender bender | $500 – $2000 |

| Engine injury | $1000 – $5000+ |

| Transmission failure | $1000 – $3000+ |

| Body injury | $1000 – $10,000+ |

| Electrical system points | $200 – $1000+ |

Assessing the Worth of Hole Insurance coverage

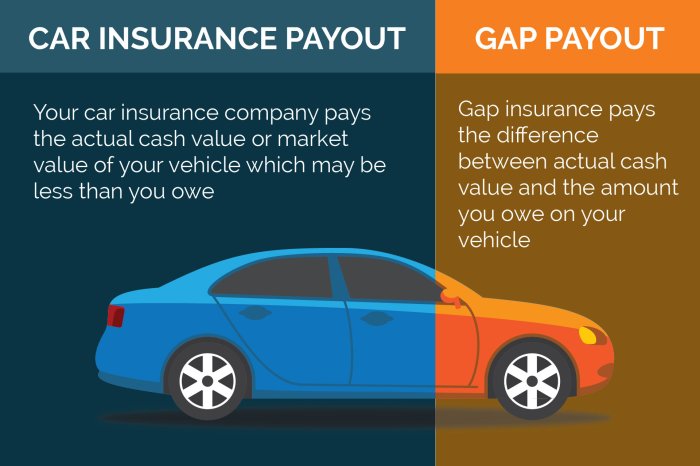

Hole insurance coverage, typically neglected, could be a essential part of used automotive possession. It protects you from a major monetary hit in case your automotive is totaled or severely broken, particularly when the worth of the mortgage or lease exceeds the automotive’s present market value. Understanding when it is worthwhile will help you make knowledgeable choices about defending your funding.Hole insurance coverage primarily bridges the “hole” between what you owe in your mortgage and the automotive’s market worth after an accident or whole loss.

This safety is especially related for used vehicles, as their depreciation means the worth typically falls beneath the excellent mortgage quantity.

Hole Insurance coverage Protection for Used Vehicles

Hole insurance coverage kicks in when the precise money worth of your used automotive, after a complete loss or vital injury, is lower than what you continue to owe on the mortgage. This distinction, the hole, is roofed by the insurance coverage. For instance, in case you owe $10,000 on a used automotive value $8,000 after an accident, hole insurance coverage would pay the $2,000 distinction.

This ensures you are not left with an impressive mortgage steadiness you can’t repay.

Situations The place Hole Insurance coverage is Helpful

Hole insurance coverage is most respected when the used automotive’s worth is considerably decrease than the excellent mortgage quantity. That is steadily the case with older fashions, higher-mileage autos, or vehicles which have sustained vital put on and tear. Moreover, in case you’ve financed a automotive for an extended interval, the hole between the automotive’s depreciated worth and the excellent mortgage is prone to widen.

The extra the automotive depreciates, the better the potential hole, therefore the better the advantage of hole insurance coverage.

Defending In opposition to Monetary Loss

Hole insurance coverage straight mitigates monetary loss from whole loss or extreme injury to your used automotive. By masking the distinction between the mortgage quantity and the automotive’s depreciated worth, it protects you from the monetary burden of an impressive mortgage steadiness you may now not repay. This safety is especially vital for used vehicles as their worth typically decreases over time.

You are shielded from the potential monetary threat of an unpaid mortgage, guaranteeing you are not left with an unmanageable debt after an unlucky occasion.

Evaluating Hole Insurance coverage with Different Protections

Whereas complete automotive insurance coverage covers repairs, it would not usually deal with the hole between the automotive’s worth and your mortgage quantity. Hole insurance coverage, in distinction, particularly covers this hole. Due to this fact, hole insurance coverage is distinct from different protections corresponding to complete or collision insurance coverage. In essence, hole insurance coverage focuses on the monetary side of automotive possession after a loss, whereas different insurance coverage varieties concentrate on repairs and potential damages.

Examples The place Hole Insurance coverage is Pointless

Hole insurance coverage is not all the time mandatory. If the used automotive’s worth intently matches the mortgage quantity, the potential hole is minimal. A used automotive not too long ago bought at a worth near its present market worth, with a mortgage quantity that mirrors the present market worth, probably will not necessitate hole insurance coverage. Additionally, in case you’re snug with the potential monetary threat of an unpaid mortgage after an accident, hole insurance coverage won’t be required.

Analyzing Components Influencing Hole Insurance coverage Selections

Deciding whether or not or to not buy hole insurance coverage for a used automotive is not a one-size-fits-all reply. It hinges on a number of essential elements, primarily revolving across the purchaser’s monetary state of affairs, the automotive’s situation and market worth, and the potential for a loss exceeding the automotive’s present value. This evaluation delves into these essential components, offering readability for potential used automotive patrons.

Monetary Circumstances of Potential Patrons

Understanding the customer’s monetary state of affairs is paramount in assessing the necessity for hole insurance coverage. A purchaser with a considerable down cost and a snug monetary cushion won’t require the safety provided by hole insurance coverage as a lot as somebody counting on a mortgage with a better loan-to-value ratio. For instance, a money purchaser of a used automotive may need much less want for hole insurance coverage in comparison with a purchaser financing the complete buy.

The financing phrases, the mortgage quantity, and the customer’s current debt load all play a task in assessing the chance tolerance and monetary capability for potential losses.

Used Automotive Buy Situations

Completely different used automotive buy eventualities current various levels of threat and consequently, completely different wants for hole insurance coverage. Think about these examples:

- A budget-conscious purchaser buying a lower-priced, older used automotive could prioritize minimizing upfront prices. On this situation, the potential loss in worth attributable to accident or whole loss is likely to be extra vital relative to the lower cost, making hole insurance coverage probably extra engaging.

- An investor buying a used automotive for resale functions is likely to be extra involved about preserving the automotive’s market worth. If the automotive is meant to be resold within the close to future, any vital depreciation may considerably impression their revenue margin, probably making hole insurance coverage a mandatory safeguard towards surprising occasions that would lower the automotive’s market worth past the mortgage quantity.

Influence of Used Automotive’s Age and Situation

The age and situation of a used automotive straight correlate to its market worth and potential for a loss exceeding the mortgage quantity. An older or considerably broken automotive faces a better threat of a complete loss exceeding the excellent mortgage steadiness. The damage and tear on the car, the mileage, and the presence of any pre-existing injury are essential elements in figuring out the necessity for hole insurance coverage.

Market Worth and Hole Insurance coverage

The market worth of a used automotive performs a essential function in hole insurance coverage choices. A used automotive with a major market worth distinction between its buy worth and its mortgage quantity is likely to be much less prone to a niche state of affairs. Conversely, a automotive with a low market worth may simply fall beneath the mortgage quantity, triggering a niche situation, making hole insurance coverage extra related.

The used automotive’s mannequin, 12 months, situation, and mileage straight impression its present market worth.

Relationship Between Used Automotive Value, Potential Harm Prices, and Hole Insurance coverage

The next desk illustrates the connection between the used automotive worth, potential injury prices, and the necessity for hole insurance coverage.

| Used Automotive Value | Potential Harm Prices | Want for Hole Insurance coverage |

|---|---|---|

| Low | Excessive | Excessive |

| Medium | Medium | Medium |

| Excessive | Low | Low |

Word: This desk is a simplified illustration and would not embody all elements. Particular person circumstances ought to be thought-about.

Evaluating Used Automotive Insurance coverage Choices

Deciding whether or not so as to add hole insurance coverage to your used automotive coverage requires cautious consideration of the potential advantages and disadvantages. This comparability will enable you to perceive the nuances of those choices, weigh the prices towards potential losses, and make an knowledgeable choice. Hole insurance coverage is a vital part within the total safety of your car, guaranteeing that you just’re financially lined in case of an accident or theft.Understanding the varied used automotive insurance coverage choices is vital to navigating the complexities of automotive possession.

This course of includes scrutinizing each normal protection and hole insurance coverage to find out the very best match to your particular wants and monetary state of affairs. Evaluating the prices of hole insurance coverage with the potential loss from a complete loss situation helps to quantify the monetary implications.

Professionals and Cons of Hole Insurance coverage

Hole insurance coverage, when added to your normal used automotive coverage, supplies an additional layer of safety towards the distinction between the car’s precise money worth (ACV) and its mortgage or excellent steadiness. This safety is very precious if the automotive is broken past restore or stolen.

- Professionals: Hole insurance coverage protects towards the distinction between the car’s worth and excellent mortgage quantity, guaranteeing that you just’re not accountable for the monetary shortfall if the car is totaled or stolen. This significant protection safeguards your monetary pursuits. As an example, if a $10,000 automotive with a $12,000 mortgage is totaled, hole insurance coverage would cowl the $2,000 distinction.

- Cons: Hole insurance coverage premiums can add to the general value of your used automotive insurance coverage. It is important to match the price of hole insurance coverage with the potential loss if the car is broken or stolen to see if the added value is justified.

Evaluating Prices of Hole Insurance coverage and Potential Losses

An important step in deciding on hole insurance coverage is evaluating its value to the potential lack of your car. A well-informed comparability helps in making a rational choice.

Calculating the potential loss from a complete loss or theft includes figuring out the car’s present market worth and the remaining mortgage quantity. The distinction between these figures represents the potential hole that hole insurance coverage can cowl.

For instance, if a used automotive value $8,000 has a remaining mortgage steadiness of $9,000, the potential loss is $1,000. This comparability ought to be factored into your decision-making course of.

Insurance coverage Supplier Comparability Desk

The desk beneath shows a pattern comparability of insurance coverage suppliers providing hole insurance coverage for used vehicles. This desk showcases the varied choices obtainable available in the market.

| Insurance coverage Supplier | Hole Insurance coverage Protection | Premium (Approximate) | Coverage Particulars |

|---|---|---|---|

| Firm A | Covers the hole between ACV and mortgage quantity | $50-$100/12 months | Versatile coverage choices, together with add-ons. |

| Firm B | Covers the hole between ACV and mortgage quantity | $60-$120/12 months | Intensive protection, consists of roadside help. |

| Firm C | Covers the hole between ACV and mortgage quantity | $40-$80/12 months | Focuses on affordability, restricted add-ons. |

Word: Premiums are approximate and might range primarily based on car age, make, mannequin, and different elements.

Hidden Prices of Hole Insurance coverage

Whereas hole insurance coverage is usually offered as an easy addition, there is likely to be hidden prices. Understanding these hidden prices is essential to keep away from monetary surprises.

- Coverage exclusions: Sure insurance policies could exclude particular sorts of injury or conditions, resulting in gaps in protection. All the time evaluation the effective print to know the complete extent of protection.

- Deductibles: Some insurance policies could embrace deductibles, which may scale back the quantity of protection supplied.

- Extra charges: Sure add-ons or options could include additional prices that are not instantly obvious.

Evaluating Hole Insurance coverage Insurance policies

A complete comparability of hole insurance coverage insurance policies from completely different suppliers ought to contain an in depth evaluation of coverage phrases, exclusions, and related prices. This thorough evaluation ensures a sound choice.An in depth comparability of insurance policies includes scrutinizing the protection limits, deductibles, exclusions, and premium buildings. Understanding these features helps in selecting probably the most appropriate coverage.

Illustrative Case Research

Navigating the world of used vehicles may be tough, particularly in relation to insurance coverage. Understanding the potential dangers and advantages of hole insurance coverage is essential for making knowledgeable choices. This part explores real-world eventualities to light up when hole insurance coverage is a great transfer and when it won’t be as very important.Analyzing the particular circumstances of a used automotive buy, contemplating its worth, options, and historical past, permits for a tailor-made evaluation of hole insurance coverage wants.

A well-informed choice minimizes monetary surprises and maximizes your safety.

Situation The place Hole Insurance coverage is Extremely Really useful

A current instance showcases a 2018 Honda Civic, bought used for $18, Whereas the automotive is in good situation, a major issue influences the necessity for hole insurance coverage: the automotive’s market worth has depreciated considerably attributable to its mannequin 12 months. Even with complete insurance coverage, if the car is totaled in an accident, the insurance coverage payout won’t cowl the complete mortgage quantity.

This case highlights the potential for a considerable hole between the excellent mortgage steadiness and the car’s recovered worth. Hole insurance coverage would be sure that the mortgage is totally repaid, defending the customer from monetary loss.

Situation The place Hole Insurance coverage Could Not Be Mandatory

Conversely, contemplate a 2015 Toyota Camry, bought used for $12,000. The automotive is in wonderful situation, and the customer made a major down cost. The automotive’s present market worth is comparatively near the remaining mortgage steadiness. In such a situation, if the automotive is totaled, the insurance coverage payout is prone to cowl the mortgage quantity. The client’s vital down cost and the shut proximity of the automotive’s worth to the mortgage steadiness scale back the chance of a major monetary hole.

How Used Automotive Worth Impacts Hole Insurance coverage Selections

The used automotive’s market worth performs a pivotal function in figuring out the necessity for hole insurance coverage. A considerable depreciation in worth, even with a comparatively low mortgage quantity, can result in a major hole. For instance, a 2010 mannequin automotive, with a excessive mortgage steadiness and low market worth, would require sturdy consideration for hole insurance coverage. A automotive with a decrease mortgage steadiness and a better present market worth would have a a lot decrease want for this sort of insurance coverage.

Monetary Advantages of Hole Insurance coverage

A 2012 Ford Fusion, bought used for $15,000 with a mortgage of $12,000, exemplifies the monetary advantages of hole insurance coverage. If the automotive have been totaled, the insurance coverage payout may solely cowl $8,000. With out hole insurance coverage, the proprietor could be chargeable for the remaining $4,000 mortgage steadiness. Hole insurance coverage would eradicate this monetary burden, guaranteeing the mortgage is totally repaid.

Figuring out Want Based mostly on Options and Historical past

Evaluating the used automotive’s options and historical past is crucial in assessing hole insurance coverage wants. Think about elements just like the automotive’s mannequin 12 months, mileage, upkeep information, and any pre-existing injury. A automotive with a excessive mileage, a historical past of repairs, or vital pre-existing injury is likely to be extra vulnerable to a complete loss with a ensuing hole within the mortgage worth.

A well-maintained automotive with a decrease mileage, alternatively, may need a decrease threat of whole loss, probably lessening the necessity for hole insurance coverage.

Finish of Dialogue: Ought to I Purchase Hole Insurance coverage On A Used Automotive

In conclusion, deciding whether or not or to not buy hole insurance coverage on a used automotive includes cautious consideration of a number of elements. Weighing the potential dangers towards the monetary safety provided by hole insurance coverage is essential. This information has supplied a radical examination of the topic, providing insights and sources to empower you to make your best option to your particular circumstances.

Bear in mind to seek the advice of with an insurance coverage skilled for customized recommendation.

FAQ Overview

What’s hole insurance coverage, and the way does it work?

Hole insurance coverage covers the distinction between the precise money worth of a car and the excellent mortgage quantity. In case your car is totaled, this insurance coverage helps you keep away from a monetary loss. It is notably related when the car’s worth depreciates sooner than the mortgage quantity.

What elements affect the necessity for hole insurance coverage?

The age and situation of the used automotive, the market worth, and your monetary circumstances are all vital concerns. A more recent, higher-value automotive may require much less hole insurance coverage than an older, lower-value mannequin.

How a lot does hole insurance coverage usually value?

The price of hole insurance coverage varies relying on the car’s make, mannequin, 12 months, and the quantity of protection. You may typically examine quotes from completely different suppliers to seek out the very best charge.

What are the potential hidden prices related to hole insurance coverage?

Some insurance policies could have added charges or restrictions. All the time evaluation the effective print and examine insurance policies from completely different suppliers to keep away from surprises.