Search for automobile insurance coverage by VIN on-line is a handy option to discover protection tailor-made to your car. This information gives a complete overview of the method, from understanding VINs to evaluating completely different on-line companies and addressing potential safety issues. It additionally delves into how car specifics influence insurance coverage premiums and particulars varied protection varieties.

The method includes inputting your car’s VIN into a web based platform to retrieve related insurance coverage info. This may streamline the insurance coverage procuring course of and make it easier to rapidly evaluate completely different insurance policies. This technique can prevent priceless time and doubtlessly decrease your premiums by evaluating provides.

Understanding Car Identification Quantity (VIN)

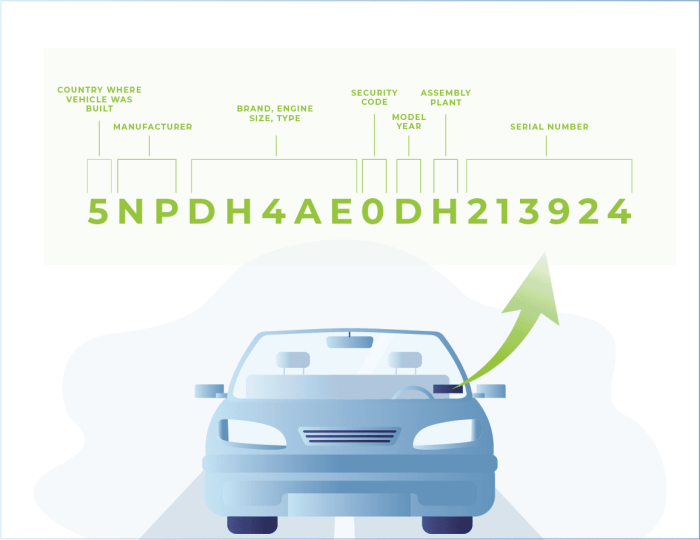

A Car Identification Quantity (VIN) is a singular 17-character alphanumeric code assigned to each car. This code serves as an important identifier for insurance coverage functions, enabling correct monitoring and identification of a particular car. Understanding its construction and elements is crucial for appropriately figuring out a car and making certain correct insurance coverage protection.The VIN comprises a wealth of details about the car, from its make and mannequin to its manufacturing particulars.

This info is significant for insurance coverage corporations to evaluate threat and precisely calculate premiums. Moreover, the VIN’s distinctive nature facilitates the tracing of a car within the occasion of theft or injury.

VIN Construction and Parts

The VIN’s construction is standardized, permitting for the extraction of particular details about the car. Every place inside the VIN sequence holds a particular that means.

- The primary three characters usually characterize the producer’s identification, indicating the car’s make and origin.

- The subsequent character typically specifies the car’s mannequin line.

- The next characters denote the car’s physique sort and different attributes, such because the engine sort, transmission, and particular choices.

- The ultimate digits are normally a sequential or verify digit, used for verification functions and making certain the VIN’s accuracy.

Distinctive Identification of a Car

The VIN’s uniqueness is essential for correct car identification. No two automobiles share the identical VIN, making certain that insurance coverage insurance policies and data are linked to the right car. This uniqueness is a elementary facet of accountable car possession and insurance coverage administration. Every VIN gives a definite document of a particular car.

VIN Codecs and Corresponding Information

Totally different producers use barely completely different codecs for his or her VINs. Whereas the essential construction stays constant, variations exist within the particular characters used to indicate sure attributes.

| VIN Instance 1 | Producer | Mannequin | Engine Kind |

|---|---|---|---|

| 1234567890ABCDEF1 | Generic Producer A | Sedan | 4.0L V6 |

| VIN Instance 2 | Producer | Mannequin | Engine Kind |

| XYZ1234567890ABC | Generic Producer B | SUV | 2.0L Turbo |

Be aware that these are illustrative examples and the precise knowledge inside a VIN can fluctuate considerably relying on the car’s particulars.

Authorized Necessities Surrounding VINs

Correct VIN documentation is a authorized requirement for car registration and insurance coverage functions. Fraudulent use of VINs is a severe offense with vital authorized ramifications. Legit use of VINs is crucial for accountable car possession.

On-line Automobile Insurance coverage Lookup Course of

Finding automobile insurance coverage insurance policies related to a particular car is a typical requirement for varied causes, reminiscent of verifying protection particulars or transferring possession. This course of, typically facilitated on-line, provides a handy various to conventional strategies. On-line platforms present a streamlined method to acquiring coverage info.The net course of for retrieving automobile insurance coverage info tied to a car identification quantity (VIN) is usually simple.

Insurance coverage corporations and third-party suppliers provide devoted portals and instruments to entry this info. These on-line sources streamline the method, enabling customers to rapidly verify the coverage’s particulars.

Typical Steps Concerned

The standard steps for a web based VIN-based automobile insurance coverage lookup contain a number of key actions. First, customers navigate to the insurer’s or third-party supplier’s web site. Second, they enter the related VIN. Third, the system verifies the VIN’s accuracy and retrieves the related coverage info. Lastly, the consumer evaluations the retrieved coverage particulars.

This simple course of allows fast entry to essential info.

Essential Info Required

To execute the lookup efficiently, sure info is crucial. The first requisite is the car’s VIN. Extra info, although typically non-obligatory, could also be required, such because the policyholder’s title or date of delivery. This supplemental knowledge can refine the search outcomes and guarantee accuracy. Offering these particulars expedites the method.

Flowchart of the Lookup Course of, Search for automobile insurance coverage by vin on-line

The flowchart under visually represents the sequence of steps concerned within the on-line lookup course of.[Flowchart Image Description: A flowchart depicting a process with the following steps: 1. User inputs VIN, 2. System validates VIN, 3. System retrieves policy details, 4. User reviews policy details, 5.

User can print/download policy, 6. End of process.]

Accessing On-line Assets

Quite a few on-line sources facilitate VIN-based insurance coverage lookups. Insurers typically present devoted portals on their web sites. Third-party comparability web sites can be used to seek out and evaluate insurance policies from completely different insurers. These platforms mixture info from a number of sources, providing customers a complete overview. Moreover, some states or regulatory our bodies might need on-line databases of insurance coverage insurance policies for public entry.

Customers ought to fastidiously analysis and choose dependable sources.

Instance Coverage Lookup Desk

The desk under illustrates a pattern of the info displayed throughout a coverage lookup. The VIN is essential for figuring out the right coverage.

| VIN | Protection Kind | Coverage Particulars | Premium Price |

|---|---|---|---|

| 1A2B3C4D5E6F7G8H9 | Complete, Collision | Policyholder: John Smith, Efficient Date: 01/01/2024 | $1,200 yearly |

| 2A2B3C4D5E6F7G8H9 | Legal responsibility Solely | Policyholder: Jane Doe, Efficient Date: 07/15/2023 | $500 yearly |

Comparability of Totally different On-line Companies

Quite a few on-line platforms facilitate the seek for automobile insurance coverage primarily based on VINs. These platforms fluctuate considerably of their options, ease of use, and related prices. Customers should fastidiously consider the accessible choices to pick the service finest suited to their particular wants and finances.Totally different on-line platforms present various ranges of element and performance for looking out automobile insurance coverage utilizing a VIN.

Components such because the platform’s interface, accessible protection choices, and buyer help can considerably affect the consumer expertise.

Comparability of Key Options

A number of key options distinguish varied on-line platforms in the case of VIN-based automobile insurance coverage searches. These embody the breadth of insurers accessible, the readability and comprehensiveness of insurance coverage quotes, and the convenience with which customers can evaluate completely different coverage choices.

- Insurer Community: Totally different platforms accomplice with various numbers of insurance coverage suppliers. Some companies might present entry to a wider vary of insurers, doubtlessly resulting in extra aggressive quotes. Others might concentrate on a smaller, choose group of insurers, doubtlessly providing a extra streamlined expertise.

- Quote Accuracy and Element: The accuracy and stage of element in quotes generated by a platform are essential. A complete quote ought to element the precise coverages, premiums, and exclusions for every coverage. Customers ought to confirm that the quote incorporates all related components reminiscent of car sort, utilization, and driver profile.

- Consumer Interface and Navigation: The consumer interface and navigation of a platform instantly influence the convenience of use for locating insurance coverage primarily based on VIN. A well-designed interface permits customers to rapidly and effectively enter the VIN, evaluate choices, and entry related info. A user-friendly platform is crucial for streamlining the search course of.

- Extra Companies: Some platforms might provide extra companies reminiscent of coverage comparability instruments, protection calculators, or buyer help sources. These options can enhance the general consumer expertise and make the method extra complete.

Platform Ease of Use

The convenience of use of a web based platform instantly impacts the general consumer expertise through the automobile insurance coverage search. Intuitive navigation, clear presentation of data, and readily accessible buyer help can streamline the method.

| Platform | Options | Ease of Use |

|---|---|---|

| Platform A | Intensive insurer community, detailed quotes, comparability instruments, coverage calculators | Excessive |

| Platform B | Deal with a particular insurer group, easy interface, quick quote technology | Medium |

| Platform C | Restricted insurer community, primary quote particulars, minimal extra companies | Low |

This desk illustrates a basic comparability throughout platforms, highlighting the variability of their options and ease of use. Actual-world experiences and consumer evaluations can additional make clear these assessments.

Overview of Accessible Choices

Customers searching for automobile insurance coverage primarily based on VINs have a various array of choices. The selection is dependent upon particular person priorities, together with the specified insurer community, quote comprehensiveness, ease of navigation, and related prices. Thorough analysis and cautious consideration of the options provided by completely different platforms are essential for making an knowledgeable resolution. The aim is to pick a platform that finest meets the precise necessities of the buyer whereas offering a seamless and environment friendly expertise.

Safety and Privateness Concerns: Look Up Automobile Insurance coverage By Vin On-line

Offering private car info on-line necessitates a excessive diploma of safety consciousness. Customers have to be vigilant concerning the potential dangers related to sharing their VIN and different particulars throughout on-line automobile insurance coverage searches. Understanding these dangers and adopting safe practices are essential for safeguarding delicate knowledge.

Significance of Safety When Offering VIN Info

On-line automobile insurance coverage suppliers require VINs to precisely assess protection wants and premiums. Sharing this info on-line necessitates a sturdy safety infrastructure to stop unauthorized entry and misuse. A compromised VIN can result in fraudulent claims and monetary loss for the car proprietor. Safety measures, reminiscent of encryption and safe protocols, are important to guard this delicate knowledge.

Potential Privateness Dangers Related to Utilizing On-line VIN Lookup Instruments

On-line VIN lookup instruments can pose privateness dangers if not used cautiously. Unauthorized entry to private knowledge, together with VINs, driver’s license info, and different particulars related to a car, might result in id theft or fraudulent actions. Information breaches, notably within the context of on-line companies, characterize a big concern. Malicious actors might exploit vulnerabilities to achieve entry to delicate knowledge, leading to monetary and private hurt.

Greatest Practices for Defending Private Info

Utilizing respected and safe on-line automobile insurance coverage comparability companies is paramount. Customers ought to prioritize platforms with robust encryption and safe authentication measures. Frequently reviewing privateness insurance policies and phrases of service is essential to understanding how private info is dealt with and guarded. Verifying the web site’s safety certifications, reminiscent of Safe Sockets Layer (SSL) certificates, is an important step in making certain safe on-line transactions.

Measures to Guarantee Information Safety Through the Course of

Implementing robust passwords and multi-factor authentication (MFA) is crucial for safeguarding accounts and stopping unauthorized entry. Keep away from utilizing public Wi-Fi networks when accessing delicate info, reminiscent of VINs, to stop interception by third events. Frequently updating software program and functions used for on-line automobile insurance coverage searches is essential to patching safety vulnerabilities. Think about using a digital non-public community (VPN) to encrypt web site visitors and improve privateness.

Function of Encryption and Safe Protocols

Encryption performs an important position in safeguarding delicate info exchanged throughout on-line automobile insurance coverage lookups. Safe protocols, reminiscent of HTTPS, be sure that knowledge transmitted between the consumer’s gadget and the web site is encrypted and protected against eavesdropping. The usage of robust encryption algorithms is significant to guard towards potential knowledge breaches. Encryption successfully scrambles the info, making it unreadable to unauthorized events.

Using robust hashing algorithms additional strengthens knowledge safety.

Insurance coverage Protection Particulars and Limitations

Insurance coverage insurance policies, encompassing varied coverages, outline the extent of safety provided to policyholders. Understanding these coverages and their limitations is essential for knowledgeable decision-making when deciding on insurance coverage. An intensive examination of the coverage particulars, together with exclusions and particular limits, permits drivers to evaluate the monetary implications of potential claims.VIN-based insurance coverage lookups present entry to coverage particulars, enabling an evaluation of protection limits and kinds tailor-made to particular automobiles.

This detailed info is essential in understanding the extent of safety afforded by the insurance coverage coverage and can be utilized to check protection quantities and kinds for various automobiles. Variations in protection can come up even with automobiles that share related VINs, notably if the car has been modified or the coverage itself has been altered.

Description of Automobile Insurance coverage Coverages

Understanding the various kinds of automobile insurance coverage coverages is crucial for evaluating the adequacy of safety. These coverages usually embody legal responsibility protection, which protects towards claims arising from injury prompted to others, and collision protection, which compensates for injury to the insured car no matter fault. Complete protection gives safety towards damages from perils aside from collisions, reminiscent of theft, vandalism, or weather-related occasions.

Uninsured/underinsured motorist protection safeguards towards incidents involving drivers missing enough insurance coverage.

Impression of VIN-Based mostly Lookups on Protection Limits

VIN-based insurance coverage lookups can reveal protection limits particular to a car. These limits, usually expressed in financial quantities, might fluctuate primarily based on components just like the car’s age, make, mannequin, and worth. The next worth car, for instance, might need greater legal responsibility limits, reflecting the potential for extra vital claims. Particular protection quantities for complete and collision protection may differ relying on the car.

Examples of Insurance coverage Insurance policies and Their Protection Particulars

Totally different insurance coverage insurance policies provide various ranges of protection. A primary coverage may embody legal responsibility protection solely, whereas a extra complete coverage would embody collision, complete, and uninsured/underinsured motorist protection. The coverage’s particular protection quantities and deductibles ought to be fastidiously examined. For instance, a coverage may provide $100,000 in legal responsibility protection, $50,000 in collision protection, and $25,000 in complete protection.

Comparability of Protection Quantities and Sorts for Totally different Automobiles

Protection quantities and kinds can differ considerably between automobiles primarily based on their VIN. A luxurious sports activities automobile, for instance, might need greater protection limits for collision and complete damages in comparison with a compact economic system automobile, reflecting the upper potential for declare payouts. This distinction is usually as a result of car’s estimated worth and its susceptibility to break. The coverage’s premium will doubtless additionally differ primarily based on the automobile’s estimated worth.

Variations in Insurance coverage Insurance policies for Automobiles with Comparable VINs

Automobiles with related VINs, typically belonging to the identical make and mannequin, might not at all times have similar insurance coverage insurance policies. Modifications to the car, reminiscent of efficiency upgrades or additions of aftermarket elements, might have an effect on the protection quantity. Moreover, variations within the policyholder’s driving document or credit score historical past can even affect the premiums and the accessible protection.

Components Influencing Insurance coverage Premiums

Automobile insurance coverage premiums usually are not a set quantity; they’re calculated primarily based on varied components to mirror the danger related to insuring a selected car and driver. Understanding these components is essential for customers to make knowledgeable selections and doubtlessly negotiate favorable charges. A complete analysis of those parts helps insurers assess the chance of claims and set acceptable premiums.A car’s traits, as revealed by its VIN, considerably affect its insurance coverage premium.

This info, mixed with driver demographics and driving historical past, permits insurers to evaluate the potential for accidents and the related monetary burden. Consequently, premiums fluctuate considerably primarily based on these parts, typically impacting the general price of insurance coverage protection.

Car Traits and Insurance coverage Premiums

Car traits, instantly identifiable by the VIN, play a big position in figuring out insurance coverage premiums. These traits mirror the car’s inherent threat components, reminiscent of its make, mannequin, yr, and particular options. This evaluation is essential in evaluating the chance of injury or theft.

- Make and Mannequin: Totally different makes and fashions of automobiles have various accident charges and restore prices. As an example, automobiles recognized for frequent mechanical points or particular design vulnerabilities might command greater premiums. Statistical knowledge on accident charges and restore prices compiled by insurance coverage corporations typically affect premium calculations.

- 12 months of Manufacture: Older automobiles typically have greater premiums as a consequence of potential for larger mechanical failures and lowered security options in comparison with newer fashions. Developments in security know-how and car building typically result in decrease threat assessments for newer fashions.

- Car Worth: Increased-value automobiles typically have greater premiums. That is as a result of larger monetary loss related to theft or injury to the car. This can be a direct correlation to the price of the car and the potential payout in case of injury or theft. The next payout typically means the next premium.

- Car Kind: Sports activities vehicles, for instance, are usually assigned greater premiums than sedans as a consequence of their elevated threat of accidents. The potential for greater speeds and extra aggressive driving habits typically correlates with greater insurance coverage premiums.

Particular Options and Choices Impacting Premiums

Varied options and choices included right into a car, typically recognized by the VIN, can even have an effect on insurance coverage premiums. These choices are instantly associated to the car’s security and potential for injury.

- Security Options: Automobiles outfitted with superior security options, reminiscent of airbags, anti-lock brakes, and digital stability management, typically obtain decrease premiums. Insurance coverage corporations acknowledge these options as lowering the chance of accidents or mitigating the severity of damages.

- Anti-theft Options: Automobiles with enhanced anti-theft techniques, reminiscent of alarm techniques or immobilizers, usually have decrease premiums. These options deter theft and cut back the danger related to car loss.

- Engine Kind and Efficiency: Excessive-performance automobiles with highly effective engines typically appeal to greater premiums as a consequence of their potential for extra severe accidents. Increased speeds and larger acceleration, together with potential for extra vital injury, are contributing components.

Authorized Restrictions on VIN Info Utilization

There are authorized restrictions on how VIN info can be utilized in insurance coverage fee calculations. These restrictions fluctuate by jurisdiction, and insurers should adhere to rules to stop discrimination and guarantee truthful pricing.

- Honest Pricing Practices: Laws typically prohibit insurers from utilizing VIN info in a discriminatory method. Insurers should be sure that premiums are primarily based on professional threat components and never on components that may very well be perceived as discriminatory.

- Information Privateness Legal guidelines: Information privateness legal guidelines typically regulate how VIN knowledge could be collected, used, and shared. Insurers should adjust to these legal guidelines to take care of the privateness and confidentiality of buyer info.

Troubleshooting Widespread Points

Correct and dependable automobile insurance coverage info is essential for knowledgeable selections. Nevertheless, technical difficulties or misunderstandings relating to VIN-based lookups can come up. This part particulars frequent points encountered and gives options for clean and profitable insurance coverage searches.

Potential Points Throughout VIN Lookups

A number of potential points can disrupt the method of acquiring automobile insurance coverage quotes utilizing a VIN. These embody inaccurate VIN entry, community connectivity issues, or inadequate info supplied by the insurance coverage supplier. Errors within the VIN, reminiscent of typos or lacking characters, will instantly have an effect on the accuracy of the outcomes.

Addressing Inaccurate VIN Entry

Inputting an incorrect VIN is a typical supply of errors. Double-checking the VIN for accuracy is paramount. Utilizing a dependable supply, such because the car’s registration paperwork or the producer’s web site, is significant. This verification step ensures the VIN is exactly entered, avoiding errors and making certain correct insurance coverage info.

Troubleshooting Community Connectivity Points

Community issues can considerably hinder the insurance coverage lookup course of. If connectivity points come up, making an attempt the lookup in periods of decrease community site visitors or utilizing a unique web connection might resolve the issue. Utilizing a wired connection as an alternative of Wi-Fi may additionally enhance the reliability of the net service. Moreover, checking for any community outages affecting the insurance coverage supplier’s web site is essential.

Coping with Inadequate Supplier Info

Often, the insurance coverage supplier’s database might not comprise the required particulars concerning the car. In such instances, contacting the insurance coverage supplier instantly or checking for up to date info on their web site could also be crucial. The insurance coverage supplier can present clarification or steering to finish the lookup course of.

Widespread Errors and Options

| Error | Answer |

|---|---|

| Incorrect VIN | Confirm the VIN towards official paperwork. Contact the car’s producer if wanted. |

| Community Connectivity Issues | Strive a unique web connection or look forward to a much less busy time to carry out the lookup. |

| Incomplete Car Info | Contact the insurance coverage supplier for help and clarification. |

| Lookup Failure/Timeout | Refresh the web page, strive once more later, or verify for web site upkeep. |

FAQ: Widespread Issues with VIN Lookups

- What if I entered the unsuitable VIN? Double-check the VIN towards official paperwork. Contact the car’s producer or insurance coverage supplier for clarification if wanted.

- Why is the lookup taking a very long time? Community points or excessive server site visitors may trigger delays. Strive once more later or use a unique web connection.

- The lookup failed. What can I do? Strive refreshing the web page, wait some time, or verify for web site upkeep by contacting the insurance coverage supplier.

- The system just isn’t displaying the car particulars. Contact the insurance coverage supplier on to confirm the car info or if the car knowledge is on the market of their system.

Resolving Technical Difficulties

Technical difficulties can come up through the on-line lookup course of. These points could be resolved by following particular steps tailor-made to the character of the issue. Guaranteeing a secure web connection and checking for any web site upkeep might help tackle frequent technical difficulties. Clearing your browser’s cache and cookies may additionally resolve particular points. Contacting the insurance coverage supplier instantly is an possibility for complicated or persistent issues.

Ultimate Ideas

In conclusion, trying up automobile insurance coverage by VIN on-line is an easy and environment friendly technique for acquiring tailor-made protection. Understanding the method, together with safety issues and components affecting premiums, empowers you to make knowledgeable selections. This information equips you with the data to navigate the net panorama and discover essentially the most appropriate insurance coverage on your car.

Steadily Requested Questions

What if I haven’t got entry to my VIN?

You may usually discover your VIN in your car’s title, registration, or insurance coverage paperwork. In the event you can not find it, contacting your automobile dealership or the DMV could be useful.

How correct are the net insurance coverage quotes primarily based on a VIN?

On-line quotes are estimates. Components like your driving historical past and private particulars may affect the ultimate premium. A quote is a place to begin for comparability, not a assured value.

Can I evaluate insurance policies from completely different insurance coverage corporations utilizing a single VIN lookup?

Sure, most on-line platforms mean you can evaluate quotes from a number of insurers utilizing the VIN. This function helps you see a spread of choices and select the most effective match on your wants.

What if I encounter technical points through the VIN lookup?

In the event you expertise issues, verify your web connection. If the difficulty persists, strive a unique internet browser or contact the net service supplier for help.