Georgia minimal automotive insurance coverage necessities pave the way in which for protected roads, guaranteeing a framework of economic safety for all. This important information delves into the specifics, illuminating the required coverages, limits, and potential exemptions. Navigating these laws is essential for drivers in Georgia, safeguarding each private property and the well-being of others.

Georgia’s minimal necessities, although elementary, should not exhaustive. Understanding the small print permits drivers to make knowledgeable choices about complete insurance coverage protection that goes past the naked minimal.

Overview of Georgia Minimal Automotive Insurance coverage Necessities

Embarking on the journey of driving in Georgia necessitates understanding the basic safeguards enshrined in its minimal automotive insurance coverage necessities. These necessities, akin to religious precepts, guarantee a harmonious coexistence on the roadways, defending all members and fostering a way of shared duty. They’re the bedrock of accountable driving, guiding people in direction of a aware and equitable method to vehicular navigation.These important provisions illuminate the trail to monetary safety within the occasion of unexpected accidents, akin to a guiding mild illuminating the way in which ahead.

Comprehending these necessities empowers drivers to navigate the complexities of Georgia’s roadways with confidence and a deeper understanding of their tasks.

Mandated Insurance coverage Coverages

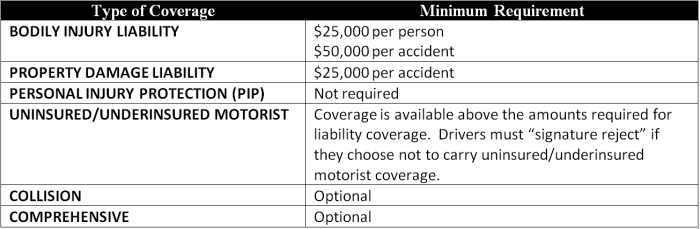

The religious essence of Georgia’s minimal insurance coverage necessities lies of their dedication to defending all events concerned in a vehicular incident. The mandated coverages, designed to mitigate monetary hardship and facilitate a swift restoration, are important for a harmonious and simply society on the roads.

| Protection Sort | Description | Minimal Restrict |

|---|---|---|

| Legal responsibility Bodily Damage | Covers medical bills and misplaced wages for injured events in an accident you trigger. | $25,000 per particular person, $50,000 per accident |

| Legal responsibility Property Injury | Covers damages to the property of one other particular person in an accident you trigger. | $25,000 |

Legal responsibility Limits Defined

Understanding the legal responsibility limits is essential for a driver’s religious dedication to the protection and well-being of others. These limits characterize the utmost quantity an insurance coverage firm pays out in case of an accident, serving as a vital safeguard in opposition to catastrophic monetary repercussions.These limits, whereas representing a minimal, ought to function a reminder of the potential penalties of an accident.

A driver’s duty extends past their car; it encompasses the well-being of others and the societal concord they contribute to. By adhering to those minimal necessities, people display their dedication to this shared duty.

Protection Particulars

Embarking on the journey of accountable driving necessitates a profound understanding of the varied insurance coverage coverages. These protections, meticulously crafted to safeguard each your well-being and your property, function a beacon of safety within the unpredictable realm of the highway. Comprehending the nuances of those coverages is paramount to navigating the complexities of the Georgia minimal automotive insurance coverage necessities.

Bodily Damage Legal responsibility Protection

Bodily harm legal responsibility protection, a cornerstone of accountable driving, safeguards in opposition to monetary repercussions stemming from accidents sustained by others in accidents involving your car. This protection extends to the compensation of medical bills, misplaced wages, and ache and struggling incurred by the affected events. It is a testomony to the popularity that accidents can inflict profound hurt, each bodily and financially.

Property Injury Legal responsibility Protection

Property harm legal responsibility protection acts as a protecting defend in opposition to monetary liabilities arising from damages inflicted upon the property of others throughout an accident. This encompasses the restore or alternative prices of broken autos, buildings, or different belongings. It underscores the significance of acknowledging the fabric hurt that accidents may cause.

Uninsured/Underinsured Motorist Protection in Georgia

Uninsured/underinsured motorist protection is an important safeguard in Georgia. This protection steps in when an accident entails a driver with out satisfactory insurance coverage or who has inadequate protection. It offers a security web, compensating you to your losses in such circumstances, defending you from monetary destroy in instances the place the at-fault driver is uninsured or underinsured. Think about a state of affairs the place a negligent driver, missing satisfactory insurance coverage, causes an accident.

This protection would offer compensation for the damages you maintain, a essential facet of accountable driving in a neighborhood.

Comparability of Legal responsibility Coverages

| Protection Sort | Description | Instance |

|---|---|---|

| Bodily Damage Legal responsibility | Protects in opposition to monetary duty for accidents sustained by others in an accident. | Covers medical payments, misplaced wages, and ache and struggling for these injured in an accident brought on by you. |

| Property Injury Legal responsibility | Protects in opposition to monetary duty for damages precipitated to the property of others in an accident. | Covers restore or alternative prices of broken autos, buildings, or different property. |

This desk highlights the distinct nature of every protection kind, illustrating how they individually deal with particular points of accident-related liabilities. Understanding these distinctions is crucial for a complete grasp of the safety provided by every protection.

Exemptions and Exceptions

Navigating the intricate tapestry of Georgia’s minimal automotive insurance coverage necessities can really feel like traversing a labyrinth. But, inside this framework of safety lies a path to tailor-made options. Understanding exemptions and exceptions illuminates the personalised method to insurance coverage that respects particular person circumstances. This part unveils the potential avenues for adaptation, guaranteeing alignment together with your distinctive wants.Navigating the realm of insurance coverage exemptions and exceptions requires a deep understanding of the guiding ideas.

These provisions, meticulously crafted, are designed to offer flexibility with out compromising the basic security web for all highway customers. The next exploration delves into the varied conditions the place exemptions may apply, the circumstances for such exemptions, and the procedures for acquiring them.

Potential Conditions for Exemptions

Georgia’s minimal insurance coverage necessities should not a inflexible, one-size-fits-all resolution. Conditions the place exemptions may apply typically contain particular circumstances and pre-defined circumstances. For instance, sure people or entities could also be eligible for diminished protection necessities, whereas others may have to stick to enhanced necessities for his or her distinctive circumstances.

Exceptions to Minimal Protection Quantities

Sure conditions might warrant exceptions to the usual minimal protection quantities. These exceptions typically align with particular circumstances or particular varieties of autos. Contemplate a basic automotive fanatic who owns a classic car. The minimal protection necessities may be tailor-made to mirror the car’s inherent worth and potential danger profile.

Course of for Acquiring an Exemption

The method for acquiring an exemption from Georgia’s minimal insurance coverage necessities is structured to make sure equity and transparency. Documentation is essential. People in search of exemptions should submit supporting documentation that verifies their distinctive circumstances. This documentation ought to clearly illustrate how the exemption aligns with the particular circumstances Artikeld in Georgia’s legal guidelines. Failure to offer full and correct documentation might delay and even forestall the approval of the exemption.

Desk of Potential Exemptions and Circumstances

| Potential Exemption | Circumstances Required |

|---|---|

| Short-term Residents | Proof of momentary residency, legitimate identification, and proof of intent to depart Georgia inside a specified timeframe. |

| Automobiles Not Recurrently Operated on Public Roads | Proof that the car isn’t usually used on public roads (e.g., a car used solely for off-road actions). |

| Vintage or Traditional Automobiles | Documentation demonstrating the car’s vintage or basic standing, typically together with value determinations and historic information. |

| Sure Industrial Automobiles | Particular permits and licenses related to business use. Particulars fluctuate relying on the character of the business operation. |

Penalties for Non-Compliance

The trail of lawful driving is paved with duty, and a vital facet of this journey is adherence to the mandated insurance coverage necessities. Neglecting these safeguards can result in penalties that ripple by means of the person’s life, impacting not solely their monetary well-being but in addition their religious connection to the neighborhood.Failure to take care of the requisite insurance coverage protection can set off a cascade of repercussions, from financial penalties to the erosion of belief and the potential for authorized entanglements.

Understanding these potential ramifications empowers people to make knowledgeable choices, guaranteeing their actions align with the ideas of moral and accountable driving.

Penalties of Non-Compliance

Non-compliance with Georgia’s minimal automotive insurance coverage necessities carries vital penalties. The repercussions lengthen past mere monetary penalties and might impression one’s sense of integrity and duty throughout the neighborhood.

Fines and Penalties Related to Driving With out Insurance coverage

Georgia’s authorized framework Artikels a spectrum of fines and penalties for driving with out satisfactory insurance coverage. These penalties are designed to discourage such habits and uphold the protection and well-being of all highway customers.

- The preliminary offense sometimes entails substantial fines, doubtlessly impacting one’s monetary stability. These penalties are supposed to function a deterrent, encouraging adherence to the regulation.

- Repeat violations escalate the penalties, reflecting a sample of disregard for the regulation and the protection of others on the roads.

- Driving with out insurance coverage can result in the suspension or revocation of driving privileges, hindering one’s capacity to navigate the each day requirements of life and keep a way of independence.

Potential Authorized Ramifications

Driving with out insurance coverage carries vital authorized ramifications that reach past financial fines. The authorized system is designed to uphold the rights of all residents and keep order on the roads. Non-compliance with these necessities can result in a variety of authorized penalties.

- The authorized system, in its pursuit of justice, can impose penalties that impression a person’s private {and professional} life, reflecting the gravity of the violation.

- In sure instances, people might face civil lawsuits filed by these harmed by their actions. These lawsuits may end up in vital monetary burdens, doubtlessly exceeding the preliminary penalties.

Desk of Violations and Penalties, Georgia minimal automotive insurance coverage necessities

This desk illustrates the potential penalties for various violations associated to driving with out insurance coverage in Georgia. It is essential to know the escalation of penalties with repeat offenses.

| Violation | Penalty |

|---|---|

| First Offense | Vital positive, potential for driving license suspension |

| Second Offense | Larger positive, prolonged license suspension, potential for court docket look |

| Subsequent Offenses | Elevated fines, attainable revocation of driving license, doubtlessly impacting future alternatives |

Insurance coverage Choices Past the Minimal

Embarking on the journey of accountable automotive possession necessitates a profound understanding of the multifaceted points of insurance coverage. Whereas the minimal necessities present a elementary security web, venturing past these boundaries unlocks a realm of enhanced safety and peace of thoughts. The pursuit of complete protection transcends mere authorized obligations; it represents a dedication to safeguarding your well-being and property.Past the naked minimal, a spectrum of insurance coverage choices extends, tailor-made to particular person wants and circumstances.

These choices typically present a layer of safety that goes past the authorized mandates, permitting for higher safety in opposition to unexpected occasions.

Benefits of Larger Protection Limits

Larger protection limits should not merely an train in monetary expenditure; they characterize a strategic funding in private safety. This funding gives a vital layer of safety in opposition to monetary hardship ought to the worst happen. Past authorized compliance, a complete insurance coverage coverage shields people from the catastrophic monetary repercussions of accidents or harm.

Monetary Implications of Larger Protection

Whereas the attract of enhanced protection is simple, the monetary implications require cautious consideration. The price of increased protection limits correlates instantly with the extent of safety afforded. Understanding the premium related to completely different protection tiers is essential to creating knowledgeable choices. Whereas increased premiums might initially seem daunting, the monetary safety they supply typically outweighs the price in the long term.

A well-thought-out comparability of premiums in opposition to potential monetary losses offers a transparent image of the general worth proposition.

Significance of Enough Protection for Private Safety

Enough protection for private safety goes past monetary compensation; it represents a elementary pillar of safety. It safeguards not solely the car but in addition the well-being of these inside it. Insurance coverage acts as a defend, absorbing the monetary burden of unexpected circumstances and permitting people to navigate life’s challenges with resilience.

Examples of Larger Protection Defending People and Property

A state of affairs involving a extreme accident illustrates the profound impression of complete protection. Contemplate a collision the place the harm exceeds the minimal protection. With out increased protection, the person might face insurmountable monetary challenges to restore their car and canopy potential medical bills. Larger protection limits would take in these prices, stopping monetary destroy. This instance highlights how complete insurance coverage acts as a security web in unexpected circumstances, safeguarding each private well-being and property.One other instance showcases the safety prolonged to people in a complete insurance coverage plan.

A catastrophic occasion, reminiscent of a complete lack of the car because of fireplace or pure catastrophe, can result in substantial monetary losses if not lined. Complete insurance coverage, extending past the minimal necessities, might cowl the full loss, thus mitigating the monetary impression on the policyholder. These examples spotlight the sensible advantages of upper protection, safeguarding people from potential monetary catastrophes.

Latest Modifications and Updates

Navigating the intricate tapestry of authorized necessities for Georgia’s minimal automotive insurance coverage can really feel like traversing a winding path. But, inside this framework lies a profound reality: a dedication to security and safety for all. This part delves into the current shifts and evolutions of those legal guidelines, illuminating how they impression each drivers and insurance coverage suppliers.

Legislative Modifications

Georgia’s dedication to enhancing highway security manifests in periodic legislative changes to its minimal automotive insurance coverage necessities. These revisions intention to refine the stability between defending susceptible highway customers and fostering a sustainable insurance coverage market. Understanding these modifications is essential for sustaining compliance and contributing to a harmonious driving setting.

Updates to Protection Necessities

The bedrock of Georgia’s minimal insurance coverage necessities hinges on particular protection quantities. Over time, these quantities have been adjusted to mirror evolving financial realities and the rising value of repairs and medical bills. These changes be sure that the minimal requirements stay related to the present monetary panorama. Latest updates mirror an upward development in minimal protection limits, bolstering the monetary safety of these concerned in accidents.

Updates to Penalties for Non-Compliance

Sustaining compliance with Georgia’s minimal automotive insurance coverage necessities is significant. Failure to conform can set off vital repercussions, together with monetary penalties and even the potential for license suspension. The penalties function a deterrent and safeguard in opposition to irresponsible driving practices. These sanctions are calibrated to advertise accountable driving habits.

Influence on Drivers and Insurance coverage Suppliers

These changes have tangible impacts on each drivers and insurance coverage suppliers. Drivers are obligated to make sure they meet probably the most present requirements, typically requiring a reassessment of their insurance coverage protection. Insurance coverage suppliers, in flip, have to adapt their insurance policies and pricing buildings to account for the revised minimums and potential penalties for non-compliance. As an illustration, a driver failing to take care of the up to date minimums may face the revocation of their driver’s license.

Conversely, insurance coverage suppliers might increase premiums for drivers in areas with increased accident charges.

Time-Based mostly Desk of Latest Modifications

| Date | Change Description | Influence on Drivers | Influence on Insurance coverage Suppliers |

|---|---|---|---|

| 2023-09-15 | Minimal legal responsibility protection elevated from $25,000 to $30,000 per particular person. | Drivers want to make sure their coverage displays the upper restrict to adjust to the regulation. | Insurance coverage suppliers want to regulate their coverage choices and pricing to mirror the elevated minimal. |

| 2024-01-01 | Penalty for non-compliance elevated from $100 to $250. | Drivers face increased monetary penalties for failing to take care of minimal protection. | Insurance coverage suppliers should clearly talk the up to date penalties to clients. |

Sources for Extra Info

Embarking on the journey of understanding Georgia’s minimal automotive insurance coverage necessities is a quest for readability and peace of thoughts. This path, illuminated by information, results in a harmonious relationship with the authorized and monetary points of driving.Navigating the complexities of insurance coverage will be daunting, however with the correct sources, the journey turns into extra accessible and fewer daunting. By understanding the obtainable data sources, you’ll be able to acquire a complete perspective on this important facet of accountable driving.

Dependable On-line Sources

This realm of knowledge is a treasure trove of data, meticulously compiled to your profit. Accessible on-line sources provide a wealth of detailed data, making it simple to understand the nuances of Georgia’s minimal necessities. These sources function a guiding mild, illuminating the trail to understanding.

- Georgia Division of Driver Providers (DDS): The DDS is the first supply for official state data. Their web site offers complete particulars on insurance coverage necessities, laws, and related kinds. You’ll be able to entry up to date data, guaranteeing your information aligns with the newest authorized stipulations. This official useful resource ensures accuracy and compliance.

- Georgia Insurance coverage Division: The Georgia Insurance coverage Division performs a essential position in regulating and overseeing insurance coverage firms throughout the state. Their web site typically offers data on insurance coverage insurance policies, procedures, and ceaselessly requested questions, empowering you with very important information. This web site serves as a worthwhile useful resource, offering a broad perspective on the insurance coverage panorama.

- Unbiased Insurance coverage Comparability Web sites: These web sites present comparative analyses of assorted insurance coverage insurance policies, serving to you make knowledgeable choices about insurance coverage protection. These web sites act as intermediaries, providing an summary of the insurance coverage market.

State Company Contact Info

Direct communication with the related state businesses can facilitate a deeper understanding of the specifics of Georgia’s minimal automotive insurance coverage necessities. Accessing this direct channel permits for personalised clarification and ensures you’ve got probably the most up-to-date data.

| Company | Web site | Contact Info (if obtainable) |

|---|---|---|

| Georgia Division of Driver Providers (DDS) | [DDS Website Address] | [DDS Contact Phone Number] and [DDS Contact Email Address] |

| Georgia Insurance coverage Division | [Georgia Insurance Department Website Address] | [Georgia Insurance Department Contact Information] |

Further Info Sources

Past official channels, there are supplementary sources obtainable to boost your understanding of Georgia’s minimal automotive insurance coverage necessities. These supplementary sources can present further views and insights, enabling a extra thorough comprehension.

- Native Authorized Assist Organizations: These organizations can provide steering on authorized points of insurance coverage, significantly for people with restricted sources or particular circumstances. They supply help and sources, guaranteeing equitable entry to data.

- Native Insurance coverage Brokers: Consulting with native insurance coverage brokers can provide personalised steering and help in understanding protection choices past the minimal necessities. They will present tailor-made recommendation, contemplating your particular person circumstances.

Illustrative Situations

Embarking on the journey of understanding Georgia’s minimal automotive insurance coverage necessities is akin to navigating a religious path. Every state of affairs reveals a aspect of this important life lesson, guiding us in direction of a deeper comprehension of duty and the interconnectedness of our actions. The knowledge of those necessities lies not simply within the safety they provide, but in addition within the classes they educate about prudence and the sacredness of shared area.The journey requires an open thoughts and a willingness to soak up the knowledge embedded in every instance.

By finding out these eventualities, we domesticate a deeper appreciation for the significance of economic duty and the important position insurance coverage performs in defending not solely ourselves but in addition these round us.

Accident Involving Property Injury Solely

Understanding the appliance of minimal necessities in eventualities involving property harm solely is crucial. A automotive accident the place solely minor harm to autos happens highlights the necessity for complete insurance coverage protection. In such an occasion, the minimal necessities will doubtless cowl the damages to the affected autos, offering a path in direction of reconciliation and restoration. The method of submitting a declare, understanding the procedures, and adhering to the rules will show instrumental in navigating this often-challenging expertise.

Damage to One other Individual

A big issue to contemplate is the appliance of Georgia’s minimal necessities when harm to a different particular person is concerned. In instances the place a driver causes an accident leading to bodily hurt to a different social gathering, the minimal insurance coverage protection might not adequately compensate for the intensive medical bills, misplaced wages, and ache and struggling. This emphasizes the necessity for complete protection past the minimal necessities to guard the well-being and the way forward for these concerned within the accident.

The monetary implications of such an accident demand cautious consideration and the appliance of moral requirements in dealing with claims and procedures.

Uninsured Driver

In a state of affairs involving an uninsured driver, the essential facet of guaranteeing satisfactory protection past the minimal turns into paramount. If an uninsured driver causes an accident, the injured social gathering’s recourse is proscribed to their very own insurance coverage coverage. In such instances, the significance of complete insurance coverage that extends past the minimal necessities turns into self-evident, guaranteeing that these concerned are shielded from potential monetary hardship.

This state of affairs underscores the importance of proactive steps to guard one’s well-being and to make sure a clean and simply decision to the accident.

Hit-and-Run

Successful-and-run accident highlights the significance of complete protection and the essential position of thorough documentation. In a hit-and-run state of affairs, the method of recovering damages or in search of compensation for accidents turns into extra complicated. The necessity for complete documentation, together with witness accounts and any obtainable proof, turns into important in navigating this intricate course of. One of these accident underscores the significance of proactive measures, reminiscent of sustaining complete information and taking swift motion, with a view to pursue justice and safety.

A number of-Automobile Accidents

A number of-vehicle accidents, the place a number of drivers are concerned, additional emphasize the significance of a transparent understanding of minimal necessities. These incidents require a scientific method to claims and procedures. In such complicated eventualities, the necessity for complete documentation and a meticulous understanding of the relevant legal guidelines and laws is significant. The intricate net of tasks and the necessity for a cautious evaluation of particular person circumstances additional spotlight the worth of insurance coverage protection.

Closure

In conclusion, Georgia’s minimal automotive insurance coverage necessities are a cornerstone of highway security. Comprehending these laws, from the important coverages to potential exemptions and penalties, empowers drivers to navigate the complexities of the system. By understanding these particulars, drivers can select one of the best insurance coverage options to safeguard their pursuits and contribute to a safer driving setting.

Query & Reply Hub

What are the various kinds of legal responsibility protection required in Georgia?

Georgia mandates bodily harm legal responsibility and property harm legal responsibility protection. These are designed to cowl accidents and damages sustained by others within the occasion of an accident.

What are the minimal legal responsibility limits for automotive insurance coverage in Georgia?

The minimal limits fluctuate, however typically, the minimal limits for bodily harm legal responsibility are $25,000 per particular person and $50,000 per accident, and the minimal restrict for property harm legal responsibility is $25,000.

Are there any exemptions from Georgia’s minimal insurance coverage necessities?

Sure, there are particular exemptions, reminiscent of for autos used solely for agricultural functions. Particular circumstances might warrant exemptions, and the small print of those are Artikeld within the state’s laws.

What are the penalties for driving with out automotive insurance coverage in Georgia?

Driving with out satisfactory insurance coverage in Georgia may end up in fines, suspension of driving privileges, and potential authorized ramifications. The severity of the penalties will depend on the particular violation.