Do you want insurance coverage to register a automotive in Florida? This important query impacts each Floridian driver. Navigating the state’s car registration course of could be difficult, particularly when insurance coverage necessities are concerned. Understanding the particular guidelines, exemptions, and potential penalties is essential for a clean registration course of.

Florida’s legal guidelines concerning car registration and insurance coverage are multifaceted, encompassing numerous car sorts and conditions. This information will delve into the mandatory documentation, charges, and potential exemptions, making certain you are absolutely knowledgeable earlier than embarking on the registration journey.

Florida Automobile Registration Necessities

Registering a car in Florida entails fulfilling particular necessities. These necessities guarantee security and accountability inside the state’s transportation system. Understanding these procedures is essential for clean and authorized car possession.Florida’s car registration course of encompasses numerous points, together with documentation, charges, and sorts of automobiles. This part Artikels the final necessities, detailing particular documentation wanted and related prices for various car classes.

Normal Necessities for Automobile Registration

Florida mandates that each one automobiles, together with automobiles, bikes, vans, and trailers, should be registered with the Division of Freeway Security and Motor Autos (DHSMV). This registration course of establishes authorized possession and facilitates the monitoring of automobiles inside the state.

Sorts of Autos Topic to Registration

Florida’s registration necessities apply to a broad vary of automobiles. This contains passenger automobiles, sport utility automobiles (SUVs), bikes, vans (pickup vans, vans, and supply vans), and trailers. Even boats and leisure automobiles (RVs) could have registration necessities relying on their use and classification.

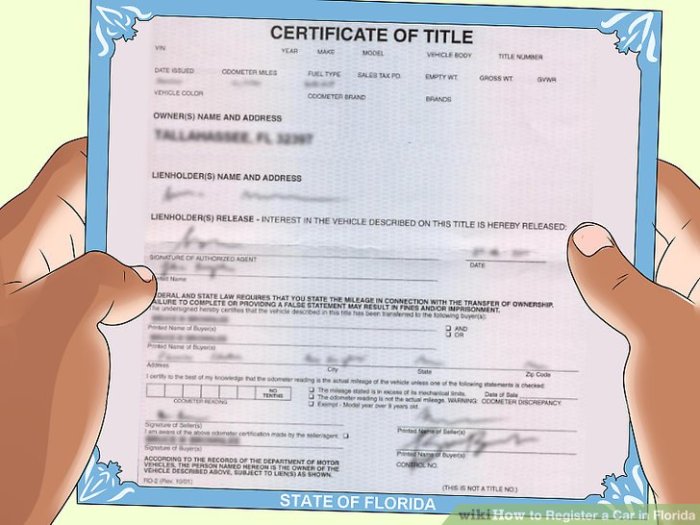

Documentation Wanted for Automobile Registration

To register a car in Florida, you want particular documentation. This usually features a legitimate Florida driver’s license or identification card, proof of insurance coverage, the car’s title, and a accomplished software kind. In some instances, extra paperwork like a invoice of sale or a car historical past report may be crucial.

Automobile Registration Charges and Paperwork

| Automobile Kind | Required Paperwork | Related Charges |

|---|---|---|

| Passenger Automobiles | Automobile title, proof of insurance coverage, software kind, legitimate driver’s license/ID | Registration charge, title charge, and probably a plate charge |

| Bikes | Automobile title, proof of insurance coverage, software kind, legitimate driver’s license/ID | Registration charge, title charge, and probably a plate charge |

| Vehicles | Automobile title, proof of insurance coverage, software kind, legitimate driver’s license/ID, probably an emissions inspection | Registration charge, title charge, plate charge, and probably an emissions inspection charge |

| Trailers | Automobile title, proof of insurance coverage, software kind, legitimate driver’s license/ID, probably a invoice of sale | Registration charge, title charge, plate charge, and probably a invoice of sale charge |

Notice: Charges are topic to vary and will differ based mostly on particular car particulars and circumstances. All the time examine with the DHSMV for essentially the most up-to-date data.

Insurance coverage Necessities for Registration

Florida regulation mandates proof of vehicle insurance coverage for car registration. This significant requirement protects each drivers and the general public by making certain monetary accountability within the occasion of an accident. With out ample insurance coverage, people face vital penalties. Understanding these necessities is important for clean and compliant car registration.Florida regulation necessitates that each one automobiles registered within the state have energetic and legitimate insurance coverage protection.

It is a cornerstone of Florida’s complete strategy to visitors security. Failure to keep up this protection may end up in substantial penalties and hinder the registration course of.

Necessity of Insurance coverage

Proof of insurance coverage is a prerequisite for car registration in Florida. This requirement stems from the state’s dedication to making sure that drivers have monetary sources to compensate victims of accidents. With out insurance coverage, drivers lack the means to cowl potential damages brought on by their actions.

Penalties for Lack of Insurance coverage

Failure to display legitimate insurance coverage protection in the course of the registration course of may end up in vital penalties. These penalties could embody, however are usually not restricted to, denial of registration, fines, and doable authorized repercussions. The precise penalties and related procedures could be discovered within the Florida Statutes.

Acceptable Sorts of Insurance coverage Protection

A number of sorts of insurance coverage protection are acceptable for car registration in Florida. These coverages usually embody legal responsibility insurance coverage, which covers damages precipitated to different folks or property. Collision insurance coverage and complete insurance coverage are extra choices, although not mandated for registration. The precise necessities for every protection kind can differ relying on the car kind and particular person circumstances.

Insurance coverage Necessities for Totally different Automobile Sorts

The insurance coverage necessities for various car sorts, resembling bikes, leisure automobiles (RVs), and vans, are sometimes comparable however could have particular protection minimums. These necessities are clearly Artikeld in Florida statutes and could be reviewed for correct data.

Examples of Acceptable Insurance policies

A number of sorts of insurance coverage insurance policies fulfill Florida’s registration necessities. For example, a regular auto legal responsibility coverage with minimal protection quantities, as mandated by Florida regulation, would suffice. Insurance policies exceeding these minimums provide elevated safety and monetary safety for the insured and others concerned in accidents. It’s essential to seek the advice of with an insurance coverage supplier to make sure the coverage meets Florida’s necessities.

Insurance coverage Necessities by Automobile Class

| Automobile Class | Required Insurance coverage Protection |

|---|---|

| Passenger Automobiles | Minimal legal responsibility protection as per Florida Statute; extra protection like collision or complete is non-obligatory. |

| Vehicles | Minimal legal responsibility protection as per Florida Statute; extra protection is strongly suggested, particularly for business automobiles. |

| Bikes | Minimal legal responsibility protection as per Florida Statute; extra protection is very really helpful because of elevated danger. |

| Leisure Autos (RVs) | Minimal legal responsibility protection as per Florida Statute; extra protection could also be required based mostly on the particular kind of RV and its use. |

Exemptions and Exceptions: Do You Want Insurance coverage To Register A Automotive In Florida

Florida’s car registration necessities, whereas usually requiring insurance coverage, provide sure exemptions for particular conditions. Understanding these exemptions is essential for making certain compliance with out pointless monetary burdens. These exemptions usually apply to automobiles that do not usually fall underneath the usual registration tips.Florida regulation permits for exceptions to the necessary insurance coverage requirement for car registration. These exemptions usually pertain to automobiles used for particular functions or with distinctive traits, resembling vintage or collector automobiles.

Realizing these exceptions can save drivers from pointless prices.

Vintage and Collector Automobile Exemptions

Florida acknowledges the worth and historic significance of vintage and collector automobiles. These automobiles are sometimes exempt from the necessary insurance coverage requirement for registration. This exemption, nevertheless, usually comes with particular situations and documentation necessities.

To qualify for this exemption, homeowners should display that the car meets the factors for vintage or collector standing. The precise standards and documentation required for every class differ. For instance, vintage automobiles usually require proof of age and historic significance, whereas collector automobiles could require documentation verifying their distinctive worth and situation.

Different Potential Exemptions

There are different circumstances the place insurance coverage won’t be required for car registration in Florida. These embody however are usually not restricted to automobiles used solely for agricultural functions or automobiles used for particular non-profit actions.

Particular documentation, together with a letter from the suitable authority, is normally required to show eligibility. That is to make sure that the exemption is granted solely within the professional instances. For example, a letter from a acknowledged agricultural group verifying the car’s agricultural use can be crucial for exemption.

Making use of for Exemptions

The method for making use of for exemptions varies relying on the particular exemption sought. Every exemption has particular necessities and documentation wanted. It’s essential to completely overview the necessities of the relevant exemption to make sure a profitable software. Failure to satisfy all the factors may end in denial of the exemption.

Usually, it’s worthwhile to submit the required documentation to the suitable Florida Division of Freeway Security and Motor Autos (FLHSMV) workplace. Detailed directions on the mandatory types and procedures could be discovered on the FLHSMV web site. This can allow you to navigate the appliance course of successfully and stop any delays or issues.

Desk of Potential Exemptions

| Exemption Class | Situations |

|---|---|

| Vintage Autos | Autos over a sure age (usually 25 years or older) and possessing historic significance. Particular documentation, resembling historic information and restoration data, is commonly required. |

| Collector Autos | Autos with distinctive options, excessive worth, or vital collector standing. Documentation to show collector worth, resembling appraisal experiences, could also be wanted. |

| Agricultural Use | Autos used completely for agricultural functions, with acceptable documentation from an agricultural group confirming this use. |

| Non-Revenue Actions | Autos used solely for non-profit actions, with crucial paperwork from the non-profit group confirming the car’s use. |

Latest Adjustments and Updates

Florida’s car registration and insurance coverage necessities are topic to periodic updates. These changes replicate evolving security requirements, financial situations, and legislative priorities. Understanding these adjustments is essential for Florida car homeowners to keep up compliance and keep away from penalties.Latest legislative motion has targeted on streamlining the registration course of and enhancing enforcement of insurance coverage mandates. This has led to delicate however impactful alterations within the procedures and documentation wanted for a clean and compliant registration.

Latest Legislative Actions Impacting Insurance coverage Necessities

Legislative periods usually introduce payments impacting insurance coverage necessities for car registration. These payments can vary from clarifying current legal guidelines to introducing new stipulations. The impression of those legislative actions on the common Florida car proprietor varies based mostly on the particular adjustments.

- In 2023, Florida lawmakers amended the monetary accountability legal guidelines for car homeowners. This modification elevated the minimal insurance coverage protection required for drivers, elevating the legal responsibility limits from a regular $10,000 to $30,000 per particular person and $60,000 per accident. This enhance goals to raised shield people injured in accidents involving uninsured or underinsured drivers. The brand new necessities took impact on January 1, 2024.

- A current legislative initiative targeted on bettering the transparency and accessibility of insurance coverage data for customers. This included measures to make it simpler to check protection choices and perceive insurance coverage coverage phrases. These adjustments purpose to empower customers and promote higher knowledgeable decision-making in choosing insurance policy.

- There was a renewed emphasis on imposing compliance with insurance coverage necessities. This contains elevated scrutiny of insurance coverage insurance policies and stricter penalties for violations. This enhanced concentrate on enforcement goals to discourage non-compliance and enhance total street security.

Affect on Common Florida Automobile Homeowners

The current adjustments in Florida’s car registration legal guidelines and insurance coverage necessities have a number of implications for the common car proprietor.

- Elevated Insurance coverage Premiums: The rise in minimal insurance coverage protection has usually led to greater insurance coverage premiums for drivers. Whereas this can be a direct consequence of the elevated legal responsibility limits, it additionally displays the insurance coverage firms’ have to offset the elevated danger of claims.

- Enhanced Documentation Necessities: Amendments to registration procedures could require homeowners to supply extra documentation to show insurance coverage protection. These adjustments are aimed toward simplifying the method, however they might end in barely extra paperwork.

- Potential for Penalties: The intensified enforcement of insurance coverage mandates might result in extra fines or penalties for drivers who are usually not compliant with the brand new requirements. This underscores the significance of sustaining correct insurance coverage data and verifying protection standing.

Examples of Related Court docket Instances or Authorized Selections

Whereas no particular courtroom instances had been cited as having a direct impression on current legislative adjustments, Florida’s courts have persistently upheld the state’s proper to manage car registration and insurance coverage necessities. These rulings have helped to make clear the authorized framework and guarantee consistency in enforcement.

Sensible Implications for Automobile Homeowners

Navigating Florida’s car registration course of requires cautious consideration to insurance coverage necessities. Understanding the procedures, potential penalties of non-compliance, and the insurance coverage panorama is essential for clean registration and authorized compliance. This part particulars the sensible points of registering a car in Florida whereas adhering to insurance coverage laws.

Automobile Registration Process with Insurance coverage Compliance

Florida’s car registration course of hinges on proof of insurance coverage. Failure to supply this proof may end up in delays or rejection of the appliance. An in depth process is Artikeld under.

- Collect Required Paperwork: Guarantee you’ve gotten the car’s title, proof of insurance coverage (insurance coverage coverage or affirmation), registration software kind, and fee for registration charges. Failure to supply all required paperwork can halt the registration course of.

- Acquire Insurance coverage: It is a essential first step. Earlier than making use of for registration, safe insurance coverage protection for the car. This step should be accomplished previous to making use of for registration.

- Full Registration Utility: Fill out the Florida Division of Freeway Security and Motor Autos (FLHSMV) software precisely. Present all requested data and guarantee all particulars are appropriately documented. Inaccurate data can result in delays or errors in processing.

- Submit Utility and Paperwork: Submit the finished software, insurance coverage proof, and different required paperwork to the FLHSMV, both on-line or at a delegated workplace. Guarantee all paperwork are full and legible.

- Pay Registration Charges: Pay the relevant registration charges. Failure to pay the correct quantity might result in additional delays or penalties.

- Obtain Registration Paperwork: As soon as permitted, obtain your car registration paperwork. These paperwork are essential for authorized operation of the car.

Penalties of Non-Compliance with Insurance coverage Necessities

Failure to adjust to Florida’s insurance coverage necessities for car registration carries vital penalties. These vary from administrative penalties to authorized ramifications.

- Delayed or Rejected Registration: The FLHSMV could delay or reject the registration software if correct insurance coverage proof is not offered.

- Monetary Penalties: Penalties for not having ample insurance coverage could be substantial and have an effect on your driving report. Overview Florida statutes for exact penalty particulars.

- Authorized Motion: Failure to keep up legitimate insurance coverage can result in authorized motion from regulation enforcement, probably leading to fines and even suspension of driving privileges.

Acquiring Insurance coverage for a Automobile in Florida

Securing insurance coverage for a car in Florida entails a number of steps. A transparent understanding of the method simplifies the duty.

- Assess Protection Wants: Decide the kinds and quantities of protection that meet your wants and monetary state of affairs. Overview coverage choices to make sure acceptable protection towards numerous potential incidents. This contains legal responsibility, collision, complete, and uninsured/underinsured motorist protection.

- Examine Insurance coverage Suppliers: Analysis completely different insurance coverage firms providing insurance policies in Florida. Elements to think about embody charges, protection choices, customer support scores, and firm monetary stability.

- Request Quotes: Acquire quotes from numerous suppliers. Evaluating quotes is significant for figuring out the absolute best worth. Quotes usually differ by components resembling driving historical past, car kind, and site.

- Select a Coverage: Choose a coverage that meets your necessities and funds. Learn the coverage paperwork fastidiously to know the phrases and situations.

- Full Utility: Full the insurance coverage software precisely and submit the mandatory paperwork.

- Obtain Coverage Paperwork: After approval, obtain the coverage paperwork and hold them readily accessible.

Evaluating Insurance coverage Suppliers and Prices, Do you want insurance coverage to register a automotive in florida

Insurance coverage suppliers provide various premiums and protection choices. A comparability can help in choosing essentially the most appropriate coverage.

| Insurance coverage Supplier | Common Premium (Instance) | Protection Highlights |

|---|---|---|

| Firm A | $1,200 yearly | Complete protection, good customer support scores |

| Firm B | $1,500 yearly | Wonderful claims dealing with, reductions accessible |

| Firm C | $900 yearly | Decrease premiums, probably restricted protection choices |

Notice: Premiums are examples and might differ based mostly on particular person components.

Discovering and Evaluating Insurance coverage Quotes

A number of on-line sources and instruments will help you discover and evaluate insurance coverage quotes. Utilizing these instruments effectively streamlines the method.

- On-line Comparability Web sites: Web sites devoted to insurance coverage comparability present detailed data on numerous suppliers and insurance policies.

- Direct Supplier Web sites: Insurance coverage firms’ web sites usually let you request quotes immediately.

- Insurance coverage Brokers: Insurance coverage brokers can help in evaluating quotes from a number of suppliers, probably saving effort and time.

Automobile Registration and Insurance coverage Course of Flowchart

[A flowchart depicting the steps from obtaining insurance to registering the vehicle would be highly beneficial here. This would visually represent the sequential process and highlight key decision points. Unfortunately, I cannot create images.]

Frequent Misconceptions

Navigating Florida’s car registration course of could be complicated, and sadly, many misconceptions flow into concerning insurance coverage necessities. Understanding these widespread misunderstandings is essential for avoiding expensive errors and making certain a clean registration course of. This part particulars typical errors and deceptive data, emphasizing the potential authorized ramifications and offering real-world examples.Misconceptions usually come up because of evolving laws and the complexities of the authorized framework.

These misunderstandings can result in delays, penalties, and even authorized motion if not addressed promptly. Correcting these misconceptions empowers car homeowners to adjust to Florida’s legal guidelines and keep away from potential points.

False impression: Proof of Insurance coverage is Solely Wanted on the Time of Buy

Incorrect assumptions usually come up concerning when proof of insurance coverage is required. Many imagine that insurance coverage is just crucial on the time of buying a car, not for ongoing registration. That is incorrect. Florida regulation mandates proof of insurance coverage for all registered automobiles, no matter when the car was bought.

False impression: Insurance coverage Protection Quantities Do not Matter

One other prevalent false impression is that the quantity of insurance coverage protection does not matter for registration. Whereas Florida does not mandate a particular protection quantity, it does require enough protection to satisfy minimal legal responsibility necessities. Insurance coverage firms are free to set their very own premiums, which could be influenced by the chosen protection quantity. Failing to satisfy the minimal necessities might result in penalties or denial of registration.

False impression: Insurance coverage Sorts Matter Equally

Some imagine that any kind of insurance coverage is enough for registration. Nevertheless, Florida regulation specifies that the insurance coverage should meet the necessities of a regular legal responsibility coverage. Insurance policies that don’t cowl legal responsibility could not fulfill the registration necessities.

False impression: Policyholder’s Deal with Issues for Registration

A standard misunderstanding entails the policyholder’s handle. Some imagine the policyholder’s handle should match the car’s registered proprietor’s handle. That is inaccurate. The policyholder’s handle is unrelated to the car registration handle.

False impression: Insurance coverage Expiry Date is Irrelevant

An additional false impression is that the insurance coverage expiry date is irrelevant to registration. That is incorrect. The insurance coverage coverage should be energetic and legitimate on the date of registration. Insurance policies which have expired or are set to run out quickly are usually not acceptable. In abstract, the insurance coverage coverage should be legitimate on the time of registration.

False impression: Short-term Insurance coverage is Acceptable

Some assume that momentary insurance coverage is enough for registration. It is a false assumption. Short-term insurance coverage is normally not enough for everlasting registration. Everlasting, legitimate insurance coverage is required for correct registration. Insurance policies that don’t cowl the mandatory interval are unacceptable.

Examples of Incorrect Assumptions

A current case concerned a car proprietor who believed that insurance coverage bought after the preliminary car buy was not crucial. The registration was denied. This highlights the misunderstanding in regards to the timing of insurance coverage acquisition. Equally, one other instance illustrates the misunderstanding concerning insurance coverage kind, the place an proprietor believed their complete insurance coverage protection sufficed. The registration was rejected, demonstrating the necessity for particular legal responsibility protection.

Illustrative Examples

Florida’s car registration course of requires cautious consideration of insurance coverage, and the particular necessities differ relying on the kind of car. Understanding these nuances is essential for avoiding penalties and making certain a clean registration course of.Understanding the particular insurance coverage necessities for various automobiles and insurance policies helps Florida residents navigate the registration course of effectively. This part gives sensible examples for instance the varied eventualities encountered by car homeowners.

Examples of Automobile Sorts and Insurance coverage Wants

Florida’s insurance coverage necessities apply to all registered automobiles. Totally different car sorts, nevertheless, could have differing insurance coverage wants. A traditional automotive, for instance, may require specialised protection in comparison with a contemporary, on a regular basis commuter car. It is because the worth and potential danger related to every kind of auto varies.

- Traditional Automobiles: Insurance coverage for traditional automobiles usually entails greater premiums and specialised protection to account for the distinctive worth and potential for harm. The insurance coverage coverage could have to account for the automotive’s age, rarity, and historic significance.

- Bikes: Insurance coverage for bikes usually requires the next deductible and probably greater premiums in comparison with passenger automobiles because of the greater danger of accidents. Bodily harm legal responsibility protection is commonly an important element of bike insurance coverage.

- Business Autos: Insurance coverage for business automobiles, resembling vans and vans, is commonly required to cowl the elevated legal responsibility related to their use. Business automobiles normally require particular business insurance coverage insurance policies tailor-made to their enterprise operations.

Sorts of Insurance coverage Insurance policies Assembly Florida Necessities

Florida’s minimal insurance coverage necessities for car registration should be met. A number of coverage sorts can fulfill these necessities.

- Legal responsibility Insurance coverage: Any such coverage covers damages to different folks or their property within the occasion of an accident. It’s the most elementary kind of insurance coverage and infrequently the minimal requirement for car registration in Florida. It normally covers property harm and bodily harm.

- Complete Insurance coverage: This coverage covers harm to the car itself from numerous occasions past collisions, resembling climate occasions, theft, vandalism, and extra. Any such coverage gives broader safety for the car.

- Collision Insurance coverage: This protection pays for harm to the insured car no matter who’s at fault in an accident. It’s a essential a part of insurance coverage safety for automobiles, notably if a driver is anxious about the price of repairs in case of an accident.

Examples of Exempt Autos

Sure automobiles could also be exempt from Florida’s insurance coverage necessities for registration. This exemption usually applies to automobiles not supposed for public use or for sure people.

- Vintage Autos: Vintage automobiles, usually registered as historic or non-operational, could also be exempt from some insurance coverage necessities. This normally is determined by the particular guidelines and laws for vintage automobiles within the state of Florida.

- Autos Used Completely for Agricultural Functions: Autos primarily used for agricultural actions could qualify for particular exemptions. The precise exemption necessities must be reviewed with the suitable Florida authorities.

Case Research: Registering a Automobile and Acquiring Insurance coverage

- Situation 1: A current automotive purchaser purchases a used sedan. To register the car, they should display proof of insurance coverage protection. They get hold of a regular legal responsibility coverage that meets Florida’s minimal necessities. Following the mandatory steps Artikeld by the Division of Freeway Security and Motor Autos (DHSMV), they efficiently register the car.

- Situation 2: A house owner purchases a golf cart for private use. The golf cart, nevertheless, just isn’t registered for freeway use. On this case, they might not want insurance coverage to register the car. The precise necessities and laws for golf carts and comparable automobiles in Florida must be reviewed with the related authorities.

Closure

In conclusion, registering a car in Florida requires cautious consideration of insurance coverage necessities. Realizing the specifics of your car kind, potential exemptions, and up to date legislative adjustments is paramount. This information has supplied a complete overview, empowering you to make knowledgeable selections and keep away from potential pitfalls. Bear in mind to seek the advice of official Florida DMV sources for essentially the most up-to-date data.

Frequent Queries

Q: What sorts of insurance coverage are acceptable for car registration in Florida?

A: Florida accepts numerous sorts of auto insurance coverage insurance policies, together with legal responsibility, collision, and complete protection. The minimal protection necessities should be met, as detailed by the Florida Division of Freeway Security and Motor Autos.

Q: Are there any exemptions for registering automobiles with out insurance coverage?

A: Sure, there are exemptions for sure automobiles, resembling vintage or collector automobiles. Nevertheless, particular documentation and standards should be met. Seek the advice of the Florida DMV web site for particulars.

Q: What are the penalties for registering a car with out the required insurance coverage?

A: Failure to adjust to insurance coverage necessities may end up in fines and/or a denial of registration. Particular penalties differ relying on the circumstances and are topic to vary. It is advisable to examine the Florida DMV’s present laws.

Q: How can I discover and evaluate insurance coverage quotes for my car in Florida?

A: A number of on-line sources and insurance coverage comparability web sites will help you discover quotes from numerous suppliers. Elements resembling your driving historical past and car kind will affect the fee.