If Chris has automotive legal responsibility insurance coverage everfi, it is a query that many individuals are asking. Understanding automotive insurance coverage, particularly legal responsibility protection, is vital. This dialogue delves into the specifics of Chris’s state of affairs, exploring the function of Everfi in training and the assorted components that affect insurance coverage insurance policies.

We’ll discover the elemental ideas of automotive legal responsibility insurance coverage, inspecting protection particulars, potential eventualities involving Chris, and Everfi’s function in educating policyholders about their obligations. We’ll additionally take a look at real-world examples, hypothetical case research, and insurance coverage coverage evaluation to offer a complete image.

Understanding Automobile Legal responsibility Insurance coverage

Automobile legal responsibility insurance coverage is a vital element of car possession, defending you from monetary burdens within the occasion of an accident the place you might be at fault. It is designed to cowl the prices related to damages you inflict on others. Understanding its specifics is important for accountable driving and monetary preparedness.Automobile legal responsibility insurance coverage, at its core, acts as a security web.

It safeguards you from vital monetary losses in the event you’re chargeable for an accident. This protection ensures that you simply’re not held personally chargeable for the damages brought on to a different particular person or their property.

Elementary Idea of Automobile Legal responsibility Insurance coverage

Automobile legal responsibility insurance coverage is designed to guard the monetary pursuits of others concerned in an accident brought on by the insured driver. It’s a legally required protection in most jurisdictions, guaranteeing that these harmed by a driver’s actions are compensated. The elemental idea is to switch the monetary duty for damages from the motive force to an insurance coverage firm.

Protection Offered by Automobile Legal responsibility Insurance coverage

Legal responsibility insurance coverage covers damages ensuing from accidents the place the insured driver is at fault. This consists of two main classes: bodily damage and property injury. Bodily damage protection pays for medical bills, misplaced wages, and ache and struggling of the injured events. Property injury protection compensates for the restore or alternative prices of broken property, together with automobiles, houses, or different belongings.

Examples of Conditions The place Automobile Legal responsibility Insurance coverage Would Be Used

Quite a few eventualities necessitate using automotive legal responsibility insurance coverage. In case you rear-end one other car, inflicting vital injury, your legal responsibility insurance coverage would step in to cowl the opposite driver’s restore prices. Equally, in the event you trigger an accident that ends in accidents to passengers within the different car, your legal responsibility insurance coverage would deal with the medical bills and potential misplaced wages.

One other instance is damaging a pedestrian’s property throughout an accident.

Comparability with Different Kinds of Auto Insurance coverage

Whereas automotive legal responsibility insurance coverage focuses on overlaying damages to others, different auto insurance coverage varieties handle totally different facets of car possession. Collision insurance coverage, for instance, covers injury to your personal car no matter who’s at fault. Complete insurance coverage protects towards non-collision injury, comparable to theft or weather-related incidents. Legal responsibility insurance coverage is distinct as a result of it primarily addresses the monetary duty for damages brought on to others.

Completely different Kinds of Automobile Legal responsibility Insurance coverage Insurance policies

Automobile legal responsibility insurance coverage insurance policies sometimes embrace two foremost sorts of protection:

- Bodily Damage Legal responsibility (BIL): This protection pays for the medical bills, misplaced wages, and ache and struggling of these injured in an accident the place the insured driver is at fault. BIL is essential for guaranteeing injured events obtain compensation.

- Property Harm Legal responsibility (PDL): PDL protection addresses the restore or alternative prices of broken property, together with automobiles, buildings, or different belongings. It is important for overlaying the monetary burden of damages to a different occasion’s property.

Significance of Automobile Legal responsibility Insurance coverage

Automobile legal responsibility insurance coverage is important for authorized and monetary causes. It safeguards the insured from potential lawsuits and exorbitant monetary obligations. Moreover, it is typically a authorized requirement in lots of jurisdictions, and failure to hold enough protection can result in critical penalties. It protects each the motive force and the general public by guaranteeing monetary duty within the occasion of an accident.

Desk Illustrating Varied Kinds of Protection and Their Descriptions

| Protection Kind | Description |

|---|---|

| Bodily Damage Legal responsibility (BIL) | Covers medical bills, misplaced wages, and ache and struggling of injured events in accidents the place the insured driver is at fault. |

| Property Harm Legal responsibility (PDL) | Covers the restore or alternative prices of broken property (automobiles, buildings, and so forth.) in accidents the place the insured driver is at fault. |

Figuring out Insurance coverage Protection for Chris

Understanding automotive insurance coverage protection is essential for people like Chris, particularly when navigating potential dangers. This part delves into the specifics of how insurance coverage protects Chris within the occasion of an accident, contemplating varied eventualities and the components influencing protection. A radical grasp of those ideas is important for accountable monetary planning.

Accident Eventualities and Potential Liabilities

Accidents are unpredictable occasions that may result in vital monetary repercussions. For Chris, the potential liabilities prolong past simply restore prices. For instance, a collision may contain property injury, accidents to different events, and even authorized penalties. These components considerably influence the character and extent of insurance coverage protection required.

Position of Insurance coverage in Mitigating Liabilities

Insurance coverage performs a crucial function in mitigating the monetary burden related to accidents. Insurance coverage insurance policies sometimes cowl damages to the insured car, in addition to accidents to the insured occasion and others concerned. The extent of protection is decided by the coverage specifics and the circumstances of the accident. As an illustration, complete protection might prolong to incidents indirectly involving a collision.

Hypothetical Case Examine: Chris at Fault

Think about Chris is discovered at fault in a automotive accident the place vital property injury and accidents happen. On this situation, Chris’s legal responsibility insurance coverage would doubtless cowl the damages to the opposite car, and probably the medical bills of the injured occasion. Nonetheless, the precise quantity of protection depends upon the coverage limits and the extent of the injury.

It is vital to notice that even with insurance coverage, Chris should have private monetary obligations that stretch past the coverage limits.

Variations in Insurance coverage Protection

Insurance coverage protection varies considerably based mostly on a number of components associated to Chris’s state of affairs. These components embrace the kind of coverage (e.g., liability-only, complete), the coverage limits, and the particular circumstances of the accident. Moreover, components like the motive force’s historical past and the situation of the accident can affect premiums. The protection supplied may additionally differ based mostly on the particular state’s legal guidelines.

Insurance coverage Firm Danger Evaluation

Insurance coverage corporations make use of refined threat evaluation fashions to find out premiums. These fashions analyze varied components comparable to the motive force’s historical past (e.g., accidents, visitors violations), the car’s make and mannequin, the motive force’s location, and different demographic information. A historical past of accidents or violations sometimes results in larger premiums. A secure driving document, alternatively, might lead to decrease premiums.

Comparability of Potential Insurance coverage Wants

| Insurance coverage Function | Chris’s Potential Wants (Based mostly on Situation) | Commonplace Coverage Providing |

|---|---|---|

| Legal responsibility Protection | Possible wants enough protection to satisfy potential damages and accidents to different events. | Usually features a minimal legal responsibility protection requirement mandated by regulation. |

| Collision Protection | Is determined by the accident situation and potential injury to Chris’s car. | Supplies protection for injury to Chris’s car, no matter who’s at fault. |

| Complete Protection | Is perhaps needed if the accident entails non-collision components, comparable to vandalism or climate injury. | Covers injury to Chris’s car from occasions apart from collisions, like fireplace or theft. |

| Uninsured/Underinsured Motorist Protection | Important to guard Chris from accidents brought on by drivers with out enough insurance coverage. | Covers damages if the at-fault driver has inadequate insurance coverage. |

Everfi’s Position in Insurance coverage Training

Everfi performs an important function in offering accessible and fascinating insurance coverage training, notably for understanding automotive legal responsibility insurance coverage. Their interactive applications transcend merely defining phrases; they goal to equip learners with the data and expertise to navigate real-world insurance coverage eventualities successfully. This empowers people to make knowledgeable selections about their insurance coverage wants and obligations.Everfi’s applications supply a structured strategy to studying about automotive legal responsibility insurance coverage, emphasizing the significance of proactive threat administration and accountable policyholder habits.

The interactive nature of the teachings permits learners to use their data in simulated eventualities, fostering a deeper understanding of the complexities of insurance coverage.

Academic Supplies on Automobile Legal responsibility Insurance coverage

Everfi’s supplies cowl a variety of matters associated to automotive legal responsibility insurance coverage, from primary definitions to complicated claims processes. This system’s interactive modules present clear explanations of coverage phrases and circumstances, emphasizing the authorized and monetary implications of accidents and insurance coverage claims.

Tasks of Insurance coverage Policyholders

Everfi applications clearly delineate the obligations of policyholders. These obligations embrace understanding coverage protection limits, reporting accidents promptly, and adhering to the phrases and circumstances of the insurance coverage settlement. Policyholders are taught that their actions instantly influence their claims course of and their monetary obligations.

Actual-World Software of Insurance coverage Ideas

Everfi successfully connects summary insurance coverage ideas to real-world eventualities. For instance, this system would possibly current a simulated accident involving a driver who did not preserve enough insurance coverage protection. Learners analyze the implications of this case, understanding how insufficient protection can result in vital monetary penalties. Additionally they look at the method of submitting a declare and the significance of sustaining correct information.

Significance of Acquiring and Sustaining Automobile Legal responsibility Insurance coverage

Everfi highlights the crucial significance of automotive legal responsibility insurance coverage. This system demonstrates how any such insurance coverage protects people and their belongings in case of accidents. By illustrating the potential monetary and authorized repercussions of driving with out enough insurance coverage, Everfi motivates learners to prioritize insurance coverage.

Danger Evaluation and Insurance coverage Prices

Everfi’s applications train customers about threat evaluation and its connection to insurance coverage prices. This system doubtless explains how components comparable to driving historical past, location, and car sort can affect insurance coverage premiums. For instance, a driver with a historical past of accidents would possibly face larger premiums in comparison with a driver with a clear document. This system explains the correlation between threat and value, enabling knowledgeable decision-making concerning driving habits and car choice.

Components Influencing Insurance coverage Charges

Everfi’s applications handle varied components that affect insurance coverage charges. This consists of, however isn’t restricted to, age, driving document, car sort, location, and claims historical past. These components are defined throughout the context of threat evaluation, enabling customers to grasp how their selections influence their insurance coverage premiums. As an illustration, youthful drivers typically have larger premiums on account of their statistically larger accident charges.

Abstract of Key Classes and Subjects

| Lesson/Subject | Key Takeaways |

|---|---|

| Understanding Coverage Protection | Understanding the bounds and circumstances of a coverage is important. |

| Reporting Accidents | Immediate and correct reporting is important for a profitable declare. |

| Danger Evaluation | Driving historical past, location, and car sort influence insurance coverage prices. |

| Insurance coverage Prices | Understanding the correlation between threat and premium is essential. |

| Claims Course of | Understanding the steps concerned in submitting and resolving a declare. |

| Sustaining Protection | The significance of guaranteeing enough insurance coverage protection always. |

Insurance coverage Coverage Evaluation (Chris’s State of affairs)

Understanding Chris’s particular insurance coverage coverage is essential to evaluating his safety within the occasion of an accident. This evaluation delves into the main points of a hypothetical coverage, highlighting protection limits, exclusions, and circumstances. It additionally considers the potential implications for Chris in a simulated collision situation and compares varied coverage choices obtainable to him.

Hypothetical Insurance coverage Coverage Doc

This part presents a pattern insurance coverage coverage for Chris, specializing in legal responsibility protection. The specifics are fictional however symbolize frequent components present in actual insurance policies.

Policyholder: Chris Johnson

Coverage Efficient Date: October 26, 2023

Coverage Quantity: 1234567890

Protection Limits: Legal responsibility protection of $100,000 per particular person and $300,000 per accident. This implies if Chris causes an accident leading to $150,000 in damages to at least one particular person, the coverage would cowl the complete quantity. Nonetheless, if the damages exceed the coverage limits, Chris can be chargeable for the distinction.

Exclusions: The coverage explicitly excludes protection for injury brought on by intentional acts, use of the car for unlawful actions, or injury brought on by pre-existing circumstances of the car. Additional, it doesn’t cowl damages exceeding the coverage restrict.

Circumstances: The coverage Artikels the obligations of each the insurer and the insured. It consists of provisions for reporting accidents promptly, offering needed documentation, and adhering to authorized necessities. The coverage states that Chris should cooperate absolutely with the insurance coverage firm throughout any declare investigation.

Case Examine: A Simulated Collision

Think about Chris is concerned in a collision the place one other driver, deemed at-fault, suffers $120,000 in accidents. A second occasion, a pedestrian, additionally suffers $50,000 in accidents. The coverage’s legal responsibility protection would handle these damages as much as the bounds specified. Nonetheless, if the whole damages exceed the coverage limits, Chris can be chargeable for the surplus quantity.

Coverage Response to the Collision

Given the above situation, the insurance coverage firm would examine the accident, assess the damages, and decide the suitable quantity to pay out. The coverage’s legal responsibility protection can be utilized to compensate the injured events. If the whole damages exceeded the protection limits, the insurance coverage firm would solely cowl the utmost quantity allowed by the coverage, and the rest can be Chris’s duty.

Comparability of Insurance coverage Coverage Choices, If chris has automotive legal responsibility insurance coverage everfi

Completely different insurance coverage insurance policies supply various ranges of protection. Some insurance policies would possibly embrace uninsured/underinsured motorist protection, which might shield Chris if the at-fault driver lacked enough insurance coverage. Different choices may present complete protection, which covers injury to Chris’s car in an accident. The selection depends upon Chris’s particular person wants and threat tolerance.

Potential Loopholes and Gaps within the Coverage

One potential loophole is the shortage of an in depth definition for “pre-existing circumstances” within the car. This might result in disputes concerning protection if the injury stems from an underlying situation. One other potential hole is the shortage of protection for punitive damages, that are awarded in instances of gross negligence or malicious intent. This would depart Chris susceptible if a courtroom deems the accident resulted from extreme misconduct by the at-fault driver.

Desk of Coverage Clauses and Implications

| Clause | Implications for Chris |

|---|---|

| Protection Limits | Determines the utmost quantity the insurer can pay in a declare. |

| Exclusions | Highlights conditions the place protection isn’t offered. |

| Circumstances | Artikels obligations and expectations for the policyholder. |

Actual-World Examples and Eventualities: If Chris Has Automobile Legal responsibility Insurance coverage Everfi

Understanding the real-world implications of automotive legal responsibility insurance coverage entails inspecting the way it protects people and companies in varied accident eventualities. This part explores various accident varieties, the claims course of, and customary causes for insurance coverage declare denials. This supplies a sensible perception into the day-to-day workings of insurance coverage insurance policies and their influence on individuals’s lives.

Automobile Accident Eventualities and Their Affect

Automobile accidents can vary from minor fender benders to catastrophic collisions, considerably impacting people and their monetary well-being. Insurance coverage claims are essential for recovering damages and guaranteeing accountability in such occasions.

Kinds of Automobile Accidents and Insurance coverage Roles

Varied accident varieties spotlight the crucial function of automotive legal responsibility insurance coverage. A rear-end collision, as an illustration, typically entails vital property injury and potential accidents. An accident involving a distracted driver or a driver underneath the affect may have extreme penalties and complicate the claims course of.

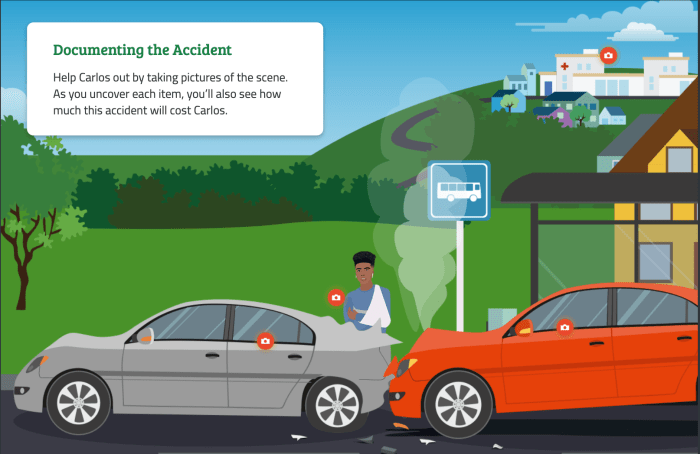

Insurance coverage Declare Submitting Procedures

Submitting an insurance coverage declare entails a number of steps, sometimes starting with reporting the accident to the police and acquiring needed documentation. This consists of exchanging info with the opposite driver, documenting the scene, and gathering medical information if accidents occurred. Insurance coverage corporations typically require detailed reviews and supporting proof to judge the declare.

Insurance coverage Firm Declare Evaluation

Insurance coverage corporations meticulously assess claims to make sure honest and correct payouts. Their evaluation course of consists of reviewing police reviews, medical information, witness statements, and injury estimates. This complete analysis goals to find out legal responsibility and the suitable compensation.

Detailed Situation: A Automobile Accident and Declare Course of

Think about a two-car accident the place a driver, Sarah, was rear-ended by one other driver, Mark. Sarah sustained minor accidents and her automotive required vital repairs. The police report indicated Mark’s negligence. Sarah reported the accident to her insurance coverage firm, offering police reviews, medical payments, and restore estimates. The insurance coverage firm investigated, confirming Mark’s legal responsibility.

Sarah acquired a payout overlaying her medical bills and car repairs, minus her deductible. Mark’s insurance coverage firm paid for Sarah’s damages based mostly on their coverage phrases.

Examples of Insurance coverage Declare Denials and Causes

Insurance coverage corporations might deny claims on account of varied causes, together with a scarcity of enough proof, failure to cooperate with the investigation, or if the accident is deemed the policyholder’s fault. For instance, a declare is perhaps denied if the policyholder was driving underneath the affect, or if the accident occurred outdoors the coverage’s protection limits, or if pre-existing circumstances weren’t disclosed.

Desk: Typical Automobile Accident Eventualities and Insurance coverage Implications

| Accident Situation | Insurance coverage Implications |

|---|---|

| Rear-end collision with minor injury | Usually lined by at-fault driver’s insurance coverage. |

| Multi-car accident with critical accidents | Claims involving a number of events and extreme accidents require thorough investigation and potential involvement of a number of insurance coverage insurance policies. |

| Accident involving uninsured/underinsured driver | Requires a complete evaluation of the policyholder’s protection choices, together with uninsured/underinsured motorist protection. |

| Accident on account of pre-existing situation | Claims could also be denied or decreased if pre-existing circumstances will not be correctly disclosed or in the event that they contribute to the accident. |

Epilogue

In conclusion, figuring out if Chris has automotive legal responsibility insurance coverage by means of Everfi entails inspecting varied facets of insurance coverage insurance policies, potential liabilities, and Everfi’s academic supplies. Understanding the main points and exploring potential eventualities is vital to creating knowledgeable selections. Hopefully, this dialogue supplies readability and helpful insights into the complexities of automotive insurance coverage.

Query & Reply Hub

What if Chris’s insurance coverage coverage does not cowl all potential damages in a automotive accident?

It is essential to evaluation the coverage’s protection limits and exclusions. If there are gaps in protection, extra safety is perhaps needed.

How does Everfi assist in understanding threat evaluation for insurance coverage?

Everfi applications typically spotlight components that insurance coverage corporations use to evaluate threat, comparable to driving historical past and placement, serving to people perceive how these components influence premiums.

What are some frequent causes for insurance coverage declare denials?

Frequent causes embrace offering inaccurate info, failing to satisfy coverage necessities, or incidents not lined by the coverage, comparable to these involving intentional acts.

What are the everyday steps concerned in submitting an insurance coverage declare?

Reporting the accident, gathering documentation (police report, medical information), and cooperating with the insurance coverage firm are important steps.