Energy of legal professional for automobile insurance coverage functions empowers a delegated agent to deal with insurance coverage issues on behalf of one other individual. This complete information explores the intricacies of building, managing, and understanding the authorized implications of such preparations. From navigating various kinds of energy of legal professional to understanding insurance coverage firm insurance policies, this text delves into the important elements for people and their brokers.

This information will cowl the important components, together with authorized necessities, procedures, potential points, and related eventualities. Understanding the complexities of energy of legal professional for automobile insurance coverage is essential for clean transactions and authorized safety.

Understanding Energy of Lawyer for Insurance coverage

A Energy of Lawyer (POA) is a authorized instrument that empowers one particular person (the Principal) to grant one other (the Agent or Lawyer-in-Truth) the authority to behave on their behalf in particular issues. This bestows a sacred belief, guaranteeing continuity and care in essential life selections, significantly when the Principal’s potential to handle their affairs is diminished. This doc, rigorously crafted and executed, permits for a clean transition of duty, safeguarding monetary and authorized pursuits with the utmost respect.The essence of a POA lies in its potential to delegate authority for specified actions, permitting the agent to behave with the identical authorized standing because the Principal, throughout the scope of the granted powers.

This belief, when exercised with integrity, generally is a beacon of help throughout difficult occasions. Various kinds of POAs exist, tailor-made to varied wants.

Completely different Kinds of Energy of Lawyer

An influence of legal professional could be basic, granting broad authority, or particular, limiting the scope of motion to sure duties. Within the context of insurance coverage, a selected energy of legal professional is often most popular. This doc delineates the exact actions the agent can take, similar to managing insurance coverage insurance policies, making funds, or submitting claims. A sturdy energy of legal professional stays in impact even when the Principal turns into incapacitated.

This kind is especially essential for insurance coverage issues.

Authorized Implications of POA for Automotive Insurance coverage

Utilizing a POA for automobile insurance coverage carries important authorized weight. The agent, appearing below the POA, has the authority to handle the insurance coverage coverage, together with paying premiums, making claims, and updating coverage particulars. The authorized standing of the agent is equal to that of the Principal throughout the approved boundaries of the doc. This ensures that the insurance coverage firm acknowledges the agent’s authority to behave on behalf of the Principal.

Care have to be taken to make sure the POA doc is correctly executed, witnessed, and registered with the related authorities.

Evaluating POA with Different Strategies

Different strategies for managing automobile insurance coverage for people unable to handle their affairs embody guardianship or conservatorship. These authorized processes contain a court-appointed guardian or conservator who assumes full management over the person’s funds and affairs. A POA, in distinction, permits for a extra managed and private strategy, granting authority to a trusted particular person whereas retaining sure autonomy.

The agent is instantly appointed by the Principal and operates throughout the specified scope. A vital consideration is the extent of management and autonomy desired.

Conditions Requiring POA for Automotive Insurance coverage

A POA for automobile insurance coverage is critical when the policyholder turns into incapacitated, is unable to handle their affairs because of sickness or damage, or is briefly absent from the nation or area. This could cowl conditions starting from a protracted sickness to a short lived damage, guaranteeing that the automobile insurance coverage stays so as and claims are filed promptly. The POA empowers a trusted particular person to behave on behalf of the policyholder throughout this era.

Function of the Designated Agent/Lawyer-in-Truth

The designated agent or attorney-in-fact performs a crucial function in managing automobile insurance coverage. They’re accountable for adhering to the phrases of the POA, guaranteeing the Principal’s pursuits are protected. This includes rigorously understanding the coverage’s phrases and situations, retaining data of all transactions, and sustaining open communication with the insurance coverage firm. Their duty is to make sure that the automobile insurance coverage capabilities easily in the course of the interval when the Principal is unable to handle their affairs.

This ensures that the policyholder’s car stays protected.

Necessities and Procedures

Embarking on the trail of granting energy of legal professional for automobile insurance coverage necessitates meticulous adherence to authorized protocols and a transparent understanding of the procedures concerned. This journey requires navigating jurisdictional variations and adhering to established formalities. This part unveils the crucial steps and concerns, guaranteeing a clean and legally sound course of.The institution of an influence of legal professional (POA) for automobile insurance coverage functions requires meticulous adherence to the authorized frameworks inside every jurisdiction.

Navigating these frameworks ensures the validity and enforceability of the POA. Understanding the precise necessities of your location is paramount.

Authorized Necessities for Establishing a POA

Jurisdictions worldwide have particular authorized necessities for establishing an influence of legal professional. These necessities make sure the doc’s validity and the safety of the events concerned. These necessities fluctuate considerably from one jurisdiction to a different. Thorough analysis and session with authorized professionals are important.

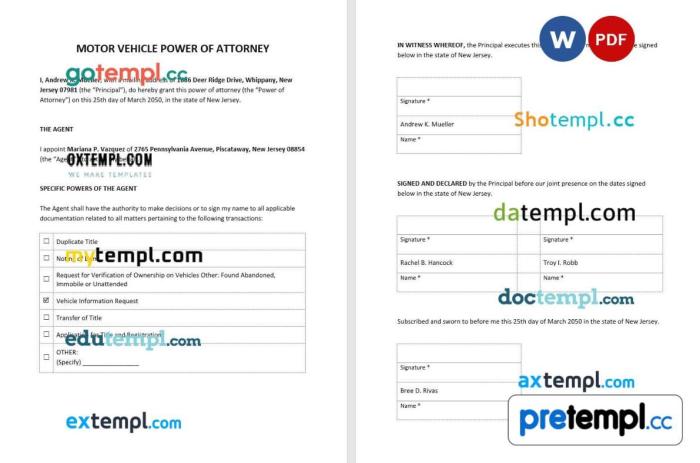

Step-by-Step Process for Making a Legitimate POA

Creating a sound energy of legal professional for automobile insurance coverage includes a sequence of well-defined steps. This methodical strategy safeguards in opposition to potential errors and ensures the doc’s authorized energy. The steps fluctuate in accordance with the relevant laws.

1. Session with Authorized Counsel

In search of steerage from a authorized skilled is essential to grasp the precise necessities in your jurisdiction.

2. Drafting the POA Doc

This doc should clearly outline the powers granted to the agent.

3. Signing and Witnessing

The doc have to be signed by the principal (the individual granting the ability) and witnessed in accordance with the necessities of the related jurisdiction. The witnesses have to be people who aren’t beneficiaries of the ability of legal professional.

4. Notarization (if required)

Some jurisdictions mandate notarization to validate the signatures and make sure the doc’s authenticity.

Crucial Documentation and Kinds

A complete POA for automobile insurance coverage typically includes particular paperwork and varieties. These paperwork present proof of the principal’s intention and the agent’s authority. This documentation varies from state to state.

- Energy of Lawyer Type: A typical kind tailor-made to the aim of granting energy over automobile insurance coverage issues.

- Identification Paperwork: Proof of identification for each the principal and the agent (e.g., driver’s licenses, passports). This ensures verification of the people concerned.

- Insurance coverage Coverage Info: The coverage particulars, together with the coverage quantity, to allow the insurance coverage firm to precisely establish the car and coverage.

- Witness Statements (if relevant): Statements from the witnesses verifying the signing course of, as required by native legal guidelines.

Desk of Required Paperwork by Jurisdiction

The desk under supplies examples of paperwork required for establishing a POA for automobile insurance coverage in varied jurisdictions. Word that this isn’t an exhaustive checklist and must be verified with authorized professionals in every jurisdiction.

| Jurisdiction | Required Paperwork |

|---|---|

| United States – California | Energy of Lawyer Type, Driver’s Licenses/State-Issued IDs, Automobile Registration |

| United States – New York | Energy of Lawyer Type, Driver’s Licenses/State-Issued IDs, Automobile Registration, Affidavit of Authority |

| United Kingdom | Energy of Lawyer Type, Proof of Identification (Passport/Driving License), Automobile Registration Doc |

Updating or Revoking a POA

A POA for automobile insurance coverage, like all authorized doc, could be up to date or revoked. The precise procedures for updating or revoking a POA are ruled by the legal guidelines of the related jurisdiction. This course of ensures that the ability of legal professional stays present and aligned with the principal’s intentions.

- Updating: A brand new POA doc, changing the previous one, must be ready and executed in accordance with the required procedures.

- Revoking: A proper revocation doc, clearly stating the intention to revoke the POA, must be ready and executed.

Speaking the POA to the Insurance coverage Firm

Speaking the POA to the insurance coverage firm is essential for enabling the agent to behave on behalf of the principal. The communication course of varies relying on the precise insurance coverage firm. This requires a proper course of for the corporate to acknowledge the POA.

- Formal Notification: The insurance coverage firm ought to obtain a licensed copy of the POA doc.

- Documentation of Receipt: Confirming the insurance coverage firm’s acknowledgment of the POA is significant for readability and accountability.

Insurance coverage Firm Insurance policies

Navigating the intricate world of insurance coverage can really feel like traversing a labyrinth. But, understanding the insurance policies of various insurance coverage corporations concerning Energy of Lawyer (POA) for automobile insurance coverage is essential for guaranteeing clean transitions and avoiding potential pitfalls. This data empowers us to make knowledgeable selections, fostering a way of safety and readability in these often-complex issues.

Procedures and Insurance policies of Completely different Insurance coverage Corporations

Insurance coverage corporations fluctuate of their procedures and insurance policies regarding POAs. These variations stem from the necessity to shield their pursuits and make sure the legitimacy of the claims. Corporations prioritize sustaining the integrity of their processes and stopping fraudulent actions.

Comparability of Insurance coverage Firm Insurance policies

A standardized strategy to dealing with POAs for automobile insurance coverage throughout all corporations would simplify the method for everybody concerned. Nevertheless, the present panorama reveals various practices. This necessitates a diligent evaluation of the precise insurance policies of the related insurance coverage corporations.

| Insurance coverage Firm | Coverage on POA | Contact Info |

|---|---|---|

| Instance Firm 1 | Instance Firm 1 requires a notarized POA doc, particularly outlining the scope of authority granted to the agent. Additionally they require a replica of the insured’s driver’s license and proof of tackle. | (800) 555-1212, examplecompany1@e-mail.com |

| Instance Firm 2 | Instance Firm 2 necessitates a licensed copy of the POA, together with the unique doc for verification. They prioritize an in depth POA specifying the precise insurance coverage protection concerned. Additionally they require a further verification step, similar to a cellphone name to the policyholder. | (800) 555-1213, examplecompany2@e-mail.com |

| Instance Firm 3 | Instance Firm 3 follows a streamlined course of. They settle for a notarized POA and a replica of the insured’s driver’s license. They won’t require additional verification, besides in extremely uncommon circumstances. | (800) 555-1214, examplecompany3@e-mail.com |

Widespread Insurance coverage Firm Necessities for POAs

Insurance coverage corporations usually require sure paperwork to confirm the legitimacy and scope of a POA. These necessities make sure that the insurance coverage firm is coping with a sound and approved consultant. The necessity for documentation varies by firm.

Potential Limitations of Utilizing a POA for Particular Insurance coverage Claims

Whereas POAs supply a handy option to handle automobile insurance coverage, sure limitations may come up in particular declare eventualities. For instance, a POA won’t be adequate for claims involving disputes over legal responsibility or circumstances requiring the private testimony of the insured. A POA’s scope of authority is paramount in figuring out its applicability to varied claims. Insurance coverage corporations will typically scrutinize the POA’s wording to make sure it explicitly covers the precise declare.

Particular Eventualities and Concerns

Embarking on the journey of a Energy of Lawyer for automobile insurance coverage is akin to charting a course, guaranteeing your car’s safety is guided by a transparent and loving compass. This part delves into particular eventualities, empowering you with insights to navigate the complexities and guarantee your cherished car stays safeguarded, even in difficult occasions.

Essential Conditions for a POA

A Energy of Lawyer for automobile insurance coverage is indispensable in a myriad of conditions. It acts as a beacon of safety, guiding the vessel of your insurance coverage by turbulent waters. Take into account these essential eventualities:

- Surprising Sickness or Incapacity: If you happen to face a debilitating sickness or damage, a POA can guarantee your automobile insurance coverage stays energetic and your car’s safety continues. That is significantly essential for sustaining insurance coverage protection in circumstances of long-term incapacitation.

- Seniority and Diminished Capability: As we age, our talents could diminish. A POA ensures {that a} trusted particular person can handle automobile insurance coverage issues once you’re not in a position to take action independently. That is paramount for preserving your car’s security web.

- Prolonged Journey or Relocation: Whenever you’re touring extensively or relocating, a POA can empower a trusted particular person to deal with automobile insurance coverage issues in your behalf. That is important for seamless administrative duties, guaranteeing steady protection when you’re away.

- Emergency Conditions: A POA could be instrumental in managing insurance coverage issues in sudden emergencies, like accidents or theft. A chosen particular person can swiftly tackle the insurance coverage necessities, minimizing disruption and guaranteeing a clean course of.

Age Group Concerns

The optimum age for establishing a POA for automobile insurance coverage varies based mostly on particular person circumstances. Understanding these concerns permits for the creation of a well-structured plan:

- Youthful Adults: For youthful adults, a POA generally is a security web for unexpected circumstances. That is significantly related for conditions involving monetary or authorized challenges. This is a crucial step in constructing resilience for the longer term.

- Center-Aged Adults: Center-aged adults could discover a POA helpful for managing insurance coverage duties when going through busy schedules or potential well being points. It is a sensible measure for guaranteeing ongoing safety for his or her car and household.

- Seniors: For seniors, a POA is commonly essential for sustaining automobile insurance coverage protection as they age. This ensures that their car’s security and safety are managed successfully, even when they expertise diminishing talents.

Emergency Help

A Energy of Lawyer generally is a lifeline in emergency conditions, guaranteeing swift and environment friendly dealing with of automobile insurance coverage issues. It might probably streamline the method and supply a way of safety.

- Accident Administration: Within the occasion of an accident, a POA holder can rapidly and successfully handle insurance coverage claims and documentation. This reduces stress and disruption throughout a crucial time.

- Automobile Theft: A POA can expedite the method of submitting claims and acquiring needed paperwork associated to a stolen car. This could considerably decrease the disruption and restoration time.

- Coverage Renewals and Modifications: A POA permits for clean renewal and modifications to automobile insurance coverage insurance policies with out delays, guaranteeing uninterrupted safety.

POA Holder Duties

The POA holder has a vital function in managing automobile insurance coverage insurance policies. Their obligations embody:

- Coverage Compliance: The POA holder is accountable for guaranteeing the coverage is maintained in compliance with the phrases and situations Artikeld within the settlement.

- Communication: Common communication with the insurance coverage firm is important to handle any inquiries or considerations associated to the coverage.

- Documentation: Sustaining meticulous data of all communications, funds, and coverage updates is essential for accountability.

Conditions The place a POA Would possibly Not Be Acceptable

Whereas a POA is commonly helpful, there are cases the place it won’t be the best answer:

- Intentional Misuse: In circumstances the place there is a potential for intentional misuse of the POA, it is important to rigorously contemplate different options to safeguard your pursuits.

- Conflicts of Curiosity: If there is a important battle of curiosity between the POA holder and the policyholder, it is vital to discover different preparations.

Potential Prices and Charges, Energy of legal professional for automobile insurance coverage functions

Establishing a POA for automobile insurance coverage could contain related prices and charges. These bills can fluctuate relying on the precise scenario and the chosen strategy:

- Authorized Charges: Consultations with authorized professionals to draft the POA doc could incur related prices.

- Administrative Prices: Administrative duties concerned in organising and sustaining the POA could contain sure charges.

Potential Points and Dangers: Energy Of Lawyer For Automotive Insurance coverage Functions

The trail of empowerment by a Energy of Lawyer for automobile insurance coverage, whereas seemingly easy, could be fraught with potential pitfalls. Navigating these complexities requires a eager consciousness of the potential conflicts and dangers, fostering a deep understanding that empowers knowledgeable selections. It’s a journey that calls for vigilance and readability to make sure the sleek and equitable execution of the settlement.Navigating the potential points related to a Energy of Lawyer for automobile insurance coverage necessitates a profound understanding of the complexities concerned.

The inherent dangers, whereas typically refined, can result in disputes and difficulties if not proactively addressed. Recognizing these potential challenges permits one to proactively mitigate the related dangers, guaranteeing a transparent and unambiguous pathway towards a profitable end result.

Conflicts of Curiosity

Understanding the potential for conflicts of curiosity when appointing a Energy of Lawyer for automobile insurance coverage is essential. A battle arises when the person granted the ability has a private stake that might affect their selections concerning insurance coverage issues, probably jeopardizing the perfect pursuits of the principal. This might manifest in conditions the place the appointed agent has a monetary relationship with the insurance coverage firm or a competing insurance coverage supplier.

For instance, a detailed member of the family appointed as a Energy of Lawyer may inadvertently prioritize their very own monetary achieve over the principal’s finest pursuits when choosing an insurance coverage coverage.

Dangers Related to Utilizing a POA for Automotive Insurance coverage

Using a Energy of Lawyer for automobile insurance coverage carries inherent dangers. The agent’s lack of familiarity with the nuances of automobile insurance coverage insurance policies, mixed with potential misunderstandings or misinterpretations of the principal’s needs, can result in unintended penalties. For instance, an agent may inadvertently decide that leads to the next premium or a much less complete protection than what the principal would have chosen.

Furthermore, disputes can come up over the agent’s actions or selections, difficult the validity of their actions.

Examples of Potential Disputes

Disputes regarding a Energy of Lawyer for automobile insurance coverage can stem from varied sources. One frequent situation includes disagreements over coverage modifications. As an example, the agent may determine to cancel a coverage with out correct authorization or alter protection ranges, resulting in a dispute concerning the appropriateness of those modifications. One other potential dispute arises when the agent fails to correctly notify the insurance coverage firm of the POA, resulting in the corporate refusing to honor the agent’s actions.

An additional complication happens when the agent makes selections based mostly on their very own preferences quite than the principal’s expressed needs.

Significance of In search of Authorized Counsel

The institution of a Energy of Lawyer for automobile insurance coverage shouldn’t be undertaken with out looking for skilled authorized counsel. Authorized counsel supplies crucial steerage in structuring the doc, guaranteeing compliance with relevant legal guidelines, and clarifying the scope of authority granted to the agent. This proactive measure helps mitigate potential conflicts and disputes, fostering a transparent understanding of the authorized implications concerned.

Procedures for Resolving Disputes

Disputes concerning a Energy of Lawyer for automobile insurance coverage must be addressed promptly and professionally. Preliminary steps typically contain communication with the insurance coverage firm and the agent to aim a decision by negotiation. If this fails, formal dispute decision mechanisms, similar to mediation or arbitration, could be pursued. These processes goal to achieve a mutually acceptable answer whereas upholding the rights of all events concerned.

Steps to Take if Insurance coverage Firm Refuses to Acknowledge POA

If the insurance coverage firm refuses to acknowledge the Energy of Lawyer, a complete strategy is important. Firstly, assessment the Energy of Lawyer doc to make sure its validity and compliance with authorized necessities. Secondly, contact the insurance coverage firm to request clarification on the explanations for his or her refusal. If the problem persists, seek the advice of with authorized counsel to discover out there choices, similar to initiating a proper dispute decision course of.

This methodical strategy is essential for resolving the matter effectively and guaranteeing the principal’s rights are protected.

Epilogue

In conclusion, energy of legal professional for automobile insurance coverage supplies a vital framework for managing insurance coverage issues when a person is unable to take action. Navigating the authorized and sensible elements, together with particular necessities, insurance coverage firm insurance policies, and potential dangers, is significant for a clean course of. This information goals to supply a transparent understanding, enabling knowledgeable selections and a sturdy strategy to managing automobile insurance coverage in varied circumstances.

Bear in mind, looking for authorized counsel is at all times beneficial for personalised recommendation.

Widespread Queries

What are the various kinds of energy of legal professional related to insurance coverage?

Various kinds of energy of legal professional exist, every with various scopes. A sturdy energy of legal professional, for instance, grants authority that continues even when the principal turns into incapacitated. Particular powers of legal professional for insurance coverage are tailor-made to deal with insurance-related issues.

What are the everyday prices and charges related to an influence of legal professional for automobile insurance coverage?

The prices of an influence of legal professional can fluctuate, depending on elements such because the jurisdiction and complexity of the doc. Lawyer charges, doc preparation, and any administrative prices incurred must be factored in.

How can I guarantee my energy of legal professional doc is legally legitimate in my jurisdiction?

Authorized validity varies by jurisdiction. Consulting with a authorized skilled in your space is important to make sure the doc complies with all needed authorized necessities.

How can I talk the ability of legal professional to the insurance coverage firm?

The insurance coverage firm wants correct documentation of the ability of legal professional. Usually, offering a licensed copy of the signed doc, together with any supporting paperwork, is required.