Do you want automotive insurance coverage for DoorDash? This query pops up like a pizza order notification in your telephone. It is a respectable concern, particularly because you’re seemingly juggling deliveries and dodging potholes (hopefully with no delivery-related accident!). So, buckle up for a experience by way of the insurance coverage maze, as we delve into the authorized panorama for supply drivers, exploring the precise guidelines for DoorDash, and analyzing various kinds of insurance coverage protection.

Navigating the world of supply companies may be difficult. This information goals to offer clear solutions to your burning questions on automotive insurance coverage and DoorDash, making certain you are on the street safely and legally. We’ll break down the authorized necessities, DoorDash’s stance, insurance coverage varieties, and state variations to equip you with the data it’s essential make knowledgeable selections.

Authorized Necessities

Navigating the authorized panorama of supply companies requires understanding car insurance coverage mandates. Compliance with these rules is paramount, not only for avoiding hefty penalties, but in addition for making certain private security and upholding the legislation. Drivers should grasp the intricacies of insurance coverage necessities, particularly regarding private versus industrial use of autos for supply operations.Working a car with out correct insurance coverage protection carries important authorized ramifications.

Failure to take care of ample insurance coverage can result in fines, suspension of driving privileges, and even authorized motion. The severity of those penalties typically relies on the precise jurisdiction and the extent of the violation. Understanding these potential penalties is vital for accountable supply operations.

Car Insurance coverage Necessities for Supply Drivers

The authorized necessities for car insurance coverage differ by state in america. Typically, drivers should preserve legal responsibility insurance coverage, which protects others in case of accidents. Nonetheless, some states would possibly require extra forms of protection, corresponding to uninsured/underinsured motorist safety. This complete method ensures safety towards varied situations.

Private Use vs. Industrial Use

The excellence between private and industrial use considerably impacts insurance coverage necessities. Private use usually entails rare or occasional journeys, whereas industrial use entails common journeys for enterprise functions, corresponding to supply companies. Insurance coverage insurance policies designed for private use typically have decrease limits and exclusions for industrial actions. Consequently, drivers want to make sure their insurance coverage protection adequately addresses their supply actions.

Insurance coverage Wants for Completely different Supply Platforms, Do you want automotive insurance coverage for doordash

A vital side is the various insurance coverage wants throughout completely different supply platforms. Completely different supply platforms typically have various ranges of legal responsibility or tasks. This side immediately impacts the insurance coverage insurance policies wanted by drivers.

| Supply Platform | Insurance coverage Wants |

|---|---|

| DoorDash | Drivers usually want legal responsibility insurance coverage to cowl potential damages or accidents arising from accidents. Particular necessities could differ relying on state legal guidelines. DoorDash’s insurance policies could affect protection. |

| Uber Eats | Just like DoorDash, legal responsibility insurance coverage is crucial. The platform’s pointers and native rules would possibly dictate particular insurance coverage protection. |

| Grubhub | Legal responsibility insurance coverage stays essential. Grubhub’s phrases and circumstances, mixed with state rules, dictate the mandatory insurance coverage protection. |

DoorDash Specifics

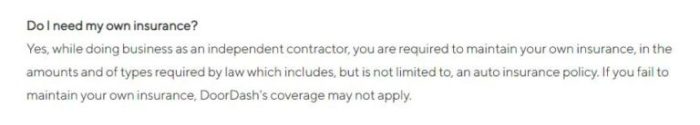

DoorDash, like many gig financial system platforms, does not mandate particular insurance coverage insurance policies for its drivers. This ambiguity can go away drivers uncertain about their legal responsibility protection, particularly within the occasion of an accident. Understanding the corporate’s stance on driver insurance coverage is essential for navigating the authorized and monetary tasks inherent within the gig financial system.DoorDash’s method to driver insurance coverage is not a direct requirement of a particular coverage.

As a substitute, the platform usually emphasizes the significance of drivers having ample private insurance coverage protection. This typically means highlighting the necessity for complete auto insurance coverage to guard each the motive force and the potential for third-party legal responsibility. Primarily, DoorDash encourages drivers to take care of their present private insurance coverage insurance policies, which ought to adequately cowl them in conditions involving accidents or property harm.

DoorDash’s Place on Driver Insurance coverage

DoorDash doesn’t explicitly require drivers to buy a specific insurance coverage coverage. Their stance focuses on the motive force’s duty to take care of ample private auto insurance coverage. This leaves the main points of protection as much as the person driver.

Examples of Driver Insurance coverage Relevance

Conditions the place driver insurance coverage is essential within the DoorDash context embrace accidents involving different autos, pedestrians, or property harm. For example, if a DoorDash driver is concerned in an accident whereas delivering meals, private auto insurance coverage would usually cowl the related prices of accidents or damages to different events. Moreover, if a driver causes harm to a buyer’s property throughout a supply, their private insurance coverage ought to cowl the related damages.

Equally, if a driver will get into an accident whereas on a supply run and injures one other celebration, their insurance coverage is crucial for overlaying the associated prices.

Potential Dangers for DoorDash Drivers With out Insurance coverage

Lack of ample insurance coverage for DoorDash drivers presents important monetary and authorized dangers. Failure to take care of insurance coverage can expose the motive force to appreciable private legal responsibility in case of accidents or damages. With out correct protection, drivers would possibly face substantial out-of-pocket bills for medical payments, property harm, or authorized charges. This might considerably impression their private funds and even result in authorized penalties.

| Danger Class | Description | Influence |

|---|---|---|

| Monetary Legal responsibility | Uncovered medical bills, property harm, authorized charges for different events concerned in accidents. | Potential for important monetary losses. |

| Authorized Penalties | Going through lawsuits, fines, or different penalties for not having ample insurance coverage protection. | Potential for authorized points and repercussions. |

| Repute Injury | Lack of belief and reliability from the DoorDash platform, clients, and different stakeholders. | Adverse impression on future alternatives or enterprise relationships. |

Insurance coverage Sorts and Protection: Do You Want Automobile Insurance coverage For Doordash

Navigating the world of supply companies, particularly with platforms like DoorDash, necessitates a transparent understanding of insurance coverage varieties and their protection. A complete insurance coverage coverage is essential for shielding drivers from monetary dangers, making certain peace of thoughts, and sustaining operational viability. This part particulars the important forms of insurance policies, their protection parts, and illustrative examples.

Important Insurance coverage Sorts for Supply Drivers

Understanding the various kinds of insurance coverage insurance policies related to DoorDash drivers is paramount. Legal responsibility insurance coverage, a cornerstone of any driver’s coverage, covers damages incurred to others. Collision insurance coverage protects towards harm to the motive force’s personal car. Past these fundamentals, complete insurance coverage, which frequently contains extra protections, supplies a broader security web. The significance of those insurance policies lies in safeguarding towards potential monetary break from accidents or damages.

Components of a Complete Coverage for Supply Drivers

A complete coverage for supply drivers goes past the minimal necessities. It should handle particular dangers related to the occupation. This contains protection for private harm safety (PIP), which compensates drivers and passengers for medical bills ensuing from accidents. Uninsured/underinsured motorist protection is crucial, shielding drivers from people missing ample insurance coverage. Property harm protection, defending the motive force’s car and different property, is one other important ingredient.

Lastly, protection for street hazards, corresponding to potholes or particles, ought to be thought-about to handle sudden harm to the car.

Illustrative Examples of Protection

Think about a state of affairs the place a DoorDash driver is concerned in an accident. Legal responsibility insurance coverage would cowl damages incurred by the opposite celebration concerned. Collision insurance coverage would cowl repairs to the motive force’s car if harm occurred. Complete insurance coverage would offer extra safety, probably overlaying damages brought on by elements like vandalism or climate occasions. This demonstrates how complete protection is crucial to mitigate monetary dangers for supply drivers.

One other instance is a driver who experiences an accident attributable to a defective street. Protection for street hazards would shield towards such incidents, serving to with repairs or monetary losses.

Insurance coverage Coverage Comparability for Supply Providers

| Insurance coverage Sort | Protection Particulars | Relevance to Supply Providers |

|---|---|---|

| Legal responsibility Insurance coverage | Covers damages to others’ property or accidents to others. | Essential for shielding drivers from lawsuits and monetary obligations. |

| Collision Insurance coverage | Covers harm to the motive force’s car in an accident. | Important for car restore prices in accidents involving the motive force’s car. |

| Complete Insurance coverage | Covers harm to the motive force’s car from non-collision occasions. | Protects towards incidents like vandalism, hail harm, or theft. |

| Uninsured/Underinsured Motorist Protection | Covers damages if the at-fault driver is uninsured or underinsured. | Offers essential safety towards financially irresponsible drivers. |

| Private Damage Safety (PIP) | Covers medical bills for the motive force and passengers. | Important for overlaying medical payments incurred in an accident. |

This desk supplies a concise comparability of insurance coverage varieties, highlighting their relevance to supply companies. It underscores the significance of every kind in defending the motive force towards varied situations. Understanding the precise protection particulars is essential for making knowledgeable selections about insurance coverage choices.

State Variations

Navigating the varied panorama of automotive insurance coverage rules for supply drivers, particularly these working throughout state traces, presents a major problem. Completely different states have various necessities, impacting the monetary duty and authorized standing of DoorDash drivers. This complexity underscores the significance of understanding the precise insurance coverage wants for every state a driver operates in.State-specific rules concerning automotive insurance coverage for supply companies differ broadly, making a patchwork of necessities that may be tough for drivers to navigate.

This variability extends past the minimal protection ranges and might embrace necessities for particular forms of insurance coverage or extra endorsements. Understanding these variations is essential for drivers to keep away from potential authorized points and guarantee compliance with the legislation.

State-Particular Insurance coverage Necessities for Supply Providers

This desk Artikels the numerous variations in insurance coverage necessities throughout completely different states for supply companies. Be aware that these are common pointers and particular necessities could differ based mostly on native ordinances or particular conditions. Drivers are strongly suggested to seek the advice of with their insurance coverage suppliers and native authorities for exact and up-to-date data.

| State | Insurance coverage Necessities | Potential Challenges |

|---|---|---|

| California | California requires drivers to take care of minimal legal responsibility insurance coverage protection, together with bodily harm and property harm. Particular protection limits could differ. Further endorsements could be wanted for industrial use or specialised forms of deliveries. | Excessive value of insurance coverage, complicated regulatory setting. Strict enforcement of rules for supply companies. |

| New York | New York mandates minimal legal responsibility insurance coverage for drivers, however specifics would possibly rely upon the kind of supply service and the car used. Industrial insurance coverage could be mandatory for in depth deliveries or utilizing a car modified for deliveries. | Potential for confusion concerning protection for supply actions. The necessity to reveal correct insurance coverage protection for industrial use could be demanding. |

| Florida | Florida has minimal insurance coverage necessities, however these could differ for supply companies if the car is used for industrial functions. A complete coverage is really helpful for drivers in Florida, as industrial use may impression protection. | Potential confusion concerning the appliance of business car insurance coverage rules. Drivers should guarantee their coverage covers industrial actions. |

| Texas | Texas requires minimal legal responsibility insurance coverage, however particular rules for supply drivers would possibly differ based mostly on native rules or the character of the supply enterprise. Drivers should confirm their coverage covers industrial use and supply companies. | Figuring out if a coverage is enough for industrial use in supply companies may be difficult. Compliance with native ordinances and rules is essential. |

| Illinois | Illinois mandates minimal legal responsibility insurance coverage, and particular protection quantities could apply. Drivers should confirm their coverage covers industrial use, notably if the car is regularly used for supply functions. | Making certain the insurance coverage coverage covers the precise nature of supply actions in Illinois generally is a problem. Compliance with industrial insurance coverage rules for supply companies is vital. |

Potential Challenges for Drivers Working Throughout State Strains

Working a supply service throughout state traces requires meticulous consideration to the various insurance coverage rules in every jurisdiction. The challenges for drivers embrace navigating a number of insurance coverage necessities, making certain protection in all jurisdictions, and probably encountering penalties for non-compliance.

- Drivers working throughout state traces should guarantee their insurance coverage coverage covers them in each state they function in. This typically requires specialised industrial insurance coverage insurance policies that accommodate the varied state necessities.

- Making certain compliance with insurance coverage rules throughout a number of states may be time-consuming and complicated. The method entails acquiring mandatory paperwork and verifying coverage protection in every state.

- Penalties for non-compliance with state insurance coverage rules for supply companies can vary from fines to suspension of operations. This emphasizes the significance of diligent analysis and understanding of the principles in every jurisdiction.

Influence of State-Particular Laws on DoorDash Drivers

State-specific rules can considerably impression DoorDash drivers. Compliance with insurance coverage necessities in every state they function in is essential for sustaining their skill to work as supply drivers.

- Drivers want to know the specifics of every state’s insurance coverage rules for supply companies to keep away from authorized points and preserve operational standing.

- DoorDash drivers working throughout state traces ought to contemplate buying complete industrial insurance coverage to make sure protection in all jurisdictions they function in.

- Understanding the intricacies of state-specific rules will allow drivers to make knowledgeable selections about their insurance coverage wants and guarantee authorized compliance.

Sensible Implications

Navigating the world of gig financial system driving, notably with companies like DoorDash, necessitates an intensive understanding of the sensible implications of insurance coverage. This part delves into the monetary ramifications of working with out insurance coverage, the price comparability of various insurance coverage choices, and the claims course of for incidents. A prudent method to insurance coverage can considerably mitigate dangers and shield each private and monetary well-being.

Monetary Implications of Uninsured Driving

Failure to safe ample insurance coverage for DoorDash deliveries exposes drivers to substantial monetary dangers. Accidents, no matter fault, can lead to substantial out-of-pocket bills. These bills can embrace medical payments for these concerned within the accident, car repairs, and potential authorized charges. With out insurance coverage, drivers face the total burden of those prices, probably resulting in crippling debt and important monetary hardship.

Moreover, an absence of insurance coverage may negatively impression credit score scores, making it tough to safe loans or different monetary merchandise sooner or later.

Price Comparability of Insurance coverage Choices

A number of insurance coverage choices cater to supply drivers. The premiums for these choices differ based mostly on a number of elements together with the motive force’s driving historical past, the car’s make and mannequin, and the state through which the motive force operates. For instance, a driver with a clear driving file and a more moderen, cheaper car would possibly discover decrease premiums in comparison with somebody with a historical past of accidents or an older, costlier car.

Complete insurance coverage insurance policies, providing broader protection, usually include increased premiums than fundamental liability-only insurance policies. The price-benefit evaluation of every possibility is essential for drivers to make knowledgeable selections.

Breakdown of Insurance coverage Claims Procedures

The claims course of for delivery-related incidents usually entails reporting the accident to the insurance coverage firm promptly. Documentation, together with police experiences, witness statements, and medical data, is crucial. The insurance coverage firm will then assess the validity of the declare and decide the suitable plan of action. Drivers ought to all the time seek the advice of with their insurance coverage supplier to know the precise procedures for his or her coverage.

A clean claims course of can drastically cut back the stress and monetary burden related to an accident.

Potential Prices Related to Accidents With out Insurance coverage

| Incident Sort | Potential Prices | Instance ||—|—|—|| Minor accident (property harm) | $500 – $5,000 for repairs | A fender bender inflicting $1,500 in repairs to the motive force’s car || Reasonable accident (property harm, minor accidents) | $5,000 – $25,000 | Collision leading to $10,000 in repairs and $5,000 in medical bills for an additional driver || Severe accident (main accidents, important property harm) | $25,000+ | A rollover accident leading to $50,000 in car repairs and substantial medical payments for a number of events || Authorized charges | $1,000 – $10,000+ | Authorized illustration wanted to navigate the claims course of, particularly in circumstances of great legal responsibility or disputes |

Trade Greatest Practices

Navigating the complexities of supply companies like DoorDash requires proactive measures for drivers. Insurance coverage performs a pivotal function in mitigating dangers and making certain monetary safety. Understanding trade finest practices is essential for accountable and knowledgeable decision-making. These practices embody complete insurance coverage protection, proactive session, and coverage choice.

Greatest Practices for DoorDash Drivers Relating to Insurance coverage

DoorDash drivers should prioritize insurance coverage that adequately covers potential dangers. This extends past the normal private auto insurance coverage insurance policies, typically inadequate for the distinctive calls for of gig work. Drivers ought to actively search insurance coverage tailor-made to their supply actions.

Significance of Consulting with Insurance coverage Professionals

Consulting with insurance coverage professionals is paramount. They provide specialised data in evaluating particular person wants and tailoring insurance coverage options for supply drivers. This customized method is crucial for securing the suitable degree of safety. Insurance coverage brokers can analyze the precise dangers related to DoorDash driving, corresponding to elevated mileage, potential for accidents, and legal responsibility exposures.

Recommendation for Choosing an Acceptable Insurance coverage Coverage

Choosing an acceptable insurance coverage coverage requires cautious consideration. Drivers ought to prioritize complete protection, encompassing legal responsibility, collision, and uninsured/underinsured motorist safety. Evaluating the coverage’s protection limits and deductibles is equally vital. A coverage that displays the elevated dangers related to gig driving is crucial. Drivers ought to search readability on add-on coverages like roadside help, rental automotive reimbursement, and medical funds.

Examples of Knowledgeable Recommendation on Car Insurance coverage for Supply Drivers

“For supply drivers, the normal private auto insurance coverage coverage typically falls quick. A devoted industrial auto insurance coverage coverage or an endorsement to the prevailing private coverage is usually essential to cowl the distinctive dangers related to gig work. Drivers ought to talk about their particular wants with an insurance coverage skilled to make sure acceptable protection.”

Alternate options and Options

Navigating the complexities of transportation companies typically necessitates exploring different approaches to handle potential dangers. Drivers with out necessary insurance coverage for DoorDash or comparable platforms face a vital want for viable danger mitigation methods. This part explores different protections, private insurance coverage issues, and varied danger mitigation methods for drivers working with out mandated insurance coverage.

Private Insurance coverage Protection

Private auto insurance coverage insurance policies typically present protection for incidents whereas working a car. Nonetheless, the extent of this protection in relation to ride-sharing actions, corresponding to DoorDash deliveries, varies drastically relying on the precise coverage wording. Drivers ought to fastidiously evaluate their coverage paperwork to know if DoorDash actions are lined. Some insurance policies could explicitly exclude legal responsibility for industrial actions or outline industrial use broadly, probably impacting protection for DoorDash operations.

Journey-Sharing Insurance coverage Packages

A number of insurance coverage firms and organizations are providing specialised ride-sharing insurance coverage choices. These packages usually present protection tailor-made to the precise dangers inherent within the trade. Such packages could provide a extra complete and inexpensive answer than utilizing private insurance policies, notably if the non-public coverage excludes or limits protection for ride-sharing actions.

Self-Insured Methods

For drivers working with out mandated insurance coverage, self-insuring entails establishing a monetary cushion to cowl potential liabilities. This methodology requires meticulous planning and a sensible evaluation of potential dangers. Accumulating a considerable financial savings account particularly designated for accident or legal responsibility claims is a standard self-insuring technique. This method, whereas probably appropriate for some, carries a excessive diploma of danger.

The driving force should be certain that the amassed financial savings are ample to deal with any accident declare.

Desk Evaluating Options for Drivers With out Obligatory Insurance coverage

| Answer | Professionals | Cons |

|---|---|---|

| Private Auto Insurance coverage | Usually available; present protection could apply | Protection for ride-sharing actions could also be restricted or excluded; coverage phrases and circumstances differ considerably |

| Journey-Sharing Insurance coverage Packages | Tailor-made protection for ride-sharing; typically complete and inexpensive | Will not be obtainable in all areas; coverage phrases and circumstances differ |

| Self-Insured Methods | Probably cost-effective for drivers with low accident danger | Requires substantial monetary reserves; important danger of inadequate funds for legal responsibility claims; no protection for potential accidents |

Ending Remarks

So, do you want automotive insurance coverage for DoorDash? The quick reply is: seemingly, sure. However the

-how* is the place the enjoyable (and legalities) start. This information has geared up you with the instruments to know your insurance coverage wants, so you’ll be able to concentrate on delivering scrumptious meals, not coping with a hefty positive. Bear in mind, security first, and consulting with insurance coverage professionals is all the time a good suggestion!

FAQ Compilation

Is DoorDash required to offer insurance coverage for drivers?

No, DoorDash doesn’t present insurance coverage for drivers. Drivers are chargeable for acquiring their very own insurance coverage.

What if I’ve an accident whereas delivering for DoorDash?

Having the appropriate insurance coverage is essential. It protects you and others concerned in case of an accident.

Can I exploit my private auto insurance coverage for DoorDash deliveries?

It is a widespread query, and generally, sure, it is potential. Nonetheless, it’s essential test your coverage fastidiously to see if it covers industrial use. A dialog along with your insurer is a should.

What are the potential penalties for working a car with out ample insurance coverage?

Relying on the state and the severity of the violation, penalties may embrace fines, suspension of your license, and even authorized motion.