Common automotive insurance coverage price Wisconsin is an important issue for each driver. This information dives deep into the elements influencing premiums, out of your driving report to the kind of automotive you personal. We’ll discover the everyday prices throughout Wisconsin, evaluating them to different states and providing you with tricks to save.

Understanding the typical automotive insurance coverage price in Wisconsin empowers you to make knowledgeable selections. We’ll cowl all the pieces from protection choices to insurance coverage suppliers, serving to you navigate the complicated world of automotive insurance coverage within the Badger State.

Overview of Wisconsin Automotive Insurance coverage Prices

Automotive insurance coverage premiums in Wisconsin, like many different states, are influenced by a posh interaction of things. Understanding these elements is essential for anybody trying to safe probably the most reasonably priced protection whereas sustaining ample safety. This overview delves into the overall price tendencies, influential elements, and variations throughout completely different demographics and automobile varieties.

Normal Value Tendencies

Wisconsin automotive insurance coverage prices typically mirror nationwide tendencies, with premiums fluctuating primarily based on numerous elements. Whereas exact figures can range relying on particular person circumstances, the general price is influenced by the state’s financial circumstances, legislative modifications, and the extent of reported accidents and claims. This dynamic nature underscores the significance of staying knowledgeable in regards to the newest market tendencies.

Elements Impacting Premiums

A number of key elements considerably affect automotive insurance coverage premiums in Wisconsin. These elements affect the danger evaluation carried out by insurance coverage firms, which instantly impacts the value of your coverage.

- Driving Report: A clear driving report with no accidents or visitors violations is a significant component. A historical past of accidents or violations dramatically will increase premiums, reflecting the upper danger related to such conduct. As an example, a driver with a number of dashing tickets may count on to pay significantly greater than a driver with a clear report.

- Automobile Sort: The kind of automobile being insured impacts the premium. Excessive-performance sports activities vehicles or autos with a historical past of theft are more likely to have greater premiums in comparison with commonplace autos. This displays the various danger profiles of various fashions and makes.

- Location: Geographical location inside Wisconsin can affect premiums. Areas with greater charges of accidents or crime might need greater premiums. For instance, cities with a better density of visitors and a better frequency of accidents may count on to pay greater than these in additional rural areas.

- Age and Gender: Age and gender are additionally vital elements. Youthful drivers and male drivers, in some instances, are inclined to have greater premiums in comparison with older drivers and feminine drivers, respectively. That is primarily based on statistical analyses of accident charges, demonstrating the danger evaluation methods employed by insurance coverage firms.

Automobile Sort Value Vary

The typical price of automotive insurance coverage in Wisconsin varies considerably primarily based on the kind of automobile. Completely different makes, fashions, and forms of autos current various dangers, impacting their related premiums.

- Luxurious autos: Luxurious autos, typically high-performance fashions, normally have greater insurance coverage premiums attributable to their potential for greater restore prices and theft dangers. This issue is mirrored within the premiums charged by insurance coverage firms, who use actuarial fashions to evaluate and value dangers.

- Sports activities vehicles: Sports activities vehicles, attributable to their excessive speeds and probably extra highly effective engines, typically have greater premiums in comparison with commonplace autos. The larger danger of accidents and potential for prime restore prices contributes to this.

- Customary autos: Customary autos, typically household sedans or compact vehicles, usually have extra average insurance coverage premiums. Their decrease danger profiles, in comparison with high-performance fashions, affect their pricing.

Gender Value Variations

Historic knowledge exhibits slight variations in automotive insurance coverage prices primarily based on gender. Whereas this distinction is not all the time substantial, it is necessary to grasp how insurers consider danger primarily based on these elements.

- Statistical variations: Insurance coverage firms use statistical knowledge on accident charges and claims to find out pricing. These knowledge typically present patterns the place male drivers, on common, might need greater premiums. This displays the historic knowledge and danger assessments of insurance coverage firms.

- Particular instances: Nevertheless, this distinction is not common and might range considerably relying on the motive force’s particular person circumstances. Elements resembling driving report, location, and automobile kind play a extra substantial function in figuring out insurance coverage premiums.

Age-Primarily based Value Desk

The next desk illustrates the approximate common automotive insurance coverage prices primarily based on age teams in Wisconsin. These figures are estimates and might range considerably primarily based on particular person circumstances.

| Age Group | Approximate Common Value (USD) |

|---|---|

| 16-24 | $1,800-$2,500 |

| 25-34 | $1,500-$2,000 |

| 35-44 | $1,200-$1,700 |

| 45-54 | $1,000-$1,500 |

| 55+ | $800-$1,200 |

Elements Influencing Automotive Insurance coverage Prices

Wisconsin’s automotive insurance coverage panorama is a posh tapestry woven from numerous threads. Understanding these threads, or elements, is essential for anybody searching for to navigate the market and safe the very best charges. These elements prolong past easy demographics and embody driving habits, automobile traits, and even location.Wisconsin automotive insurance coverage premiums aren’t a one-size-fits-all state of affairs. Various factors considerably affect the ultimate price ticket.

Understanding these components can empower you to make knowledgeable selections about your protection and probably get monetary savings.

Driving Data and Their Impression

Wisconsin’s insurance coverage firms carefully scrutinize driving data. A historical past of accidents or visitors violations instantly impacts insurance coverage prices. It is a well-established observe within the business, as insurers have to assess danger. A clear driving report demonstrates accountable conduct, resulting in decrease premiums. Conversely, a historical past of accidents or violations signifies a better danger, which generally interprets to elevated premiums.

For instance, a driver with a number of dashing tickets may face a considerably greater premium in comparison with a driver with a clear report. It is because insurers use this knowledge to foretell the chance of future claims.

Automobile Sort and Mannequin Affect

The sort and mannequin of a automobile are additionally vital determinants of insurance coverage premiums. Insurers think about elements such because the automobile’s worth, security options, and its propensity to be concerned in accidents. Luxurious autos, sports activities vehicles, or high-performance fashions typically have greater premiums than commonplace fashions. Equally, older autos may command greater premiums attributable to potential mechanical points or a decrease resale worth.

This displays the insurance coverage firm’s evaluation of the potential price of repairing or changing the automobile within the occasion of an accident.

Geographic Location Issues, Common automotive insurance coverage price wisconsin

Location inside Wisconsin performs a vital function in automotive insurance coverage prices. Areas with greater charges of accidents or theft will typically have greater premiums. That is typically attributable to elements resembling visitors density, crime charges, and even the frequency of extreme climate occasions. As an example, areas with greater concentrations of visitors or a historical past of extreme climate could have greater premiums because of the elevated chance of accidents and claims.

Protection Sorts and Their Prices

The various kinds of protection—legal responsibility, collision, complete, and uninsured/underinsured—every include various prices. Legal responsibility protection, the minimal required in most states, protects in opposition to claims from different drivers. Collision protection protects in opposition to injury to your automobile no matter who’s at fault. Complete protection extends this safety to cowl injury from incidents like fireplace, vandalism, or theft. The quantity of protection chosen will affect the general premium.

Credit score Rating and Insurance coverage Charges

Insurers typically think about credit score scores as a consider figuring out premiums. A powerful credit score historical past is commonly related to decrease premiums, reflecting a decrease danger profile. Conversely, a poor credit score rating can result in greater premiums, indicating a better danger of default or monetary instability. This observe relies on the idea that accountable monetary administration is correlated with accountable driving conduct.

The connection is not all the time direct, however it typically displays a broader sample of accountable conduct.

| Credit score Rating Vary | Estimated Impression on Automotive Insurance coverage Premium |

|---|---|

| Wonderful (750-850) | Doubtlessly 5-10% decrease premiums |

| Good (700-749) | Typically common premiums |

| Honest (650-699) | Doubtlessly 5-15% greater premiums |

| Poor (beneath 650) | Doubtlessly 10-25% greater premiums |

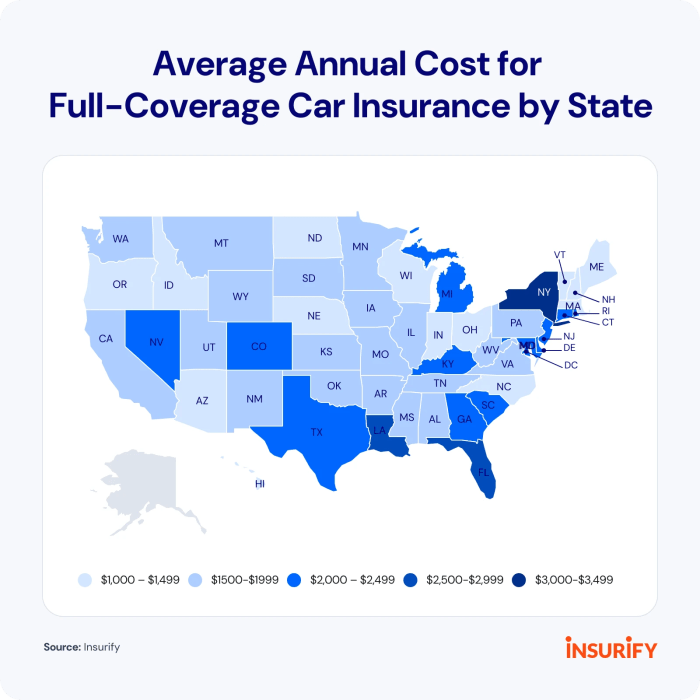

Comparability with Different States

Wisconsin’s automotive insurance coverage prices sit inside a selected vary in comparison with different states, notably within the Midwest. Understanding these regional comparisons gives a clearer image of Wisconsin’s place relative to nationwide averages and related demographics. This enables for a extra nuanced understanding of the elements driving these prices.Elements like driving habits, the frequency of accidents, and the price of medical care in a specific area play a major function in shaping automotive insurance coverage premiums.

Evaluating Wisconsin to its neighboring states and people with related demographics reveals potential correlations between these elements and insurance coverage prices.

Midwest Regional Comparability

A better have a look at the Midwest reveals that Wisconsin’s automotive insurance coverage prices typically fall throughout the common vary for the area. Whereas exact figures range primarily based on elements resembling protection kind and driving report, some states are inclined to have barely greater or decrease premiums. The variations mirror the distinctive circumstances of every state.

Nationwide Common Comparability

Wisconsin’s common automotive insurance coverage prices usually stand in the course of the nationwide spectrum. States with considerably greater populations, greater accident charges, or various ranges of rules can affect the general common. Which means Wisconsin’s common falls someplace throughout the broader nationwide vary, neither exceptionally excessive nor exceptionally low.

State-by-State Comparability Desk

This desk illustrates the potential variations in common automotive insurance coverage prices between Wisconsin and its neighboring states. Needless to say these are estimated averages and particular person premiums can range tremendously primarily based on private elements.

| State | Estimated Common Automotive Insurance coverage Value (USD) |

|---|---|

| Wisconsin | $1,700 – $2,200 per 12 months |

| Illinois | $1,800 – $2,400 per 12 months |

| Minnesota | $1,600 – $2,100 per 12 months |

| Iowa | $1,500 – $2,000 per 12 months |

| Michigan | $1,900 – $2,500 per 12 months |

Comparability with Related Demographics

Wisconsin’s demographic profile is similar to a number of different Midwestern states. When evaluating insurance coverage prices throughout states with related inhabitants density, earnings ranges, and age distributions, Wisconsin’s common premiums normally align with the general sample. These states typically have related elements influencing automotive insurance coverage charges. As an example, if a state experiences greater accident charges or has a good portion of its inhabitants driving older autos, this might result in greater premiums.

Causes Behind the Variations

A number of elements contribute to variations in automotive insurance coverage prices throughout states. These elements embody:

- Accident charges: States with greater accident charges typically have greater insurance coverage premiums. That is because of the elevated danger of payouts for claims.

- Driving habits: Driving behaviors, resembling aggressive driving or dashing, can have an effect on premiums. States with greater situations of dangerous driving may see greater premiums.

- Automobile utilization: The kind of automobile pushed, whether or not it is a sports activities automotive or a compact automotive, can even affect the fee. Sure forms of autos could be dearer to insure attributable to potential restore prices or perceived danger.

- Laws and legal guidelines: Completely different states have various rules regarding insurance coverage protection and necessities. States with extra stringent rules might need greater premiums.

Protection Choices and Prices

Navigating the world of automotive insurance coverage can really feel like a maze, with numerous protection choices and complicated prices. Understanding these selections is essential for securing ample safety whereas minimizing pointless bills. Wisconsin, like different states, affords a variety of coverages tailor-made to completely different wants and budgets.

Frequent Automotive Insurance coverage Coverages in Wisconsin

Wisconsin drivers have a number of key insurance coverage coverages to select from. These choices range within the extent of safety they provide and, consequently, of their price. Understanding the variations between these choices is significant for making knowledgeable selections. The most typical coverages embody legal responsibility, collision, complete, and uninsured/underinsured motorist protection.

Legal responsibility Protection Prices in Wisconsin

Legal responsibility protection is probably the most fundamental kind of automotive insurance coverage. It protects you if you happen to’re discovered at fault in an accident, masking damages to the opposite occasion’s automobile and medical bills. The price of liability-only protection in Wisconsin varies primarily based on elements resembling your driving report, automobile kind, and placement. For instance, a driver with a clear report and a more recent, inexpensive automobile may pay considerably much less for liability-only protection in comparison with somebody with a historical past of accidents or a dearer sports activities automotive.

The minimal legal responsibility protection required by Wisconsin legislation usually entails a mixture of bodily harm and property injury legal responsibility.

Collision and Complete Protection Prices

Collision and complete protection transcend legal responsibility. Collision protection pays for damages to your automobile no matter who’s at fault, whereas complete protection protects in opposition to injury brought on by occasions like theft, vandalism, or pure disasters. These coverages typically price greater than liability-only protection. The price of collision and complete protection in Wisconsin is influenced by related elements as legal responsibility, together with the motive force’s report, automobile kind, and placement.

As an example, a driver with a historical past of accidents or an older, dearer automobile may pay a better premium for collision and complete protection in comparison with a driver with a clear report and a more recent, inexpensive automobile.

Comparability of Protection Choices in Wisconsin

| Protection Sort | Description | Approximate Value (Instance) |

|---|---|---|

| Legal responsibility-only | Covers damages to different events’ property and medical bills if you happen to’re at fault. | $500 – $1500 per 12 months |

| Collision | Covers injury to your automobile no matter who’s at fault in an accident. | $200 – $800 per 12 months |

| Complete | Covers injury to your automobile from occasions like theft, vandalism, or pure disasters. | $100 – $500 per 12 months |

| Uninsured/Underinsured Motorist | Protects you if you happen to’re concerned in an accident with an uninsured or underinsured driver. | $50 – $250 per 12 months |

Observe: These are approximate prices and might range considerably primarily based on particular person circumstances. Seek the advice of with an insurance coverage agent for personalised quotes.

Insurance coverage Firms and Value Variations

Navigating the world of automotive insurance coverage can really feel like a maze, with completely different suppliers providing various charges and coverages. Understanding the important thing gamers and the elements influencing their pricing methods is essential for securing the very best deal. This part delves into the most important insurance coverage firms in Wisconsin, the disparities of their pricing, and the rationale behind these variations.

Main Automotive Insurance coverage Suppliers in Wisconsin

Wisconsin boasts a various vary of automotive insurance coverage suppliers, every with its personal strengths and techniques. Acquainted names like State Farm, Progressive, and Allstate keep a robust presence, whereas firms like Geico and USAA additionally cater to particular segments of the market. Native insurers, typically specializing specifically areas or demographics, additionally supply aggressive choices.

Worth Variations Amongst Insurance coverage Firms

The prices of automotive insurance coverage range considerably amongst completely different suppliers in Wisconsin. Elements resembling underwriting practices, claims dealing with procedures, and advertising and marketing methods all contribute to those discrepancies. Whereas some firms may supply decrease premiums attributable to aggressive pricing fashions, others may deal with complete protection at a better price.

Comparability of Common Prices

The next desk presents a common comparability of common automotive insurance coverage prices from main suppliers in Wisconsin. Needless to say these are averages and particular person charges will differ primarily based on particular elements.

| Insurance coverage Firm | Estimated Common Value (per 12 months) |

|---|---|

| State Farm | $1,500 – $2,000 |

| Progressive | $1,300 – $1,800 |

| Allstate | $1,400 – $1,900 |

| Geico | $1,200 – $1,700 |

| USAA | $1,100 – $1,600 (usually for army members and their households) |

Elements Influencing Insurance coverage Supplier Pricing

A number of key elements affect the pricing methods of insurance coverage suppliers. These elements embody:

- Driving Data: Firms meticulously analyze driving historical past, together with visitors violations and accidents, to evaluate danger. Drivers with clear data typically qualify for decrease premiums.

- Automobile Sort and Worth: The make, mannequin, and worth of the automobile play a major function. Excessive-value autos or these liable to theft or injury command greater premiums.

- Protection Choices: The extent of protection chosen by the policyholder impacts the premium. Complete protection, together with safety in opposition to injury, theft, and vandalism, normally comes with a better price.

- Location and Demographics: Claims frequency and severity range throughout completely different areas and demographic teams. Excessive-risk areas or demographic teams with a historical past of upper claims are inclined to have greater premiums.

- Claims Historical past: Firms rigorously monitor declare histories. A historical past of frequent or pricey claims usually ends in greater premiums.

Methods Used to Decide Charges

Insurance coverage firms make use of refined actuarial fashions to calculate premiums. These fashions analyze massive datasets of historic knowledge, incorporating elements resembling:

- Statistical Evaluation: Knowledge evaluation is essential in understanding danger profiles. The corporate makes use of statistical strategies to foretell the chance of a declare occurring primarily based on numerous elements.

- Threat Evaluation: The corporate rigorously evaluates danger elements related to particular person drivers and autos.

- Competitors: The aggressive panorama considerably influences pricing methods. Firms typically alter their charges to stay aggressive available in the market.

Suggestions for Decreasing Automotive Insurance coverage Prices

Navigating the complexities of automotive insurance coverage may be daunting, particularly in a state like Wisconsin with its numerous driving circumstances and insurance coverage panorama. Understanding methods to cut back premiums is essential for saving cash with out sacrificing important protection. This part delves into actionable suggestions for minimizing automotive insurance coverage prices in Wisconsin, empowering you to make knowledgeable selections about your insurance coverage insurance policies.

Secure Driving Practices for Decrease Insurance coverage Premiums

Secure driving practices persistently contribute to decrease insurance coverage premiums. Driving defensively and avoiding dangerous behaviors considerably reduces the chance of accidents, a key issue insurers think about when figuring out charges. These practices usually are not nearly avoiding accidents; in addition they show accountable driving habits, an element that insurers worth.

- Defensive Driving Programs: Finishing a defensive driving course can result in reductions in your insurance coverage premiums. These programs equip drivers with methods for anticipating and avoiding probably hazardous conditions, leading to safer driving habits and a decrease danger of accidents. The information gained can translate to extra cautious driving on the street.

- Keep away from Distracted Driving: Wisconsin, like many different states, strictly enforces legal guidelines in opposition to distracted driving. Participating in actions like texting, speaking on the telephone, or consuming whereas driving tremendously will increase the danger of accidents. Avoiding these distractions is essential for sustaining a protected driving report and, consequently, securing decrease insurance coverage premiums.

- Keep a Constant Driving Report: A clear driving report is paramount for acquiring favorable insurance coverage charges. Sustaining a constant historical past of protected driving practices, together with avoiding visitors violations and accidents, instantly impacts insurance coverage premiums. Insurers usually reward drivers with clear data with decrease charges, reflecting the lowered danger related to their driving conduct.

Evaluating Quotes from A number of Suppliers

Evaluating quotes from a number of insurance coverage suppliers is crucial for securing the very best deal. Insurers typically have various pricing buildings, reductions, and protection choices. A radical comparability helps you establish probably the most cost-effective plan with out compromising important protection.

- On-line Comparability Instruments: Make the most of on-line comparability instruments to shortly examine quotes from numerous insurance coverage suppliers. These instruments usually gather details about your automobile, driving historical past, and desired protection to current personalised quotes from a number of firms. This enables for a simple comparability of charges and insurance policies.

- Contact A number of Firms Instantly: Do not hesitate to contact a number of insurance coverage firms instantly. This enables for personalised discussions about your wants and potential reductions, which on-line instruments could not all the time supply. Direct contact gives an opportunity to barter and perceive particular coverage particulars tailor-made to your particular person circumstances.

- Contemplate Protection Choices: Consider the protection choices provided by completely different suppliers. Tailoring protection to your particular wants and monetary scenario is vital. This avoids pointless bills whereas sustaining ample safety.

Sustaining a Good Driving Report

Sustaining a very good driving report is key to securing decrease insurance coverage premiums. A clear report demonstrates accountable driving habits and a decrease danger of accidents. Insurers typically supply reductions to drivers with spotless data.

- Keep away from Site visitors Violations: Site visitors violations, together with dashing tickets and different infractions, considerably affect insurance coverage premiums. Avoiding such violations helps keep a clear driving report and safe favorable insurance coverage charges.

- Report Accidents Promptly: Promptly reporting any accidents to the suitable authorities is essential. This ensures that your driving report precisely displays your driving historical past and avoids any potential problems or misrepresentation.

The Function of Reductions in Decreasing Automotive Insurance coverage Premiums

Reductions can considerably cut back your automotive insurance coverage premiums. Many insurers supply reductions for numerous elements, from protected driving habits to particular way of life selections.

- Secure Driving Reductions: Insurers typically present reductions to drivers who show protected driving habits. These reductions mirror the decrease danger related to their driving conduct. Examples embody reductions for finishing defensive driving programs or sustaining a clear driving report.

- Multi-Coverage Reductions: Bundling a number of insurance coverage insurance policies, resembling automotive, dwelling, and life insurance coverage, with a single supplier can typically result in substantial financial savings. This technique, often called a multi-policy low cost, displays the elevated worth of the shopper to the insurer.

- Anti-theft Units: Putting in anti-theft gadgets in your automobile can qualify you for reductions. These gadgets improve the safety of your automobile and deter potential theft, thus resulting in decrease premiums.

Bundling Insurance coverage Insurance policies for Financial savings

Bundling insurance coverage insurance policies can result in substantial financial savings. Combining a number of insurance policies, resembling automotive and residential insurance coverage, with the identical supplier, can typically end in a major discount in total premiums. This technique can enhance your monetary scenario by reducing your total insurance coverage bills.

- Mixed Insurance policies: Bundling insurance policies, resembling auto and householders insurance coverage, with the identical insurer can result in a discount in premiums.

- Elevated Buyer Worth: Bundling a number of insurance policies with a single supplier demonstrates elevated buyer worth to the insurer. This loyalty and stability can translate to reductions on every particular person coverage.

Latest Tendencies and Projections: Common Automotive Insurance coverage Value Wisconsin

Wisconsin’s automotive insurance coverage panorama is consistently shifting, mirroring nationwide tendencies and native elements. Understanding these dynamics is essential for drivers searching for to navigate the complexities of insurance coverage prices. Latest years have witnessed fluctuating premiums, influenced by all the pieces from financial circumstances to legislative modifications.Latest tendencies point out a posh interaction of things impacting automotive insurance coverage prices in Wisconsin. Inflation, coupled with rising restore prices and altering driving behaviors, have contributed to the general upward stress on premiums.

Projections for the longer term counsel that these pressures will probably persist, though the exact diploma of enhance stays unsure.

Latest Tendencies in Wisconsin Automotive Insurance coverage Prices

Wisconsin automotive insurance coverage prices have exhibited a multifaceted pattern lately. Claims frequency and severity have each performed a job. For instance, elevated accidents in sure areas, or an increase in dearer restore applied sciences, can enhance premiums. Moreover, modifications within the state’s demographics and driving habits have had an affect. Evaluation of insurance coverage claims knowledge reveals fluctuations in premiums primarily based on these elements.

Projections for Future Automotive Insurance coverage Prices in Wisconsin

Predicting future insurance coverage prices requires cautious consideration of a number of elements. Inflation is anticipated to proceed to be a serious driver, impacting each restore prices and the general price of offering insurance coverage. Additional, rising applied sciences and the rising use of electrical autos are probably affecting the fee and kind of repairs wanted, thereby probably impacting insurance coverage premiums.

Legislative Modifications Impacting Automotive Insurance coverage Charges

Wisconsin has seen some legislative modifications lately affecting insurance coverage charges. These embody legal guidelines regarding no-fault insurance coverage or the standardization of sure insurance policies. The affect of those legal guidelines is being assessed by way of analyses of insurance coverage declare knowledge. Modifications within the construction of the insurance coverage market can also have an effect on prices.

Impression of Inflation on Automotive Insurance coverage Premiums

Inflation’s affect on automotive insurance coverage premiums is important. Rising restore prices attributable to inflation are a direct contributor to greater premiums. The price of elements and labor will increase, which instantly interprets to a better price for insurance coverage firms. For instance, a automotive needing a serious restore in 2024 will probably price greater than the same restore in 2020.

This elevated price is mirrored within the premiums charged to customers.

Impression of Important Occasions on Automotive Insurance coverage Prices

Important occasions, resembling pure disasters, can have a considerable affect on automotive insurance coverage prices. If a serious storm or flood impacts a selected area, claims associated to break to autos will enhance. This typically results in greater premiums within the affected areas as insurance coverage firms alter their pricing to mirror the elevated danger. Wisconsin, like different states, is weak to all these occasions.

Final Phrase

So, what is the common automotive insurance coverage price in Wisconsin? It will depend on many elements, out of your age and placement to your driving historical past and automotive kind. This complete information gives an in depth overview, serving to you perceive the fee panorama and equip your self to search out the perfect deal on your wants. In the end, the appropriate automotive insurance coverage protection is about peace of thoughts, and this information helps you obtain that.

Clarifying Questions

What is the common price of liability-only insurance coverage in Wisconsin?

Legal responsibility-only insurance coverage in Wisconsin usually prices between $700 and $1,500 yearly, however this varies tremendously relying on elements like age, driving report, and placement.

How does my credit score rating have an effect on my automotive insurance coverage charges in Wisconsin?

A decrease credit score rating typically ends in greater insurance coverage premiums. Insurance coverage firms typically use credit score scores as a proxy for danger evaluation, as a poor credit score historical past could point out a better chance of constructing claims.

Are there reductions obtainable for protected drivers in Wisconsin?

Completely! Many insurers supply reductions for protected drivers, resembling these with accident-free data or who’ve taken defensive driving programs.

How do automotive fashions have an effect on insurance coverage prices in Wisconsin?

Excessive-performance or luxurious autos are inclined to have greater insurance coverage premiums in comparison with extra fundamental fashions. That is typically because of the perceived danger of injury or theft.