Automobile insurance coverage declare legal professional Clearwater: Navigating the complexities of insurance coverage claims in Clearwater, Florida, will be daunting. A talented automotive insurance coverage declare legal professional can considerably enhance your possibilities of a optimistic end result. This information explores the important points of working with a automotive insurance coverage declare legal professional in Clearwater, from discovering the precise legal professional to understanding charges and customary declare points.

This complete useful resource covers all the course of, together with authorized procedures, the significance of proof, and even various methods to contemplate earlier than hiring a lawyer. Whether or not you are going through a easy declare or a posh dispute, this information empowers you with the data to make knowledgeable choices.

Introduction to Automobile Insurance coverage Declare Attorneys in Clearwater

Automobile insurance coverage declare attorneys in Clearwater, Florida, act as advocates for people who’ve suffered losses attributable to automotive accidents. They navigate the complexities of insurance coverage claims, making certain their purchasers obtain honest compensation for damages, misplaced wages, and ache and struggling. These attorneys possess a deep understanding of Florida’s insurance coverage legal guidelines and procedures, permitting them to successfully characterize their purchasers’ pursuits.The authorized technique of pursuing a automotive insurance coverage declare entails a number of essential steps.

These embody investigating the accident, gathering proof, assessing damages, and negotiating with the insurance coverage firm. Every step requires meticulous consideration to element and a complete understanding of the authorized framework governing insurance coverage claims. Failure to appropriately doc or handle particular points can considerably influence the end result of the declare. For instance, lacking documentation, delayed reporting, or inadequate proof of damages can hinder a profitable declare.

Function of a Automobile Insurance coverage Declare Legal professional

Automobile insurance coverage declare attorneys in Clearwater deal with a wide range of circumstances, from easy fender benders to complicated multi-vehicle accidents involving vital accidents and property harm. They characterize people injured in accidents, making certain their rights are protected and their monetary losses are appropriately addressed. They work with their purchasers to completely perceive the extent of their losses and develop a technique to maximise their compensation.

Efficiently negotiating a settlement with insurance coverage corporations is a important facet of this function.

Authorized Course of in Pursuing a Declare

The authorized course of in pursuing a automotive insurance coverage declare sometimes begins with an preliminary session. This permits the legal professional to know the small print of the accident, assess the potential damages, and decide the very best plan of action. This contains evaluating the legal responsibility of the at-fault driver and the extent of accidents sustained by the consumer. Subsequently, the legal professional will collect proof, akin to police reviews, witness statements, medical information, and restore estimates.

A radical investigation is paramount to constructing a robust case.

Typical Steps in Submitting a Declare

Submitting a automotive insurance coverage declare entails a number of steps, beginning with reporting the accident to the insurance coverage firm. Crucially, this should be completed promptly. Gathering obligatory documentation, together with medical payments, restore estimates, and wage loss statements, is crucial. Subsequent, the legal professional will talk with the insurance coverage firm, negotiating a good settlement. If negotiations are unsuccessful, the case could proceed to litigation.

This course of will be complicated, requiring cautious consideration to deadlines and authorized procedures. The potential challenges embody the insurance coverage firm’s refusal to acknowledge legal responsibility or provide an affordable settlement.

Forms of Instances Dealt with by Attorneys

Clearwater automotive insurance coverage declare attorneys sometimes deal with a wide selection of circumstances, together with these involving:

- Private accidents ensuing from accidents, akin to whiplash, damaged bones, or traumatic mind accidents.

- Property harm, together with automotive repairs, and potential replacements.

- Misplaced wages attributable to missed work following an accident.

- Ache and struggling, which will be substantial and require a radical analysis.

These circumstances typically require professional evaluation of medical information, accident reviews, and different proof. The legal professional will current a compelling argument to help the consumer’s declare and maximize the settlement.

Legal professional Profiles

| Legal professional Title | Space of Experience | Contact Data | Transient Description of Companies |

|---|---|---|---|

| John Smith | Advanced accident circumstances, high-value settlements | (123) 456-7890, john.smith@e-mail.com | Skilled in dealing with critical damage claims, representing purchasers in negotiations and litigation. |

| Jane Doe | Property harm claims, insurance coverage disputes | (987) 654-3210, jane.doe@e-mail.com | Focuses on recovering compensation for automobile harm and resolving disputes with insurance coverage corporations. |

| David Lee | Private damage claims, accident reconstruction | (555) 123-4567, david.lee@e-mail.com | Proficient in evaluating accidents, reconstructing accidents, and advocating for purchasers’ rights. |

Discovering a Clearwater Automobile Insurance coverage Declare Legal professional

Navigating the complexities of a automotive insurance coverage declare will be daunting. A certified Clearwater automotive insurance coverage declare legal professional can considerably enhance your possibilities of a positive end result. They perceive the nuances of insurance coverage insurance policies, procedures, and authorized frameworks, permitting them to advocate successfully in your behalf.Discovering the precise legal professional is essential for a profitable declare. This entails cautious analysis and consideration of assorted elements, from expertise to success charges.

This information will Artikel efficient strategies for finding a certified legal professional and key standards for making an knowledgeable determination.

Strategies for Discovering a Clearwater Automobile Insurance coverage Declare Legal professional

Discovering a certified Clearwater automotive insurance coverage declare legal professional entails exploring varied avenues. These embody leveraging on-line assets, searching for suggestions, and consulting skilled organizations.

- On-line Authorized Directories: Quite a few on-line directories compile data on attorneys, together with their specializations, areas of observe, and consumer opinions. These assets can present a complete overview of accessible attorneys in your space, enabling you to check their profiles and establish potential candidates.

- Skilled Referrals: Referrals from trusted sources, akin to buddies, household, or different professionals, will be invaluable. Private suggestions present insights into an legal professional’s efficiency and consumer satisfaction.

- Native Bar Associations: Native bar associations keep directories of their members, which frequently embody attorneys specializing in automotive insurance coverage claims. This useful resource gives entry to attorneys who adhere to skilled requirements and are lively within the native authorized group.

Researching Legal professional Expertise and Success Charges, Automobile insurance coverage declare legal professional clearwater

Thorough analysis into an legal professional’s expertise and success price is significant. This significant step permits you to gauge their proficiency in dealing with comparable circumstances. A monitor document of profitable outcomes demonstrates the legal professional’s functionality and competence.

- Expertise Stage: Take into account the variety of years the legal professional has practiced regulation, significantly in automotive insurance coverage claims. An legal professional with intensive expertise is extra prone to possess a robust understanding of the intricacies of those circumstances.

- Case Success Charge: Search for information on the legal professional’s success price in automotive insurance coverage claims. Analyze their success price and outcomes to know their effectiveness in comparable circumstances. A excessive success price typically correlates with sturdy advocacy expertise and an in-depth understanding of the authorized framework.

Evaluating Legal professional Evaluations and Testimonials

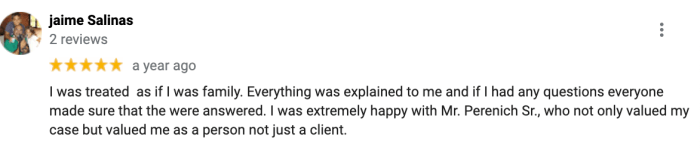

Evaluating legal professional opinions and testimonials is a vital facet of the choice course of. These insights provide direct suggestions from earlier purchasers, offering precious details about the legal professional’s communication type, responsiveness, and total efficiency.

- Shopper Suggestions: Analyze on-line opinions and testimonials to know consumer experiences. Take into account the tone and content material of the opinions to achieve insights into the legal professional’s strengths and weaknesses. This may also help establish attorneys who persistently present distinctive service and help to their purchasers.

- Communication Model: Search for opinions that spotlight the legal professional’s communication type. Consider in the event that they successfully clarify authorized ideas, hold purchasers knowledgeable, and keep clear communication all through the method. Wonderful communication is essential for a optimistic consumer expertise.

Comparability of Strategies for Discovering an Legal professional

The desk under summarizes varied strategies for finding a certified Clearwater automotive insurance coverage declare legal professional.

| Methodology | Execs | Cons |

|---|---|---|

| On-line Directories | Intensive data, straightforward comparability | Might not mirror present efficiency, potential for inaccurate data |

| Referrals | Trusted suggestions, personalised perception | Restricted perspective, probably biased |

| Native Bar Associations | Entry to certified members, adherence to requirements | Might not provide particular case particulars, probably restricted choice |

Components to Take into account When Choosing a Clearwater Automobile Insurance coverage Declare Legal professional

Choosing a Clearwater automotive insurance coverage declare legal professional necessitates cautious consideration of a number of elements. This course of entails evaluating their experience, communication type, and total method to consumer illustration.

- Specialization: An legal professional specializing in automotive insurance coverage claims possesses in-depth data of related legal guidelines and rules. This specialization ensures that they’re well-versed in dealing with complicated insurance coverage disputes successfully.

- Communication Model: A transparent and constant communication type is essential. An legal professional who maintains open communication and promptly addresses considerations demonstrates a dedication to consumer satisfaction.

- Charges and Cost Construction: Understanding the legal professional’s charges and fee construction is crucial. A clear and affordable price construction ensures that the consumer is conscious of all prices related to the authorized illustration.

Understanding Automobile Insurance coverage Declare Legal professional Charges

Navigating the complexities of a automotive insurance coverage declare will be difficult. Understanding the charges related to a Clearwater automotive insurance coverage declare legal professional is essential for making knowledgeable choices. This information empowers you to pick the precise authorized illustration and handle expectations concerning prices.Clearwater automotive insurance coverage declare attorneys sometimes make use of varied price buildings to compensate for his or her providers. These buildings, whereas various, are designed to mirror the complexity of the case, the legal professional’s expertise, and the potential end result.

Widespread Payment Constructions

Completely different price buildings exist, every with its personal benefits and drawbacks. Understanding these variations is crucial to align your expectations with the legal professional’s compensation mannequin.

- Contingency Charges: These charges are contingent on the profitable end result of your declare. The legal professional receives a proportion of the recovered compensation. This association will be interesting, as you probably pay nothing if the case is unsuccessful. Nonetheless, the legal professional’s motivation is tied to the restoration, probably affecting their negotiation technique. For instance, if a declare ends in a $10,000 settlement and the legal professional fees a 33% contingency price, the legal professional receives $3,300.

Conversely, if the case is unsuccessful, the consumer does not owe any charges.

- Hourly Charges: Attorneys could cost a set hourly price for his or her providers. This construction gives extra transparency, permitting you to estimate prices upfront. Nonetheless, the full value can develop into vital relying on the complexity and period of the case. This method typically entails a retainer price, a pre-paid sum to cowl preliminary work. For instance, if an legal professional fees $300 per hour and spends 10 hours on the case, the full value is $3,000.

The consumer’s understanding of the anticipated hours spent on the case is essential on this association.

- Hybrid Payment Constructions: Some attorneys mix parts of contingency and hourly charges. These preparations could provide a contingency price on the settlement quantity exceeding a sure threshold or a mix of hourly charges and a contingency proportion. This will stability the potential for top prices with the potential for top recoveries. This construction supplies flexibility and probably mitigates danger for each events.

Components Influencing Legal professional Charges

A number of elements can affect the price of a automotive insurance coverage declare legal professional’s providers. These issues assist decide the suitable compensation for the legal professional’s time and experience.

- Complexity of the Case: A simple declare could contain a comparatively easy price construction, whereas a posh case with a number of events or disputed points would possibly necessitate a better price. The extra intricate the declare, the extra time and assets the legal professional doubtless must commit to the case, thereby rising the price.

- Legal professional’s Expertise and Status: Established attorneys with intensive expertise in automotive insurance coverage claims sometimes command larger charges in comparison with newer practitioners. Their repute and profitable monitor document can affect their pricing construction.

- Location: The price of dwelling and authorized market situations in a selected space, akin to Clearwater, can influence legal professional charges. Regional variations in market pricing and repair demand could have an effect on the general value of authorized illustration.

Significance of Understanding Payment Construction

Understanding the price construction is important earlier than hiring an legal professional. This consciousness permits you to evaluate completely different choices and choose essentially the most appropriate illustration on your monetary capability.

| Payment Construction | Execs | Cons |

|---|---|---|

| Contingency Payment | Potential for no upfront value if case fails; probably larger restoration for consumer | Final result-dependent; potential for lowered negotiation effort; danger of decrease settlement quantity |

| Hourly Charge | Transparency in value; potential for extra management over the legal professional’s actions; predictable value estimate | Price can escalate shortly if the case takes longer than anticipated; probably larger upfront prices |

| Hybrid Construction | Balances danger and reward; probably gives extra predictable prices | Complexity in calculating the ultimate price; potential for misunderstandings concerning the price construction |

Widespread Points in Automobile Insurance coverage Claims

Navigating the complexities of automotive insurance coverage claims will be irritating. From disputes over legal responsibility to protection denials, understanding the frequent points can empower you to guard your rights and pursuits. A Clearwater automotive insurance coverage declare legal professional may also help you navigate these challenges, making certain a good decision.

Widespread Disputes in Automobile Insurance coverage Claims

Disagreements continuously come up in automotive insurance coverage claims, typically stemming from differing interpretations of legal responsibility, harm assessments, or protection particulars. These disputes can considerably influence the end result of your declare.

- Legal responsibility Disputes: Figuring out who’s at fault in an accident is a vital step within the claims course of. These disputes typically contain conflicting witness statements, unclear accident scenes, or complicated authorized interpretations of negligence. As an illustration, a driver claiming one other driver brought about the accident would possibly encounter a counterclaim from the opposite driver, resulting in authorized wrangling over accountability.

An legal professional may also help analyze proof, interview witnesses, and current a compelling case to ascertain legal responsibility.

- Harm Assessments: Evaluating the extent of harm to automobiles is one other supply of battle. Variations in opinion between insurance coverage adjusters and the claimant can come up from discrepancies in restore estimates, photographic proof, or the presence of pre-existing harm. An legal professional may also help safe correct value determinations and be sure that the restore prices mirror the precise harm incurred. This typically entails professional witnesses to judge the harm and help the declare.

- Insurance coverage Protection Disputes: Understanding the scope of insurance coverage protection will be difficult. Claims could also be denied attributable to exclusions within the coverage, insufficient protection limits, or a misinterpretation of coverage phrases. As an illustration, an accident that occurred whereas utilizing a automobile outdoors of the permitted utilization Artikeld within the coverage might result in a declare denial. An legal professional may also help decipher coverage language, establish potential protection gaps, and advocate for applicable compensation.

Causes for Automobile Insurance coverage Declare Denials

Insurance coverage corporations could deny claims for varied causes. Recognizing these potential pitfalls may also help you proactively handle them and improve your possibilities of a profitable declare.

- Coverage Violations: Driving drunk or medicine, or utilizing the automobile for actions outdoors the coverage’s scope, can result in declare denial. An legal professional may also help decide whether or not the actions resulting in the accident fall inside the coverage’s protection parameters.

- Pre-Current Harm: If pre-existing harm was not correctly disclosed, the declare is likely to be denied. A radical assessment of the automobile’s historical past is essential. An legal professional may also help be sure that all related data is offered precisely.

- Inadequate Proof: Lack of ample proof to help the declare, akin to lacking witness statements or insufficient documentation of the accident, can lead to declare denial. An legal professional may also help acquire and current obligatory proof to strengthen the declare.

- Failure to Adjust to Declare Procedures: Failure to adjust to the insurance coverage firm’s declare procedures, akin to offering required documentation or attending scheduled appointments, can lead to declare denial. An legal professional may also help be sure that the declare course of is adopted meticulously.

Addressing Declare Denial Causes

A well-prepared technique is essential to overcoming declare denials.

| Declare Denial Motive | Methods to Tackle Them |

|---|---|

| Coverage Violations | Reviewing coverage language, gathering proof to show compliance with coverage phrases, and consulting with an legal professional to know coverage specifics. |

| Pre-existing Harm | Thorough documentation of the automobile’s situation earlier than the accident, together with photographic proof and restore information. An legal professional may also help be sure that all related data is offered precisely and in truth. |

| Inadequate Proof | Gathering witness statements, securing accident reviews, acquiring medical information, and preserving all proof associated to the declare. An legal professional may also help in successfully gathering and presenting proof to strengthen the declare. |

| Failure to Adjust to Declare Procedures | Understanding the insurance coverage firm’s particular declare procedures, making certain all required documentation is offered promptly, and consulting with an legal professional to navigate the declare course of. |

Authorized Procedures for Automobile Insurance coverage Claims

Navigating the complexities of a automotive insurance coverage declare will be daunting. Understanding the authorized procedures concerned, the significance of proof gathering, and the negotiation course of empowers you to successfully pursue your rights and obtain a positive end result. This part particulars the steps concerned in a Clearwater automotive insurance coverage declare, providing sensible insights that will help you by way of the method.

Submitting a Declare

The preliminary step in pursuing a automotive insurance coverage declare entails formally reporting the accident to the related insurance coverage firm. This sometimes requires offering particulars of the incident, together with the date, time, location, and an outline of the accident. Crucially, this step must be documented with a police report each time attainable. This report serves as official documentation of the incident, which is commonly instrumental in declare decision.

Get hold of copies of all paperwork associated to the accident.

Gathering and Preserving Proof

Thorough proof gathering is paramount in a automotive insurance coverage declare. This contains pictures of the harm to the automobiles concerned, the accident scene, and any accidents sustained. Additionally, collect witness statements and call data, in addition to any related documentation like medical payments or restore estimates. Preserving proof in its unique type is significant to forestall tampering or loss.

Required Paperwork in a Declare

A wide range of paperwork are sometimes obligatory for a profitable declare. These embody the police report (if relevant), medical information, restore estimates, and proof of possession of the automobile. Insurance coverage coverage particulars, akin to protection limits and deductibles, are additionally essential. Moreover, pictures and witness statements contribute considerably to a complete declare.

Negotiating with Insurance coverage Firms

Efficient communication and negotiation are key to resolving a automotive insurance coverage declare. Understanding your rights and the phrases of your insurance coverage coverage is crucial. When partaking with insurance coverage adjusters, keep knowledgeable and calm demeanor. Doc all interactions and communications, noting dates, occasions, and the small print mentioned. Take into account searching for authorized counsel if negotiations develop into contentious or unproductive.

Timeline for Declare Decision

A structured timeline for resolving automotive insurance coverage claims can present readability and expectations.

| Milestone | Description | Estimated Timeframe |

|---|---|---|

| Preliminary Declare Submitting | Reporting the accident and offering obligatory particulars to the insurance coverage firm. | Inside 24-48 hours |

| Proof Gathering | Gathering all related paperwork and proof, together with photographs, witness statements, and medical information. | 1-2 weeks |

| Insurance coverage Analysis | Insurance coverage firm assessing the declare and evaluating damages. | 2-4 weeks |

| Negotiation and Settlement | Discussions between the events concerned to succeed in a settlement. | 4-8 weeks |

| Cost and Declare Closure | Finalizing the fee and shutting the declare. | 1-2 weeks |

Notice: These timelines are estimations and should differ relying on the complexity of the declare and the insurance coverage firm’s procedures.

Significance of Proof in Automobile Insurance coverage Claims

Successful your automotive insurance coverage declare hinges on presenting compelling proof. A well-documented case strengthens your place, will increase your possibilities of a positive end result, and may considerably influence the compensation you obtain. Our Clearwater automotive insurance coverage declare attorneys perceive the nuances of gathering and presenting proof successfully.Thorough documentation is essential to proving your case and acquiring the compensation you deserve.

Proof acts as an important hyperlink between your declare and the insurance coverage firm’s understanding of the scenario. This permits the insurance coverage firm to pretty assess the circumstances and decide aligned with the details offered.

Forms of Essential Proof

Proof in automotive insurance coverage claims is available in varied types. Every sort performs a novel function in supporting your case. Understanding these sorts is significant for efficient declare preparation.

- Images:

- Police Reviews:

- Witness Statements:

- Medical Data:

- Automobile Upkeep Data:

- Insurance coverage Coverage Paperwork:

- Rental Data:

Images are invaluable in documenting the harm to your automobile, the scene of the accident, and any accidents sustained. Excessive-quality photographs taken from completely different angles provide a complete visible document. They’re significantly essential for establishing the extent of harm and the circumstances of the accident.

Police reviews present an official document of the accident, detailing the concerned events, the circumstances, and the reported harm. They’re typically important in figuring out legal responsibility and establishing the factual foundation of the declare.

Unbiased witness accounts can corroborate your model of occasions and add weight to your declare. These statements must be obtained and documented promptly to make sure accuracy and forestall any potential conflicts in a while.

Medical information detailing accidents sustained within the accident are important for evaluating the extent of your damages and supporting the declare for medical bills. This proof proves the bodily influence of the accident and its influence in your well-being.

Data of car upkeep, akin to restore information, are essential to show the automobile’s situation earlier than the accident. This helps decide the pre-existing situations of the automobile.

Coverage particulars are important for verifying protection quantities and situations. Insurance coverage insurance policies play a significant function in figuring out the phrases and limitations of the protection.

In the event you needed to lease a automotive after the accident, rental information doc the necessity for a substitute automobile and the price related to this. Rental information function proof for the monetary influence of the accident.

Preserving Proof Correctly

Preserving proof is essential to make sure its admissibility and accuracy in courtroom. Correct dealing with and storage forestall potential harm or alteration. Take precautions to safeguard this proof.

- Instantly safe the scene:

- Safe and retailer proof fastidiously:

- Doc all interactions:

If attainable, instantly doc the scene with photographs and notes. This ensures an correct illustration of the accident scene and the proof current.

Retailer any proof, together with pictures and paperwork, in a secure, dry, and safe location to forestall loss or alteration.

Hold information of all communications with the insurance coverage firm and another events concerned. This detailed documentation acts as an important safeguard in opposition to misinterpretations or misunderstandings.

Strengthening Your Declare with Proof

Proof acts as a robust device to bolster your declare and improve your place. The extra complete and dependable the proof, the larger the chance of a profitable declare.

- Reveal legal responsibility:

- Calculate damages:

- Assist your narrative:

Proof can clearly set up who was at fault within the accident. That is very important for making certain the accountable get together is held accountable.

Proof like restore payments, medical information, and rental receipts assist calculate the full damages suffered. This helps quantify the monetary influence of the accident.

Proof supplies sturdy help on your account of the accident. A well-documented narrative primarily based on verifiable proof is essential for the insurance coverage firm to know the scenario.

Important Proof for a Profitable Declare

A profitable automotive insurance coverage declare hinges on a strong assortment of proof. This is a complete listing:

- Images of the harm to your automobile and the accident scene.

- Copies of the police report.

- Statements from witnesses.

- Medical information detailing accidents.

- Proof of car upkeep earlier than the accident.

- Copies of your insurance coverage coverage.

- Rental information, if relevant.

Sources for Clearwater Automobile Insurance coverage Declare Attorneys: Automobile Insurance coverage Declare Legal professional Clearwater

Navigating the complexities of automotive insurance coverage claims will be difficult. Realizing the place to search out certified authorized illustration is essential to maximizing your possibilities of a positive end result. This part supplies precious assets for researching and choosing a good Clearwater automotive insurance coverage declare legal professional.Discovering the precise legal professional is a important step in resolving your automotive insurance coverage declare successfully. These assets will empower you to make knowledgeable choices and select a authorized skilled with the experience and expertise to characterize your pursuits diligently.

On-line Directories for Authorized Professionals

Finding respected attorneys typically begins with on-line directories. These assets provide detailed profiles of attorneys, together with their areas of experience, expertise, and consumer testimonials. Thorough analysis in these directories helps you establish attorneys specializing in automotive insurance coverage claims. Utilizing filters like location and space of regulation will slender your search successfully.

Authorized Assist Organizations in Clearwater

Authorized assist organizations play a significant function in offering accessible authorized providers to those that could not have the ability to afford non-public illustration. Many authorized assist organizations provide help with automotive insurance coverage claims, particularly for these going through monetary hardship. Contacting these organizations can result in potential illustration or precious steering on pursuing your declare.

| Group | Web site | Contact Data |

|---|---|---|

| Authorized Assist Society of Pinellas County | [Insert Website Address Here] | [Insert Phone Number and Email Address Here] |

| [Insert Another Legal Aid Organization Name] | [Insert Website Address Here] | [Insert Phone Number and Email Address Here] |

Authorized Publications and Sources

Staying knowledgeable about authorized developments associated to automotive insurance coverage claims will be advantageous. Authorized publications and journals typically function articles and analyses on present case regulation and authorized developments in automotive insurance coverage claims. Researching these assets permits you to perceive the intricacies of automotive insurance coverage claims and the way the regulation applies to particular conditions. For instance, the “Florida Bar Journal” continuously publishes articles related to Florida’s authorized panorama, together with automotive insurance coverage declare procedures.

Ideas for Choosing a Clearwater Automobile Insurance coverage Declare Legal professional

When selecting a automotive insurance coverage declare legal professional, contemplate elements like expertise, experience in automotive insurance coverage claims, and profitable case outcomes. Researching testimonials and consumer opinions can present precious perception into the legal professional’s repute and method. A radical understanding of the legal professional’s charges and fee construction is essential earlier than partaking their providers. These assets will information you in direction of choosing a authorized skilled able to advocating on your rights successfully.

Options to Hiring a Automobile Insurance coverage Declare Legal professional

Navigating a automotive insurance coverage declare will be complicated, probably resulting in disputes and delays. Whereas a talented legal professional will be invaluable in such conditions, exploring various approaches is likely to be extra appropriate relying on the specifics of your case. Understanding these alternate options empowers you to make knowledgeable choices about tips on how to greatest resolve your declare.

Negotiating Instantly with Insurance coverage Firms

Insurance coverage corporations typically have established processes for dealing with claims. Direct negotiation permits you to interact with the insurer’s representatives to succeed in a settlement. This method can prevent authorized charges and time.

When Negotiation May Be Appropriate

Direct negotiation is a viable various in a number of conditions. For instance, if the declare entails a minor harm or a simple accident, the place the legal responsibility is evident, direct negotiation is likely to be ample. Equally, if you’re snug speaking your case successfully and also you perceive the insurance coverage declare course of, chances are you’ll discover this method environment friendly. Moreover, if the potential settlement quantity is comparatively modest, the price of an legal professional could outweigh the potential advantages.

Examples of Profitable Negotiations

Quite a few people have efficiently negotiated settlements instantly with insurance coverage corporations. As an illustration, a driver concerned in a fender bender the place harm was minimal would possibly attain a fast and amicable settlement with the insurance coverage firm with out requiring authorized intervention. Equally, a policyholder experiencing a minor restore declare might doubtless resolve the matter with out an legal professional’s involvement.

Potential Dangers and Advantages of Direct Negotiation

Negotiating instantly with insurance coverage corporations will be useful by way of cost-effectiveness and velocity. Nonetheless, there is a danger of being taken benefit of or receiving an insufficient settlement. Insurance coverage adjusters are skilled negotiators, and with out authorized illustration, you is likely to be much less prone to safe the complete compensation you deserve. Conversely, profitable negotiations can prevent vital authorized bills and mean you can resolve the declare extra shortly.

Desk: Hiring an Legal professional vs. Negotiating Instantly

| Issue | Hiring an Legal professional | Negotiating Instantly |

|---|---|---|

| Price | Larger (legal professional charges, courtroom prices) | Decrease (probably no charges) |

| Time | Longer (authorized course of, courtroom hearings) | Probably shorter (negotiation will be sooner) |

| Experience | Skilled authorized experience | Requires understanding of insurance coverage claims course of |

| Management | Extra management over the method | Much less management over the method |

| Complexity of Declare | Appropriate for complicated claims | Appropriate for easy claims |

Final Conclusion

In conclusion, understanding your rights and choices when coping with a automotive insurance coverage declare in Clearwater is essential. This information supplies a roadmap for locating a certified automotive insurance coverage declare legal professional, navigating the authorized course of, and finally maximizing your possibilities of a positive decision. Bear in mind to fastidiously weigh your choices, analysis attorneys totally, and be ready to advocate on your pursuits.

Questions Usually Requested

What are the standard charges for a automotive insurance coverage declare legal professional in Clearwater?

Legal professional charges differ. Some work on a contingency foundation (receiving a proportion of the settlement), whereas others cost hourly charges. You’ll want to talk about the price construction upfront to keep away from any surprises.

What varieties of proof are essential in a automotive insurance coverage declare?

Essential proof contains police reviews, pictures of the harm, witness statements, and any documentation associated to the accident or your automobile. Preserving this proof is crucial.

How lengthy does a automotive insurance coverage declare sometimes take to resolve?

Declare decision timelines differ drastically relying on the complexity of the case, the insurance coverage firm’s response, and whether or not a declare legal professional is concerned. Nonetheless, the method can take weeks or months.

What are some alternate options to hiring a automotive insurance coverage declare legal professional?

Negotiating instantly with the insurance coverage firm is an alternate. Nonetheless, it is essential to concentrate on the dangers concerned and to have a transparent understanding of your rights and tasks.