Automotive insurance coverage for Hyundai Elantra is an important choice, impacting your pockets and peace of thoughts. Understanding the elements influencing premiums, evaluating insurance policies, and choosing the proper protection choices is vital to securing the absolute best deal. This complete information dives deep into every little thing it’s good to learn about insuring your Hyundai Elantra, from fundamental protection to specialised choices and probably saving cash.

Navigating the world of auto insurance coverage can really feel overwhelming, particularly in relation to a particular mannequin just like the Hyundai Elantra. This information is designed to simplify the method, offering a transparent and concise overview of insurance coverage insurance policies, comparisons between suppliers, and issues for various Hyundai Elantra fashions and driver profiles.

Hyundai Elantra Insurance coverage Overview

Defending your Hyundai Elantra is paramount, and understanding the nuances of insurance coverage prices is vital. Insurance coverage premiums aren’t a one-size-fits-all determine; elements like the precise mannequin, driver profile, and even your location play a big function. This overview gives a complete take a look at Hyundai Elantra insurance coverage, overlaying prices, influencing elements, and typical protection choices.

Typical Insurance coverage Prices for Hyundai Elantra Fashions

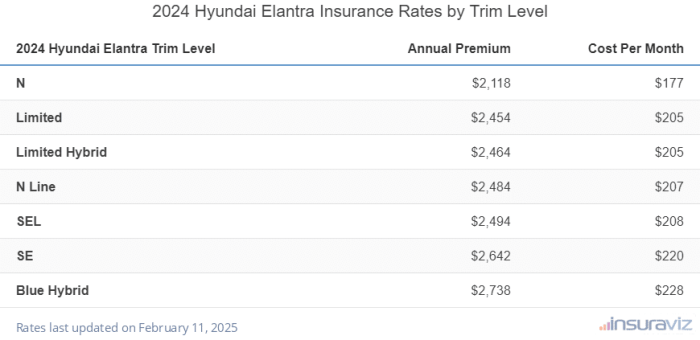

The value of insurance coverage for a Hyundai Elantra varies considerably relying on the trim stage and mannequin 12 months. Typically, newer fashions and better trim ranges usually command barely increased premiums on account of superior security options and probably increased restore prices. For instance, a top-of-the-line 2023 Elantra with superior driver-assistance programs will probably value extra to insure than a base mannequin from the identical 12 months.

Used fashions, conversely, usually have decrease premiums than their newer counterparts. These variations are usually not solely in regards to the automobile itself, but additionally the perceived worth and potential danger related to it.

Components Influencing Hyundai Elantra Insurance coverage Premiums

A number of key elements contribute to the ultimate insurance coverage premium to your Hyundai Elantra. A complete understanding of those parts means that you can make knowledgeable selections to probably decrease your prices. Driver historical past, together with previous accidents and site visitors violations, is a big issue. A clear driving document often interprets to decrease premiums, highlighting the significance of accountable driving habits.

The automobile’s options, like anti-theft programs or superior security applied sciences, may also affect premiums. For example, automobiles with superior airbags or computerized emergency braking programs usually include a perceived decrease danger of injury, which may result in a lower in premiums. Lastly, your location considerably impacts insurance coverage prices. Areas with increased charges of accidents or theft will usually end in increased premiums.

Widespread Insurance coverage Protection Choices for Hyundai Elantra Homeowners

Complete insurance coverage is an important side of defending your automobile. It covers injury from numerous perils, together with vandalism, hearth, and hail. Collision protection, then again, protects you from injury to your automobile ensuing from an accident, no matter who was at fault. Legal responsibility protection is obligatory in most states, guaranteeing you might be financially protected in case you trigger an accident and are held chargeable for damages to others.

The precise protection choices you select ought to align along with your private danger tolerance and monetary circumstances.

Common Insurance coverage Prices Comparability Desk

This desk gives a basic estimate of common annual premiums for various Hyundai Elantra fashions. Needless to say these are simply estimates and precise prices might fluctuate based mostly on particular person circumstances.

| Mannequin 12 months | Trim Stage | Estimated Annual Premium |

|---|---|---|

| 2022 | SE | $1,200 – $1,500 |

| 2022 | Restricted | $1,500 – $1,800 |

| 2023 | SE | $1,300 – $1,600 |

| 2023 | Restricted | $1,600 – $1,900 |

| 2024 | SE | $1,400 – $1,700 |

Evaluating Insurance coverage Suppliers for Hyundai Elantra

Defending your Hyundai Elantra is essential, and understanding the nuances of various insurance coverage suppliers is vital to securing the absolute best protection on the most inexpensive value. Choosing the proper insurance coverage firm is usually a daunting process, however it’s a significant step in safeguarding your funding. This usually includes weighing protection choices, premiums, and the extent of customer support supplied.Discovering the precise stability between these elements can considerably affect your peace of thoughts and monetary well-being.

By evaluating insurance policies, you may determine suppliers that supply aggressive charges tailor-made to your particular wants and driving habits. This exploration will empower you to make an knowledgeable choice, permitting you to confidently navigate the complexities of auto insurance coverage.

Protection Choices and Premiums

Totally different insurance coverage suppliers provide various ranges of protection to your Hyundai Elantra. Understanding these choices is significant to making sure you will have ample safety. Complete protection, which protects in opposition to damages past collisions, can considerably cut back your out-of-pocket bills within the occasion of an accident or injury. Legal responsibility protection, then again, safeguards you from monetary accountability if you’re at fault in an accident.

These completely different tiers of protection are important to think about when assessing your wants. Premiums fluctuate based mostly on elements equivalent to your driving document, automobile mannequin, and placement.

Aggressive Charges for Hyundai Elantra Homeowners

A number of insurance coverage suppliers usually provide aggressive charges for Hyundai Elantra homeowners. This usually relies on elements just like the automobile’s mannequin 12 months, security options, and the motive force’s profile. Reductions, equivalent to these for secure drivers or those that keep a clear driving document, are steadily supplied to encourage accountable driving practices and might considerably affect premiums. Moreover, some suppliers tailor their charges based mostly on elements such because the automobile’s anti-theft options.

Evaluating Main Insurance coverage Corporations

Analyzing the professionals and cons of outstanding insurance coverage firms is essential in making an knowledgeable choice. A comparative evaluation gives a transparent understanding of the strengths and weaknesses of every firm. This may help you discover a firm that aligns along with your wants and preferences.

| Insurance coverage Firm | Execs | Cons |

|---|---|---|

| Firm A | Aggressive charges, in depth protection choices, strong customer support portal. | Potential for increased premiums in high-risk areas. |

| Firm B | Glorious customer support fame, a number of reductions, digital declare course of. | Restricted protection choices in sure areas. |

| Firm C | Wide selection of bundled companies, usually affords a loyalty program. | Might have much less aggressive charges for sure drivers. |

Utilizing On-line Instruments for Comparability

Quite a few on-line instruments mean you can evaluate insurance coverage quotes to your Hyundai Elantra throughout numerous suppliers. These instruments streamline the method of acquiring quotes from a number of firms, saving you precious effort and time. By inputting your automobile particulars, location, and driving historical past, you may shortly evaluate premiums and protection choices from completely different suppliers. These instruments steadily present customized suggestions based mostly in your particular wants and preferences.

Utilizing these assets successfully can result in substantial financial savings and higher safety to your automobile.

Protection Choices Particular to Hyundai Elantra

Defending your Hyundai Elantra is extra than simply insuring its bodily type; it is about safeguarding your peace of thoughts on the street. Understanding the precise protection choices out there can considerably affect your monetary well-being and general driving expertise. This part delves into the important protection choices usually related to Hyundai Elantra fashions, emphasizing the benefits and drawbacks that will help you make knowledgeable selections.Complete insurance coverage goes past the fundamentals, overlaying unexpected circumstances.

The correct protection protects your funding and gives a security internet when sudden occasions happen, like accidents or damages from storms. Choosing the proper stage of protection is essential, tailor-made to your particular person driving habits and monetary circumstances.

Roadside Help

Roadside help is an important add-on protection that gives very important help while you encounter mechanical points or sudden conditions on the street. It usually consists of companies like jump-starting your automobile, offering gasoline supply, and towing in case of a breakdown. This protection can prevent vital time and expense, particularly in distant areas or throughout sudden conditions.

Rental Automotive Protection

Rental automobile protection is a precious add-on, particularly for many who steadily use their Hyundai Elantra for commuting or enterprise journey. It compensates for the inconvenience and price of renting a automobile when your automobile is out of service on account of an accident or restore. This protection can considerably cut back monetary stress in periods of auto unavailability.

Collision Protection, Automotive insurance coverage for hyundai elantra

Collision protection protects your Hyundai Elantra in opposition to damages attributable to collisions with different automobiles or objects. This protection is vital for stopping monetary losses from repairs or substitute prices, particularly in circumstances of extreme injury. It’s often a worthwhile addition to your coverage, guaranteeing you are financially protected in opposition to unexpected circumstances.

Complete Protection

Complete protection is designed to guard your Hyundai Elantra from damages that are not attributable to collisions, equivalent to vandalism, hearth, or pure disasters. This protection is essential for safeguarding your automobile in opposition to numerous unexpected circumstances that may result in substantial repairs or replacements. The significance of complete protection is especially excessive in areas susceptible to pure disasters or excessive crime charges.

Instance Add-on Protection Prices

| Protection Possibility | Estimated Value (Annual) |

|---|---|

| Roadside Help | $75 – $150 |

| Rental Automotive Protection | $100 – $250 |

| Collision Protection | $100 – $300 |

| Complete Protection | $50 – $200 |

Observe: These are estimates and precise prices might fluctuate based mostly in your particular location, driving historical past, and chosen insurance coverage supplier.

Selecting the Proper Protection Stage

Evaluating your particular person wants and driving habits is vital to deciding on the suitable stage of protection. Components like your commute distance, driving frequency, and the probability of encountering extreme climate situations all play a job in figuring out the mandatory protection. If you happen to steadily journey lengthy distances or dwell in a high-risk space, increased ranges of protection may be extra prudent.

This cautious evaluation ensures you are financially protected whereas avoiding pointless premiums.

Security Options and Insurance coverage Implications

Defending your self on the street is paramount, and the protection options in your Hyundai Elantra immediately affect your insurance coverage premiums. A automobile’s inherent security performs a pivotal function within the danger evaluation that insurance coverage firms carry out. Drivers with automobiles boasting superior security applied sciences usually get pleasure from extra favorable insurance coverage charges, reflecting the diminished probability of accidents and the potential for much less extreme injury within the occasion of 1.Understanding the intricate hyperlink between security options and insurance coverage prices empowers you to make knowledgeable selections about your automobile’s safety and your monetary well-being.

This information means that you can select a Hyundai Elantra mannequin that aligns along with your security priorities and price range, providing a seamless mix of safety and affordability.

Influence of Security Options on Insurance coverage Premiums

Insurance coverage firms meticulously analyze automobile security options to evaluate danger. Fashions outfitted with a complete suite of security applied sciences usually obtain decrease premiums, demonstrating the direct correlation between superior security and diminished insurance coverage prices. This is not merely a theoretical idea; it is a sensible reflection of how security options translate into real-world monetary advantages.

Particular Security Options and Their Influence

Numerous security options in Hyundai Elantra fashions contribute to decrease insurance coverage premiums. Options like anti-lock braking programs (ABS), digital stability management (ESC), and superior airbags demonstrably cut back accident severity and the potential for vital damages. These are essential parts in a complete security package deal.

Superior Driver-Help Methods (ADAS) and Insurance coverage

Superior Driver-Help Methods (ADAS) are remodeling the driving expertise and influencing insurance coverage premiums. Options like lane departure warning, computerized emergency braking, and adaptive cruise management have gotten more and more frequent. These applied sciences proactively mitigate dangers, considerably lowering the probability of accidents. Insurance coverage firms acknowledge the constructive affect of ADAS on security, usually reflecting this in additional favorable premiums for automobiles outfitted with these programs.

Correlation Between Hyundai Elantra Security Options and Estimated Insurance coverage Prices

| Security Characteristic | Estimated Influence on Insurance coverage Prices | Rationalization |

|---|---|---|

| Anti-lock Braking System (ABS) | Doubtlessly decrease premiums | ABS improves braking management, lowering the chance of skidding and accidents. |

| Digital Stability Management (ESC) | Doubtlessly decrease premiums | ESC enhances automobile stability in difficult situations, stopping lack of management. |

| Superior Airbags (together with driver and passenger airbags, facet airbags) | Doubtlessly decrease premiums | Airbags mitigate accidents in collisions by deploying to guard occupants. |

| Lane Departure Warning | Doubtlessly decrease premiums | This technique alerts the motive force to unintended lane departures, lowering the chance of collisions. |

| Computerized Emergency Braking (AEB) | Doubtlessly decrease premiums | AEB can robotically apply brakes in sure conditions, stopping or mitigating collisions. |

| Adaptive Cruise Management | Doubtlessly decrease premiums | ACC maintains a secure distance from the automobile forward, lowering the chance of rear-end collisions. |

Observe: Estimated affect on insurance coverage prices depends on particular person driving historical past, location, and different elements. Insurance coverage premiums are in the end decided by the insurance coverage supplier.

Insurance coverage Claims Course of for Hyundai Elantra

Navigating the complexities of an insurance coverage declare may be emotionally draining, particularly when a cherished Hyundai Elantra is concerned. This course of, whereas usually daunting, may be streamlined with a transparent understanding of the steps concerned. Figuring out what to anticipate and tips on how to proceed can ease the burden and assist you to get again on the street as shortly as doable.

Understanding Widespread Declare Causes

Accidents, sadly, are a typical incidence on the roads. A variety of incidents can result in insurance coverage claims for a Hyundai Elantra. These embrace collisions with different automobiles, accidents involving pedestrians, and even injury attributable to extreme climate. Typically, the injury to your Elantra would possibly stem from vandalism or theft. Understanding the explanations behind a declare is essential to making sure a clean and environment friendly course of.

A transparent understanding of the circumstances surrounding the injury is significant for precisely assessing the declare.

Documentation Required for a Hyundai Elantra Declare

Thorough documentation is crucial for a profitable insurance coverage declare. This includes gathering proof that particulars the incident, the extent of injury, and your actions following the accident. Accumulating the precise paperwork ensures your declare is processed effectively. The next is a complete checklist of the paperwork wanted:

- Police Report (if relevant): A police report is a crucial piece of documentation, particularly in circumstances of accidents involving different events. It gives a proper document of the incident, together with particulars of the accident scene, witness statements, and the reason for the accident. This helps guarantee all events concerned are held accountable.

- Pictures of Injury: Excessive-quality images of the injury to your Hyundai Elantra are important. These ought to clearly depict the extent of the injury to all seen components of the automobile. This proof is instrumental in assessing the declare and establishing the necessity for repairs.

- Rental Automotive Receipts (if relevant): If you happen to wanted a rental automobile whereas your Elantra was being repaired, preserve information of rental automobile receipts. This demonstrates the necessity for non permanent transportation and helps in declare processing.

- Medical Data (if relevant): In circumstances the place accidents happen, preserve detailed medical information to doc the remedy obtained. Medical payments and physician’s notes are vital components of the declare course of.

- Insurance coverage Coverage Paperwork: Having your insurance coverage coverage available is essential. This doc Artikels your protection particulars, coverage limits, and different related data for declare processing.

Step-by-Step Declare Submitting Course of

Submitting an insurance coverage declare to your Hyundai Elantra includes a collection of steps, every enjoying a vital function within the general course of. Following these steps diligently can tremendously cut back the stress and anxiousness related to a declare.

- Contact Your Insurance coverage Supplier: Instantly contact your insurance coverage supplier to report the incident and provoke the declare course of. Offering correct particulars of the incident is essential for the declare to be processed appropriately. Clear communication at this stage is significant.

- Collect Required Documentation: Accumulate all mandatory documentation, together with police reviews, images, medical information, and receipts, as beforehand described. This ensures a clean declare processing expertise.

- Present Vital Data: Present all requested data to your insurance coverage supplier, together with particulars in regards to the accident, the injury to your automobile, and any related bills. Finishing the mandatory varieties precisely is vital.

- Submit Your Declare: Submit the declare type, together with the collected documentation, to your insurance coverage supplier. Making certain the declare is submitted precisely and utterly will save effort and time in the long term.

- Evaluation and Approval: Your insurance coverage supplier will assessment the submitted declare. The claims adjuster will consider the injury and decide in case your declare meets the phrases of your insurance coverage coverage. This stage can take time.

- Repairs and Settlement: In case your declare is authorized, the insurance coverage supplier will authorize repairs. It’s possible you’ll be concerned in selecting the restore store. As soon as the repairs are accomplished, the insurance coverage firm will course of the settlement based mostly on the agreed-upon phrases.

Reductions and Promotions for Hyundai Elantra Insurance coverage

Unlocking financial savings in your Hyundai Elantra insurance coverage is like discovering a hidden gem – a sense of aid and empowerment. Figuring out the out there reductions and promotions can considerably cut back your insurance coverage premium, placing extra money again in your pocket. This empowers you to make knowledgeable selections and ensures you are getting the absolute best worth to your insurance coverage protection.Figuring out and strategically leveraging these reductions is usually a game-changer, saving you a whole bunch of {dollars} yearly.

By understanding the factors and diligently looking for relevant promotions, you may maximize your financial savings, permitting you to allocate these funds in direction of your monetary targets, or just benefit from the peace of thoughts that comes with a extra inexpensive insurance coverage coverage.

Widespread Reductions for Hyundai Elantra Insurance coverage

Hyundai Elantra homeowners can usually qualify for a number of reductions, making insurance coverage extra inexpensive. These reductions are designed to reward accountable driving habits and replicate the worth you place in your automobile. Understanding these choices empowers you to take management of your insurance coverage prices and obtain monetary freedom.

- Protected Driving Reductions: Many insurance coverage suppliers provide reductions for secure drivers. This usually includes sustaining a clear driving document, that means no accidents or violations. For example, a driver with an ideal driving document for 5 years might probably see a considerable low cost on their insurance coverage premium. This encourages accountable driving habits, and rewards those that actively prioritize security.

- Defensive Driving Programs: Finishing a defensive driving course demonstrates a dedication to enhancing your driving expertise and data of site visitors legal guidelines. This usually leads to a reduction in your insurance coverage premiums, because it showcases your dedication to secure driving practices.

- A number of Autos Low cost: Insuring a number of automobiles with the identical supplier usually leads to a reduction. This low cost acknowledges the dedication of insuring a number of automobiles with a single firm. For instance, a household insuring each their sedan and SUV with the identical supplier would possibly qualify for this low cost.

- Anti-theft Gadgets: Putting in anti-theft units like alarms or monitoring programs can present a reduction. This low cost acknowledges the additional safety measures taken to guard your automobile, and rewards proactive measures to safeguard your property.

- Pupil Reductions: Younger drivers usually qualify for reductions if they’re enrolled in a acknowledged academic establishment. That is based mostly on the belief that college students are sometimes extra accountable and conscious of the significance of secure driving practices. For instance, faculty college students or excessive schoolers might qualify for this low cost.

Figuring out and Leveraging Reductions

Profiting from out there reductions requires proactive analysis and engagement along with your insurance coverage supplier. Understanding the eligibility standards and diligently looking for relevant promotions is vital.

- Evaluation Coverage Paperwork: Rigorously assessment your insurance coverage coverage paperwork to determine any out there reductions. The advantageous print usually holds the important thing to unlocking vital financial savings.

- Contact Your Insurance coverage Supplier: Immediately contact your insurance coverage supplier to inquire about potential reductions. A easy cellphone name can uncover hidden financial savings alternatives.

- Verify for Bundled Reductions: Some insurance coverage suppliers provide bundled reductions for a number of companies. This will embrace combining your automobile insurance coverage with dwelling or renters insurance coverage for added financial savings.

- Discover On-line Sources: Make the most of on-line assets and comparability instruments to determine potential reductions throughout completely different insurance coverage suppliers.

Saving on Hyundai Elantra Insurance coverage Premiums

Insurance coverage premiums are a mandatory value of auto possession. There are a number of methods to successfully cut back these premiums and lower your expenses.

- Keep a Good Driving Document: Sustaining a clear driving document is crucial. Avoiding accidents and site visitors violations is essential for lowering insurance coverage premiums. Sustaining a clear document demonstrates accountable driving habits, which insurers worth.

- Evaluation Protection Choices: Evaluation your protection choices to make sure you aren’t paying for pointless safety. Tailoring your protection to your particular wants can considerably cut back your premiums.

- Evaluate Charges from A number of Suppliers: Evaluate charges from a number of insurance coverage suppliers to determine probably the most aggressive choices. This lets you choose the absolute best deal, optimizing your financial savings.

Understanding Hyundai Elantra Insurance coverage in Totally different Areas

The price of insuring your Hyundai Elantra is not a one-size-fits-all determine. Identical to the varied landscapes of America, insurance coverage premiums fluctuate considerably from state to state. Understanding these regional variations is essential for securing the absolute best protection at a value that matches your price range. This variability is a results of complicated elements, and realizing them empowers you to make knowledgeable selections about your automobile’s safety.

Regional Variations in Hyundai Elantra Insurance coverage Charges

Insurance coverage charges to your Hyundai Elantra are influenced by a posh interaction of things, primarily the traits of the area. Components like common accident charges, the frequency of extreme climate occasions, and even the general driving habits of the inhabitants in a given space considerably affect premiums. Think about a coastal state with a excessive incidence of hurricanes, the place automobiles might have extra complete protection.

Conversely, a state with low accident charges and a extra temperate local weather will probably have decrease premiums.

Influence of Location-Particular Components on Hyundai Elantra Insurance coverage

A number of key location-specific elements play a big function in shaping insurance coverage prices to your Hyundai Elantra. These embrace however aren’t restricted to: the native crime price, the variety of drivers per capita, and the typical age of drivers in a given space. A area with a excessive crime price may even see a rise in premiums on account of a better danger of theft or vandalism.

Equally, an space with a excessive proportion of younger drivers might face increased premiums reflecting a larger probability of accidents. An in depth understanding of those elements means that you can anticipate potential variations in your insurance coverage prices.

Evaluating Hyundai Elantra Insurance coverage Prices Throughout US Areas

The price of insurance coverage for a Hyundai Elantra varies dramatically throughout the US. For example, residents in states recognized for top accident charges, like sure areas of the northeast, would possibly pay considerably greater than these within the South or Southwest. A hypothetical comparability reveals a 20% distinction in premiums between a driver in California and a driver in Texas for a similar mannequin.

This illustrates the essential want for native evaluation when searching for insurance coverage.

Illustrative Map of Common Hyundai Elantra Insurance coverage Prices

A visible illustration of common Hyundai Elantra insurance coverage prices throughout the US may be created utilizing a map. The map could be color-coded, with darker shades representing increased common premiums and lighter shades representing decrease ones. States with increased charges might be highlighted in pink or orange, whereas these with decrease charges might be proven in inexperienced or yellow.

This map would clearly illustrate the geographic disparities in insurance coverage prices, permitting drivers to make knowledgeable comparisons between completely different areas and tailor their protection accordingly.

Components Influencing Regional Premiums

The elements affecting insurance coverage charges in numerous areas are quite a few. It isn’t merely in regards to the frequency of accidents, but additionally the severity of these accidents. A state with a historical past of extra extreme accidents, maybe on account of distinctive street situations or climate patterns, will usually command increased premiums. Moreover, the general monetary stability of the insurance coverage market in a given space additionally performs a job.

Conclusive Ideas: Automotive Insurance coverage For Hyundai Elantra

In conclusion, securing the precise automobile insurance coverage to your Hyundai Elantra includes cautious consideration of assorted elements. From evaluating completely different suppliers to understanding protection choices, security options, and potential reductions, this information equips you with the data to make knowledgeable selections. Finally, selecting the perfect coverage ensures monetary safety and peace of thoughts on the street.

Key Questions Answered

What elements affect the price of insurance coverage for a Hyundai Elantra?

A number of elements have an effect on your insurance coverage premium, together with your driving document, location, chosen protection choices, and the precise options and mannequin 12 months of your Hyundai Elantra.

What’s the distinction between legal responsibility, complete, and collision protection?

Legal responsibility protection protects you in case you’re at fault in an accident. Complete protection covers injury to your automobile from occasions apart from collisions (e.g., vandalism, climate). Collision protection pays for damages to your automobile in case you’re concerned in a collision, no matter who’s at fault.

How can I discover the perfect insurance coverage offers for my Hyundai Elantra?

Evaluating quotes from a number of insurance coverage suppliers is essential. Use on-line comparability instruments and take into account elements like reductions, protection choices, and buyer evaluations.

What are some frequent reductions out there for Hyundai Elantra insurance coverage?

Reductions usually embrace secure driving applications, good pupil reductions, and multi-policy reductions, if relevant.