Bike insurance coverage vs automobile insurance coverage – a vital choice for any rider. Navigating the nuances of protection, prices, and claims processes is important. This in-depth look gives a complete comparability, highlighting key variations and serving to you make the fitting selection.

From legal responsibility protection to complete safety, understanding the particular wants of motorbike insurance coverage is vital. Elements like rider expertise, bike kind, and placement considerably affect premiums. We’ll discover these points intimately to offer a transparent image.

Introduction to Bike Insurance coverage

Embarking on the exhilarating journey of motorcycling requires a profound understanding of the protecting protect provided by insurance coverage. Bike insurance coverage, a vital element of accountable using, safeguards your monetary well-being and the well-being of others. It is greater than only a doc; it is a dedication to security, a testomony to your consciousness of the highway’s inherent challenges, and a beacon of peace of thoughts on two wheels.Bike insurance coverage differs considerably from customary auto insurance coverage.

The inherent nature of bikes, their decrease weight, and sometimes smaller dimension contribute to elevated danger components. This necessitates a tailor-made method to protection, addressing the particular vulnerabilities and potential liabilities distinctive to bikes.

Bike Insurance coverage Protection Choices

Bike insurance coverage insurance policies usually embody a variety of coverages designed to deal with various potential dangers. These choices should not merely contractual provisions; they symbolize layers of safety in opposition to the uncertainties that life on the highway can current.

Widespread Bike Insurance coverage Coverages

The cornerstone of any complete motorbike insurance coverage coverage lies in its protection choices. These protections should not merely stipulations; they symbolize layers of safety, safeguarding your monetary future and providing peace of thoughts.

| Protection | Description |

|---|---|

| Legal responsibility | This elementary protection pays for damages to a different particular person or their property in an accident the place you might be at fault. It is akin to a security web, offering monetary help to these harmed by your actions on the highway. That is usually a compulsory element of any motorbike insurance coverage coverage, making certain your duty to others is upheld. |

| Complete | This protection protects your motorbike in opposition to incidents aside from collisions, comparable to theft, vandalism, or harm from pure disasters. It safeguards your funding and gives a way of safety, figuring out your motorbike is protected in opposition to a broad spectrum of potential perils. |

| Collision | This protection pays for damages to your motorbike in an accident, no matter who’s at fault. It gives monetary help within the occasion of a collision, making certain you’ll be able to restore or substitute your motorbike, whatever the circumstances. This protection is an important ingredient in sustaining your capacity to proceed your motorbike journey. |

| Uninsured/Underinsured Motorist | This protection protects you if you’re concerned in an accident with a driver who doesn’t have ample insurance coverage or is uninsured. It’s a necessary safeguard in opposition to monetary loss when confronted with irresponsible or negligent drivers. |

Elements Affecting Bike Insurance coverage Premiums

The trail to accountable using usually begins with understanding the components that form your motorbike insurance coverage premiums. These components, very similar to the intricate dance of the weather, affect the price of your safety, guiding you in direction of knowledgeable selections. Simply as a talented navigator reads the celestial charts, you can also navigate the panorama of insurance coverage prices by recognizing the variables at play.

Rider Expertise and Age

Rider expertise and age considerably affect motorbike insurance coverage premiums. A seasoned rider, having gathered miles and mastered the nuances of dealing with, usually receives a decrease premium. This displays the diminished danger related to expertise. Conversely, a more recent rider, nonetheless creating their expertise, carries the next danger profile, which interprets into the next premium. Age additionally performs a task, as youthful riders are typically thought of higher-risk because of components like inexperience and fewer developed judgment.

For instance, a rider with 5 years of expertise and a clear driving document could qualify for a decrease premium than a rider with just one yr of expertise and minor site visitors violations.

Bike Sort and Modifications

The kind of motorbike and any modifications considerably have an effect on insurance coverage premiums. Touring bikes, with their added weight and complexity, usually incur greater premiums in comparison with smaller, lighter sportbikes. Modifications, comparable to aftermarket exhaust methods or high-performance elements, may enhance premiums. It is because such modifications can alter the motorbike’s dealing with traits and probably improve its danger of involvement in accidents.

As an example, a custom-built sportbike with upgraded elements may appeal to the next premium than a typical mannequin.

Location and Claims Historical past

Location, just like the geographical terrain of the journey, is an important issue influencing motorbike insurance coverage premiums. Areas with the next focus of accidents or greater ranges of site visitors density usually end in greater premiums. A complete claims historical past, very similar to an in depth account of previous journeys, holds immense weight in figuring out premiums. A rider with a historical past of claims will typically pay greater than a rider with a clear document.

For instance, a rider in a metropolitan space with a latest accident declare may see a big enhance of their premium. A rider in a rural space with a clear document, nonetheless, may see a decrease premium.

Comparability of Bike and Automobile Insurance coverage Premium Elements

| Issue | Bike Insurance coverage | Automobile Insurance coverage |

|---|---|---|

| Rider Expertise | Essential; greater expertise, decrease premium | Essential; greater expertise, decrease premium |

| Rider Age | Youthful riders, greater premium | Youthful drivers, greater premium |

| Bike Sort | Bigger, extra highly effective bikes, greater premium | Bigger, extra highly effective automobiles, greater premium |

| Modifications | Aftermarket elements, greater premium | Aftermarket elements, greater premium |

| Location | Excessive-accident areas, greater premium | Excessive-accident areas, greater premium |

| Claims Historical past | Claims, greater premium | Claims, greater premium |

This desk summarizes the important thing components influencing each motorbike and automobile insurance coverage premiums. Understanding these components permits for proactive steps to handle insurance coverage prices and promote protected using practices.

Protection Comparisons

Embarking on the journey of motorbike possession necessitates a profound understanding of the intricate tapestry of protection choices. The ethereal dance between safety and duty takes middle stage in navigating the realm of insurance coverage. This understanding transcends mere monetary issues, encompassing the profound sense of safety that comes with figuring out your chosen automobile is shielded in opposition to unexpected circumstances.The realm of motorbike insurance coverage, whereas usually mirroring automobile insurance coverage, possesses distinctive nuances.

Legal responsibility necessities, complete protection, and the significance of roadside help all intertwine to form the contours of your protecting protect. This exploration delves into the delicate however important disparities, making certain you navigate this realm with enlightened discernment.

Legal responsibility Protection Necessities

Legal responsibility protection safeguards you in opposition to monetary repercussions stemming from incidents the place your actions trigger hurt to others. Bikes and vehicles each necessitate legal responsibility protection, however the particular necessities and limits range considerably. Bike legal responsibility protection usually entails decrease minimums in comparison with automobile insurance coverage, highlighting the differing levels of danger related to every automobile kind. Nevertheless, exceeding these minimums stays essential for sturdy monetary safety.

This disparity underscores the significance of tailoring protection to particular person circumstances and potential liabilities.

Complete and Collision Protection Variations

Complete protection safeguards in opposition to perils past your management, comparable to vandalism, theft, or weather-related incidents. Collision protection, conversely, addresses damages incurred in accidents involving your motorbike. Bike complete and collision protection usually possess decrease limits than comparable automobile protection, reflecting the inherent vulnerabilities of bikes in sure situations. This distinction emphasizes the need for cautious analysis of your particular wants and potential dangers.

Enough protection ensures you are outfitted to face unexpected occasions.

Uninsured/Underinsured Motorist Protection

Uninsured/underinsured motorist protection protects you if one other driver, missing enough insurance coverage, causes an accident. This protection is equally very important for bikes and vehicles, offering a security web within the occasion of an incident involving a negligent or uninsured driver. This side underscores the profound want for accountable and moral driving habits from all events concerned.

Roadside Help and Emergency Providers

Roadside help and emergency providers protection supply very important help when your motorbike encounters mechanical points or is concerned in an accident. This protection, usually missing in customary automobile insurance coverage, proves notably essential for bikes, given their inherent vulnerability in sure circumstances. Its inclusion can considerably mitigate the stress and inconvenience related to unexpected mechanical breakdowns or accidents. This emphasizes the vital position of preemptive planning in navigating the unpredictable nature of the highway.

Typical Protection Limits

| Protection Sort | Bike Insurance coverage (Typical) | Automobile Insurance coverage (Typical) |

|---|---|---|

| Legal responsibility Bodily Harm | $25,000-$100,000 per particular person, $50,000-$300,000 per accident | $25,000-$100,000 per particular person, $50,000-$300,000 per accident |

| Legal responsibility Property Harm | $25,000-$100,000 | $25,000-$100,000 |

| Complete | $1,000-$5,000 | $1,000-$10,000 |

| Collision | $1,000-$5,000 | $1,000-$10,000 |

| Uninsured/Underinsured Motorist | $25,000-$100,000 per particular person, $50,000-$300,000 per accident | $25,000-$100,000 per particular person, $50,000-$300,000 per accident |

This desk showcases typical protection limits. Precise limits range tremendously primarily based on the insurer, your location, and your particular person circumstances. All the time seek the advice of your insurance coverage supplier for exact particulars. A radical understanding of those figures is important to make sure ample safety.

Claims Course of and Settlements

The journey by the aftermath of a bike accident might be fraught with complexities. Navigating the claims course of and securing a good settlement requires understanding the particular procedures and potential pitfalls distinctive to motorbike insurance coverage. This intricate dance entails meticulous documentation, communication, and a nuanced appreciation for the inherent variations between motorbike and vehicle claims. The trail to decision requires a transparent understanding of the roles performed by all events concerned, from the injured rider to the insurance coverage adjusters.The claims course of for motorbike accidents usually differs considerably from that of automobile accidents as a result of inherent vulnerability of bikes and the usually extra complicated nature of accidents sustained.

Bike accidents steadily contain greater ranges of danger and potential for extra extreme penalties, necessitating a specialised method to dealing with claims. The objective of each processes, nonetheless, is to pretty compensate the injured events whereas making certain a simply and environment friendly decision.

Bike Accident Claims Course of

The method usually begins with reporting the accident to the related authorities and your insurance coverage firm. Thorough documentation is essential. This contains amassing witness statements, images of the accident scene, and medical data. The severity of the accident considerably impacts the period of the method. Minor incidents could also be resolved swiftly, whereas severe accidents can take a number of months and even years to conclude.

Adjusters play a vital position in assessing the harm, figuring out legal responsibility, and negotiating a good settlement.

Variations in Claims Dealing with

Bike insurance coverage claims usually contain a extra detailed evaluation of the harm to the motorbike and the rider’s accidents, as in comparison with automobile insurance coverage claims. This stems from the motorbike’s inherent vulnerability and the potential for extra severe accidents. Bike insurance coverage adjusters are sometimes extra conversant in the particular components affecting motorbike accidents and the distinctive challenges in calculating damages.

This specialization permits for a extra tailor-made method to resolving the declare.

Settlement Approaches

Settlement approaches in each kinds of claims usually contain negotiation between the events. This negotiation goals to achieve a mutually acceptable decision. The severity of the accident, the extent of accidents, and the perceived legal responsibility of the events affect the settlement. In some instances, mediation or arbitration could also be essential to facilitate a decision. Examples of such instances are these involving disputed legal responsibility or in depth accidents requiring important compensation.

Position of Adjusters

Bike insurance coverage adjusters are sometimes extremely specialised professionals. They possess a deep understanding of motorbike accident dynamics, restore prices, and damage evaluations. Their position extends past merely evaluating damages; they play a key position in investigating the accident, gathering proof, and negotiating settlements. Adjusters guarantee a good and environment friendly decision by adhering to established insurance coverage insurance policies and procedures.

Typical Steps in a Bike Declare

- Reporting: Instantly report the accident to the authorities and your insurance coverage firm. Correct and immediate reporting is essential for initiating the declare course of and preserving proof.

- Documentation: Gather all related paperwork, together with medical data, witness statements, and images of the accident scene. Thorough documentation considerably strengthens your declare and helps within the evaluation of damages.

- Investigation: The insurance coverage firm will conduct an investigation to find out the reason for the accident and the extent of damages. This entails reviewing proof and contacting witnesses to reconstruct the occasion.

- Evaluation: Adjusters consider the damages to the motorbike, property, and the accidents sustained by the rider. This evaluation kinds the premise for figuring out the quantity of compensation.

- Negotiation: The insurance coverage firm and the claimant negotiate a settlement that adequately compensates for the damages and accidents. Negotiations intention for a good decision that respects the rights and obligations of all events concerned.

- Settlement: As soon as an settlement is reached, the settlement is finalized, and the compensation is paid. This course of entails transferring funds and finishing all obligatory paperwork.

Settlement Timelines

| Facet | Bike Insurance coverage | Automobile Insurance coverage |

|---|---|---|

| Minor Accidents | Sometimes resolved inside 2-4 weeks | Sometimes resolved inside 1-3 weeks |

| Reasonable Accidents | Sometimes resolved inside 4-8 weeks | Sometimes resolved inside 2-6 weeks |

| Critical Accidents | Could take a number of months to a yr or extra | Could take a number of weeks to some months |

Notice: These are normal estimations. Precise timelines could range considerably relying on the specifics of the case, the complexity of the investigation, and the negotiation course of.

Bike vs. Automobile Insurance coverage

Embarking on the open highway, the wind whispering by your hair, a bike affords an exhilarating freedom. Nevertheless, this exhilarating expertise carries distinctive dangers that have to be acknowledged and understood. A profound understanding of those dangers is important for navigating the complexities of motorbike insurance coverage, permitting riders to make knowledgeable selections that safeguard their monetary well-being and their journey.

Particular Dangers Related to Bike Driving, Bike insurance coverage vs automobile insurance coverage

Bike using inherently presents distinct dangers in comparison with driving a automobile. The diminished safety afforded by a bike body, coupled with the rider’s larger publicity to the weather, considerably impacts insurance coverage premiums. Bikes are extra prone to collisions, with the rider usually bearing a larger portion of the affect. The smaller dimension and decrease profile of bikes additionally enhance the probability of being ignored by drivers of different automobiles, thereby growing the danger of accidents.

Understanding these distinctive dangers is essential for securing applicable insurance coverage protection.

Impression of Driving Sort on Premiums

The frequency and severity of potential accidents range considerably relying on the kind of motorbike using. Commuting riders, for example, usually face predictable and fewer hazardous routes, whereas racers or fans engaged in high-speed actions on twisting roads face larger dangers. This distinction immediately interprets into various premiums, with racing or stunt-style using usually commanding considerably greater charges.

Dangers of Accidents Involving Bikes

Accidents involving bikes steadily contain high-impact collisions. The vulnerability of the rider and the inherent instability of the motorbike can result in extra extreme accidents in comparison with automobile accidents. The rider’s lack of safety, coupled with the often-greater pressure of affect, considerably will increase the potential for severe damage and consequential monetary burden. This issue is a vital ingredient in assessing motorbike insurance coverage wants.

Specialised Protection for Particular Bikes

Sure kinds of bikes, comparable to custom-built or off-road fashions, usually require specialised insurance coverage protection. The distinctive options and potential for harm related to a lot of these bikes may necessitate extra protections not usually included in customary insurance policies. For instance, custom-built bikes could have modifications that void customary protection or necessitate specialised assessments.

Potential for Increased Declare Payouts in Bike Accidents

The potential for greater declare payouts in motorbike accidents is a big concern. The rider’s lack of considerable safety, mixed with the elevated probability of significant accidents, usually ends in substantial medical bills and long-term rehabilitation prices. Claims involving extreme accidents can considerably exceed these from comparable automobile accidents, underscoring the significance of complete motorbike insurance coverage protection.

Significance of Riders’ Consciousness of Private Dangers

A rider’s private danger evaluation is essential in figuring out the suitable insurance coverage protection. Elements like using expertise, using habits, and the kind of motorbike ridden considerably affect the potential for accidents. Skilled riders with a confirmed monitor document of protected using may qualify for decrease premiums, whereas these with a historical past of violations or reckless habits could face greater charges.

Kinds of Bike Accidents

| Accident Sort | Description |

|---|---|

| Collision with one other automobile | This can be a frequent kind of motorbike accident, the place a bike collides with a automobile, truck, or different motorbike. Typically, the motorbike is ignored, resulting in a extra extreme affect. |

| Fall or lack of management | Accidents can come up from varied causes, together with slippery roads, mechanical failures, or rider error. The dearth of protecting obstacles can result in severe accidents. |

| Object or impediment affect | Sudden objects or obstacles within the highway could cause riders to lose management, leading to falls or collisions. |

| Environmental hazards | Climate circumstances, like rain or ice, could make the highway floor hazardous, growing the probability of falls and accidents. |

Riders needs to be conscious about their particular person danger components and modify their using habits accordingly.

Value-Profit Evaluation and Suggestions: Bike Insurance coverage Vs Automobile Insurance coverage

Embarking on the trail of motorbike possession is a journey of freedom, a dance with the wind, a communion with the open highway. Nevertheless, this exhilarating expertise comes with the duty of understanding the monetary implications, particularly in terms of insurance coverage. This evaluation delves into the cost-benefit equation, illuminating the potential financial savings and profound advantages of securing applicable motorbike insurance coverage.A profound understanding of the associated fee construction of motorbike insurance coverage is important for navigating this journey properly.

This evaluation will unveil the nuances of the monetary panorama, offering a transparent roadmap to make knowledgeable selections. The comparability between motorbike and automobile insurance coverage, coupled with insightful suggestions, will empower you to decide on a path aligned along with your monetary objectives and private philosophy.

Common Prices of Bike and Automobile Insurance coverage

The monetary panorama of motorbike insurance coverage usually presents a stark distinction to that of automobile insurance coverage. Bike insurance coverage premiums usually fall under these for automobile insurance coverage, reflecting the decrease danger profile related to bikes. This distinction in prices arises from varied components, together with the decrease worth of a bike in comparison with a automobile, the potential for much less harm in an accident, and the often-lower probability of accidents in a bike accident.

Elements just like the rider’s expertise, location, and the kind of motorbike additional affect the associated fee.

Potential Financial savings Related to Bike Insurance coverage

Vital financial savings are sometimes attainable by the considered collection of motorbike insurance coverage. The decrease common premiums for motorbike insurance coverage can translate into substantial annual financial savings in comparison with automobile insurance coverage. As an example, a rider with a clear driving document and a low-risk motorbike mannequin may probably save tons of of {dollars} yearly by choosing a bike insurance coverage coverage as an alternative of a complete automobile insurance coverage coverage.

These financial savings might be channeled into experiences on the open highway, upgrades to the motorbike, or different private pursuits.

Advantages of Having Bike Insurance coverage

Past the monetary benefits, motorbike insurance coverage gives vital safety in unexpected circumstances. The monetary safety afforded by insurance coverage is important for dealing with the prices related to repairs, medical payments, and authorized charges within the occasion of an accident. This safety is not only about monetary safety, but in addition about peace of thoughts, permitting riders to benefit from the journey with out the burden of monetary anxieties.

It fosters a way of safety, enabling a extra carefree method to the highway.

Necessity of Fastidiously Evaluating Bike Insurance coverage Choices

The realm of motorbike insurance coverage affords a various spectrum of choices, every catering to various wants and preferences. A radical analysis of various coverage provisions is important to make sure the chosen coverage successfully safeguards your pursuits. Cautious consideration of things comparable to protection limits, deductibles, and add-on choices is essential for maximizing safety with out pointless bills.

Complete Overview of Value Concerns for Totally different Insurance coverage Choices

Navigating the panorama of motorbike insurance coverage requires a eager eye for element. Totally different choices, comparable to liability-only insurance policies, complete protection, and add-ons for roadside help or uninsured/underinsured motorist safety, include various worth tags. Understanding the specifics of every choice is vital to creating knowledgeable selections. The prices related to totally different choices usually mirror the extent of safety and the particular dangers concerned.

This necessitates a cautious examination of 1’s particular person wants and circumstances.

Value-Profit Evaluation Desk

| Insurance coverage Sort | Common Premium (USD) | Potential Financial savings (USD) | Key Advantages |

|---|---|---|---|

| Bike Legal responsibility Solely | $200-$500 | $300-$800+ | Primary authorized safety; lowest value. |

| Bike Complete | $300-$800 | $200-$700+ | Covers damages to the motorbike and different events concerned in an accident. |

| Automobile Insurance coverage | $800-$2000+ | $500-$1500+ | Broader protection; protects in opposition to automobile harm and potential accidents. |

Bike insurance coverage, usually a considerably extra inexpensive choice than automobile insurance coverage, permits riders to allocate extra sources in direction of the expertise and delight of the journey.

Bike Insurance coverage Sources

Navigating the labyrinth of motorbike insurance coverage choices can really feel overwhelming. But, understanding the obtainable sources empowers you to make knowledgeable selections, making certain your chosen coverage aligns harmoniously along with your wants and religious aspirations. A well-researched coverage, akin to a well-maintained machine, can present the safety and freedom obligatory for the soul’s journey.

Respected Bike Insurance coverage Suppliers

A plethora of insurance coverage suppliers cater to the motorbike group. Selecting a good supplier is paramount, because it signifies a dedication to honest practices and accountable service. Search suppliers with a robust monitor document, optimistic buyer opinions, and a transparent understanding of the nuances of motorbike insurance coverage. Transparency and moral practices are hallmarks of a good supplier.

Their dedication to buyer satisfaction is akin to a guiding mild within the huge expanse of insurance coverage decisions.

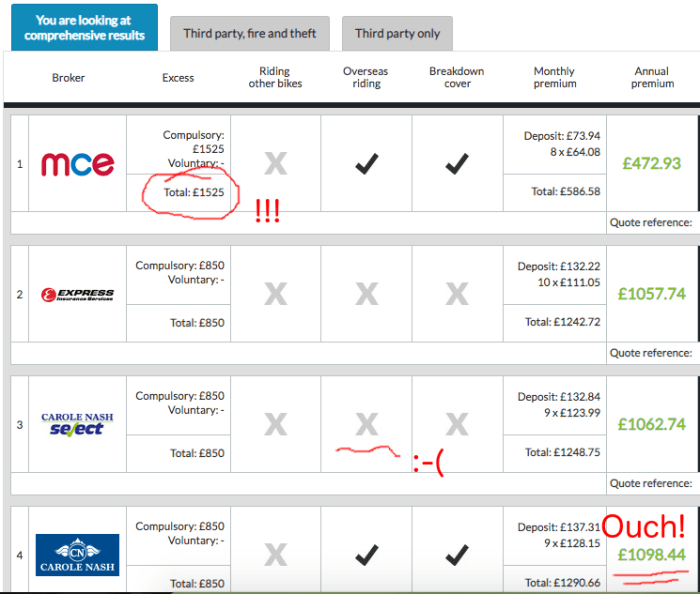

Helpful Sources for Evaluating Bike Insurance coverage Quotes

Comparability web sites present a handy platform to guage varied motorbike insurance coverage insurance policies. These platforms mixture quotes from a number of suppliers, simplifying the method of discovering the perfect match in your particular person wants. Make the most of these instruments to discover a variety of choices, making certain you uncover the optimum steadiness between protection and value. These instruments are like celestial maps, guiding you thru the complicated panorama of insurance coverage choices.

Significance of Researching and Evaluating Insurance policies

Thorough analysis and coverage comparisons are essential for acquiring probably the most favorable phrases. Do not accept the primary quote; as an alternative, evaluate insurance policies from totally different suppliers. This ensures you are not lacking out on probably decrease premiums or enhanced protection. This diligence is sort of a pilgrimage, a journey of discovery, that finally results in a safer and spiritually fulfilling path.

Position of On-line Comparability Instruments in Discovering the Greatest Bike Insurance coverage

On-line comparability instruments are invaluable belongings within the quest for the optimum motorbike insurance coverage. These instruments usually present personalised suggestions primarily based in your particular necessities, comparable to location, using expertise, and motorbike kind. They streamline the method, permitting you to concentrate on the core components of your religious journey. These instruments are akin to clever mentors, guiding you in direction of the very best path.

On-line Sources for Bike Insurance coverage

| Useful resource | Description |

|---|---|

| Insure.com | A complete on-line platform for evaluating varied insurance coverage insurance policies, together with motorbike insurance coverage. |

| Policygenius | A user-friendly web site offering a big selection of insurance coverage choices, together with motorbike insurance coverage. |

| NerdWallet | Gives detailed comparisons of motorbike insurance coverage insurance policies, enabling knowledgeable decision-making. |

| QuoteWizard | Offers an in depth collection of motorbike insurance coverage quotes, facilitating an easy comparability course of. |

These sources are important instruments for navigating the complicated world of motorbike insurance coverage.

Closure

Finally, selecting between motorbike and automobile insurance coverage is dependent upon particular person wants and circumstances. Contemplate your using model, potential dangers, and price range. Thorough analysis and comparisons are very important earlier than making a dedication. This information affords the insights you want to make an knowledgeable choice.

Widespread Queries

What are the everyday protection choices in a bike insurance coverage coverage?

Typical choices embody legal responsibility, complete, collision, and uninsured/underinsured motorist protection. Particular particulars range by insurer and coverage.

How does rider expertise have an effect on motorbike insurance coverage premiums?

Extra expertise usually interprets to decrease premiums, as insurers understand much less danger. Conversely, newer riders face greater premiums.

What are some frequent kinds of motorbike accidents?

Widespread sorts embody collisions with different automobiles, rollovers, and single-vehicle crashes. The particular kind of accident usually influences declare settlements.

What on-line sources can I take advantage of to match motorbike insurance coverage quotes?

Quite a few on-line comparability instruments exist that can assist you evaluate insurance policies from totally different suppliers.