Automotive insurance coverage in gainesville fl – Automotive insurance coverage in Gainesville, FL presents a posh panorama for drivers looking for optimum protection. This information delves into the intricacies of the native market, evaluating charges and protection choices to these in different Florida areas. Elements influencing premiums, equivalent to driving information and car sorts, will probably be analyzed intimately, providing insights into how these parts have an effect on your monetary accountability.

The out there insurance coverage corporations in Gainesville, FL will probably be reviewed, alongside numerous coverage sorts and their related advantages. Understanding the variations between legal responsibility, collision, and complete protection is essential for making knowledgeable selections. This detailed exploration may even tackle the claims course of and sources out there to Gainesville residents for help.

Automotive Insurance coverage in Gainesville, FL – Straight Info

Yo, Gainesville, lemme break down the automobile insurance coverage sport for you. It is not rocket science, nevertheless it’s vital to know the lay of the land. Insurance coverage charges ain’t the identical all over the place, and Gainesville, FL, has its personal distinctive vibe.The automobile insurance coverage market in Gainesville, FL, is fairly commonplace, like most locations. A number of corporations compete for your small business, however the charges are normally consistent with the remainder of Florida, although there are some native variations.

You will possible pay greater than another areas, particularly for those who stay in a high-theft zone or a crash-prone spot. It is all about danger and reward, fam.

Typical Automotive Insurance coverage Charges in Gainesville, FL

Insurance coverage premiums in Gainesville, FL, sometimes fall someplace in the midst of the state’s vary. Whereas exact figures are arduous to nail down, components like your driving document, car sort, and site all play a task in how a lot you will pay. Take into account that some components of Gainesville could be dearer than others attributable to greater crime charges or accident frequency.

Give it some thought like this: a model new sports activities automobile in a high-theft space will price extra to insure than a beat-up sedan in a quieter neighborhood.

Elements Influencing Automotive Insurance coverage Premiums in Gainesville, FL

A number of components contribute to your automobile insurance coverage price ticket. Driving document is HUGE. Accidents and dashing tickets are main crimson flags, considerably elevating your charges. The kind of automobile you drive additionally issues. Excessive-performance automobiles or these with the next probability of theft normally price extra to insure.

Location inside Gainesville is an element. Some areas could be extra liable to accidents or have greater theft charges, impacting premiums. Lastly, your age, gender, and even your credit score rating can affect your charges. So, be an excellent driver, preserve an excellent credit score rating, and make sensible decisions to maintain your premiums down.

Frequent Automotive Insurance coverage Firms Obtainable in Gainesville, FL

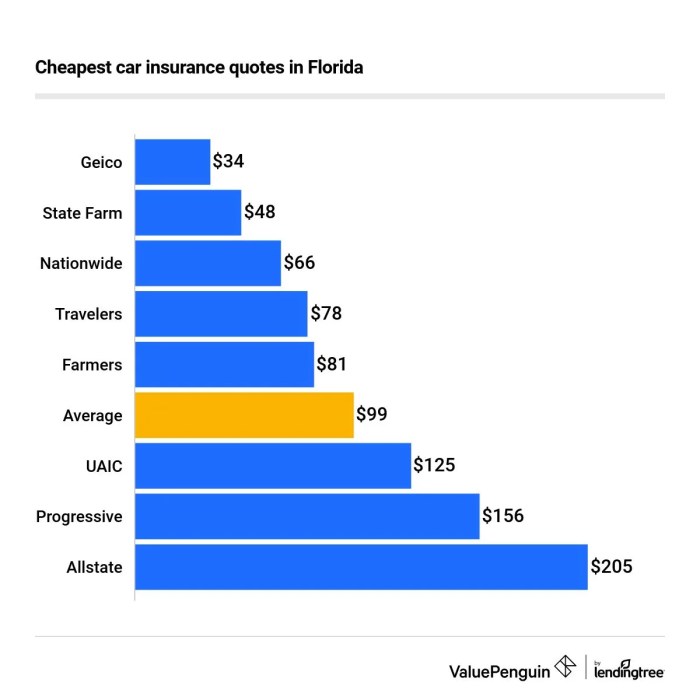

Loads of corporations provide automobile insurance coverage in Gainesville, FL. Some fashionable decisions embrace Geico, State Farm, Progressive, Allstate, and Nationwide. Every has its personal pricing methods and customer support approaches, so it is sensible to buy round. Examine completely different corporations to search out the most effective deal that fits your wants.

Completely different Kinds of Automotive Insurance coverage Insurance policies in Gainesville, FL, Automotive insurance coverage in gainesville fl

Completely different insurance policies provide various ranges of protection. Legal responsibility insurance coverage is the naked minimal, defending you for those who trigger an accident and damage another person. Collision protection kicks in in case your automobile will get broken in an accident, no matter who’s at fault. Complete protection protects your car from non-accident injury, like vandalism or theft. Uninsured/Underinsured Motorist protection is important; it safeguards you for those who’re hit by somebody with no insurance coverage or insufficient protection.

You gotta be sure to’ve bought the proper protection to guard your self and your automobile.

Kinds of Protection

Yo, Gainesville fam! Insurance coverage ain’t just a few paper; it is your defend on the street. Realizing your protection is vital to feeling protected and sound, particularly on this city. Completely different plans have completely different ranges of safety, so that you gotta decide the proper one for you.Understanding the varied sorts of automobile insurance coverage coverages out there is essential for any driver in Gainesville, FL.

This information empowers you to make knowledgeable selections about your insurance coverage wants and ensures you are correctly protected on the street. Selecting the best protection is like selecting the best trip – you gotta make sure that it suits your wants.

Legal responsibility Protection

Legal responsibility protection steps in for those who trigger an accident and damage another person or injury their property. It is principally your accountability to pay for the opposite particular person’s losses. With out it, you can be dealing with enormous payments. That is the naked minimal you want, however do not skimp on it! Consider it like insurance coverage for the opposite driver’s ache and struggling, or the restore invoice for his or her automobile.

Collision Protection

Collision protection kicks in in case your automobile will get broken in an accident, no matter who’s at fault. This protectsyour* car. It is like having a security web for those who’re concerned in a fender bender or a extra severe wreck. In case your automobile is totaled, this protection helps pay for the repairs or the alternative. Having this protection is a lifesaver in a crash.

Complete Protection

Complete protection protects your automobile fromnon-collision* injury. This consists of issues like vandalism, hearth, theft, hail injury, and even weather-related occasions. Think about your trip getting keyed or hit by a tree – complete has your again. This protection helps cowl these surprising prices.

Uninsured/Underinsured Motorist Protection

Uninsured/underinsured motorist protection is a game-changer for those who’re in an accident with somebody who would not have insurance coverage or would not have sufficient protection. It steps in to pay on your accidents or damages in these conditions. This protection is significant for peace of thoughts, making certain you are protected in all attainable situations.

Protection Quantities and Deductibles

Protection quantities and deductibles range based mostly on the coverage and the insurance coverage firm. Protection quantities decide the utmost quantity the insurer pays out for a declare. Deductibles are the quantity you will pay out-of-pocket earlier than your insurance coverage kicks in. For instance, the next deductible means decrease premiums, however you will need to pay extra for those who file a declare.

Consider a deductible as your preliminary funding to get your insurance coverage cash.

Protection Choices Amongst Insurance coverage Firms

Completely different insurance coverage corporations in Gainesville, FL, provide various protection choices. Some corporations may provide extra complete packages, whereas others could have higher charges on particular sorts of protection. Store round and evaluate insurance policies to search out the most effective match on your wants. It is like completely different automobiles – some are sooner, some are extra fuel-efficient, some are extra fashionable.

All of it comes all the way down to what you worth.

Comparability Desk

| Firm | Legal responsibility Limits | Collision Deductibles | Complete Deductibles |

|---|---|---|---|

| InsCo 1 | $100,000/$300,000 | $500 | $250 |

| InsCo 2 | $250,000/$500,000 | $1000 | $500 |

| InsCo 3 | $500,000/$1,000,000 | $250 | $250 |

This desk reveals a glimpse into the attainable variations in legal responsibility limits and deductibles. All the time do your analysis and evaluate quotes from completely different corporations to search out the most effective deal on your wants.

Elements Affecting Insurance coverage Prices: Automotive Insurance coverage In Gainesville Fl

Yo, Gainesville fam! Insurance coverage charges ain’t no joke, and so they’re completely influenced by a bunch of various issues. Whether or not you are a younger buck or a seasoned driver, your pockets’s gonna really feel the warmth relying on these components. Let’s break down the game-changers.Insurance coverage corporations gotta make sure that they are not shedding their shirts, proper? They use a bunch of things to determine how a lot to cost you.

These components embrace your driving historical past, the kind of automobile you drive, your age, the place you reside, and even your credit score rating. It is a advanced equation, however we’ll break it down so you possibly can perceive it.

Driving Document

Your driving historical past is a significant component in your insurance coverage premiums. A clear slate is vital, fewer tickets and accidents imply decrease charges. In the event you’ve bought a historical past of dashing tickets, fender benders, or worse, a DUI, anticipate to pay extra. It is all about danger evaluation, yo. Insurance coverage corporations wish to know for those who’re a protected driver, and so they’ll cost you accordingly.

Car Sort

The kind of automobile you drive performs an enormous position. Insurance coverage corporations assess the danger related to completely different makes and fashions. Sports activities automobiles and high-performance automobiles normally include greater premiums, as they’re extra more likely to be concerned in accidents or have greater restore prices. Give it some thought: a souped-up muscle automobile is extra more likely to trigger injury than a easy sedan.

The identical goes for older automobiles, which can have extra restore points.

Age

Age is one other biggie. Youthful drivers, properly, they’re statistically extra liable to accidents, so insurance coverage corporations cost them extra. Older drivers might need extra expertise, however well being points may enhance the danger. The candy spot is normally within the center, with charges normally lowering as you achieve expertise and turn into extra accountable drivers.

Location

The place you reside in Gainesville issues too. Areas with greater crime charges or extra visitors accidents typically have greater insurance coverage premiums. Give it some thought, if there are extra accidents in a sure space, insurance coverage corporations need to issue that into their charges to cowl potential claims. It is all in regards to the danger degree of the placement.

Site visitors Accidents

Site visitors accidents considerably have an effect on your insurance coverage charges. A single accident can drastically enhance your premiums. A number of accidents or accidents with vital injury will lead to even greater charges. It is a clear indicator of danger for the insurance coverage firm. They will take a look at your accident historical past and decide your fee based mostly on that.

Credit score Historical past

Your credit score historical past, surprisingly, can have an effect on your automobile insurance coverage charges. Insurance coverage corporations see a hyperlink between good monetary accountability and protected driving habits. credit score rating suggests you are accountable with funds and certain a safer driver. A bad credit score, nonetheless, can result in greater premiums.

Car Security Options

Trendy automobiles typically include security options like airbags, anti-lock brakes, and digital stability management. These options can cut back the danger of accidents and related damages, which results in decrease premiums. In case your automobile has extra superior security expertise, your insurance coverage fee is extra more likely to be decrease.

Reductions and Financial savings Alternatives

Yo, Gainesville fam! Insurance coverage ain’t gotta be a ache within the neck. There’s severe dough to be saved on automobile insurance coverage, and we’re about to drop some severe information on methods to snag these candy reductions.Realizing methods to get the most effective charges is vital, like, completely important. We’re breaking down the widespread reductions out there in Gainesville, FL, and exhibiting you methods to rating these financial savings.

It is all about getting the most effective deal attainable, so pay attention up!

Frequent Reductions Obtainable

Insurance coverage corporations like to throw reductions your method for being an excellent driver and taking precautions. Suppose protected driving, a number of insurance policies, and anti-theft measures – all of them add up. Savvy buyers know that reductions can translate into main financial savings in your premium.

- Protected Driver Reductions: Insurance coverage corporations reward drivers with clear driving information. This typically interprets into vital financial savings in your coverage. Firms sometimes observe your driving historical past utilizing issues like your driving document and accident historical past. Suppose good grades in driving college, or no fender benders – you possibly can lock in financial savings.

- Multi-Coverage Reductions: You probably have a number of insurance policies with the identical insurance coverage firm (like house insurance coverage, too!), you may qualify for a multi-policy low cost. This implies you are getting a reduction for being a loyal buyer. It is like getting a bonus for being a complete buyer.

- Anti-Theft Reductions: Putting in anti-theft units, like alarm methods or monitoring methods, can considerably cut back your danger of automobile theft. Insurance coverage corporations acknowledge this and reward you with reductions for taking proactive steps to guard your car. That is particularly related in areas like Gainesville the place theft is a priority.

- Bundling Reductions: That is the place you bundle your property, auto, and life insurance coverage with the identical firm. This typically results in substantial financial savings.

- Defensive Driving Programs: Finishing a defensive driving course can typically result in a discount in your insurance coverage premium, because it reveals that you’re dedicated to protected driving practices.

Acquiring Reductions and Financial savings

Getting these reductions is fairly simple. It is all about ensuring your data is up-to-date along with your insurance coverage firm. Preserve your driving document clear, and be proactive in letting your supplier know for those who’ve made adjustments that would qualify you for a reduction.

- Overview Your Coverage Frequently: Your insurance coverage firm’s web site or app typically permits you to examine for out there reductions. Do not assume you are not eligible, all the time double-check!

- Preserve Your Insurance coverage Info Up to date: In the event you’ve gotten a brand new job, moved, or modified your driving habits, replace your data along with your insurance coverage supplier. This ensures your coverage displays your present scenario, which could unlock further reductions.

- Contact Your Insurance coverage Agent: Your agent is your greatest good friend within the insurance coverage world. They’re the go-to for understanding which reductions you qualify for and methods to get them utilized to your coverage.

Advertising and marketing Methods for Reductions

Insurance coverage corporations use numerous advertising and marketing strategies to draw clients and spotlight their low cost packages. This may vary from catchy slogans to direct mailers and on-line advertisements. It is all about making the financial savings clear and simple to know.

- Direct Mailers: Insurance coverage corporations ship direct mailers that particularly spotlight out there reductions. They could goal particular demographics or spotlight reductions which are significantly engaging.

- On-line Advertisements and Social Media Campaigns: On-line advertisements, social media campaigns, and focused electronic mail advertising and marketing campaigns give attention to the money-saving side of those reductions. They could spotlight the proportion of financial savings which are out there.

- In-Retailer Promotions: Insurance coverage companies may provide in-store promotions that emphasize the worth of the reductions.

Evaluating Reductions and Discovering the Finest

Evaluating reductions throughout completely different insurance coverage corporations is crucial for getting the most effective deal. Do not simply go along with the primary firm you see; store round! Use comparability web sites or instruments to see how numerous corporations stack up when it comes to reductions.

| Low cost Sort | Description | Share Financial savings |

|---|---|---|

| Protected Driver | Clear driving document | 5-15% |

| Multi-Coverage | A number of insurance policies with the identical firm | 5-10% |

| Anti-Theft | Set up of anti-theft units | 3-8% |

| Bundling | Combining auto, house, and life insurance coverage | 5-15% |

| Defensive Driving | Finishing a defensive driving course | 3-7% |

Discovering the Proper Insurance coverage Firm

Yo, Gainesville fam! Insurance coverage could be a whole grind, however discovering the proper firm ain’t rocket science. We’re breaking down methods to get the most effective charges and protection with out getting scammed. It is all about realizing your choices and doing all of your homework.Insurance coverage corporations, like completely different manufacturers of sneakers, all bought their very own sport. Some are identified for low costs, others for stellar customer support.

You gotta work out what works for you, whether or not it is velocity, model, or consolation.

Evaluating Automotive Insurance coverage Quotes in Gainesville, FL

Getting a number of quotes is essential. It is like making an attempt on completely different pairs of denims—you gotta see what suits your funds and your wants. Completely different corporations have completely different pricing fashions. That is the place comparability instruments are available clutch. They’re like a private shopper on your insurance coverage.

Researching Insurance coverage Firm Reputations

Checking on-line critiques and scores is crucial. Phrase-of-mouth is big, particularly in a small city like Gainesville. See what different drivers are saying about their experiences. Learn critiques, examine criticism information, and see what the specialists say about an organization’s observe document. A strong fame is vital, like having a dependable trip.

Key Elements to Take into account When Selecting a Automotive Insurance coverage Firm

Value is not the one factor that issues. You should weigh components like protection choices, customer support, and claims course of. An organization identified for quick payouts can prevent a ton of complications down the street. Consider it like selecting an excellent mechanic—you need somebody dependable and quick. Take into account how straightforward it’s to file a declare and the way responsive the corporate is to your wants.

Issues like on-line portals, 24/7 customer support, and an easy claims course of could make a world of distinction.

Contacting Insurance coverage Brokers and Brokers in Gainesville, FL

Native brokers and brokers are your go-to for customized recommendation. They may also help you navigate the complexities of insurance coverage and tailor a coverage to your particular wants. They’re like having a private shopper for insurance coverage. They know the native scene and might provide insights that on-line instruments may miss. Discovering an agent is like discovering a dependable mechanic—you need somebody who understands your automobile and its wants.

Advantages of Utilizing On-line Comparability Instruments

On-line instruments can prevent a ton of effort and time. They’re like a supercharged search engine for insurance coverage. These instruments mixture quotes from a number of corporations, making it straightforward to check costs and protection. You’ll be able to evaluate quotes from numerous corporations in minutes, with out having to name each firm. This may prevent hours of telephone calls and provide you with a transparent image of your choices.

Claims Course of and Procedures

Yo, Gainesville fam, navigating insurance coverage claims could be a whole drag. However do not sweat it! That is the lowdown on methods to file a declare like a boss. We’ll break it down step-by-step, so that you’re able to deal with something.Submitting a declare is a vital a part of the automobile insurance coverage sport, particularly for those who’re concerned in an accident.

Understanding the method and being ready will prevent a ton of complications.

Steps to File a Declare

This ain’t rocket science, however following these steps will guarantee a clean declare course of. It is key to maintaining issues organized and getting your declare processed rapidly.

- Report the Accident Instantly: Do not delay! Contact your insurance coverage firm ASAP. Present them with all the main points, just like the time, location, and a quick description of what occurred. That is essential for getting the ball rolling. Failing to report instantly may influence your declare.

- Collect Important Paperwork: You will want your insurance coverage coverage particulars, the police report (if relevant), photos of the injury, and witness statements in case you have them. Having these docs prepared will make the entire course of method smoother. That is your ammo; make sure that it is organized and accessible.

- Full the Declare Kind: Your insurance coverage firm will present a declare type. Fill it out fully and precisely. Be sincere and thorough in your description of the incident. In the event you’re unsure about one thing, ask for clarification. Accuracy is vital.

- Present Obligatory Info: Be prepared to offer particulars in regards to the different driver(s) concerned, their insurance coverage data, and every other related particulars. Transparency is your greatest good friend right here.

- Comply with Up with Your Insurance coverage Firm: Preserve tabs in your declare’s progress. Frequently examine in along with your insurance coverage agent or adjuster for updates. It will allow you to keep knowledgeable and tackle any points promptly.

Paperwork Required for Submitting a Declare

Received to have the proper paperwork to get your declare shifting. This checklist will allow you to collect all the pieces you want.

- Insurance coverage Coverage Paperwork: Your coverage particulars are your golden ticket. Ensure you have the coverage quantity, protection limits, and every other related data.

- Police Report (if relevant): A police report is a worthwhile doc, particularly in accidents. It particulars the incident and can be utilized as proof. That is typically required for a declare.

- Images of the Injury: Pics are price a thousand phrases. Take clear photographs of the injury to your automobile and every other property concerned. This proof is essential.

- Witness Statements (if out there): Witness accounts can present worthwhile insights. If there have been witnesses, get their contact data and statements.

- Medical Data (if relevant): In the event you or anybody else concerned within the accident sustained accidents, collect medical information.

Timeframes Concerned in Processing Claims

This ain’t immediate, however you will get a way of how lengthy issues will take.

- Preliminary Evaluation: Your insurance coverage firm will evaluate the declare and collect essential data. This sometimes takes just a few days.

- Investigation: They could want to research the incident additional, which might take just a few extra days to weeks.

- Settlement: As soon as the investigation is full, they will decide the settlement quantity. This half can range relying on the complexity of the declare.

- Cost: After the settlement is agreed upon, the fee will probably be processed. Timeframes range, however it is best to get updates.

Documenting the Incident

Being ready is vital! It will prevent complications later.

- Detailed Notes: Write down all the pieces you possibly can bear in mind in regards to the accident. The time, location, climate circumstances, and the opposite driver’s actions are essential.

- Images and Movies: Take photographs and movies of the injury, the scene, and the opposite car. Proof is your greatest good friend.

- Contact Info: Get the contact data of anybody who witnessed the accident.

Resolving Disputes with the Insurance coverage Firm

In the event you really feel just like the insurance coverage firm is not enjoying honest, you’ve got bought choices.

- Communication: Attain out to your insurance coverage firm and focus on your issues. Specific your issues clearly and politely.

- Mediation: If direct communication would not work, mediation could be an choice. A impartial third social gathering may also help facilitate a decision.

- Authorized Counsel: If the dispute shouldn’t be resolved, looking for authorized counsel is a sound choice. A lawyer can signify your pursuits and allow you to navigate the authorized course of.

Sources for Customers

Yo, fam! Navigating automobile insurance coverage in Gainesville could be a whole grind, nevertheless it would not need to be. Realizing your rights and the place to get legit data is vital to getting the most effective deal. This part breaks down the sources that you must crush it.

Respected Info Sources

Getting the news on automobile insurance coverage in Gainesville means hitting up the proper spots. Legit shopper safety companies, authorities websites, and comparability web sites are your greatest associates. These sources provide unbiased data and may also help you keep away from scams. They supply clear particulars on protection choices, pricing, and even the legalities of the sport. This fashion, you are not simply winging it—you are making sensible strikes.

Understanding Your Shopper Rights

Realizing your rights is essential when coping with automobile insurance coverage corporations. Florida’s Division of Monetary Companies, for instance, supplies a wealth of information on shopper safety within the insurance coverage trade. Understanding your rights empowers you to make knowledgeable selections and deal with points pretty. This implies you are not getting taken benefit of; you are getting the actual deal.

The Function of Shopper Advocates

Shopper advocates are like your private insurance coverage gurus. They battle on your rights and allow you to navigate the complexities of the system. They’ll present assist throughout claims processes and allow you to perceive coverage phrases. In the event you’re dealing with a troublesome scenario, a shopper advocate could be your rock.

A Information to Understanding Automotive Insurance coverage Choices

This ain’t no thriller novel. This information breaks down your automobile insurance coverage choices into digestible items. It’s going to clarify various kinds of protection, like legal responsibility, collision, and complete. It’s going to additionally stroll you thru deductibles and premiums, serving to you decide the proper plan on your wants.

On-line Sources for Automotive Insurance coverage in Gainesville, FL

Discovering the proper automobile insurance coverage in Gainesville is simpler than ever with these on-line sources:

- Florida Division of Monetary Companies: Supplies shopper sources, criticism procedures, and data on licensed insurance coverage corporations. Essential for trying out the ins and outs of the trade.

- Insurance coverage Info Institute (III): Presents instructional supplies and guides on automobile insurance coverage fundamentals, making it a one-stop store for studying the ropes.

- Shopper Experiences: A trusted supply for unbiased automobile insurance coverage critiques and comparisons. They provide the lowdown on numerous corporations and insurance policies, letting you select what works greatest.

- Insurify or related comparability web sites: These websites mean you can evaluate quotes from completely different insurance coverage corporations, saving you worthwhile effort and time. They present you the completely different costs, which is clutch.

- Native Shopper Safety Companies: Your native shopper safety companies are your native specialists. They know the ins and outs of the insurance coverage sport in your space.

Abstract

In conclusion, securing the proper automobile insurance coverage in Gainesville, FL requires an intensive understanding of the native market and out there choices. This information has offered a complete overview, addressing key facets equivalent to protection sorts, premium components, and the claims course of. By fastidiously contemplating the offered data, drivers can confidently navigate the complexities of automobile insurance coverage and select a coverage that aligns with their particular person wants and monetary circumstances.

Solutions to Frequent Questions

What’s the common price of automobile insurance coverage in Gainesville, FL?

Common charges range considerably based mostly on components like driver age, car sort, and driving historical past. A exact common can’t be definitively said with out particular information.

How do I file a declare for an accident?

The claims course of sometimes entails reporting the accident to the insurance coverage firm, offering essential documentation (police stories, medical information), and cooperating with the corporate’s investigation.

What are some widespread reductions out there for automobile insurance coverage in Gainesville, FL?

Frequent reductions typically embrace protected driver reductions, multi-policy reductions, and anti-theft reductions. Particular particulars on availability and proportion financial savings range by insurance coverage firm.

What are the steps to check automobile insurance coverage quotes in Gainesville, FL?

Drivers can use on-line comparability instruments, contact a number of insurance coverage brokers, and collect quotes from completely different corporations to successfully evaluate choices. Thorough analysis is crucial to determine the most effective worth.