$1 a day automobile insurance coverage NJ presents a compelling, but doubtlessly perilous, path to inexpensive car safety. This journey delves into the intricate particulars, uncovering the guarantees and pitfalls of such remarkably low-cost insurance policies. The attract of saving cash should be weighed in opposition to the dangers of insufficient protection, guiding you towards knowledgeable selections.

We’ll study the kinds of protection usually included, highlighting the essential distinctions between $1 a day insurance policies and extra complete choices. Understanding the everyday exclusions and limitations is paramount, equipping you with the data to navigate this monetary panorama with readability and confidence.

Introduction to $1 a Day Automobile Insurance coverage in NJ

The siren tune of $1 a day automobile insurance coverage in New Jersey might be tempting. Think about paying a minuscule quantity for defense on the highway. Nevertheless, the truth is usually extra complicated than the catchy headline. This inexpensive choice, whereas alluring, comes with caveats that potential clients ought to pay attention to. Understanding the potential pitfalls and the kinds of protection supplied is essential to creating an knowledgeable determination.The frequent false impression surrounding such a insurance coverage is that it provides complete safety at a ridiculously low value.

This is not at all times the case. Typically, these insurance policies include important limitations. Understanding these limitations is paramount to avoiding monetary hardship ought to the surprising happen.

Frequent Misconceptions and Pitfalls

Low-cost automobile insurance coverage insurance policies incessantly have limitations in protection quantities. Which means if a declare exceeds the coverage limits, the policyholder could also be chargeable for a considerable portion of the bills. Moreover, these insurance policies might exclude sure kinds of damages, equivalent to injury to your personal car in an accident, or accidents sustained by others.

Varieties of Protection Accessible

The kinds of protection obtainable in these low-cost insurance policies usually fluctuate. Primary legal responsibility protection, defending you from damages you trigger to others, is often included. Nevertheless, complete protection, defending your car from injury unrelated to collisions (like vandalism or climate), is usually restricted or excluded solely. Collision protection, which protects your car in case you’re concerned in an accident, may additionally be severely restricted.

It is important to fastidiously study the coverage paperwork to find out what’s and is not lined.

Appropriate Conditions

A $1 a day coverage may be an appropriate choice for somebody with a really low-risk driving historical past and a car of low worth. This would possibly apply to an individual who drives occasionally, lives in a low-crime space, and does not want the complete spectrum of protection. For instance, a university scholar who drives often and has a primary car would possibly discover it appropriate.

It is also vital to think about that such insurance policies may be appropriate for short-term or supplemental protection.

Unsuitable Conditions

Conversely, such a coverage is unsuitable for people who incessantly drive or have a high-value car. In the event you’re concerned in a big accident, the restricted protection might depart you with substantial out-of-pocket bills. Equally, when you have a historical past of accidents or site visitors violations, a low-cost coverage might not supply the satisfactory safety you want. A driver with a historical past of site visitors violations, residing in a high-crime space, and possessing a high-value car would probably discover such a coverage inadequate.

Think about, for instance, an expert driver with a high-value truck or a driver who often commutes by congested areas with larger accident dangers.

Protection Particulars:

A Day Automobile Insurance coverage Nj

Entering into the world of budget-friendly automobile insurance coverage in New Jersey, a $1-a-day coverage guarantees affordability however comes with particular limitations. Understanding these exclusions and limitations is essential to creating an knowledgeable determination about your safety. Whereas such a coverage provides a considerably decrease premium, it sacrifices a few of the complete protection present in dearer choices.

Exclusions and Limitations

A $1 a day coverage in New Jersey is designed for primary legal responsibility safety. It is not a complete insurance coverage plan and won’t cowl every part. Consider it as a security web for the most typical situations, however not a whole protect in opposition to all potential dangers. Crucially, these insurance policies usually have stringent limitations and exclusions that differ considerably from extra conventional plans.

Varieties of Accidents and Incidents Not Lined

These insurance policies sometimes exclude protection for incidents like vandalism, theft, injury attributable to climate occasions not explicitly lined within the coverage, and injury to the car itself from a non-accident incident. For instance, in case your automobile is broken because of a hailstorm, the $1-a-day coverage may not present compensation. Equally, if somebody deliberately damages your automobile, you would possibly have to discover extra protection choices.

Insurance policies additionally incessantly exclude incidents involving a driver below the affect of medication or alcohol.

Legal responsibility Protection

Legal responsibility protection in a $1 a day coverage is often restricted to the minimal state necessities in New Jersey. Which means in case you trigger an accident and are at fault, your protection will solely compensate the opposite occasion as much as a specific amount for his or her accidents and property injury. It is vital to verify the precise limits, as they will fluctuate considerably.

Property Harm Protection Limitations

Property injury protection in these insurance policies is normally capped at a comparatively low quantity. This implies in case you trigger injury to a different particular person’s property in an accident, the protection offered may not totally compensate the opposite occasion. At all times evaluation the particular coverage particulars to determine the utmost payout quantity.

Deductibles

Deductibles are an important part of any insurance coverage coverage, and $1-a-day insurance policies are not any exception. These insurance policies sometimes have larger deductibles than complete insurance policies, that means you’ll be accountable for a bigger portion of the restore or substitute prices earlier than the insurance coverage firm steps in.

Protection Comparability Desk

This desk highlights the stark distinction in protection limits between a $1-a-day coverage and a extra complete choice. At all times confirm the particular protection limits with the insurer earlier than buying a coverage.

Understanding the Dangers

A $1-a-day automobile insurance coverage coverage in NJ would possibly appear to be a steal, however the satan is usually within the particulars. Whereas providing extremely low premiums, these insurance policies incessantly include considerably decreased protection. Understanding the potential pitfalls is essential earlier than signing up. It is not simply concerning the preliminary price; it is concerning the potential monetary penalties ought to the surprising happen.

Potential Monetary Dangers

The attract of a $1-a-day automobile insurance coverage coverage is simple, but it surely’s important to weigh the potential monetary dangers. A seemingly low premium can shortly change into a considerable burden if an accident happens. A restricted coverage may not cowl the complete extent of damages or accidents, leaving you chargeable for a considerable out-of-pocket expense. This might embody medical payments, property injury, and even authorized charges.

Think about the instance of a minor fender bender that escalates into important repairs or a extra severe accident leading to intensive accidents. The restricted protection may not be enough to deal with the prices.

Eventualities The place Low Price Is not Justified

Typically, the seemingly low price of a $1-a-day coverage may not be definitely worth the decreased protection. For instance, in case you drive a high-value car or dwell in a high-risk space, the financial savings may not outweigh the potential for important monetary losses within the occasion of an accident. Additionally, think about your private circumstances. In case you have important property, a considerable deductible, or different components that may improve your publicity in a declare, a higher-priced coverage with complete protection may be a more sensible choice.

Comparability with Larger-Priced Insurance policies

Larger-priced automobile insurance coverage insurance policies sometimes supply complete protection, together with legal responsibility, collision, and complete safety. These insurance policies are usually extra strong, defending you from a wider vary of potential dangers, together with accidents, vandalism, and even pure disasters. Nevertheless, they arrive with the next premium. The $1-a-day coverage, then again, focuses on the naked minimal to fulfill authorized necessities.

It is essential to fastidiously weigh the dangers and advantages of every choice earlier than making a call.

Penalties of Inadequate Protection

Inadequate protection can result in a cascade of monetary issues within the occasion of an accident. Think about a state of affairs the place your coverage’s legal responsibility protection is not enough to cowl the damages to a different driver’s car. You would face a lawsuit and be chargeable for paying substantial damages exceeding your coverage limits. Equally, inadequate medical protection might depart you with substantial medical payments to pay out of pocket.

Affect on Private Funds in Case of an Accident

An accident can dramatically impression your private funds. Inadequate protection might depart you going through important out-of-pocket bills, doubtlessly impacting your capability to pay for requirements and even resulting in monetary instability. It is essential to know the monetary implications of assorted protection choices and select a coverage that aligns together with your monetary state of affairs and threat tolerance.

Understanding the Dangers – A Comparative Evaluation

| Danger Issue | Clarification | Mitigation Technique |

|---|---|---|

| Restricted Protection | Diminished safety in case of accidents, doubtlessly exposing you to important out-of-pocket bills. | Think about a higher-priced coverage with complete protection. Analyze your particular person threat profile and desires. |

| Monetary Affect | Potential for substantial out-of-pocket bills within the occasion of an accident or declare. | Search skilled monetary recommendation to guage your threat tolerance and monetary capability. Assess the price of potential accidents and accidents. |

| Fraudulent Claims | Larger probability of fraudulent claims as a result of lack of thorough underwriting and inspection processes in some low-cost insurance policies. | Completely analysis and evaluate insurance coverage suppliers. Prioritize respected corporations with confirmed observe data. |

Discovering and Evaluating Insurance policies

Unlocking inexpensive automobile insurance coverage in New Jersey usually includes a proactive strategy. Realizing the place to look and how one can evaluate insurance policies is essential for securing the absolute best deal. This part particulars the method of discovering and evaluating $1 a day automobile insurance coverage choices, specializing in sensible steps and key issues.

Finding $1 a Day Automobile Insurance coverage Choices

Discovering $1 a day automobile insurance coverage in New Jersey requires a targeted search. On-line comparability instruments are a useful useful resource, permitting you to shortly evaluate quotes from varied suppliers. These platforms usually mixture quotes from a number of insurers, simplifying the method. Visiting devoted insurance coverage web sites instantly is one other avenue. These web sites present detailed details about particular insurance policies and will supply extra tailor-made quotes based mostly on particular person wants.

Do not hesitate to ask associates, household, or colleagues for suggestions; private referrals can generally result in hidden gems.

Evaluating Insurance policies Based mostly on Protection and Pricing,

a day automobile insurance coverage nj

A vital step is evaluating totally different insurance policies. Rigorously analyze the protection limits, deductibles, and premiums related to every coverage. A coverage’s protection ought to align together with your wants and monetary state of affairs. Understanding your protection is crucial. An intensive comparability of protection particulars, together with legal responsibility, collision, complete, and uninsured/underinsured motorist safety, is important.

Think about the premiums related to every coverage and evaluate them side-by-side. Assess deductibles as properly; a decrease deductible sometimes comes with the next premium, and vice versa.

Key Components to Think about When Choosing a Coverage

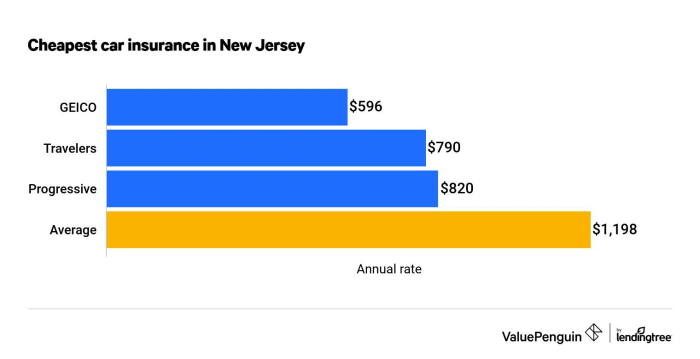

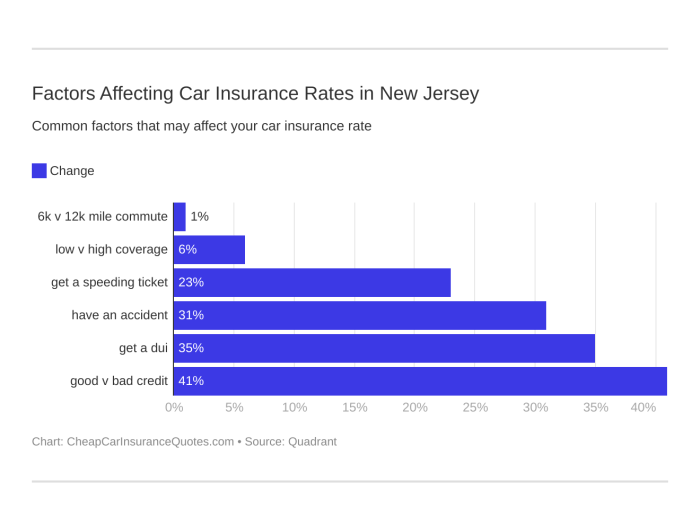

A number of key components affect the choice of an appropriate coverage. Your driving historical past is a big issue. A clear report usually results in decrease premiums. Your car’s make, mannequin, and 12 months additionally play a job within the insurance coverage price. The dearer the automobile, the upper the insurance coverage price, on common.

Your location inside New Jersey can impression premiums. City areas, for instance, might have larger charges because of elevated site visitors and accident dangers.

Inquiries to Ask an Insurance coverage Supplier

Earlier than committing to a coverage, asking the suitable questions ensures readability and understanding. Inquire concerning the particular protection limits for legal responsibility, collision, and complete insurance coverage. Ask concerning the deductible quantities and their impression in your premiums. Perceive the phrases and situations related to the coverage, together with any exclusions or limitations. Make clear the claims course of and cost choices.

Understanding the coverage’s advantageous print is important to avoiding potential surprises down the highway.

Coverage Comparability Desk

This desk presents a hypothetical comparability of various insurance coverage suppliers and their insurance policies. Precise particulars will fluctuate.

Options to $1 a Day Insurance coverage

Whereas $1 a day automobile insurance coverage in NJ may appear tempting, it usually comes with limitations. This is not a one-size-fits-all resolution. Understanding your particular wants and exploring various choices is essential for locating one of the best match in your driving historical past, car sort, and monetary state of affairs.The insurance coverage market provides a variety of choices past the fundamental $1 a day plan.

These options usually present extra complete protection and larger flexibility. Selecting correctly means taking the time to know the several types of insurance policies obtainable and the way they will defend you.

Inexpensive Insurance coverage Choices in NJ

Varied insurance coverage suppliers supply aggressive charges in New Jersey, tailor-made to totally different wants. Think about choices like:

- Bundled Packages: Many suppliers supply bundled packages that mix automobile insurance coverage with different companies, like residence insurance coverage. This may generally result in reductions and extra favorable premiums.

- Reductions for Good Drivers: Sustaining a clear driving report usually unlocks substantial reductions. Applications rewarding protected driving practices are broadly obtainable. It is a sensible method to save cash.

- A number of-Automobile Reductions: Proudly owning a number of autos would possibly qualify you for a multi-car low cost, saving cash on every coverage.

- Reductions for College students and Younger Drivers: Insurance coverage corporations incessantly supply reductions to college students and younger drivers, recognizing the upper threat profile.

Exploring Different Insurance coverage Merchandise

Discovering these choices requires lively exploration. Start by:

- Evaluating Quotes: On-line comparability instruments might help you evaluate premiums from varied suppliers. Do not hesitate to make use of these instruments, as they are often extraordinarily useful in evaluating totally different insurance policies.

- Contacting Insurance coverage Brokers: Insurance coverage brokers can present personalised suggestions based mostly in your particular person circumstances. They’ll information you thru the choices and tailor one of the best match in your wants.

- Researching Insurance coverage Suppliers: Examine the popularity and monetary stability of various insurance coverage corporations. A financially sound firm is important in your protection.

Assessing Totally different Choices

Evaluating insurance policies includes contemplating a number of components:

- Protection Limits: Completely study the protection limits for legal responsibility, collision, complete, and different vital points of the coverage.

- Deductibles: Perceive the deductible quantities. Decrease deductibles sometimes result in larger premiums.

- Premium Prices: Examine the general premium prices throughout totally different insurance policies to see how they align together with your funds.

- Coverage Phrases and Circumstances: Rigorously evaluation the advantageous print. This ensures that you simply perceive all points of the coverage, together with exclusions and limitations.

Discovering Different Insurance coverage: A Flowchart

| Step | Motion |

|---|---|

| 1 | Determine Your Wants (Automobile sort, driving report, funds) |

| 2 | Use On-line Comparability Instruments |

| 3 | Contact Insurance coverage Brokers (for personalised suggestions) |

| 4 | Analysis Insurance coverage Suppliers (reliability and monetary stability) |

| 5 | Examine Quotes, Protection Limits, Deductibles, Premiums |

| 6 | Evaluate Coverage Phrases and Circumstances |

| 7 | Choose the Finest-Becoming Coverage |

Conclusive Ideas

In conclusion, $1 a day automobile insurance coverage NJ provides a compelling various, but it surely calls for cautious consideration. By understanding the dangers, evaluating insurance policies, and in search of recommendation, you possibly can navigate the complexities and decide aligned together with your wants and monetary well-being. Keep in mind, true safety usually comes from making knowledgeable decisions. The trail to monetary peace of thoughts begins with understanding the nuances of this insurance coverage panorama.

Frequent Queries

Is $1 a day automobile insurance coverage NJ a rip-off?

No, $1 a day automobile insurance coverage NJ insurance policies are authentic, however they usually include important limitations and exclusions. It is essential to know the specifics of protection earlier than making a call.

What sort of accidents are sometimes not lined by $1 a day insurance policies?

Insurance policies usually exclude incidents like accidents involving uninsured or underinsured drivers, incidents stemming from extreme climate situations, and sure kinds of collisions. At all times evaluation the particular coverage particulars.

How do I discover dependable $1 a day automobile insurance coverage suppliers in NJ?

On-line comparability instruments and respected insurance coverage businesses in NJ can help you to find and evaluating varied insurance policies. Do not hesitate to ask inquiries to make clear the coverage’s phrases and situations.

What are some options to $1 a day automobile insurance coverage NJ?

Options embody exploring higher-deductible insurance policies with wider protection choices, analyzing choices with a barely larger premium, or doubtlessly exploring umbrella insurance coverage which will supply extra layers of protection.